AvigatorPhotographer/iStock via Getty Images

In my last article on ZIM Integrated (NYSE:ZIM), published on 23 May 2022, I said the stock is a short-term hold and a long-term buy. From 23 May to 13 June 2022, the stock price was stable. However, the stock price dropped from $68 per share on 7 June 2022 to $49 on 10 June 2022. A 28% drop happened in three days as investors expect Congress to vote soon on the Ocean Shipping Act of 2022, which will ban carriers from leaving the U.S. ports with empty containers. I do not see the new shipping hurt ZIM. I expect the container freight rate from U.S. ports to the rest of the world to increase soon. Moreover, due to ZIM’s chartering strategy, the company can change its TEU capacity to respond to the shocks and stay profitable. After the recent drop, ZIM stock is now more opportunistic.

ZIM and the new shipping act

In my last article, I explained why the stock is a long-term buy. Based on my estimations, ZIM is worth more than $65 per share. Also, based on the company’s new developments (new lines and new LNG dual-fuel container vessels), its financial performance, and my expectations of the market conditions, I explained why the future is bright for ZIM Integrated. If you have not read my last article on ZIM, I suggest you take a look at it. In this article, I explain my insight on the new shipping act and the recent drop in ZIM stock price.

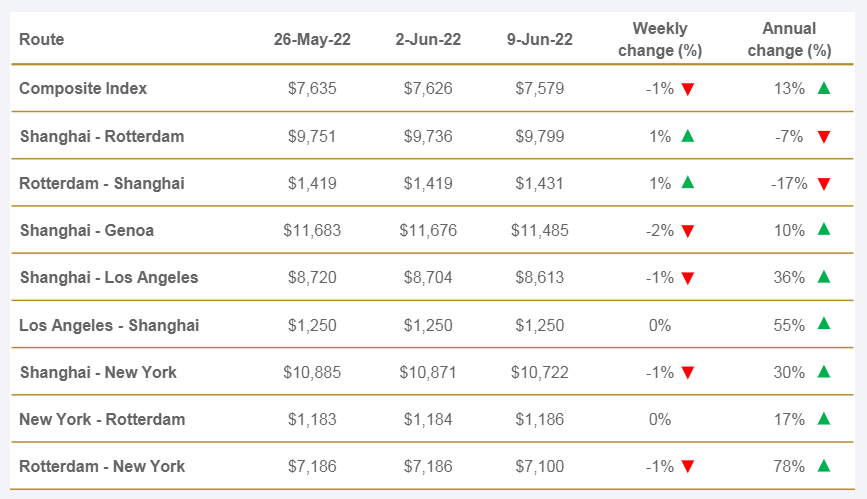

It has been more than a year that because of the significant freight rate difference of shipping from Asia to the United States than the other way round, shippers have the incentive to after transporting goods from Asia to the United States, leave U.S. ports as quickly as possible (with empty containers) to return back to Asia. Figure 1 shows that as of 9 June 2022, the freight rate from Shanghai to Los Angeles was $8613 per FEU, compared with a freight rate of $1250 per FEU the other way round. Also, it shows that as of 9 June 2022, the freight rate on Shanghai to New York route was $10722 per FEU, compared with New York to Rotterdam freight rate of $1186 per FEU. The first question is whether leaving the U.S. with empty containers to get back to China was ZIM’s strategy or not. The second question is how the new act will affect freight rates and ZIM’s revenues.

Figure 1 – Spot freight rates by major route

www.drewry.co.uk

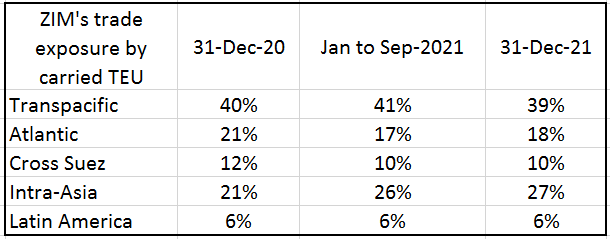

According to the company’s full-year 2020 report, at the end of 2020, ZIM was operating across five geographic trade zones (these trade zones included: Transpacific (40% of carried TEUs), Atlantic (21%), Cross Suez (12%), Intra-Asia (21%), and Latin America (6%)). Table 1 shows how ZIM’s trade exposure (by carried TEU) in the Transpacific trade zone changed from 31 December 2020 to 31 December 2021 (see 2021 annual report). The company’s trade exposure decreased from 40% to 39%. Also, ZIM’s trade exposure in the Atlantic trade zone decreased from 21% to 18%. On the other hand, the company’s trade exposure in the Intra-Asia trade zone increased from 21% to 27%.

Table 1 – ZIM’s trade exposure by carried TEU

Author (based on ZIM’s annual report)

Moreover, Table 2 shows that ZIM’s market share in US East Coast & Gulf to Mediterranean lane decreased from 14% in 4Q 2020 to 10% in 4Q 2021. On the other hand, the company’s market share in the Far East to US East Coast increased from 9% in 1Q 2020 to 9.5% in 1Q 2021. Based on this information, ZIM has been one of the companies that have rejected U.S. exports to benefit from more profitable exports. Thus, the Ocean Shipping Act of 2022, which will ban carriers from leaving U.S. ports with empty containers, will make ZIM reallocate its vessels. To respond to increased demand for container shipping services globally, ZIM chartered 11 additional vessels from 31 December 2020 to 28 February 2021. The company deployed 6 of these vessels in its new China to Los Angeles (ZEX) and South East to Los Angeles express services (ZX2). Does this reallocation of vessels hurt ZIM’s profitability?

Table 2 – ZIM’s market share in three of its trade lanes

Author (based on ZIM’s annual report)

ZIM’s profitability outlook

According to Table 1, 43% of the company’s trade exposure by carried TEU is immune to the U.S. Ocean Shipping Act of 2022. What about the other 57%? How does the new act affect ZIM’s revenue in the Transpacific trade zone?

Shipping from Asia to the U.S. is much more profitable rather than shipping from the U.S. to the rest of the world. Thus, shipping companies reject transporting U.S exports so they can return back to China as quickly as possible. As a response to shipping companies, the United States wants to ban carriers from not to transporting U.S. exports. However, I think the new act cannot decrease carriers’ total revenues. In response to the new act, carriers will reallocate their vessels to other profitable routes (like Shanghai to Genoa and Rotterdam). Due to lower vessel supply, the cost of transporting from Asia to the U.S. will increase further. With fewer vessels going to the United States, fewer vessels will be available to transport U.S. exports to the rest of the world. Thus, the freight rate for transporting U.S exports to the rest of the world will increase. Also, with the new act, carriers will request higher rates to transport U.S exports to the rest of the world. The new shipping Act will ban carriers from leaving the U.S. with empty containers. However, it does not determine the freight rates. I expect the freight rate from the U.S. to Asia and Europe will increase soon.

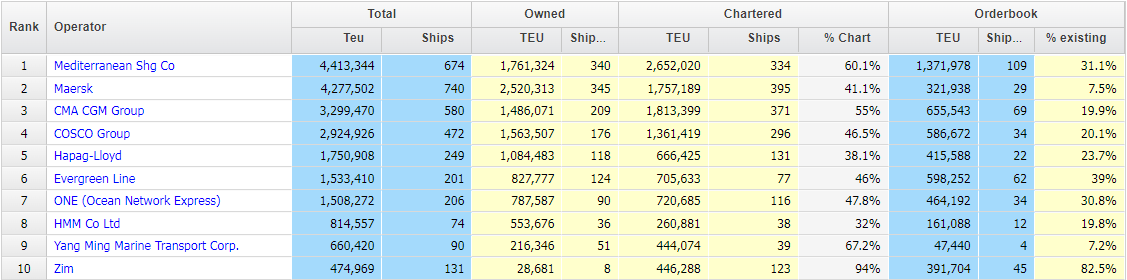

Thus, ZIM’s revenues will not be hurt by the new act. The company operates on a global scale. It can reallocate its vessels to benefit from the market condition as much as possible. Moreover, due to chartering strategy, the company can respond to shocks. According to Alphaliner, ZIM has chartered 94% of its TEU capacity, the highest among the top 10 operators (see Figure 2). Thus, compared with its competitors, ZIM can increase or decrease its TEU capacity with lower costs.

Figure 2 – Alphaliner top operators as of 12 Jun 2022

alphaliner.axsmarine.com

Summary

ZIM is well-positioned to benefit from the market condition, and its recent developments will help the company stay competitive in the following years. In my last article, I estimated that ZIM is worth more than $65 and explained why the stock is a long-term buy. However, the stock’s price dropped by 28% in a few days due to concerns about the new shipping act. I believe the new shipping act will not hurt ZIM’s profitability, and the recent sale is irrational. The stock is a buy.

Be the first to comment