Sundry Photography

Overview

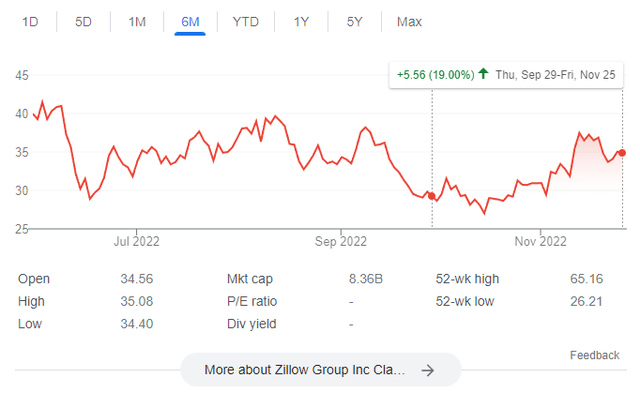

This post serves as an update to my coverage in late September.

Zillow Group (NASDAQ:ZG) (NASDAQ:Z) is still undervalued and could provide attractive returns. I continue to believe that ZG’s true value will be realized once we get past this horrifying macro environment, which is obviously bad for ZG. In the long run, ZG should be able to maintain its leadership position and be a winner in the residential home industry in the United States.

Performance review

ZG’s share price has increased by 19% since my initial post, which is obviously a good sign that the market is recognizing ZG’s intrinsic value, and my thesis is playing out.

Earnings review

Revenue and EBITDA for ZG’s third quarter of fiscal year 22 were above expectations due to strong performance in IMT (driven primarily by Premier Agent), while Mortgage was largely in line. Despite management’s prior guidance for worse-than-market conditions, Premier Agent’s revenue only fell 13% to $312 million (10+% higher than consensus estimates). Management attributed the decline to the discretionary nature of advertising. IMT operating expenses were also higher than anticipated because some hiring that was scheduled for the third quarter was delayed until the fourth quarter.

Financial highlights

Thanks to better-than-expected Premier Agent revenue and lower-than-expected opex, ZG’s adjusted EBITDA for the third quarter of fiscal year 2019 was $130 million, which was significantly higher than the $86 million that was expected and the $73 million to $88 million that was guided. Despite a challenging housing macro, a brief rebound in demand in August was caused by falling interest rates, and IMT ($457 million in revenue) outperformed on higher-than-expected Premier Agent revenue of $312 million and Rentals revenue of $75 million. While there is good news, I’d like to draw attention to a worrying trend: the reversal of the housing recovery trend at the end of September and into October, when interest rates began to rise again quickly. We could see heightened short-term fluctuations in the stock price as the stock reacts to new information.

While similar rate dynamics reduced mortgage revenue by $26 million, purchase loan origination volume increased by 24% sequentially as ZG expanded its Zillow Home Loans product. This is important because it shows that ZG’s growth into related industries is helping the company handle the inevitable ups and downs of the housing market.

On another note, ZG has completed the wind-down of its Homes business, with no homes remaining on its balance sheet at the end of the quarter, and average monthly unique users increased by 4% to 236 million, with visits increasing to 2.8 billion.

Management guidance

Profit projections for 4Q22 from ZG were lower than expected. Notably, Premier Agent 4Q revenue was predicted to be $250-$270 million, implying a 24%-29% decline and generally in line with industry housing declines. However, management reaffirmed its commitment to doubling the company’s current share of real estate transactions from 3% in 2021 to 6% by 2025YE by investing in tours, financing, seller solutions, expanding the company’s network of partners, and streamlining these processes.

Though this is promising, I anticipate that 2023 will be a difficult year for the housing industry as a whole due to low inventory and limited listings, which will act as headwinds for agent advertising spending.

Additional thoughts on near-term outlook

To me, Mortgages seem to be the most important product at the moment as the lever to unlock share gains, considering that a majority of home buyers are on Zillow today, and most of the prospective mortgage customers do not have a real estate agent.

Zillow searches are at the top of the funnel, but leads from people who have already spoken with a mortgage lender and been approved for a loan are much more valuable. Focusing on mortgages makes sense from a customer journey perspective, and it has the potential to address a major issue that agents have told us is holding them back: low lead conversion rates. ZG’s strategic positioning is promising, but more work needs to be done to ensure the company has the right business model to pursue this opportunity.

Model update

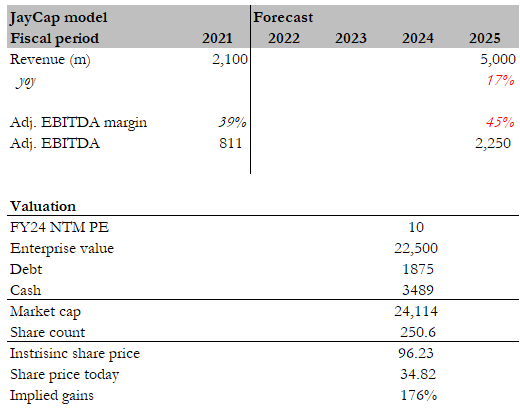

My previous model showed ZG gradually growing to meet management’s FY25 guidance, which does not accurately predict ZG’s near-term performance (i.e., in FY22). Rather than forecasting what might happen in the near term, I have focused my model on FY25, as everything in between is just volatility and noise to me. I continue to expect ZG to maintain its leadership position as its scale and profitability improve. According to my model, revenue will exceed management’s FY25 guidance of $5 billion. In terms of profits, management expects adj. EBITDA margins to reach 45% in FY25, generating $2.25 billion in adj. EBITDA.

One thing to note is that the valuation multiple (forward EV/EBTIDA) has increased from 9x to 14x since my coverage. I do not believe 14x is sustainable, and ZG should eventually return to its 10x average (which is reflected in my updated model).

Author’s estimates

Conclusion

I continue to believe that ZG is currently undervalued. The thesis remains unchanged: ZG is a leading player with an extremely long runway of growth, fueled by a larger TAM that can be further expanded by offering more services. The introduction of the new revenue model boosts profitability in the short term and allows ZG to solidify its leadership by attracting more users to its platform. The current macro environment may not be ideal for ZG, but I believe that once we get past this, ZG will be a true winner in the residential home industry in the United States.

Be the first to comment