metamorworks/iStock via Getty Images

Introduction

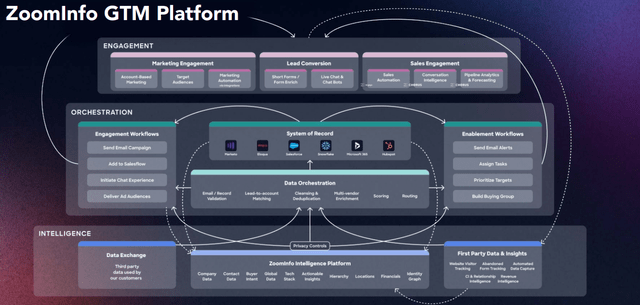

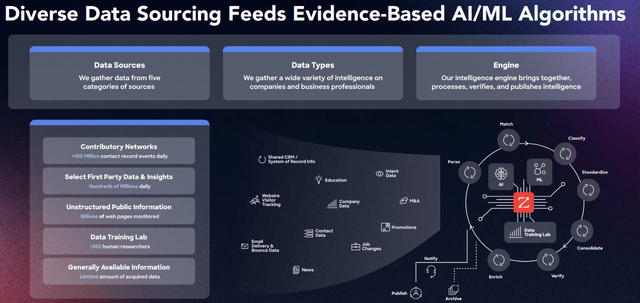

ZoomInfo (NASDAQ:ZI) provides a cloud-based, go-to-market [GTM] intelligence platform for sales and marketing teams of more than 25,000 (small, medium, and large) enterprises. ZoomInfo’s GTM platform utilizes proprietary AI/ML algorithms to deliver real-time data and insights that help improve the productivity of several business functions like sales, marketing, account management, and recruiting.

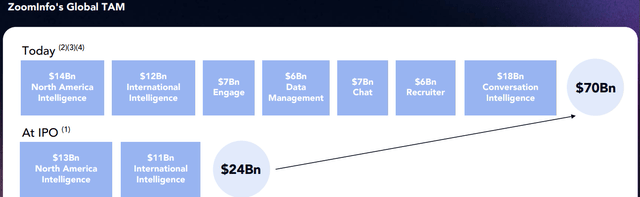

In my opinion, ZoomInfo is a very high-quality company with incredible revenue growth velocity. After its IPO in mid-2020, ZoomInfo’s business has gone from strength to strength, with new products and services driving the expansion of its TAM from $24B to $70B.

ZoomInfo Investor Presentation

In September 2020, we published our analysis on ZoomInfo in this public article on Seeking Alpha. At the time, we passed on the stock for Beating The Market due to concerns around its valuation; however, the stock has done pretty well since then, and the business has performed better than our expectations. Here’s the conclusion of my past research on ZoomInfo from 2020:

ZoomInfo enables sellers and marketers to shorten sales cycles and increase win rates by delivering the right message, to the right person, at the right time to hit their sales targets. Since every business needs to sell effectively to thrive, I expect ZoomInfo’s platform to remain in high demand in the future.

With a visionary CEO like Henry Schuck at the helm, I expect ZoomInfo to accelerate its growth (and expand its market share) by maximizing its improved financial strength following its IPO. The current valuations seem frothy, but investors could still generate annualized double-digit returns over the next decade.

With all of that being said, we cannot blind ourselves to the financial realities underlying these companies, and ZoomInfo perfectly highlights the extent to which we must remain vigilant with respect to avoiding overvalued companies.

The L.A. Stevens Valuation Model is my tool for avoiding the purchase of ZoomInfo at $50+ or even $40+ for that matter. Of course, as the years roll on, I do believe ZoomInfo will easily eclipse those valuation milestones, and it will prove to be a worthwhile investment for those who are patient.

Source: ZoomInfo: A Cautionary Tale For Those Purchasing IPOs

In the last eighteen months, ZoomInfo has launched multiple products, viz. ZoomInfo Engage, ZoomInfo Chat, Workflows, ZoomInfo Recruiter, and Conversation Intelligence. While many of these products are built in-house, ZoomInfo has made a few savvy acquisitions along the way to accelerate its growth trajectory and deepen its business moat. With the integration of Chorus.ai’s conversation intelligence solution into its go-to-market intelligence platform, ZoomInfo’s value proposition (ROI delivered to customers) has increased considerably over the last six months or so. To learn more about ZoomInfo’s long-term ambitions, you should read Henry Schuck’s note on the Chorus.ai acquisition: ZoomInfo Acquires Chorus.ai | The Pipeline | ZoomInfo.

ZoomInfo Investor Presentation

ZoomInfo Q4 Investor Presentation

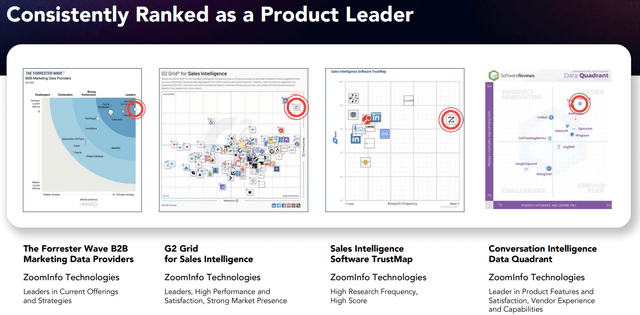

At its core, ZoomInfo is a data and AI/ML company. As ZoomInfo’s dataset grows with more and more customers using its modern GTM platform to enhance their business operations, ZoomInfo’s AI/ML-based insights get better and better. Today, ZoomInfo is ranked as a product leader in several categories served by its platform – B2B Marketing Data, Sales Intelligence, and Conversation Intelligence – and this is clear evidence of ZoomInfo being a best-of-breed platform. Frankly, there’s not a lot of competition.

ZoomInfo Q4 Investor Presentation

ZoomInfo’s organic growth of 50%+ is profitable (high free cash flow generation), and the balance sheet is ever-improving. With a humongous total addressable market opportunity of $70B, ZoomInfo is still just scratching the surface. Considering the potential expansion of its platform and international expansion, I see a long, long growth runway for ZoomInfo.

In this note, we shall analyze ZoomInfo’s Q4 report. Furthermore, we will re-evaluate its intrinsic value and expected returns to see if ZoomInfo’s stock is a good investment at current levels of ~$50 per share. Without further ado, let’s get started.

Analyzing ZoomInfo’s Q4 Earnings Report

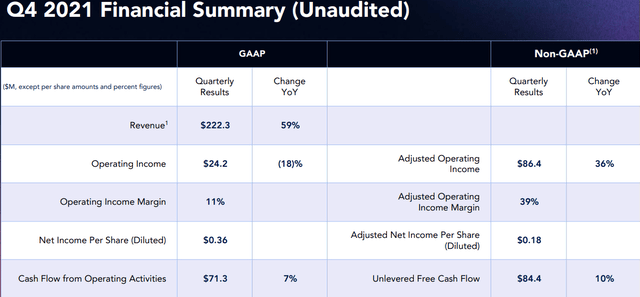

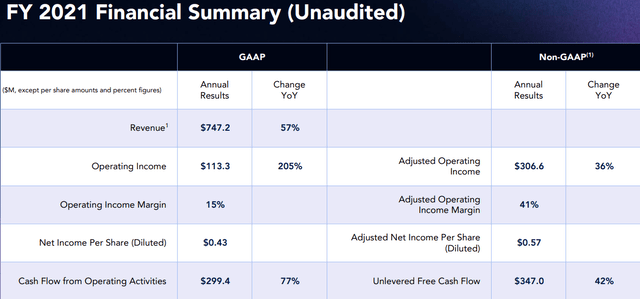

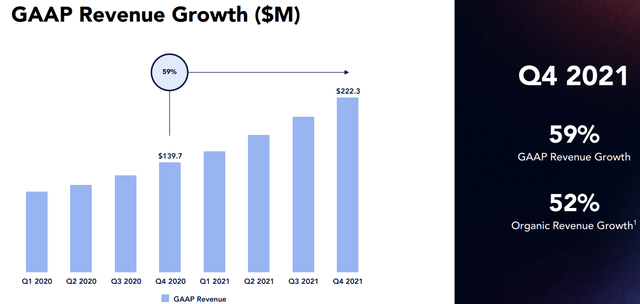

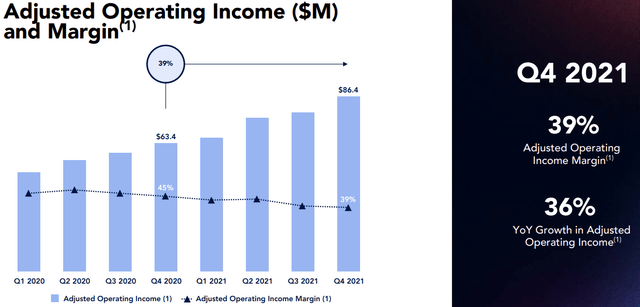

In Q4 2021, ZoomInfo’s GAAP revenues grew to $222.3M (up 59% y/y, up 12.5% q/q) beating analyst expectations by ~8%. In addition to the sales beat, ZoomInfo exceeded expectations on the bottom line, with robust margin expansion and cash flow conversion.

ZoomInfo Q4 Investor Presentation

ZoomInfo Q4 Investor Presentation

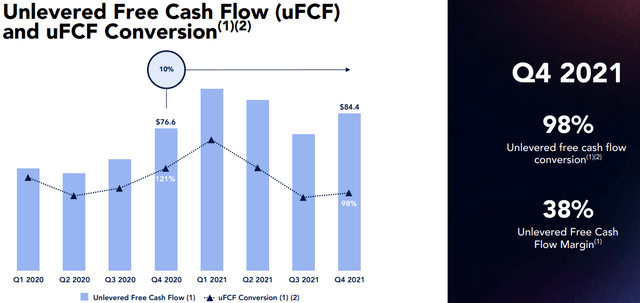

For 2021, ZoomInfo raked in total revenue of $747M and generated unlevered free cash flow of $347M (42% of total revenues). The strength in ZoomInfo’s financial performance is a mix of organic and inorganic growth.

ZoomInfo Q4 Investor Presentation

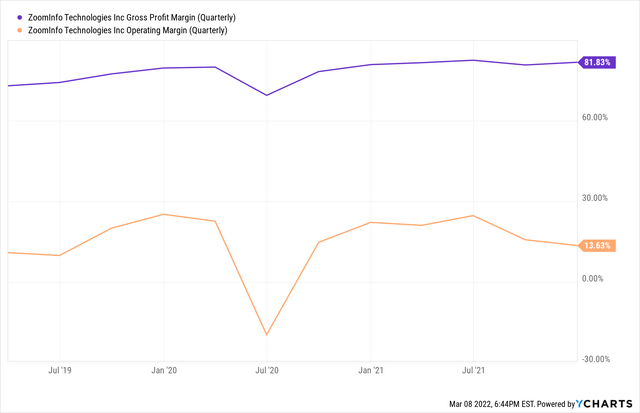

In my view, ZoomInfo’s go-to-market intelligence platform is the best-of-breed platform in its category. While some critics tend to write off ZoomInfo as a lead generation tool of little value, the company’s gross margins of ~82% are reflective of a highly-differentiated product that delivers a ton of value to its customers. ZoomInfo’s net retention rate of 116%+ further supports my view.

YCharts

With rapidly-growing sales and robust margins, ZoomInfo is turning into a free cash flow machine of sorts. In Q4, ZoomInfo’s Adj. Operating Income stood at $86.4M (Adj. Operating Margins of 39%), and 98% of this figure turned to unlevered free cash flow, which is outstanding operational efficiency.

ZoomInfo Q4 Investor Presentation

ZoomInfo Q4 Investor Presentation

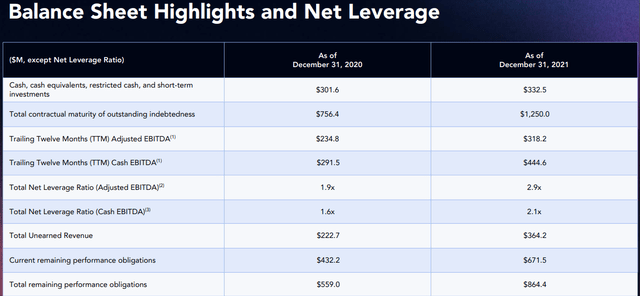

As ZoomInfo continues to produce tons of free cash flow every quarter, its balance sheet is getting better and better. With ~$332.5M of cash on its balance sheet and a highly FCF positive business, ZoomInfo is unlikely to need a cash infusion anytime soon (i.e., minimal risk of shareholder dilution).

ZoomInfo Q4 Investor Presentation

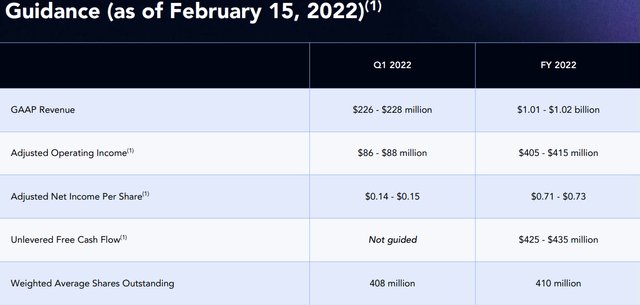

For 2022, ZoomInfo’s management has guided for $1.01B-$1.02B in sales, which, if true, would mean a sharp deceleration in revenue growth rates, from 57% in 2021 to 36% in 2022. While this guidance is weak, considering ZoomInfo’s platform expansion and business momentum, I think the numbers are sandbagged. My projection for 2022 sales is $1.1B (growth of 47% y/y), but we will review this figure after Q1.

ZoomInfo Q4 Investor Presentation

Now, let us determine ZoomInfo’s intrinsic value and expected returns.

ZoomInfo’s Fair Value And Expected Returns

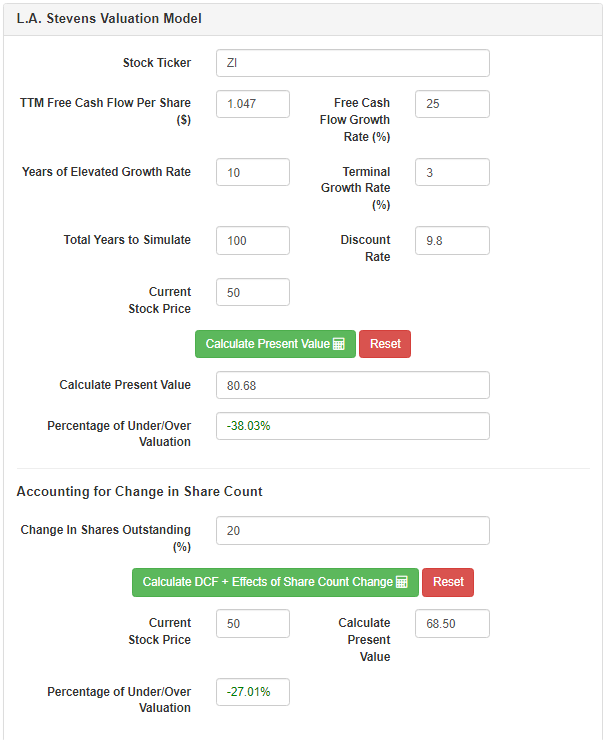

Assumptions:

|

Forward 12-month expected revenue [A] |

$1.1 billion |

|

Potential Free Cash Flow Margin [B] |

40% |

|

Average diluted shares outstanding [C] |

~420 million |

|

Free cash flow per share [ D = (A * B) / C ] |

$1.047 |

|

Free cash flow per share growth rate |

22.5% |

|

Terminal growth rate |

3% |

|

Years of elevated growth |

10 |

|

Total years to stimulate |

100 |

|

Discount Rate (Our “Next Best Alternative”) |

9.8% |

Results:

L.A. Stevens Valuation Model

According to our projections, ZoomInfo’s intrinsic value is ~$68.5, i.e., it is currently undervalued by around ~27%.

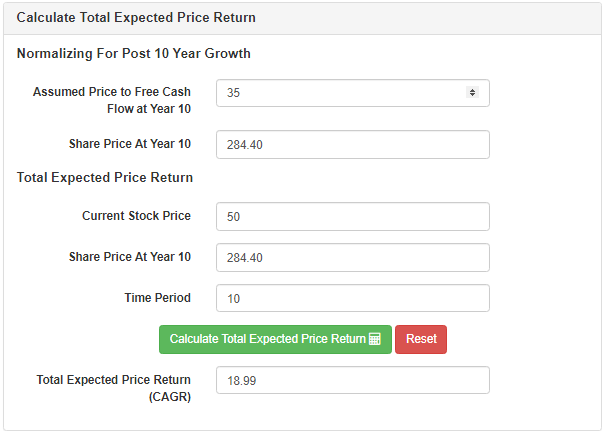

To calculate expected CAGR returns, I chose a conservative Price-to-FCF multiple of 35x (which aligns with that applied to mature SaaS companies, such as Adobe (ADBE) and Salesforce (CRM)), and multiplied it by the projected FCF per share at year-10 to generate a price target of about $284 for ZoomInfo.

L.A. Stevens Valuation Model

Since the total expected return of 18.99% is greater than my hurdle rate of 15%, I rate ZoomInfo a buy at ~$50.

ZoomInfo is a rapidly-growing, highly-profitable business trading below fair value. While ZoomInfo’s valuation may compress further if revenue growth decelerates in 2022 (as per management’s guidance), I like the idea of starting a long position here with an intent to DCA if the price declines over the coming months.

Key Takeaway: ZI stock is a buy at $50.

Thanks for reading. Please share your thoughts, questions, or concerns in the comments section below.

Be the first to comment