xefstock

I just read an article titled “ZIM: This Is Getting Ridiculous“. In this article, the argument is made that ZIM Integrated Shipping Services’ (NYSE:ZIM) valuation is at ridiculously low levels, and thus that when freight rates stabilize a bit, this stock will provide nice returns.

I must say that this article screams for a counterpoint. Which I am going to provide here.

On the valuations, the author claims that the stock trades well below its equity value (which it does). And, also, that the company trades at a Price/Earnings under 1, and that the recent results were good (and a beat). And it’s all true. And yet, ZIM isn’t necessarily an obvious buy.

The reason is rather simple. ZIM acts in an extremely cyclical industry. Why? Because:

- This industry competes exclusively on price (across different ship classes).

- The equipment used by all players is, within each segment, mostly identical.

These two things mean that pricing cycles are merely a function of very temporary imbalances in supply and demand. And as with any cyclical industry, any large increases in profitability will immediately lead to an increase in supply which kills the positive cycle. Notice the following: this increase in supply kills the cycle even if demand doesn’t suffer – it’s just the nature of the animal.

Sectors like shipping are nearly the closest they can be to perfect competition. When there are profits capacity comes in, and keeps coming in until there are no profits for the marginal capacity entering the market, or indeed no profits for any installed capacity that needs to be driven away.

It so happens that the last 3 years were the best 3 years ever for this industry. And they were this way by far, as a result of all the distortions introduced by the COVID epidemic around the world, and resulting reactions including extraordinary stimulus, supply bottlenecks, etc.

Hence, right now it’s nearly the worst time possible (well, barring the last year) to think about getting back into investing in this industry. As with any other deep cyclical industry, the right time will be when most actors in the industry are bleeding red ink. If ZIM isn’t yet bleeding red ink, then it follows that it’s not a good time to buy the stock. If one is still looking at a recent Price/Earnings, then that’s already a problem, because at the bottom there won’t be a Price/Earnings as earnings will be negative. Any earnings multiple calculated with anything that happened in 2020, 2021 and 2022 is basically useless.

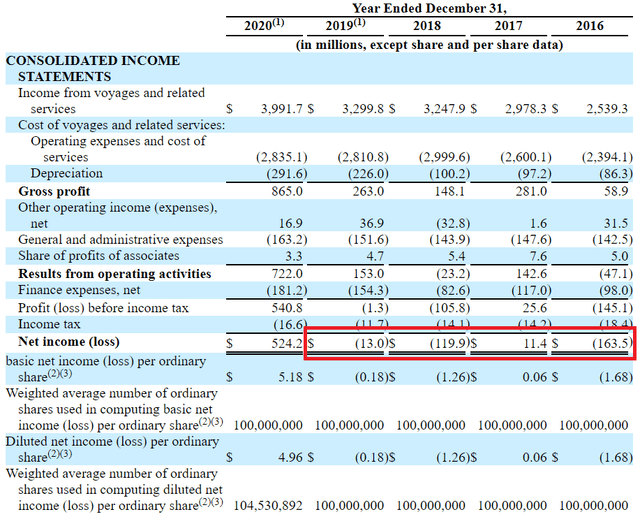

Instead, an investor has to think about how ZMI really does on a normal year. When there are no exceptions happening. Well, think about 2016, 2017, 2018, 2019. No epidemics then. No fireworks. How was ZIM doing then? The following tells it (red highlight is mine):

That’s how the company typically did outside of exceptions. Hardly something you’d want to invest in, right? Why like it now just because it got lucky with 3 extraordinary years that favored all players in the industry? This is a bad time.

Indeed, even the timing of ZIM coming to market tells you the same story. ZIM hasn’t been in the stock market for a long time. ZIM IPO’d in early 2021 (February) because its shareholders thought that was a good time to pull some money from the market. Imagine that, even the tiny positive “bip” in 2020 was already seen as an exception by ZIM’s owners (before the gigantic 2021 and 2022 profitability).

Now, maybe you’re thinking I’m cherry picking all of this. Maybe before 2016 ZIM was so much better. Well, no. ZIM had to restructure its debt in 2014 (July), handing a large part of it to creditholders. That’s called “bankruptcy”. That’s how bad the business typically is – and ZIM is hardly alone there, when it comes to shipping.

In this regard, ZIM is a classic value trap, though one with extremely cyclical undertones.

An Exception Worth Mentioning

There is one positive thing which ought to be said, though. The 2020-2022 cycle was so exceptional, that ZIM accumulated a lot of cash. It accumulated enough cash to zero out its debt, which typically wouldn’t happen on any positive cycle in the industry.

Of course, the same thing happened across the board, there wasn’t some kind of merit for ZIM on this.

It remains to be understood if and how this cash abundance will change these companies’ response to the next cyclical downturn. Will they accept lower shipping rates as they always do, to keep the ships moving? Will they rather cut activity since they’re not so pressured to keep the cash coming in to service debt? This is a legitimate doubt.

The Stock Market Partially Reflects This Cyclical Knowledge

As I said, this is a deeply cyclical sector and thus a deeply cyclical stock. It particularly doesn’t make sense to look back to earnings numbers produced by the exceptionally positive cycle that just affected the sector.

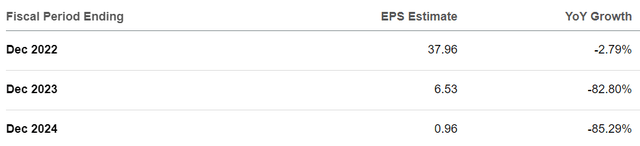

We’ve seen ZIM drop thus far, ignoring that recent extraordinary profitability, because the market discounts the future. And when we take into account the consensus earnings for 2023, 2024, we immediately see the problem:

Although the stock had a Price/Earnings under 1 now, it’s actually trading at 20.2x 2024 consensus earnings.

Of course, even this reflects a somewhat optimistic view by the market, that large positive cycles in shipping can be followed by cycles of shallow profitability, instead of outright losses. In my somewhat divergent view, though, reality will go all the way down to losses.

Conclusion

Container shipping (and most shipping in general) is a cyclical market. Services are booked on price (for a given trip and ship class). Every player has similar assets. There’s no moat to be had.

For ZIM, the most likely scenario is that the container shipping market will go back to what it was before. That’s a level at which the company will likely go into the red, and the dividend will be cut to zero or near zero. I do think the cash hoard can mean the company will try to keep the dividend above zero.

This path is commonly followed by cyclical markets where capacity is taken off the market by prices plunging to unprofitable levels for most of the industry. Since the previous (exceptional) cycle was the most profitable ever, it’s very likely the downturn will also be one of the worst ever (outside of a deep recession — though it also looks like 2023 can see a significant slowdown in the US and EU).

Considering the above, at present levels (still well above the $15 IPO), ZIM would typically be a sell. I give the IPO price as a reference, because ZIM isn’t a growth company, it’s a cyclical. If insiders thought $15 was a good price to sell at, given their long experience on the cyclicality of this business, then that’s because $15 was quite likely a good price to sell at. However, the cash hoard generated by the exceptionally positive cycle that’s now disappearing does introduce some doubts (on whether ZIM will trade well below the IPO price).

Finally, the only thing ridiculous about ZIM were the prices and margins which existed in 2020-2022, and will now likely be gone forever.

I am rating this stock a sell, in the sense that I think it’s not desirable to buy it here. That it will likely trade lower. However, currently and due to the cash hoard, I wouldn’t classify it as something I’d sell short.

Be the first to comment