MoMo Productions/DigitalVision via Getty Images

Our intention for this paper is to assess the attractiveness of Zillow today, with an emphasis on assessing the health of the housing market. Although Zillow has a competitive advantage relative to its competitors, its fortunes are heavily correlated with the health of the housing market and in extension, the economy. We are seeing evidence suggesting that the market is slowing, which will likely weaken returns in the near term.

Company Description:

Zillow (NASDAQ:Z) is a new-age estate agent, providing a platform for properties to be purchased, sold and rented. Historically, buyers needed to speak to various agents in a location to figure out what properties were available, it was a slow and time-consuming process. Then some businesses decided to innovate by listing properties online. With Zillow, people can browse properties from the comfort of a mobile app, which importantly allows for comparison of all properties listed in an area.

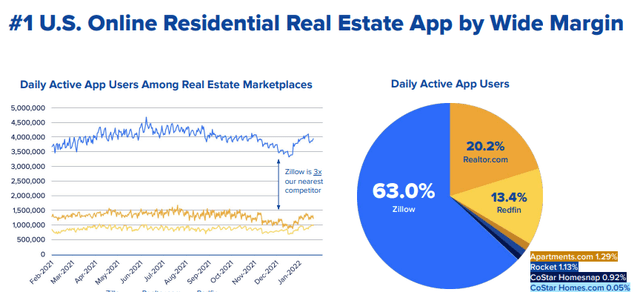

As of today, Zillow is by far the largest real estate app in the US and it is not close. Zillow was able to achieve this by providing consumers with the functionalities they want better than their competitors. Having multiple leading apps defeats the purpose and diminishes the buyer/seller experience, Zillow won the race to build a customer base.

Zillow’s market dominance (Zillow)

Zillow earns the majority of its revenue from the following services:

- Home segment – This was an iBuying business. This segment has been shut down by Zillow, as they have struggled to generate an adequate return. Zillow is in the process of liquidating the remaining properties.

- IMT segment – This is the core operations of Zillow. Premier agent and rentals.

- Premier agents are SaaS tools which allows agents to organize their listings and advertise their services on Zillow. Importantly, Zillow generates revenue from a cost-per-lead arrangement.

- Rentals are advertising services for rental properties.

- Mortgage segment – This is twofold. Firstly, Zillow is a licensed lender and so offers borrowers the option to mortgage a home they have found. Equally, Zillow allows mortgage providers to offer their services, thus giving borrowers a marketplace of options. Again, Zillow generates revenue on a cost-per-lead arrangement.

Zillow is attempting to be the “Housing Super App” where everything can be done easily in one place, capturing revenue at all stages of the housing process. We must say, Zillow has done a fantastic job of maximizing the monetization of its services. Management clearly understands the power Zillow has in the market and they leverage that to make clients pay.

Current conditions:

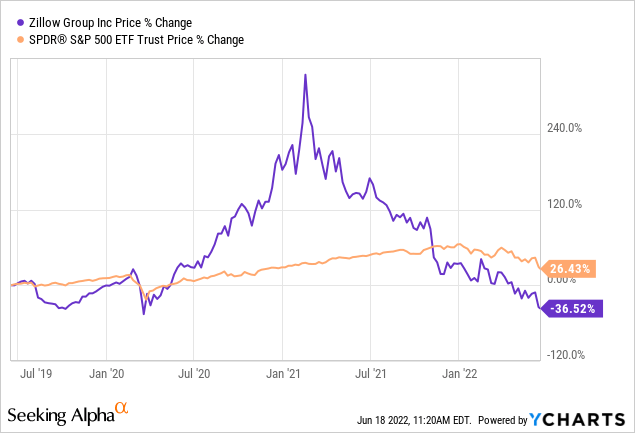

Zillow’s shares have not performed so well in recent months, falling an eye watering 85% since Feb 2021. There are many reasons for this, including the aforementioned closure of the Offers business. The biggest reason however, we believe, is the economic developments in the US market.

Between Mar 2020 and Feb 2021, shares grew 666%. The reason for this was an unsurprising boom in the housing market.

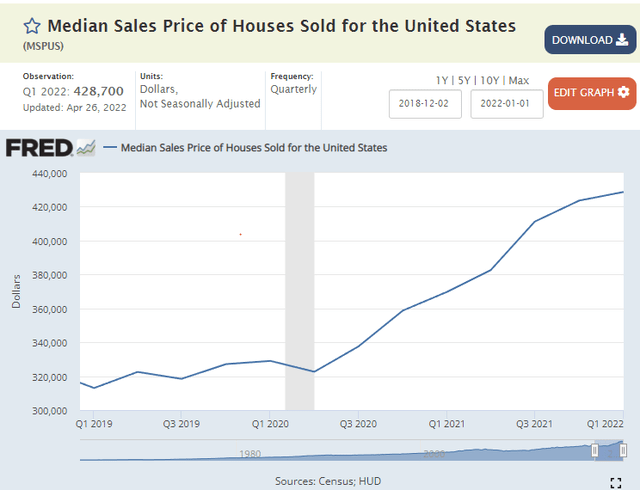

Median Sales Price of Houses Sold for the United States (FRED)

As the above graph shows, house prices screamed higher as supply could not match demand for homes. With Zillow having access to various points of the process, revenues grew aggressively.

The issue is that the business did not grow by 666% and so Zillow quickly found itself overvalued and highly sensitive to any change in conditions. As markets began cooling, Zillow began falling.

Our hesitation is that the graph above looks to be plateauing in Q1 2022. This suggests demand is either falling or supply is catching up, given that the US market is struggling with a shortage, this is likely a demand-side issue.

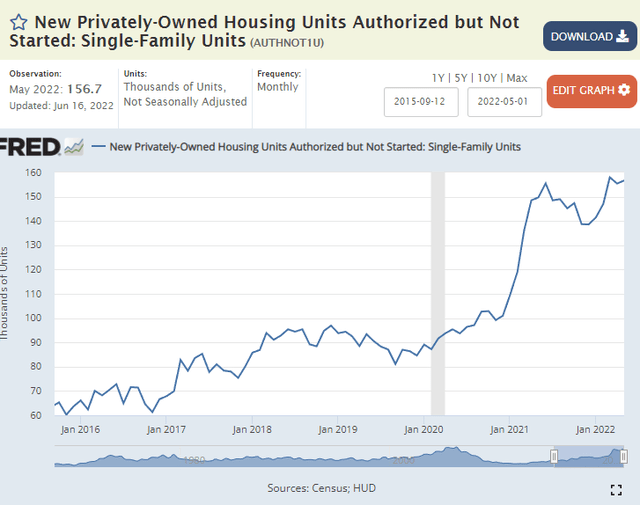

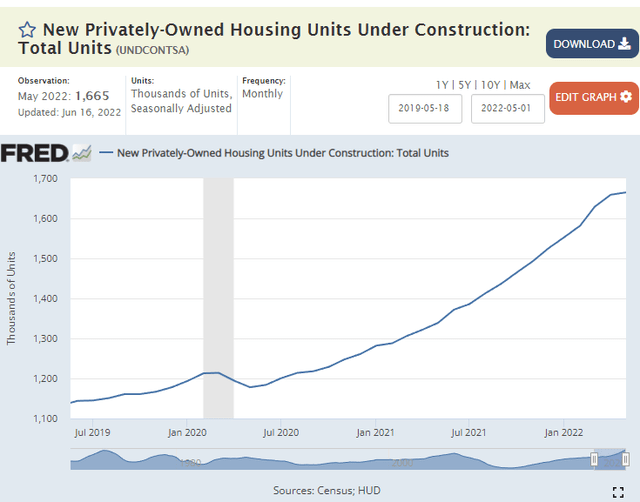

As a secondary check for the health of the housing market, we like to see a growing number of authorized new-build constructions and the number of units under construction increasing. The reason for this is that if new-builds are being authorized and built, it’s because the medium-term view is that additional properties will be required to meet demand at the current market price, if not higher.

Number of units authorized (FRED)

Number of units under construction (FRED)

What we note is that the number of units under construction has fallen for the first month since COVID-19 and the number of authorizations stabilized after the COVID-19 boom. This supports our assessment above that the market is seriously cooling as economic conditions deteriorate. This is unlikely to suddenly improve overnight.

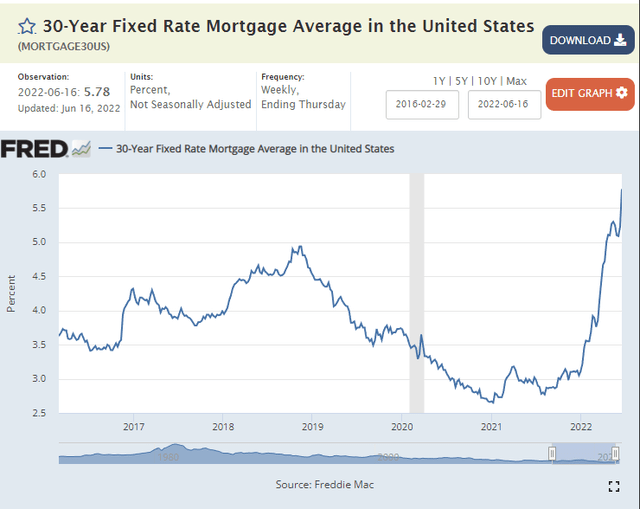

Finally, we can look at mortgage rates. Naturally the lower they are, the more likely people are to move.

US 30Y Fixed rate (FRED)

As the above shows, successive interest rate hikes have left mortgage rates soaring. As a result of this, people’s affordability falls, unless they can increase their income by the same amount.

With inflation as high as it is, people are struggling with a cost-of-living crisis rather than having the financial capacity to move home. This has already impacted demand, with the US economy shrinking. Research has shown that weakening market conditions mean falling house prices as less discretionary income is available. This is our belief of what is likely to come in the next year. This will directly impact all of Zillow’s revenue streams. At least they exited Zillow offers.

Financials:

Unfortunately, Zillow has been loss making for the majority of its existence. The reason for this is an aggressive marketing push. SG&A represents 19% of Revenue, with GPM being 21.6% in FY21. LTM performance is worse, likely on the back of more difficult trading conditions (Source: Tikr Terminal). Because of this, we are quite concerned about the medium-term performance of the business if economic conditions do worsen. It is not out of the question that losses reach $500M again. In 2021, EBITDA was $195M with an interest expense of $191M. This gives Zillow an interest coverage of 1.01, which is far from comfortable. Thankfully, they sit on a cash balance of $3.6BN.

Further, Zillow announced a share buyback program of $750M in December 2021, with an additional $1BN authorized in the most recent quarter. We do not really understand this decision. The business is asset-light and not cash intensive but the business is loss making. Investors may wonder why Zillow is not focused on fixing this instead of buying back shares.

Looking forward, Zillow is targeting $5BN in revenue by 2025, with an EBITDA margin of 45%. That would represent 23% growth from here and a 6% improvement in their EBITDA margin. We struggle to see this playing out. In our analysis of the business, we expect to see $1.8-2BN in 2022, which is flat. This is based on a reduction in property sales but an improvement in transactions through Zillow. Regarding margin expansion, this is certainly more possible than the revenue growth. Analysts are predicting revenue of $3.1BN in 2025 and an EBITDA margin of 39% (Source: Tikr Terminal).

It is important to understand that the numbers in the above paragraph are based on management’s carve out of the separate business units, as it excludes the home buying business. One additional point to factor thus is the overheads of the home buying business. Now that this business is gone, its costs will need to be allocated to the IMT and mortgage business, which will significantly depress their margins. Given that the business is loss making as a whole, there is a chance that it will make their core business (IMT) loss making, which will inevitably kill what little positive market sentiment remains.

Bright Side:

We have been quite harsh on Zillow and so would like to identify three key areas of upside.

Firstly, Zillow has single digit market share in the real estate market, yet dominates the online app market. This suggests the digitization of the market is still in its early phase. As a result of this, they should be able to sustain growth as more business is taken to online platforms.

Secondly, their app is genuinely very good and popular among more than just those looking to buy/sell/rent. Many enjoy just browsing properties, research into this has found the number to be at 35%. This gives Zillow valuable data which it can monetize. The easy way of course is advertising but they certainly have options.

Finally, if Zillow can figure out a profitable model, expansion overseas is a viable option. Although markets differ slightly in the way they do business, the concept is fairly repeatable. This will allow Zillow to diversify its revenue away from the US housing market.

Final Thoughts:

Zillow is a true innovator who has really shaken up an archaic industry. The business has made a few mistakes but that can occasionally happen when you are growing at the rate they are, criticism of management over the home buying debacle is exaggerated. That being said, they are now a victim of their own success. The business is inherently cyclical being correlated to the housing market and, in our view, is heading towards a downtrend. Our belief is that the share price correction over the last year is a reflection of market realizing that this is not another tech business which will grow at double digits forever.

Zillow did not achieve profitability during a huge housing bull market and could now suffer from greater losses should a downturn occur. Investors who see this as a diamond in the rough should consider if positive price action will occur in the coming year. We cannot see anything and so it is worth waiting for now.

We thus rate this stock a sell.

Be the first to comment