piranka/E+ via Getty Images

Investment Thesis

Zscaler (NASDAQ:ZS) has seen its share price sell-off by 50% from its former highs. Still, underneath this weak share price dynamic, we see a business that is fundamentally very robust.

Clearly, the business is rapidly growing. But it’s doing so while being GAAP unprofitable? In essence, does actually profitability matter?

Right now, Zscaler’s valuation has taken a significant haircut. For anyone considering this stock, I believe that this is probably the best entry point they are going to get.

Hence, I’m rating ZS stock a buy.

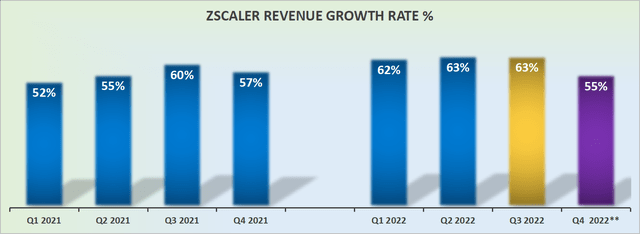

Zscaler’s Revenue Growth Rates Remain Strong

Zscaler revenue growth rates

As you can see above, Zscaler is growing its top line at a very rapid rate. Now the question that investors have to answer is whether strong top-line growth is all that matters in 2022?

Or whether being able to profitably grow is now more important than growth for growth’s sake?

Zscaler’s Near-Term Prospects

Zscaler is a network infrastructure solution. Zscaler provides network solutions to securely access externally managed applications. Zscaler’s Zero Trust Exchange cloud platform seeks to disrupt and displace on-premises security with its solutions portfolio.

There are now many players in this space. But what distinguishes Zscaler is its ability to provide a secure end-to-end zero-trust network.

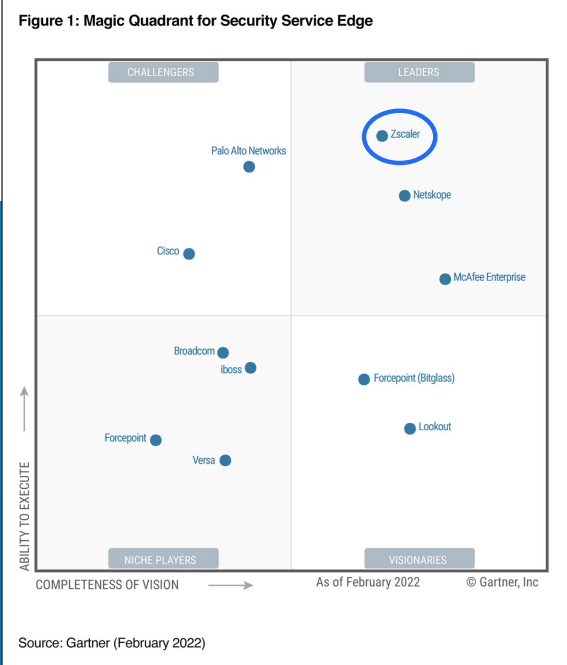

Zscaler June presentation

With Zscaler having done this for a while, 2022 marks the 11th consecutive year of Gartner Leadership, as you can see above.

Next, I’ll discuss one aspect that isn’t so positive and one aspect that makes this investment at this particular time highly favorable.

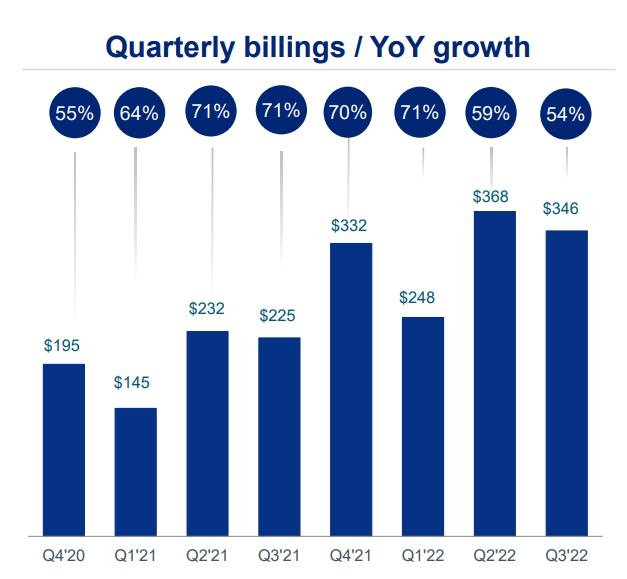

The one aspect that isn’t particularly bullish is the trend in quarterly billings.

Zscaler June presentation

As you know, quarterly billings are a leading indicator of future revenue growth. The business has seen its billings come down substantially over the past 7 quarters, and is now pointing to 54% y/y of booked growth.

Needless to say that this is something to keep a very alert eye over.

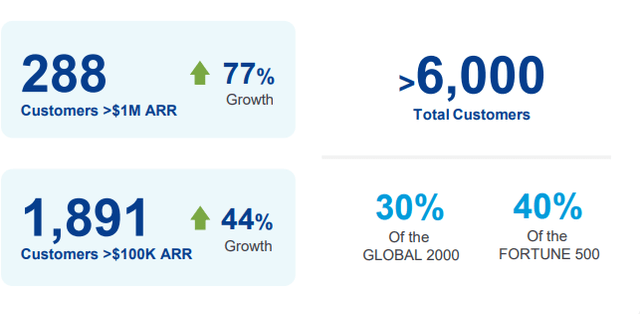

On the other hand, the one aspect that has particularly piqued my interest in Zscaler is the growth in large, +$1 million accounts.

Zscaler June presentation

As you can see above, as of Q3 2022, these large accounts were up 77% y/y. These large enterprises will have very little difficulty in weathering any fallout from a potential recession.

Indeed, this is where I would build my bullish thesis upon. While I believe that a US recession is highly likely, my argument is that companies are still going to need their digital infrastructure for their critical workloads. And companies that are servicing large enterprises are best placed to come out the other side.

Next, we’ll discuss Zscaler’s profitability profile.

Profitability Profile Leaves Much to be Desired

What follows next is Zscaler’s GAAP operating margins:

- Q3 2021: -25%

- Q4 2021: -34%

- Q1 2022: -32%

- Q2 2022: -33%

- Q3 2022: -30%

As is common in this space, the vast majority of Zscaler’s costs come in the form of stock-based compensation. Over the past 12 months, investors have been pushing back on companies’ elevated stock-based compensation payouts.

For context, Zscaler highlights to investors its very high rule of 40. But when you consider that Zscaler’s Q3 2022 free cash flow was $116 million, while its stock-based compensation in the same period, including payroll taxes associated with compensation, was $112 million, one has to minimally question, is Zscaler actually profitable? It appears that answer is that Zscaler is essentially operating at breakeven ”clean” free cash flows.

On the one hand, I know the retort to this stance. Over the past decade, nobody has been willing to consider stock-based compensation a real expense. Consequently, it’s entirely likely that looking ahead investors may also look beyond these pesky costs too.

ZS Stock Valuation – Priced at 16x Forward Sales

Zscaler is about to finish fiscal 2022 when it reports in September.

That means we should now start to look to fiscal 2023. If we presume that Zscaler can continue to grow by 40% into next year, which appears quite likely at this stage, this would see Zscaler reporting approximately $1.5 billion in revenues.

This would put Zscaler priced at 16x forward sales. This is essentially the same multiple as CrowdStrike if we adjust for the different fiscal year endings.

There’s no way that I can lay claim that this is a cheap valuation. That being said, let’s not forget that much of the air has now come out of Zscaler’s valuation.

The Bottom Line

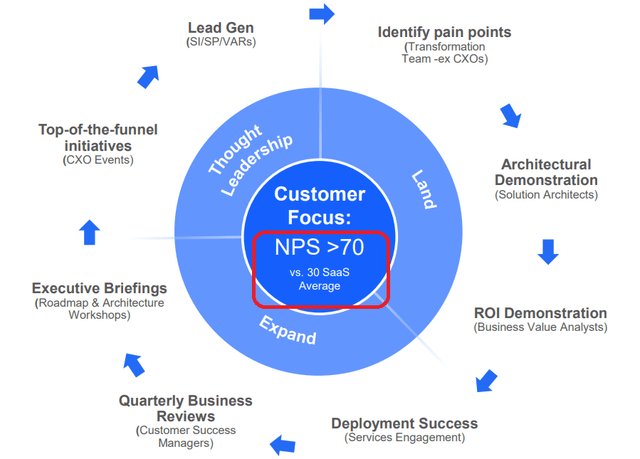

Zscaler June presentation

As you can see above, Zscaler’s customer focus has led Scaler to support a +70 NPS score. Still, there is one blemish here. That Zscaler is not GAAP profitable and unlikely to reach GAAP profitability at any point in the next 3 to 5 years.

On the other hand, I contend that this concern has already been factored into its share price, with its stock down more than 50% from its former highs.

Altogether, I rate Zscaler a buy.

Be the first to comment