shaunl

Passive income investors may not typically look for a shipping company to add to their portfolios in order to generate income, but they should look into ZIM Integrated Shipping Services Ltd. (NYSE:ZIM).

The shipping company’s stock is plummeting due to concerns about an economic downturn, which has resulted in a decrease in the price container shipping companies can charge their customers.

Furthermore, because the stock is currently trading at a future P/E ratio of only 4.6x, ZIM Integrated Shipping provides investors with a very high margin of safety.

The Container Shipping Industry Is Headed For A Recession

Much has been written about the container shipping market’s decline and the headwinds created by falling container freight spot rates, but ZIM Integrated Shipping’s financial situation paints a very different picture.

While spot freight rates peaked in September 2021 and fell in 2022, container shipping companies with strong balance sheets and free cash flow, such as ZIM Integrated Shipping, may be able to weather the storm.

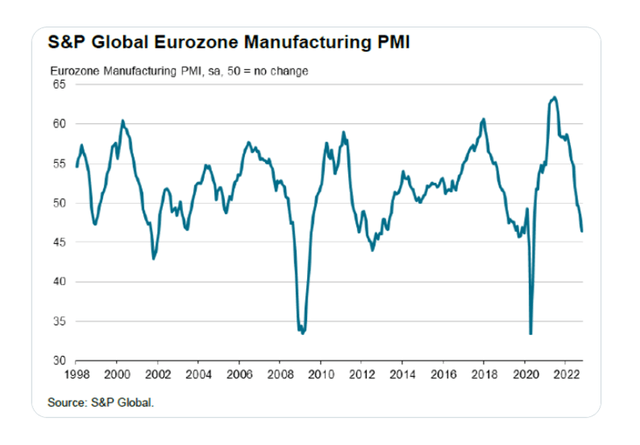

The industry as a whole is being weighed down by a trifecta of factors, including persistently high inflation, the Ukraine war, and Europe’s energy crisis, all of which are weighing on demand for container shipments.

Several container shipping companies have issued gloomy outlooks and warned of a recession, including France’s CMA CGM, which warned of declining profitability in the future, and Denmark’s Maersk, which warned of “dark clouds on the horizon.”

Two new headwinds for the global economy have recently emerged. The first is that major protests have erupted across China’s major cities, with Chinese citizens taking to the streets to protest harsh lock-down measures.

Second, manufacturing indicators in Europe show that demand for goods is declining at the fastest rate since Covid-19’s outbreak.

S&P Global Eurozone Manufacturing PMI (S&P Global)

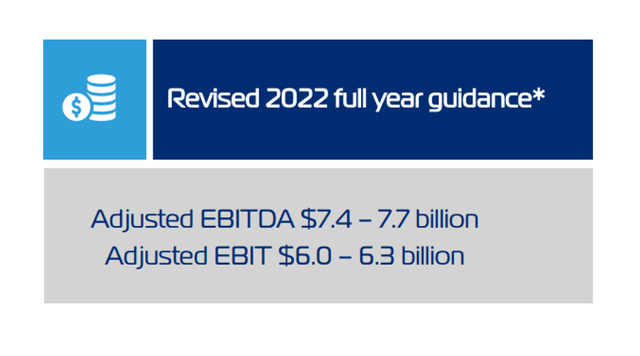

All of these factors are contributing to a single trend: global demand for goods is declining, and so are spot rates for container shipping. Even ZIM Integrated Shipping acknowledged weaker demand trends by lowering its adjusted EBITDA forecast for 2022, but only by a small margin.

The shipping company now expects adjusted EBITDA of $7.4 billion to $7.7 billion, down from an earlier forecast of $7.8 billion to $8.2 billion.

On a mid-point basis, ZIM Integrated Shipping reduced its projection by about 6%, which isn’t much to worry about, if I’m being honest.

Revised 2022 EBITDA Guidance (ZIM Integrated Shipping Services Ltd)

Robust Commercial And Financial Metrics

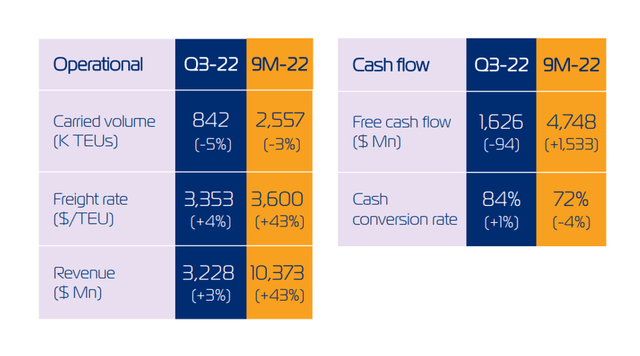

While container freight spot rates are falling, the situation is not as dire as some shipping industry forecasts currently suggest. On November 16, 2022, ZIM Integrated Shipping released a strong earnings report for 3Q-22, which showed sales of $3.2 billion, on which the shipping company made $1.17 billion in net income, implying a very robust margin of 36%.

In 3Q-22, free cash flow was $1.63 billion, a 5% decrease from the previous year. The average freight rate for ZIM Integrated Shipping increased by 4% YoY to $3,353 per container.

Commercial And Financial Metrics (ZIM Integrated Shipping Services Ltd)

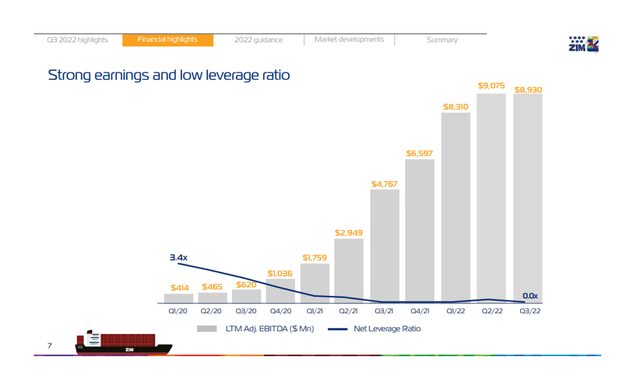

Given the consensus expectation that the economy will enter a recession soon, the fact that ZIM Integrated Shipping has very little debt on its balance sheet is a key asset.

As of September 30, 2022, the company had net debt of $250 million, translating to a net leverage ratio of 0.0x, implying that ZIM Integrated Shipping does not need to be concerned about its debt as the industry enters a deeper recession.

Strong Earnings And Low Leverage Ratio (ZIM Integrated Shipping Services Ltd)

ZIM Integrated Shipping Is Dirt Cheap

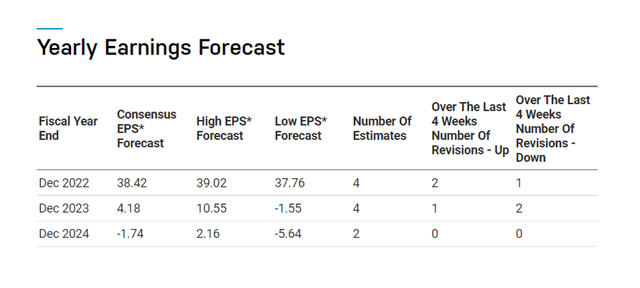

Based on profits expected in 2022, ZIM Integrated Shipping has a P/E ratio of 0.4x (really!). The P/E ratio for 2023 is 5.3x, as the market anticipates a recession in the global container shipping industry. The 5.3x P/E ratio assumes earnings of $4.18 in 2023 (see chart below).

Yearly Earnings Forecast (Nasdaq)

Why ZIM Integrated Shipping Could See A Lower Valuation

Spot container freight rates may fall further, but companies with strong balance sheets and operating margins, such as ZIM Integrated Shipping, are extremely well positioned to deal with the consequences of an industry and earnings recession.

Declining spot rates and earnings/margins should be viewed as major risks for ZIM Integrated Shipping.

My Conclusion

ZIM Integrated Shipping will be fine. There is a lot of talk and speculation about how bad the coming recession will be, but ZIM Integrated Shipping is probably in the best position any company could hope to be in to ride out the container shipping downturn.

The company has strong margins, an enviably strong balance sheet with very little debt, and a strong EBITDA guidance in place, despite headwinds.

Furthermore, ZIM Integrated Shipping’s stock is dirt cheap, trading for only 5.3x next year’s estimated profits, providing a significant margin of safety for investors willing to take a risk against the current market sentiment.

Be the first to comment