JHVEPhoto

Investment Thesis

Zimmer Biomet Holdings, Inc. (NYSE:ZBH) is one of the beneficiaries of the COVID recovery. After 2 years of lockdown and intermittent resurgence of new COVID strains leading to supply chain disruptions and inflation, hospitals are now less occupied with COVID treatments and accepting much more requests for ‘elective’ orthopedic procedures like knee and hip replacements. These events directly benefited ZBH.

Medical professionals performing knee and hip replacements tend to stick to the same equipment to ensure patients’ recovery after the procedures are predictably reliable. This is important as any shortfall to the expected results from these procedures can ruin a person’s life and lead to lawsuits and permanent reputation loss. Hence, hospitals are unlikely to take the risk of switching to other less proven alternative products. As a market leader in the Hip and Knee categories, the company is also expected to enjoy economies of scale in securing raw materials for production as compared to smaller players in the market.

In spite of its overall strategic advantage in the overall industry, its financial profile is modest when compared to other peers in the industry.

Overall, we contend that investors should be able to get more returns investing in other peer defensive companies although we still think its market leadership is unlikely to be eroded. As such, we rate the stock as ‘hold’.

Company Overview

ZBH, together with its domestic and foreign subsidiaries, operates in the musculoskeletal healthcare business in the global market. From the company’s latest annual report, this is the summary of ZBH’s business:

We design, manufacture and market orthopedic reconstructive products; sports medicine, biologics, extremities and trauma products; spine, craniomaxillofacial and thoracic products; dental implants; and related surgical products. We collaborate with healthcare professionals around the globe to advance the pace of innovation. Our products and solutions help treat patients suffering from disorders of, or injuries to, bones, joints, or supporting soft tissues. Together with healthcare professionals, we help millions of people live better lives.

The company reported strong 2nd quarter results which beat the consensus estimates on both top and bottom lines expectations and raised its FY 2022 guidance.

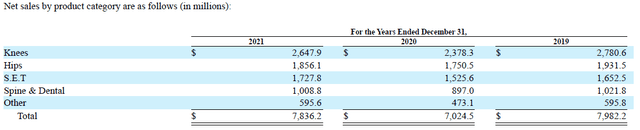

Net Sales By Product Category (Annual Report 2021)

The company’s revenue is consistently dominated by the products of Knees and Hip categories.

A Beneficiary of COVID Recovery

Generally, the demand for orthopedic procedures has taken a beating due to the industry-wide disruption caused by the COVID -19 pandemic. Since most of these procedures are comparatively more ‘elective’ and not life-threatening, it makes sense for hospitals to put them on hold in favor of hospitalizations and intensive care admissions due to COVID-19. As such, companies like ZBH that specialize in orthopedic procedures experience a shortfall in both revenue and earnings in late 2021.

Back in March this year, a McKinsey survey found that hospital leaders expected procedural volume like “orthopedic surgery” to pick up in the “next six months”. The survey findings were right as can be observed from the latest 2022 Q2 earnings call. Management of ZBH attributed the company’s strong recovery to the rebound in demands of delayed procedures due to the pandemic:

As Bryan mentioned, strong procedure volume recovery extended from the first quarter, especially as we moved into April and May, with moderation of recovery in June. U.S. sales grew 1.3% driven by strong recovery in execution as COVID cases subsided and elective procedures returned especially in knee and hips.”

As one of the market leaders in this industry, ZBH is one of the beneficiaries of COVID recovery.

High Switching Cost

Once a customer starts using ZBH’s hip and knee construction products, the cost to switch to alternative products is high. According to GuruFocus:

Zimmer has built a network of close relationships with orthopedic surgeons who make switching costs high since they tend to stick with their primary vendors, and bring in profitable procedures to keep hospital administrators from serving their own interests.

This high switching cost is likely the reason why ZBH is able to maintain its market dominance for the last few years in spite of macro tailwinds like the recent pandemic and inflation.

Market Leader in Hip and Knee Implant

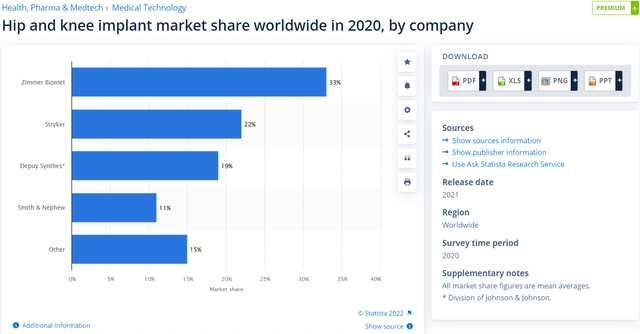

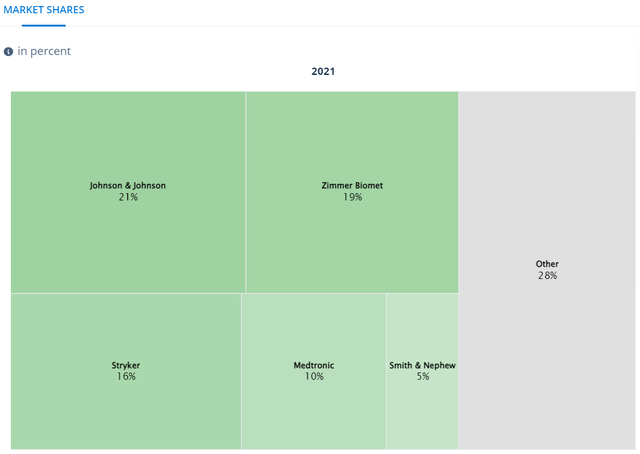

ZBH is the market leader in the category of hip and knee implants. According to Statista, it commands a 33% worldwide market share back in 2020:

Market Share for Hip and Knee implant (Statista)

According to a recent report published by Research and Markets in June 2022, ZBH is still one of the key players in the market:

In 2021, Zimmer Biomet led the global knee replacement market. The company’s solid share of the knee replacement market was largely attributed to its Persona® The Personalized Knee System.

Such dominance in the market should allow the company to benefit significantly from economies of scale and emerge stronger than its competitors as it rides on the benefits of COVID recovery.

Financial Comparison

The orthopedics and broader musculoskeletal care industry are highly competitive. According to the company’s latest annual report, these are its competitors in the various categories:

Global Market:

In the global markets for our knees, hips, and S.E.T. products, our major competitors include the DePuy Synthes Companies of Johnson & Johnson (JNJ), Stryker Corporation (SYK), and Smith & Nephew plc (SNN).

Spine Product:

In the spine product category, we compete globally primarily with the spinal and biologic business of Medtronic plc (MDT), the DePuy Synthes Companies, Stryker Corporation, NuVasive, Inc.(NUVA) and Globus Medical Inc (GMED).

Dental Implant Category:

In the dental implant category, we compete primarily with The Straumann Group (OTCPK:SAUHF), Dentsply Sirona Inc.(XRAY) and Nobel Biocare Services AG (part of Envista Holdings Corporation (NVST) ).

As discussed earlier, since the company’s largest source of revenue comes from the knees and hips segments, we will compare ZBH’s financials with competitors in this segment.

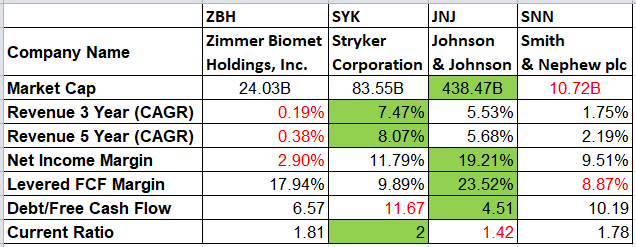

Financial Comparison (Author’s Tabulation Based on Seeking Alpha Data)

We can observe that:

- JNJ is the largest player in the comparison list.

- On a multi-year, long-term basis, SYK has been growing the fastest compared to other peers. JNJ is growing at more than 5%, which is not far behind SYK.

- Looking at the bottom lines of Net Income and FCF margins, JNJ appears much more efficient in converting sales to profits. This is not unexpected given that JNJ is “one of only two U.S-based companies that has a prime credit rating of AAA, higher than that of the United States government”, according to Wikipedia.

- Looking at the debt to FCF ratio, JNJ is also the least leveraged.

- The silver lining for ZBH is that it appears to have the highest assets with respect to liabilities as compared to its other competitors. In the long run, it might be able to convert these assets into higher financial margins.

Overall, SYK and JNJ have a clear competitive financial advantage over ZBH and SNN. This is in spite of my earlier observation that ZBH has a competitive advantage in terms of its market share in the product categories of ‘Hip’ and ‘Knee’.

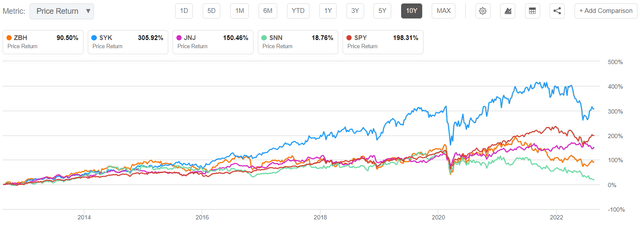

We can also compare the price action of the players over the last 10 years:

Price Action Comparison (Seeking Alpha)

We observe that not only has SYK beaten all other players in price appreciation, but it’s also the only player that has beaten the market average as benchmarked to the S&P 500 ETF.

Valuation

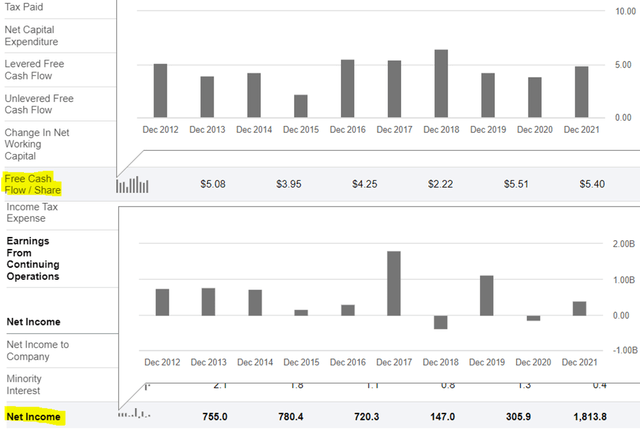

The company’s free cash flow is largely ‘flat’ and not consistently increasing. Net income is also not consistently profitable.

Free Cash Flow and Net Income (Seeking Alpha)

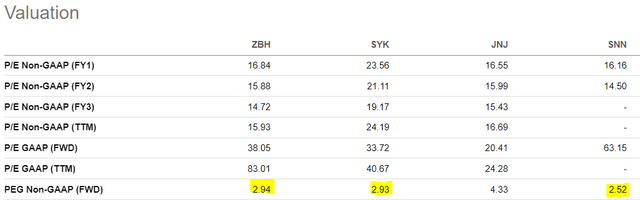

As such, it is not accurate to project the intrinsic value using discounted cash flow or net income. We will compare the valuations using the PEG values.

I consider PEG values greater than 1.5 to be overvalued. Hence, looking at the PEG values, all the players in the comparison list are overvalued.

However, comparatively, ZBH, SYK, and SNN are less overvalued.

Generally, we would advise against taking an investment position in these stocks since they are all overvalued. However, if investors feel compelled to choose only one stock to invest in out of these 3 ‘less overvalued’ stocks, SYK will be the best choice since it is also proven to appreciate more over the long run.

Risk

ZBH has some competitive advantages in terms of market share of some key product categories of Knee and Hip. However, it appears to be stagnant in terms of growth of top-line sales as observed from its less than 1% growth in the last 3 to 5 years. Investors should observe whether the company can pick up in growth rate in the next few years after recovering from the COVID headwind.

Conclusion

While ZBH dominated the more specific category of Knee and Hip category as discussed earlier, in terms of the market share for the general ‘Orthopedic Devices segment’, it is almost evenly dominated by 3 players of JNJ, ZBH, and SYK.

Market Share of Orthopedic Devices segment (Statista)

These companies enjoy high switching cost and economies of scale due to their market leadership and hence they are likely to maintain their market leadership in the foreseeable future. However, their growth rates are low and the price appreciation is modest as compared to the market average. These companies are defensive and not suitable for investors looking for high-growth stocks.

Investors who are looking for defensive stocks to invest in should consider JNJ or SYK instead of ZBH due to their more favorable financial profiles.

However, investors who already have a position in ZBH should not sell their positions at a loss since the company still has a ‘respectable’ competitive advantage as one of the key players in the ‘Orthopedic Devices segment’ and its dominance is unlikely to be eroded.

Be the first to comment