NicoElNino/iStock via Getty Images

Investment Thesis

Zscaler (NASDAQ:ZS) has been a leader in its cybersecurity niche for the past decade, and has a Founder-CEO with the most skin-in-the-game that I have ever seen. The company has seen rapid growth since its IPO, and its services are only going to become increasingly important as cloud adoption continues.

But does that make Zscaler a good investment right now? I put it through my investing framework to find out.

Business Overview

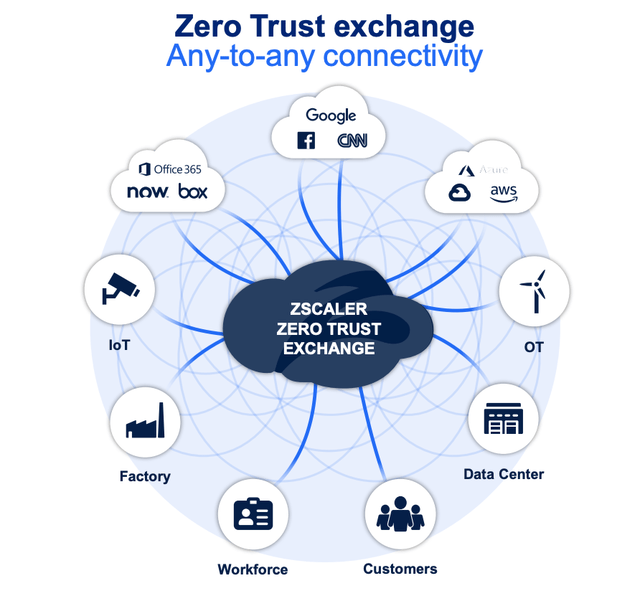

Founded in 2007, Zscaler is a leading cloud-native cybersecurity provider. Its cloud platform, the Zscaler Zero Trust Exchange, is driving forward a shift in the architectural design and approach of IT networks and security. Customers of Zscaler are generally large, enterprise level businesses, and it counts 40% of the Fortune 500 and 30% of the Global 2000 as customers.

So that’s great, but what exactly does Zscaler do? It certainly feels like more technical understanding is required to understand a business like this, compared to something like Nike (NKE) or Amazon (AMZN), but I’ll do my best to explain it in layman’s terms.

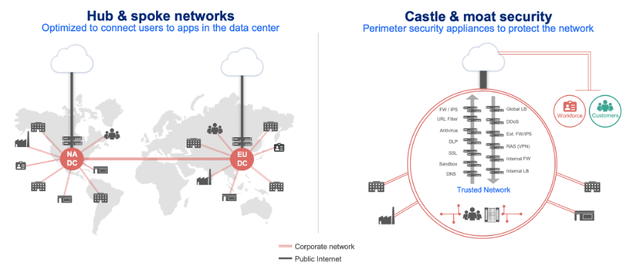

In the old world, cybersecurity companies would look to protect a business’s on-premises corporate network, which worked well in a world where applications lived in a corporate data center, and employees worked from the office.

Zscaler June 2022 Investor Presentation

However, nowadays there are more and more applications, users, devices and data that are outside of the corporate network, making the traditional method of network cybersecurity obsolete. Companies are shifting their infrastructure to the cloud, with organizations relying on internet-based destinations for a range of business activities, adopting new external SaaS applications, and moving internally managed applications to the public cloud.

Zscaler June 2022 Investor Presentation

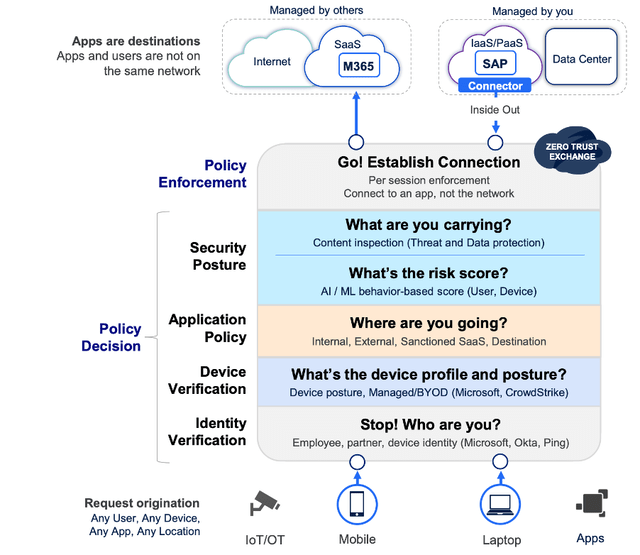

Zscaler’s Zero Trust Exchange is used to ensure that the right users are able to access the right applications at the right time. The zero-trust approach effectively means ‘trust no-one’ – that is, verify everyone. The below graphic outlines the steps taken every time a user from an organization wishes to access anything in the cloud (read the steps from the bottom upwards).

Zscaler June 2022 Investor Presentation

Zscaler checks who you are, what device you’re using, what you want to access, if you pose a risk, and if you’re carrying any potential threat. It does this every single time a user wishes to access an application or reach a specific destination.

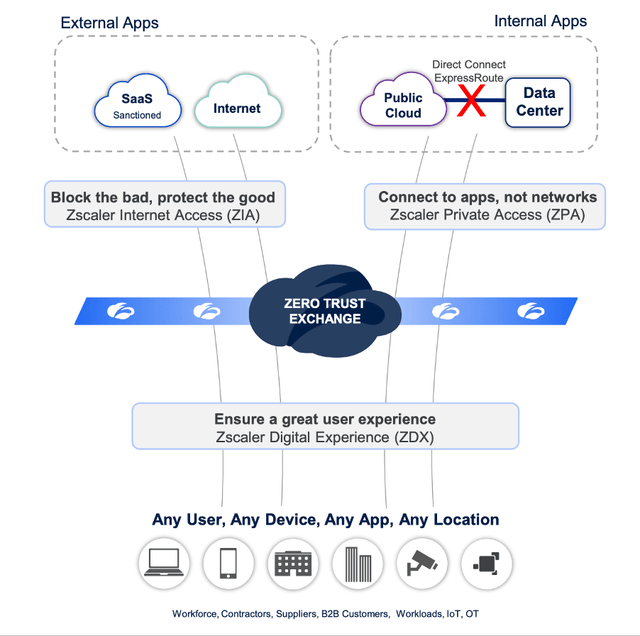

The company has two main offerings: Zscaler Internet Access (abbr. ZIA) and Zscaler Private Access (abbr. ZPA). They both still focus on ensuring the right users get access to the right place, with the core difference being that ZIA is designed to provide access to external applications, and ZPA is designed to provide access to internal applications. The other solution provided by Zscaler is the Zscaler Digital Experience, or ZDX, which is designed to measure and understand the end-to-end user experience across key business applications.

Zscaler June 2022 Investor Presentation

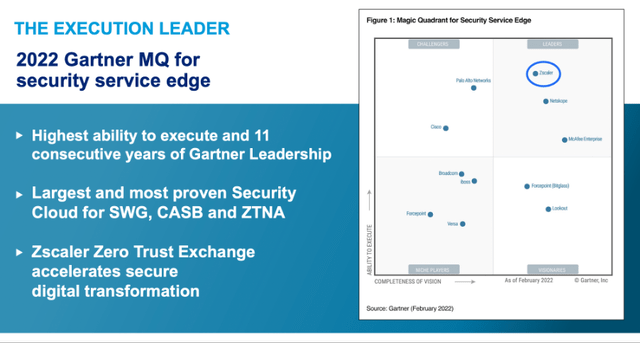

Zscaler was the first mover with its cloud-based zero-trust approach to network security, and it has been an industry leader ever since. The Gartner Magic Quadrant for Security Service Edge (abbr. SSE) is testament to this, as Zscaler has been named a leader for 11 consecutive years – which is pretty impressive!

Zscaler June 2022 Investor Presentation

Through this leadership, the company has successfully built up a strong reputation. Combine that with a Net Promoter Score above 70 (compared to the average SaaS NPS of 30), and it becomes clear why Zscaler has become the partner of choice for a huge number of enterprises thus far.

Economic Moats

With every business, I look to see if there are any durable competitive advantages (aka economic moats) that will help the company continue to thrive whilst protecting itself from competition.

This first economic moat is common within cybersecurity companies, but is particularly effective for industry leaders and larger companies (which Zscaler is), and this is a strong network effect. Zscaler has the world’s largest in-line security cloud platform with more than 150 data centers globally, and users in 185 countries. Zscaler blocks over 150 million threats every single day, and as per their 2021 Annual Report:

Our customers benefit from the cloud security effect of our ever-expanding ecosystem because once a new threat is detected, it can be blocked across our entire customer base within minutes.

So as Zscaler continues to add new customers and scale upwards, it will learn about new threats which can then be blocked across its entire network, which makes the company better at protecting its customers, which will lead to more customers – a virtuous cycle and a classic network effect that I have seen across leading cloud-based cybersecurity firms.

I would also argue that a company such as Zscaler benefits from switching costs. Once a company is a Zscaler customer, it would be a pain for them to move to a different SSE (Security Service Edge) provider given that the Zero Trust Exchange would be used for every user and every application touched by an enterprise. The only reason to switch would be if an alternative provider had a more effective solution (as of right now, there is no evidence of this) or if an alternative provider had a cheaper solution. But, in the world of cybersecurity, companies are often happier to pay for quality since they know the potential consequences of a successful cyberattack.

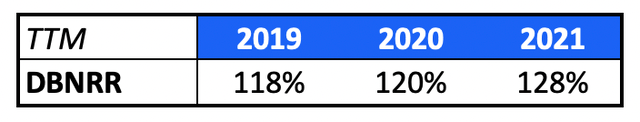

There are also figures to back this up. Zscaler has a dollar-based net retention rate above 125%, meaning that not only are customers staying with Zscaler, but they are spending over 25% more.

I’d also be tempted to give Zscaler credit for a couple of smaller, more intangible economic moats: brand and patents. Zscaler is the first mover in this industry, and had been a leader for 11 years whilst boasting an impressive NPS score above 70. All this combined leads to a strong brand that will be recognized and respected. The company also filed its 300th patent in 2022, which offers more protection against threats from competitors.

Outlook

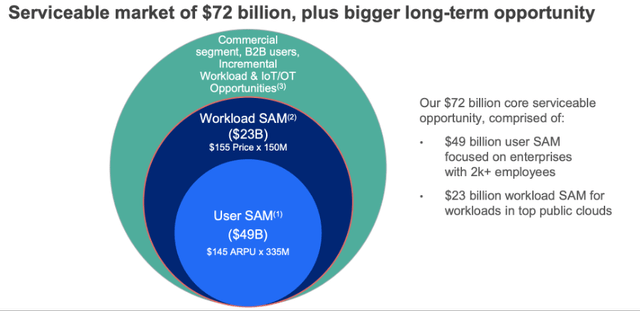

Clearly cybersecurity is an industry that will only continue to grow in importance throughout the next decade and beyond. Zscaler has called out a potential $72 billion serviceable market – it’s worth highlighting that a serviceable addressable market (or SAM) is often more realistic than the commonly quoted total addressable market. A SAM refers to the part of a total addressable market that can be reached via a company’s existing competencies. With this in mind, the fact that Zscaler’s revenues for the past 12 months correspond to only 1.3% of this opportunity implies that Zscaler has a long runway ahead of it.

Zscaler June 2022 Investor Presentation

Management

When it comes to fast-paced, innovative companies, I always aim to find founder-led businesses where inside ownership is high. Thankfully, we have this courtesy of Zscaler’s Founder, Chairman, and CEO Jay Chaudhry. He is an accomplished businessman, having successfully founded four other technology companies that went on to be acquired.

Jay Chaudhry – Zscaler Founder, Chairman and CEO (Zscaler)

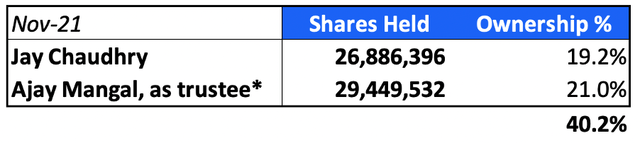

I want to invest in companies where leadership has skin-in-the-game, and Zscaler absolutely blew me out of the water when I first looked at this. I think Jay Chaudhry has the most skin-in-the-game out of any CEO in my portfolio.

Zscaler 2021 Proxy Filing / Excel

Now, a 19.2% ownership for Founder-CEO Jay Chaudhry is already extremely impressive, but who is Ajay Mangal? Well, he is the trustee of the CJCP Trust and the CKS Trust – with the beneficiaries of these trusts being members of Jay Chaudhry’s family. So not only does Chaudhry own 19.2% of the company, but his family members hold an additional 21.0%. This results in the entire Chaudhry family shareholding being just above 40%, which is absolutely phenomenal.

I also like to take a quick look on Glassdoor to get an idea about the culture of a company, and Zscaler gets some astounding scores from the 1,437 reviews left by employees. Any score over 4.0 is impressive, and Zscaler easily obtains these scores across the board, with a 4.5 in Culture & Values, Diversity & Inclusion, and Career Opportunities. Perhaps even more impressive is the fact that over 9 in 10 employees would recommend Zscaler as a place to work to their friends, and a whopping 97% of employees approve of Jay Chaudhry as CEO.

Financials

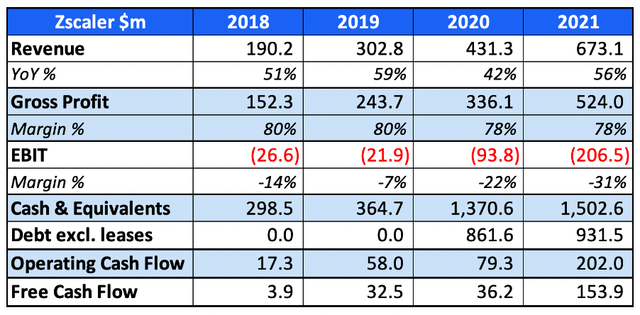

Zscaler has two traits that I keep seeing in fast-growing companies: unprofitable, and quite a lot of stock-based compensation. That said, Zscaler has been free cash flow positive since 2018, and has a good net cash position. The company is continuing to reinvest for growth, as it should since it’s in the early innings of a huge opportunity – and the cash balance and positive cash flow means that the company is able to sustain this growth without having to look for external finance – happy days!

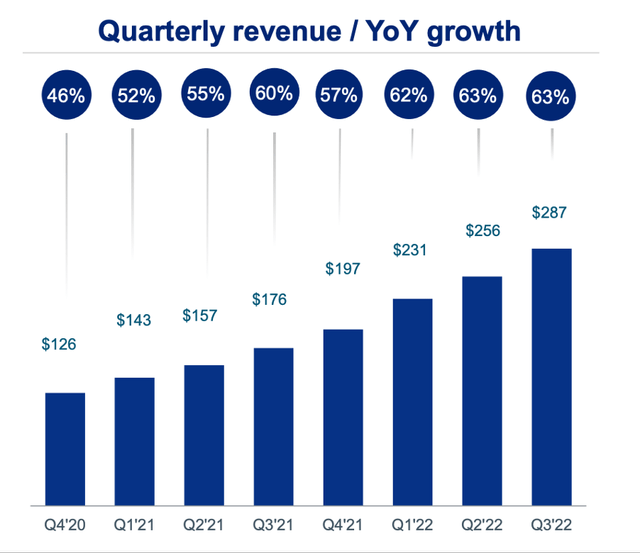

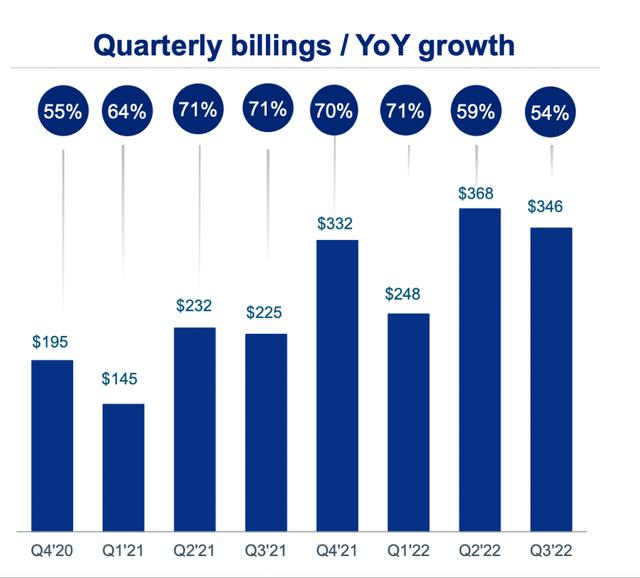

I do want to highlight what could be a potential slowdown for this hyper-growth company. If we take a look at its quarterly revenue growth YoY, it’s clear that the company is still growing rapidly – if not accelerating.

Zscaler June 2022 Investor Presentation

However, we have a forward indicator for revenues, and these are billings. The calculated billings for Zscaler reflect the amount actually invoiced in a period, and customers are generally invoiced upfront. So, if I invoiced a customer $120,000 in Q1’22 for an annual subscription, then it would be recognized as follows:

- Q1’22: $120k Billings, $30k Revenue

- Q2’22: $0k Billings, $30k Revenue

- Q3’22: $0k Billings, $30k Revenue

- Q4’22: $0k Billings, $30k Revenue

That is, revenue is recognized over the 12-month period (for subscriptions), whereas billings are recognized at the invoice date. As a result, billings growth can be used as a leading indicator for revenue growth – which is the only downside for Zscaler that I can see right now.

Zscaler June 2022 Investor Presentation

As we can see, quarterly billings growth for Q2’22 and Q3’22 are substantially slower than in the 4 quarters prior. This implies that we’ll likely see a revenue slowdown for Zscaler within the next couple of quarters. I am being picky here; 59% and 54% YoY growth rates are still fantastic, but this is just something for investors to be aware of.

Valuation

As with all high growth companies in growing industries, valuation is tough. I believe that my approach will give me an idea about whether Zscaler is insanely overvalued or undervalued, but valuation is the final thing I look at – the quality of the business itself is far more important in the long run.

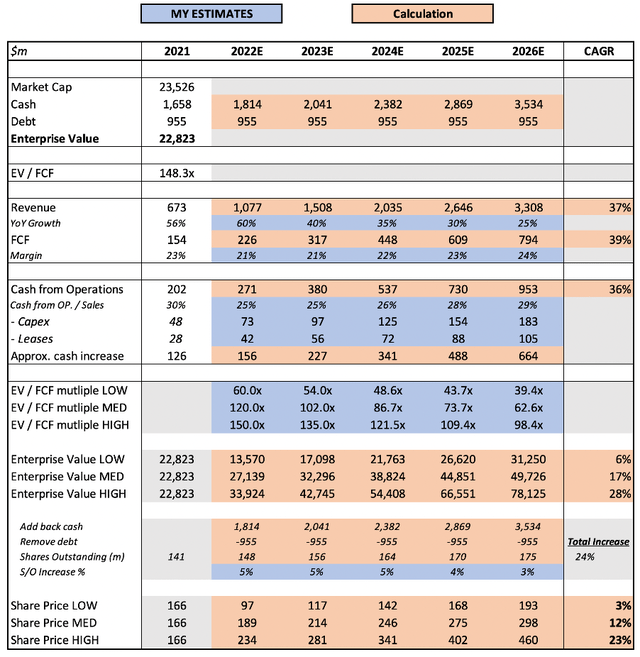

In my model, I have assumed a 37% revenue CAGR through to 2026. Note that, due to Zscaler’s strange financial year (ending July 31st), I am very confident in the 2022E revenue estimate – I think it will come in slightly above my figure. I have forecast a significant slowdown in revenue growth over the following years, as I felt it would be prudent to do so. I would much rather be surprised to the upside rather than the downside.

I have also assumed that shareholders will continue to be diluted, but the estimate I have used is slightly more extreme than the dilution shareholders have seen in the past.

Finally, I have ended on an EV/FCF multiple of 62.6x in my mid-case scenario, as I feel this is appropriate for a company growing as rapidly as Zscaler. Note that I have offered up a range of multiples, in case you think 62.6x is too cautious or too optimistic.

All things considered, I believe that Zscaler’s shares are capable of growing at a 12% CAGR in my mid-range scenario. I’ll highlight again that I believe this to be a conservative estimate, and I could certainly see Zscaler shares achieving a much higher CAGR over this period.

Bottom Line

There is no doubt that the stock looks expensive right now, but sometimes you have to pay for quality. My valuation model gives me comfort in purchasing shares of Zscaler at the current price – might it fall more? Absolutely, but I’m not in the business of predicting daily, weekly, or monthly share price movements. All I know is that Zscaler is a high-quality, founder-led, industry-leading business in an industry that will only become more important over time, and I do believe shareholders today will be well rewarded over the upcoming decade.

Be the first to comment