Juanmonino/iStock via Getty Images

Thesis

The 25+ Year Zero Coupon U.S. Treasury Index ETF (NYSEARCA:ZROZ) is an exchange-traded fund set up to mimic the results of the ICE BofAML Long US Treasury Principal STRIPS Index. The fund has a very sizable duration of 27.66 years that drives its performance. In today’s monetary tightening environment all discussions are currently centered around the duration and how the rising rates are going to impact each asset class (high duration growth equities, high-yield bonds, etc.). ZROZ is a clean long duration play, and as 30-year rates continue to rise the question centers on how low can the pricing on the fund go.

ZROZ has historically been a very solid performer, with 5- and 10-year trailing total returns currently coming in at 4.74% and 5.15% respectively. The fund has lost -17% year-to-date, hence we have witnessed a significant attrition in the trailing total returns on the back of higher rates. A savvy investor with an active management style should recognize that in a monetary tightening environment a bond portfolio should be tilted to short-duration instruments rather than ZROZ.

We feel the push higher in 30-year rates is not done and we are going to at least revisit 2018 yield levels. That translates into another at least 50bps of tightening, which for such a high duration fund results in an additional -6% pure price downswing. If you are a retail holder of this high duration name you are much better off Selling here given that you are only contemplating downside this year in terms of price. We would revisit once most of the aggressive Fed hikes are done by the fall.

Holdings

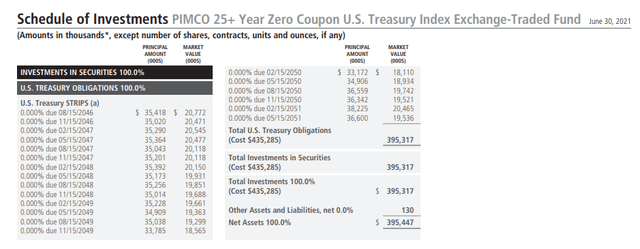

The fund is composed of only stripped US Treasuries:

Individual Holdings (Annual Report)

STRIPS is an acronym for Separate Trading of Registered Interest and Principal of Securities, and it basically references the fact that the underlying financial instruments have only one bullet payment. We can see that ZROZ holds long-dated principal strips. Historically, investors looking at Treasury securities decided that only certain aspects were appealing to some of their needs (i.e., only the interest component or only the principal component) and decided to strip the original Treasury security into underlying cash flows with their own identifiers. Basically, STRIPS lets investors hold and trade the individual interest and principal components of eligible Treasury notes and bonds as separate securities. As an example, a Treasury bond with 10 years remaining to maturity consists of a single principal payment, due at maturity, and 20 interest payments, one every six months over 10 years. When this note is converted to STRIPS form, each of the 20 interest payments and the principal payment becomes a separate security.

Irrespective of the coupon/principal feature, STRIPS are still Treasuries hence they benefit from the full guarantee of the U.S. government. There is no credit risk in this fund. An investor buying into this name only has to worry about the market risk stemming from the fund’s high duration.

Market Risk

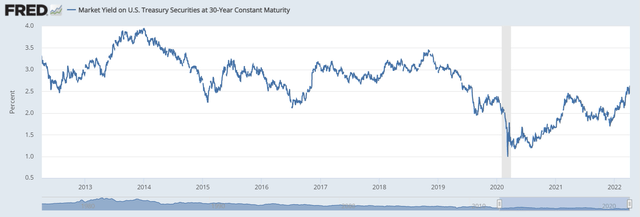

A long-term chart of 30-year rates gives us a clearer picture of what is to come:

Until the 2020 Covid crisis, 30-year rates kept bouncing off the 2.5% level, peaking in the last tightening cycle at almost 4%. However, given the substantial increase in the Fed balance sheet and quantitative easing of the past 2 years, long-dated rates have been at incredibly low levels, having touched 1% during the crisis, and currently being at approximately 2.63%. We believe 30-year rates are going to revisit the 2018 highs of 3.46% and there is more weakness to come in the ZROZ price.

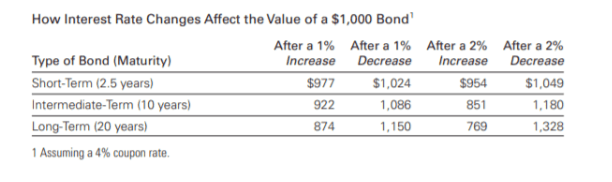

IR Sensitivity (Vanguard)

For a long-duration fund like ZROZ, we can see that a 1% increase in rates translates into a 12% NAV loss, hence the anticipated further 50 bps of tightening will result in another -6% NAV loss.

Performance

The fund is down already -17% year-to-date:

YTD Performance (Seeking Alpha)

On a long-term chart basis we can see that in stable or less aggressive tightening environments the fund tends to hold its value well or even increase on a total return basis:

10-Year Total Return (Seeking Alpha)

For example, in the 2013-2019 Fed tightening cycle, the fund had a positive total return given the drawn-out tightening schedule which allowed the fund’s dividend yield to compensate for the duration impact.

Conclusion

ZROZ is an exchange traded fund that focuses on stripped U.S. Treasuries. With a 27.66 years duration, the vehicle has been severely affected by higher 30-year rates and is down more than -17% year-to-date. We feel the move higher in rates is not done yet and we are at least going to revisit the 2018 highs for this point in the curve. That translates into another at least 50bps of tightening, which for such a high duration fund results in an additional -6% pure price downswing. If you are a retail holder of this high duration name you are much better off Selling here given that you are only contemplating downside this year in terms of price.

Be the first to comment