AnnaElizabethPhotography/iStock via Getty Images

This article is my first look at Zomedica (NYSE:NYSE:ZOM), a microcap in the veterinary supply business that trades on the NYSE American stock exchange. I’m taking a look at its stalwart efforts to break out in the fast growing veterinary care industry.

Zomedica provides a wide range of supplies for large and small animals.

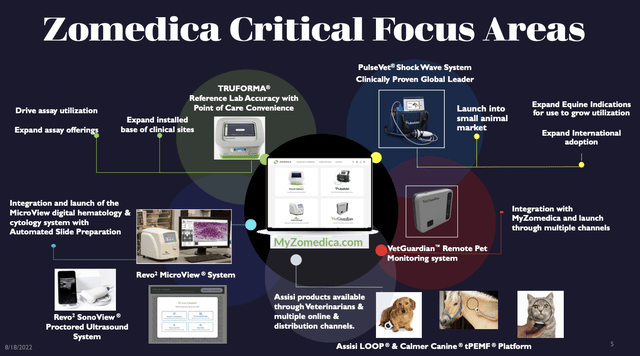

Like so many smaller companies, Zomedica foregoes quarterly earnings calls. Accordingly, finding convenient information on Zomedica is catch-as-catch-can. Luckily for my current endeavor, Zomedica published a recent (08/18/2022) investment highlights slide deck (the “Deck”); its critical focus areas slide, below, provides an extensive overview of the company’s products:

investors.zomedica.com

Its latest 10-Q, (p. 8) points to the several different revenue streams generated by these products. These include the sale of point of care instruments, consumable products, and extended warranties. Caution is however advised. Although not readily apparent from this critical focus slide, Zomedica is very much an operation in development.

In fact, this article is a voyage of discovery on Zomedica for me as an author even more so here than is normal. Zomedica reported zero revenues in its 2021 10-K (p. 1). Instead in its section describing its business, it reported:

Overview

We are a veterinary health company creating products for companion animals by focusing on the unmet needs of clinical veterinarians. We expect that our product portfolio will include innovative diagnostics and medical devices that emphasize patient health and practice health. With a team that includes clinical veterinary professionals, our goal is to provide veterinarians the opportunity to increase productivity and grow revenue while better serving the animals in their care.

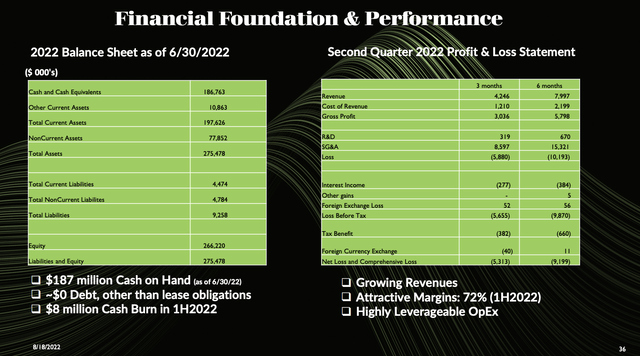

The balance of this article will describe how it has managed to progress to its Q2, 2022 revenues, revenues with astronomical growth and, as I discuss, astronomical potential. Seeking Alpha’s latest Q2, 2022 Zomedica earnings release bullet points reads:

- Revenue of $4.2M (+26438.0% Y/Y).

- The increase was primarily due to the inclusion of our PulseVet platform which had revenues of $4.2 million consisting of instruments, trodes [applicators], and warranty services sold worldwide.

- We anticipate that costs of revenue will increase in 2022 in accordance with the increased revenue as described above.

- Zomedica had cash and cash equivalents of $186.8 million as of June 30, 2022, compared to $276.2 million as of June 30, 2021.

Zomedica’s PulseVet acquisition has energized its earnings

Zomedica’s 2022 10-K reveals a great deal about the company and its strategies. Most elementally the company reports in two segments, diagnostics and therapeutics. Its legacy (2019 10-K, p. 3) business is its diagnostics segment.

The diagnostics business consists of the parent company and its subsidiary with their TRUFORMA products as described in the slide above and additionally in slides 10-15 of the Deck. These generate revenues from instrument sales, sales of cartridges and warranty services for the instruments.

Diagnostics uses a razor and razor-blades business model for its products. This will take considerable time and energy to develop as reflected by its Q2, 2022 earnings release. The release described its TRUFORMA diagnostic platform and its “Customer Appreciation Program” as follows:

…we provide veterinarians with an instrument at no cost to them in exchange for a commitment to utilize our assays. We are preparing to launch the Free T4 assay in the second half of 2022, completing our thyroid disease panel, and we continue to work with our development partner to produce assays for non-infectious GI disease for launch in 2023. To drive customer education and interest, our marketing team continues to sponsor presentations by luminaries in the field introducing new assays at veterinarian conferences throughout 2022.

In Q2, 2022 TRUFORMA generated product revenue of $92,000, a 486% increase compared to Q2, 2021 revenue of $16,000.

Zomedica’s far larger therapeutics business embraces its domestic PulseVet operations. It also includes two international subsidiaries, HMT High Medical Technologies (Japan) Co. Ltd. (“HMT”) and NeoPulse, GmbH (“NeoPulse”), and includes the ProPulse products and services.

Zomedica acquired the PulseVet business in 10/2021 in a $70.9 million all cash deal. Its release described the acquisition as:

Pulse Veterinary Technologies (“PulseVet”) … a world leader in electro-hydraulic shock wave technology for the treatment of a wide variety of conditions in veterinary patients. The high-energy sound waves stimulate cells and release healing growth factors in the body that reduce inflammation, increase blood flow, and accelerate bone and soft tissue development. PulseVet’s technology is used in conditions including tendon and ligament healing, bone healing, osteoarthritis, chronic pain, and wound healing.

The PulseVet business employs a razor-razorblade economic model in which a customer buys a shock wave generator as capital equipment, along with replaceable therapy hand pieces called “Trodes.” Each Trode has an expected life of forty to fifty therapy sessions. Once a Trode completes its useful life, the customer replaces it with a refurbished Trode.

At the time of the deal, PulseVet was the market leader in the equine space with 1,500 systems actively in use globally. It had recently introduced a new handpiece, the X-Trode, with energy output for maximum efficacy without requiring patient sedation.

As revealed by its Q2, 2022 release, PulseVet generated orders of magnitude larger revenues than did its legacy business. PulseVet contributed $4.2 million in the quarter, an increase of 48% over its second quarter 2021 revenue of $2.8 million as a standalone company.

Notably PulseVet was able to expand into small animal veterinary practices. It placed 22 units – a 20-fold increase over its Q2, 2021 placement of a single unit as a standalone company. Its full future potential is described in slides 17-23 of the Deck.

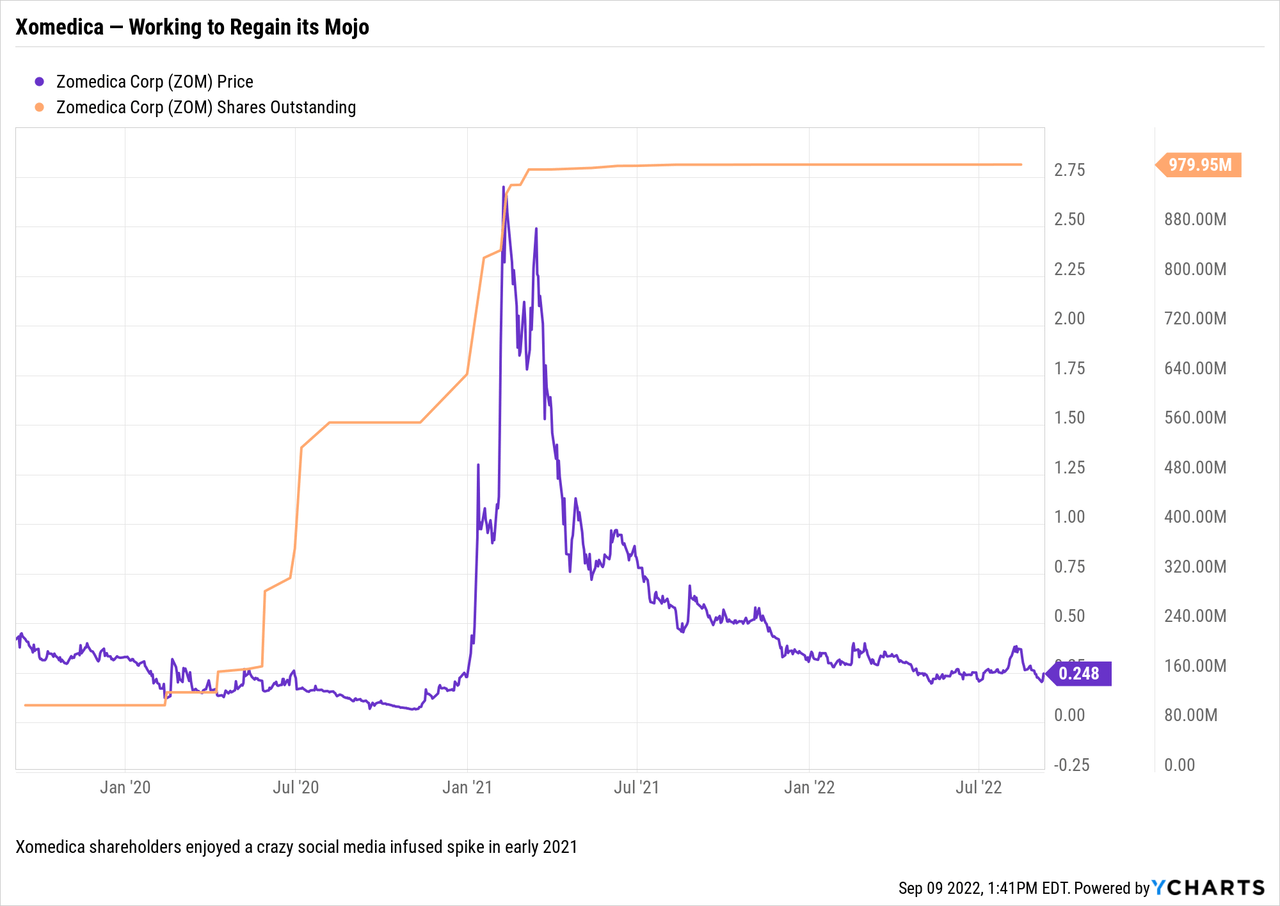

Zomedica has been a boom and bust stock since its formation; it is currently in a bust phase

Since its IPO in 2016, Zomedica has had two major booms followed by lengthy pullbacks. Its initial runup in June of 2018 took it to nearly $3.00 on no apparent specific news. Then, in early 2021 after long trading below $0.50, and even below $0.10 for a bit, the stars all came in alignment for the company as announced in its 01/18/2021 CEO’s letter to shareholders.

The shares were catching a bid based on its expected TRUFORMA commercialization. It was also trading with social media enthusiasm. Shareholders exercised millions of dollars in warrants; its cash increased and it was able to regain compliance with NYSE American listing requirements.

Then, on 02/08/2021 after having recently sunk so low, it was able to latch onto a $25 million stock bought-deal issuance at $1.90 per share. Its shares then traded up to a high of $2.91. The good times did not last. By tax day 2021, they were trading back <$1.00. They have been trending down ever since. As I write on 09/09/2022, they are trading at $0.25.

Zomedica is working methodically to rekindle its share price

Zomedica is continuing with its deals. It has done three exciting ones already in 2022. In 05/2022 it:

…purchase[d] … a $1.0 million convertible note of Ohio-based animal care company Structured Monitoring Products, Inc. giving it an option to act as a sales agent for SMP’s platform.

[And it bought] an option to acquire the VetGuardian product line, which allows real-time remote monitoring of the pet’s vital signs during the clinic or after surgery.

It is unclear what it plans to do with this asset. It offered no explanation of its future plans in its 10-Q or in its Q2, earnings release. VetGuardian is called out in its focus area slide above and in slides 31-33 of the Deck revealing significant revenue potential. The cost for the option is to be negotiated. Judging by its other deals, it will call for cash and warrants and possibly earn-outs.

Zomedica’s next deal was its 06/2020 announced acquisition of veterinary imaging company, Revo Squared’s assets. In its Q2, 10-Q (p. 21) it provided details of the deal. In addition to nominal cash, Zomedica:

…issued to Revo Squared a ten-year warrant to purchase an aggregate of 10,000,000 of the Company’s common shares at a per share exercise price equal to $0.2201. Zomedica Inc. has agreed to pay Revo Squared aggregate earn-out payments of up to $4,000 based on the achievement of milestones related to future net sales from Revo Squared Products. One-time earn-out payments of $2,000 each will be payable upon net sales from Revo Squared Products exceeding $5,000 and $10,000 during any calendar year ending on or prior to December 31, 2027.

Details of its plans for Revo are set out in slides 28 and 29 of its slide deck.

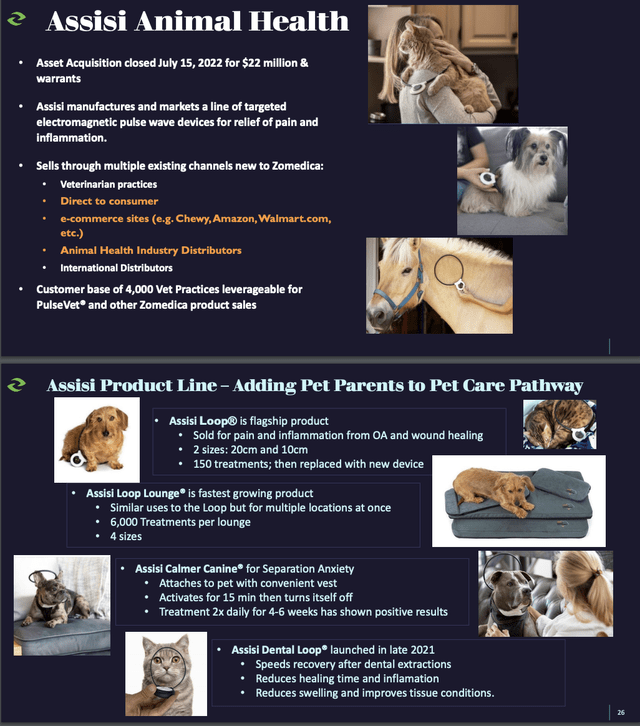

Zomedica’s third recent deal was its 07/2022 acquisition of assets of Assisi Animal Health. Its Assisi deal lines up nicely with its PulseVet deal as shown by slides 25 and 26 from the Deck, below:

seekingalpha.com

Conclusion

Zomedica is a small company which is working to do big things. This article has only touched on the company which has turned out to be at the very beginning of a new and exciting growth phase.

Its financial development is a black box at this point since it is sprouting new businesses like weeds. Its Financial Foundation slide from the Deck shows that it has the wherewithal to develop its bountiful prospects:

seekingalpha.com

Zomedica has built an interesting business with diverse revenue streams using a clever combination of cash and warrants as coin of the realm. I have labeled it as a strong buy.

There can be no doubt that it is highly speculative. None of its businesses has a proven track record, some have no record at all. The one record that is clear is that it currently generates losses and it expects to do so for the foreseeable future.

Be the first to comment