akinbostanci/iStock via Getty Images

A few months ago, I downgraded ZimVie Inc. (NASDAQ:ZIMV) due to the company lowering its full year guidance mere months after introducing it. I was also worried about Zimmer Biomet Holdings’ (ZBH) block of ZIMV shares coming for sale.

Fast forward a few months and ZimVie’s latest Q3 quarterly results were a step in the right direction, with EBITDA margins coming ahead of management’s full year guidance. Furthermore, we learned from Zimmer Biomet’s 10-Q that the company has engaged in a forward sale of its ZIMV shares, causing the large September plunge.

At this point, I do believe ZimVie’s shares are attractively priced, currently trading at less than 5.0x adj. Fwd P/E and LTM P/CF. However, investors will need lots of patience with ZimVie, as it will probably take a few quarters to regain investor confidence after the terrible stock performance. Investors will also need to weigh the company’s heavy floating rate debt load, particularly as interest rates continue to ratchet higher.

Brief Company Overview

A quick refresher for those not familiar with the company. ZimVie Inc. was spun out of Zimmer Biomet earlier in March. Its business comprised the non-core Dental and Spine businesses of Zimmer Biomet. Zimmer Biomet decided to spin out ZimVie in order to focus its corporate attention on the faster growing orthopedic business.

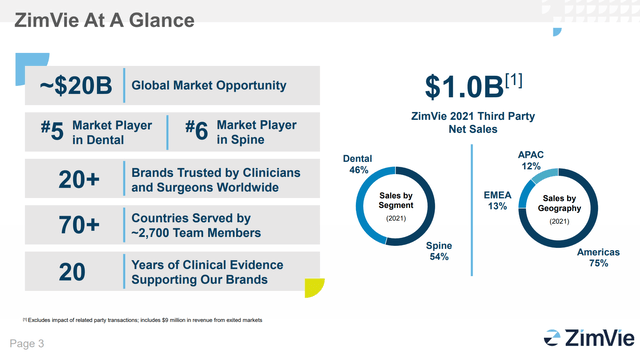

According to the ZimVie’s estimates, with sales of ~$1 billion, the company is the 5th largest player in the dental implants market and the #6 player in the spine market (Figure 1).

Figure 1 – ZimVie overview (ZIMV Investor Presentation)

Latest Quarter Was Ahead Of Lowered Guidance

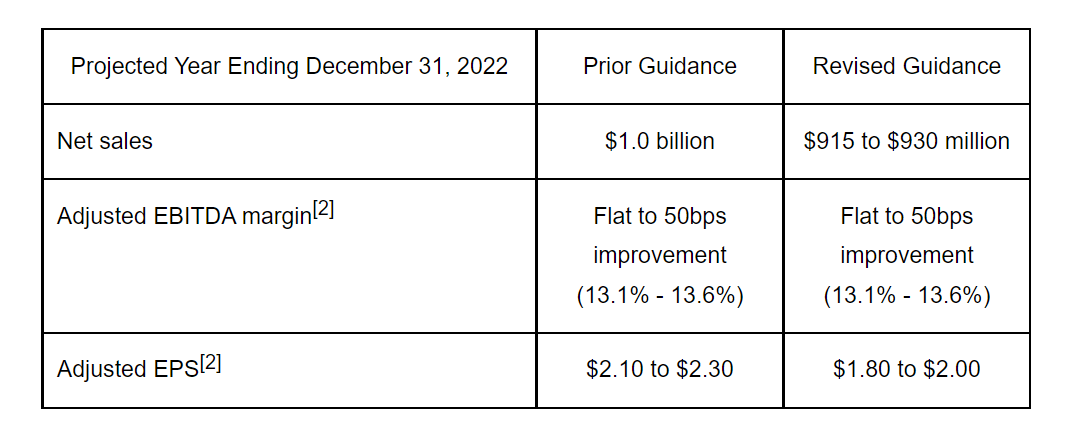

If we recall from last quarter, ZimVie surprisingly lowered its full-year guidance mere months after introducing it in March, as sales were falling faster than management had anticipated in addition to large currency headwinds. Figure 2 below shows management’s reduced guidance from August.

Figure 2 – ZimVie reduced full year guidance in August (ZimVie Q2/2022 Press Release)

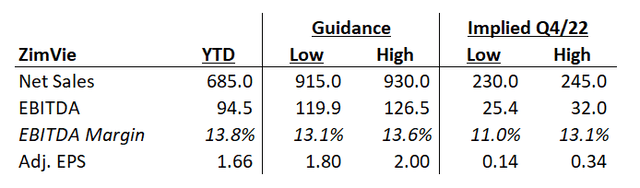

Recently, ZimVie reported Q3/2022 earnings that were slightly ahead of the lowered guidance. Q3/2022 revenues were $215 million (-10% YoY) with adjusted EBITDA margin of 13.8%, ahead of management’s expectations for the full year, and adjusted EPS was $0.49. This brings YTD revenues to $685 million, adj. EBITDA to $94.5 million (13.8% margin) and adj. EPS to $1.66.

Is A Weak Fourth Quarter Implied?

What is interesting is that with YTD adj. EBITDA margins of 13.8% and $1.66 in adj. EPS, ZimVie did not take the opportunity to raise its full year guidance. Instead, the company chose to maintain the same full year guidance that was lowered in August. Perhaps the company is trying to give out conservative guidance so it can “beat” it, but taking the company at its word would imply quite a weak upcoming Q4, with revenues ranging between $230 – $245 million and adj. EPS of $0.14 – $0.34 (Figure 3)

Figure 3 – ZimVie implied Q4 revenues and earnings (Author created with data from ZimVie press releases)

When asked about this topic on the Q3 earnings call, the CFO confirmed that there may be “choppiness” in the upcoming quarter: (author highlighted important sentences)

Unidentified Analyst

This is actually Lily on for Robbie. So you came ahead on both EPS and EBITDA, though reiterated the guide which implies a slightly softer fourth quarter. So are there any sort of headwinds or dynamics that we should be keeping in mind for the fourth quarter?

Rich Heppenstall

Yes. Not necessarily. What we are seeing is in the fourth quarter around EPS, and I’ll address that one first, is obviously with the Fed continuing to raise interest rates, interest rates continue to be a little bit higher. And then in the third quarter, we did have kind of that ongoing tax benefit from the benefit that we realized in Q2.

Relative to EBITDA, what I would say there is we do expect to be at the higher end of the range. What we’re still seeing is as we continue through the year that there’s a fair amount of choppiness in the income statement as evidenced in Q3 as we look to decouple from Zimmer Biomet.

And so we’re affirming the full year EBITDA guidance. We expect to be at the top end of that range, but there’s just some cleanup and some choppiness that we still need to kind of continue to work through. But are on track to our objectives.

– CFO Rich Heppenstall and analyst from JP Morgan

Stock Plunged Post Second Quarter Results

When I wrote my prior article on August 25, I became concerned about ZimVie as the company had to cut guidance mere months after introducing it at the inaugural investor day in March, so I recommended investors step to the sidelines. That appears to be a fortunate call, as the stock plunged shortly after my article, with the stock falling by as much as 60% to touch a low of $6.67 / share at one point in October (Figure 4).

Figure 4 – ZimVie stock plunged in September/October (Seeking Alpha)

Was the plunge in ZIMV’s shares purely on the reduction in full year guidance, or was there something more to the story?

Zimmer Biomet Pledged ZimVie Shares For A Loan

Recall from my initial article, I noted the odd structure of the ZimVie spinoff in which Zimmer Biomet retained just under 20% shareholding in ZimVie with the intention to use it to satisfy some of its own indebtedness. I warned: (author highlighted important sentences)

Incidentally, as of the writing of this article, Zimmer Biomet is still registered as a 10% holder of ZimVie stock and has not disposed them yet. I believe the reason is Zimmer Biomet is restricted from selling its ZIMV shares as the shares are ‘unregistered’ and Zimmer Biomet must wait 6 months before selling them, according to SEC Rule 144. This puts a potential catalyst around September as when Zimmer Biomet may offload their ZimVie shares.

It appears I was correct in my assessment on Zimmer Biomet’s course of action and timeline. Here is an excerpt from Zimmer Biomet’s latest Q3/2022 10-Q report: (author highlighted important sentences)

On August 31, 2022, we borrowed an aggregate principal amount of $83.0 million under a short-term credit agreement (the “Short-Term Term Loan”) with a third-party financial institution, the proceeds of which will be used to repay certain of our existing indebtedness. On September 1, 2022, we entered into a forward exchange agreement and pledge agreement (collectively the “Forward Exchange Agreement”) with the same financial institution to deliver to them our 5.1 million shares of ZimVie common stock in the first quarter of 2023. It is likely that the financial institution has entered into hedging transactions, which may include selling the ZimVie shares in the market, in anticipation of receiving the shares in the first quarter of 2023. We have pledged our 5.1 million shares of ZimVie common stock to the financial institution as collateral for our obligations under the Short-Term Term Loan and the Forward Exchange Agreement. Upon settlement of the Short-Term Term Loan, which is expected to be in the first quarter of 2023, we will transfer our ZimVie common shares to the financial institution counterparty to settle the Forward Exchange Agreement and we will either receive or pay an amount primarily depending upon the difference between the average of the daily volume-weighted average price of the ZimVie shares over the outstanding term of the Forward Exchange Agreement and the principal amount of $83.0 million.

No wonder ZimVie’s stock plunged in September, as the investment bank mentioned above likely shorted ZIMV stock in anticipation of receiving the shares in Q1/23. This Zimmer Biomet/ZimVie transaction may be remembered by future historians as one of the worst spinoff executions in history, with ZBH setting up ZIMV to fail from day one!

What Do I Think Of The Valuation Now?

With the Zimmer Biomet block of shares effectively sold, I do believe a valuation overhang has been lifted from ZIMV’s shares. Currently, at ~$9 per share, ZIMV is trading at less than 5.0x adj. Fwd P/E, based on management’s guidance for adjusted earnings of $1.80 – $2.00 / share.

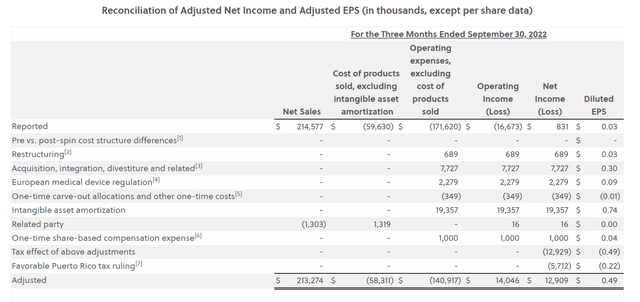

The main problem is whether one trusts the adjusted earnings figure. Similar to prior quarters, ZIMV’s adj. earnings in Q3/2022 ($12.9 million) continue to differ materially from its reported GAAP earnings ($0.8 million). In Q3/2022, the notable differences were $7.7 million in divestiture related expenses, $19.4 million in intangible amortizations, $12.9 million in tax adjustments, and $5.7 million from a favorable Puerto Rico tax ruling, in addition to a host of other small adjustments (Figure 5).

Figure 5 – ZimVie Q3/2022 Adjusted Earnings (ZimVie Q3/2022 Press Release)

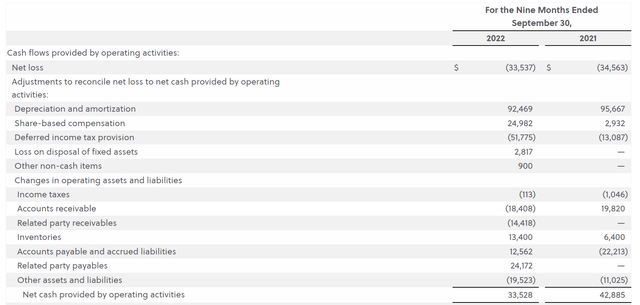

Rather than look at earnings with lots of quarterly adjustments, investors can instead look at operating cash flows, which is less prone to manipulation. On a cash flow basis, ZIMV’s business has generated $33.5 million in CFO YTD ($1.28 / share), a decline of 22% vs. $42.9 million in the same period in 2021 (Figure 5).

Figure 6 – ZimVie Q3/2022 CFO (ZimVie Q3/2022 Press Release)

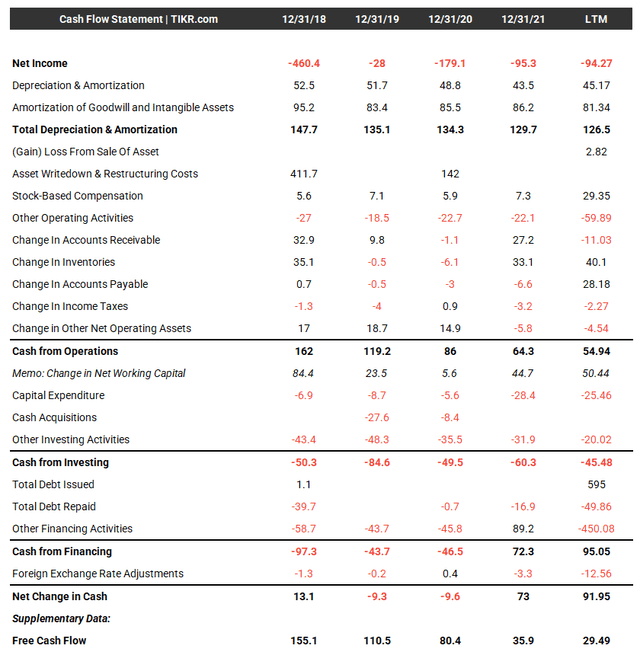

In the last twelve months, ZIMV generated $54.9 million in CFO, or $2.10 per share, vs. $64.3 million in 2021 or $2.46 per share (Figure 7).

Figure 7 – ZimVie historical CFO (tikr.com)

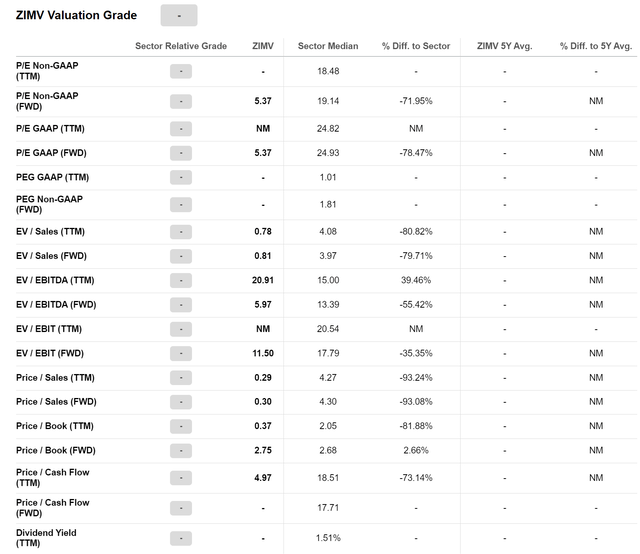

On a Price-to-cashflow basis, ZimVie does screen very cheap vs. the healthcare sector (Figure 8). According to Seeking Alpha, ZIMV is trading at sub 5.0x P/CF, vs. 18.5x for peers.

Figure 8 – ZimVie screens cheap on P/CF (Seeking Alpha)

Debt Burden Remains Biggest Worry

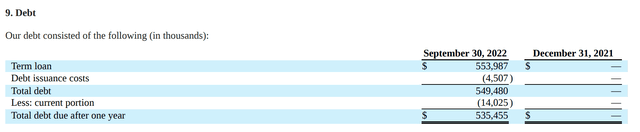

ZimVie’s heavy debt burden remains my biggest worry. As part of the Zimmer Biomet spinoff, ZimVie took on $595 in term loans and paid a large $540 million dividend to ZBH. To date, $554 million of the term loan remains outstanding (Figure 9).

Figure 9 – ZimVie debt outstanding (ZimVie Q3/2022 10Q Report)

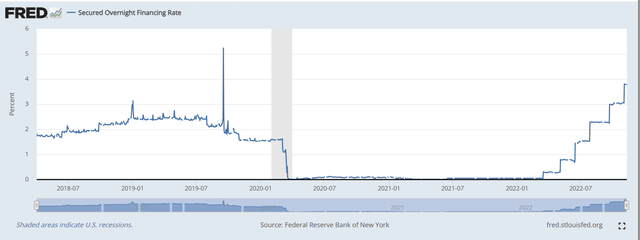

Interest on the term loan accrues at Secured Overnight Financing Rate (“SOFR”) plus 1.5% to 1.75%, depending on the company’s total net leverage. With the Fed continuing to ratchet up interest rates, SOFR has been rapidly rising in lockstep (Figure 10).

Figure 10 – SOFR has been rising due to interest rate increases (St. Louis Fed)

ZimVie’s term loan balance is large relative to its revenues and earnings. With cash of $116 million, this translates to Net Debt of $438 million or 3.6x Net Debt / adj. EBITDA of $123 million, assuming the midpoint of management’s adj. EBITDA guidance range from Figure 3 above.

High levels of debt are worrisome, as debt can impede management’s response to changing market conditions. Furthermore, the medical devices industry is R&D intensive and requires lots of capital to develop new products and treatments. With cash going to service the high debt load, ZimVie may be starving its business of research and development capital.

Conclusion

In conclusion, ZimVie’s latest quarter results was a step in the right direction, with EBITDA margins coming ahead of management’s full-year guidance. However, by maintaining the full-year guidance unchanged, management is implying the upcoming quarter could be weak.

The most important event in the quarter actually had nothing to do with ZimVie’s operations. In early September, Zimmer Biomet pledged its shareholdings in ZimVie for a loan with an investment bank, causing a large selloff in ZimVie’s shares.

With Zimmer Biomet effectively sold out, I believe ZimVie’s shares do look cheap, currently trading at less than 5x adj. Fwd P/E and LTM P/CF. However, investors will need lots of patience with ZimVie, as it will probably take a few quarters to regain investor confidence after a terrible few months of stock performance. Investors will also need to weigh the company’s heavy floating rate debt load, particularly as interest rates continue to ratchet higher.

Be the first to comment