D-Keine/E+ via Getty Images

Investment Thesis

Zoom Video Communications, Inc. (NASDAQ:ZM) is apparently Cathie Wood’s most significant stock, given its huge weightage of 9.49% in the ARK Innovation ETF (NYSEARCA:ARKK) and 8.14% in the ARK Next Generation Internet ETF (NYSEARCA:ARKW). With a combined market value of $987.3M in her portfolio, it is evident that Cathie Wood remains highly confident of ZM’s potential in the post-COVID-19 world.

However, we are skeptical, given the deceleration of ZM’s revenue growth, plateauing net income profitability, and the intense competition waged by the Big Techs, such as G Suite (GOOG) and Microsoft Teams/Skype (MSFT). These deep-pocketed companies tend to offer better-packaged deals to enterprises, thus we are not surprised by ZM’s slowing growth in the segment. In addition, numerous new players in the market are offering similar teleconference products, indicating ZM’s lack of economic moat moving forward.

Though we were once Zoom users as well, we have to admit that there are many exciting options now for varying purposes of virtual meetings or online collaborative work. As a result, we think that the “single-product company” has more or less reached its maximum potential for now. Even though the market is large enough to accommodate multiple players, ZM is likely to remain stagnant for some time to come, barring another pandemic occurrence.

ZM Hit The Jackpot During The Pandemic

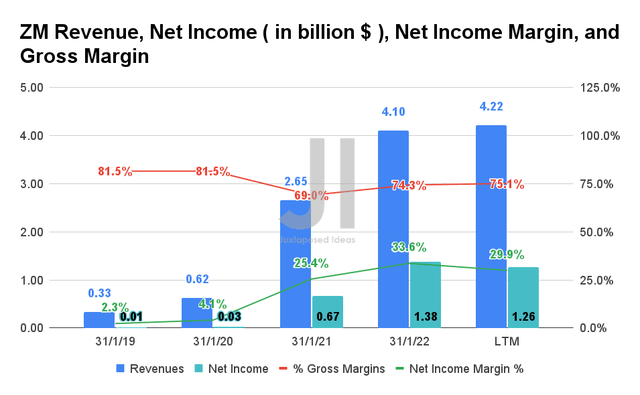

ZM Revenue, Net Income, Net Income Margin, and Gross Margin (S&P Capital IQ)

ZM obviously has had a blast in the past two years, with a meteoric rise in revenue and net income growth. The company reported revenues of $4.22B and gross margins of 75.1% in the LTM, representing a massive revenue increase of 680.6% from FY2020 levels, respectively. That has directly translated to its improved profitability with net incomes of $1.26B and net income margins of 29.9% in the LTM, representing an increase of 4200% and 25.8 percentage points from FY2020 levels, respectively.

ZM’s Decent Growth In Enterprise Segment

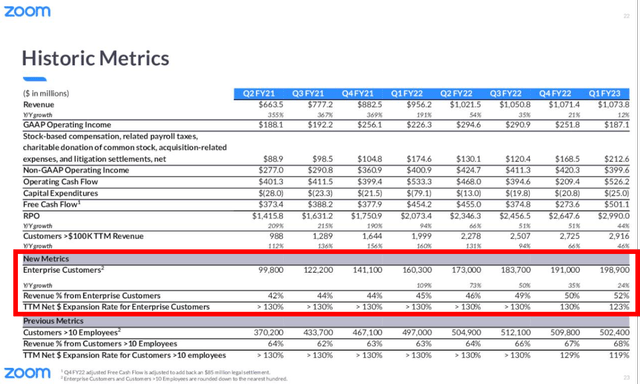

ZM’s Decent Growth In Enterprise Segment (Seeking Alpha)

It is evident that ZM has somewhat maintained its relevance after the boom in the past two years, given its 198.9K of enterprise customers by FQ1’23. Nonetheless, despite the segment accounting for 52% of its revenue, it is apparent that its net dollar expansion is slowly declining to 123% by FQ1’23 as opposed to 130% in FQ4’22. In addition, we are also observing an apparent deceleration of growth for its enterprise segment in FQ1’23 at 24% YoY, compared to 73.3% in FQ2’22. Nonetheless, we can also see ZM expanding its suite of products to potentially increase enterprise spending, given its recent launch of the New Call Center Product adopted by TEAMHealth and Franklin Covey.

ZM Cash/Equivalents, FCF, And FCF Margins

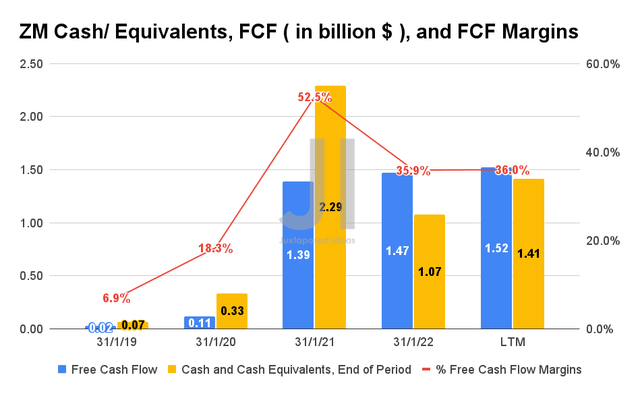

ZM Cash/ Equivalents, FCF, and FCF Margins (S&P Capital )

As a result of the windfall since FY2021, ZM improved its Free Cash Flow (FCF) generation to $1.52B and FCF margins of 36% in the LTM, representing a remarkable increase of 1381.8% and 17.7 percentage points from FY2020 levels, respectively. The company also grew its cash and equivalents on its balance sheet to $1.41B in the LTM.

ZM Operating Expense

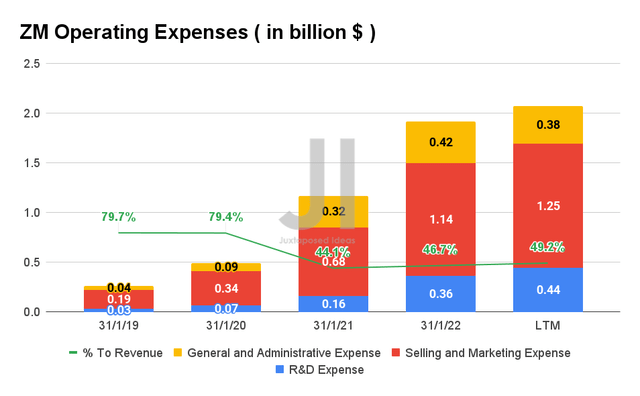

ZM Operating Expense (S&P Capital IQ)

As a result of its expansion, ZM also grew its operating expenses to $2.07B at the LTM, representing an increase of 414% from FY2020 levels, given the massive increase in internal hiring in the past two years. However, we are not overly concerned since the company kept it within 49.2% of its growing revenues in the LTM. Nonetheless, given the potential economic slowdown, investors would be well advised to monitor this segment, as it directly translates to ZM’s net income and FCF profitability moving forward.

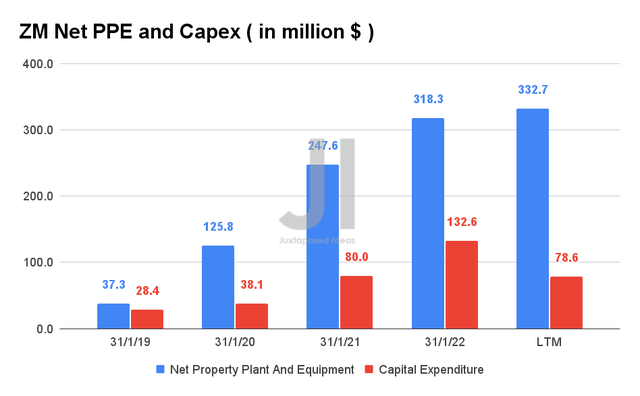

ZM Net PPE And Capex

ZM Net PPE and Capex (S&P Capital IQ)

ZM also kept its PPE assets and capital expenditure relatively modest compared to its profitability, at a total Capex of $78.6M in the LTM, representing 6.2% of its net income. Therefore, the management seemed rather capable in its capital management thus far.

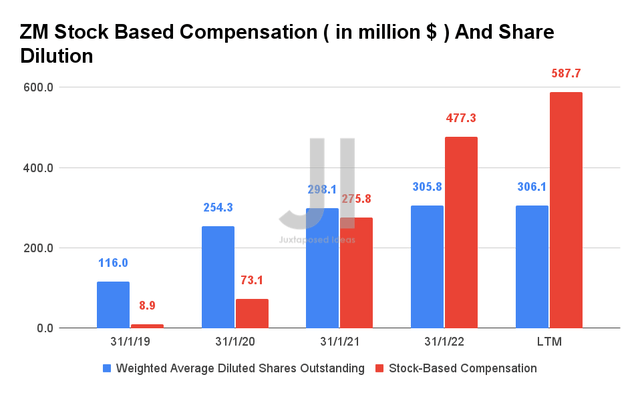

ZM Stock-Based Compensation And Share Dilution

ZM Stock-Based Compensation And Share Dilution (S&P Capital IQ)

However, despite ZM’s apparent net income and FCF profitability, the company has been increasing its Stock-Based Compensation (SBC) at an aggressive rate. By the LTM, the company reported $587.7M of SBC expenses, representing a massive increase of 23.1% from FY2022 levels and 213% from FY2021 levels.

However, we must also commend ZM for holding its share count relatively stable in the past two years, despite its recent windfall. In addition, with a share buyback program of up to $1B, we may see a meaningful value creation for its existing shareholders through February 2024.

ZM’s Normalization Of Growth Is To Be Expected

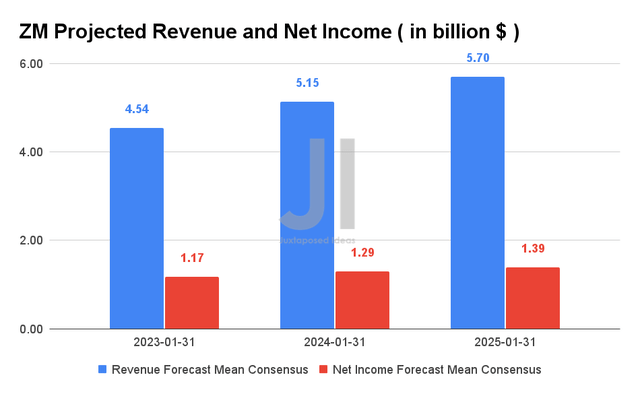

ZM Projected Revenue and Net Income

ZM Projected Revenue and Net Income (S&P Capital IQ)

Over the next three years, ZM is expected to report revenue growth at a CAGR of 11.7% while reporting in-line net income profitability. That would be a massive decline in revenue gain compared to the pandemic hypergrowth at a CAGR of 156.84%. In addition, it is evident that its net income profitability is likely to decline over time, from net income margins of 33.6% in FY2022 to 24.3% in FY2025. For FY2023, consensus estimates that ZM will report revenues of $4.54B and net income of $1.17B, representing YoY growth of 11% though a decline of 14.5%, respectively.

ZM will likely continue its decent performance over time, given that the market will grow large enough to accommodate multiple players. Fortune Business Insights project that the global video conferencing market will grow from $6.28B in 2021 to $14.58B in 2029 at a CAGR of 11.3%. YTD, ZM also commands an approximate market share of 5.38% in the video conferencing market, as opposed to the apparent winner, G Suite, with 85.24%, and Skype, owned by MSFT, with 1.54%. Nonetheless, we expect ZM’s market share to continue declining over time, given the intense competition from the booming market with over 140 other teleconferencing alternatives.

As a result, given the normalization of its revenue growth and falling profitability, we are unconvinced of the ZM stock’s ability to reach a $1.5K stock price by 2026, as projected by Cathie Wood and ARK Invest. Obviously, short of another pandemic-induced global lockdown, I am confident that the world is better prepared now and would be more likely to diversify beyond ZM’s offerings.

So, Is ZM Stock A Buy, Sell, Or Hold?

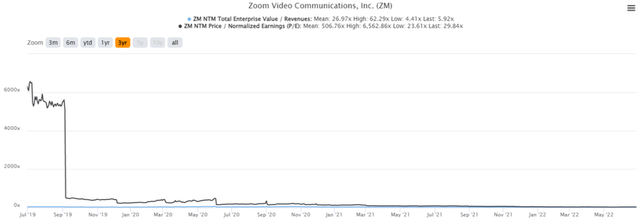

ZM 3Y EV/Revenue and P/E Valuations

S&P Capital IQ

ZM is currently trading at an EV/NTM Revenue of 5.92x and NTM P/E of 29.84x, lower than its 3Y mean of 26.97x and 506.76x, respectively. The stock is also trading at $111.87, down 72.4% from its 52 weeks high of $406.48, though at a premium of 41.5% from its 52 weeks low of $79.03.

ZM 3Y Stock Price

S&P Capital IQ

Long-term ZM investors that had bought in during the IPO would have been glad to cash out their holdings during the height of the pandemic. In contrast, those that had added at highs would have been disappointed at its current stock performance, significantly worsened by the reopening cadence.

Therefore, despite the attractive buy rating from the consensus estimates with a price target of $119.18, we are not convinced by the minimal 6.53% upside. In addition, we believe that ZM has more to fall in the intermediate term, given the glaring lack of moat, current bearish market sentiment, and the potential recession.

Therefore, those who are somehow still holding on to the stock should quickly sell the stock and recoup all their capital in the subsequent recovery. In contrast, good luck to the believers since the stock will likely remain stagnant for some time.

Therefore, we rate ZM stock as a Hold for now.

Be the first to comment