Maks_Lab/iStock via Getty Images

A Quick Take On Zhihu

Zhihu (NYSE:ZH) went public in April 2021, raising approximately $773 million in gross proceeds from an IPO and concurrent private placements that priced at $9.50 per share.

The firm provides an online question & answer community in China.

Until management makes progress toward operating breakeven while continuing to grow total revenue, it is likely the stock will continue to have little upside potential.

I’m on Hold for ZH in the near term.

Zhihu Overview

Beijing, China-based Zhihu was founded to provide Chinese visitors with a destination to answer their questions on a variety of topics.

Management is headed by founder, Chairman and CEO Yuan Zhou, who was previously founder of Beijing Nuobote Informational Technology Co., an e-commerce data analytics firm.

The firm monetizes its offering through a combination of advertising, paid membership, content-commerce solutions, online education and e-commerce related activities.

The company operates solely online, so it attracts visitors through various forms of digital marketing, including through its relationship with investor Tencent.

Zhihu’s Market & Competition

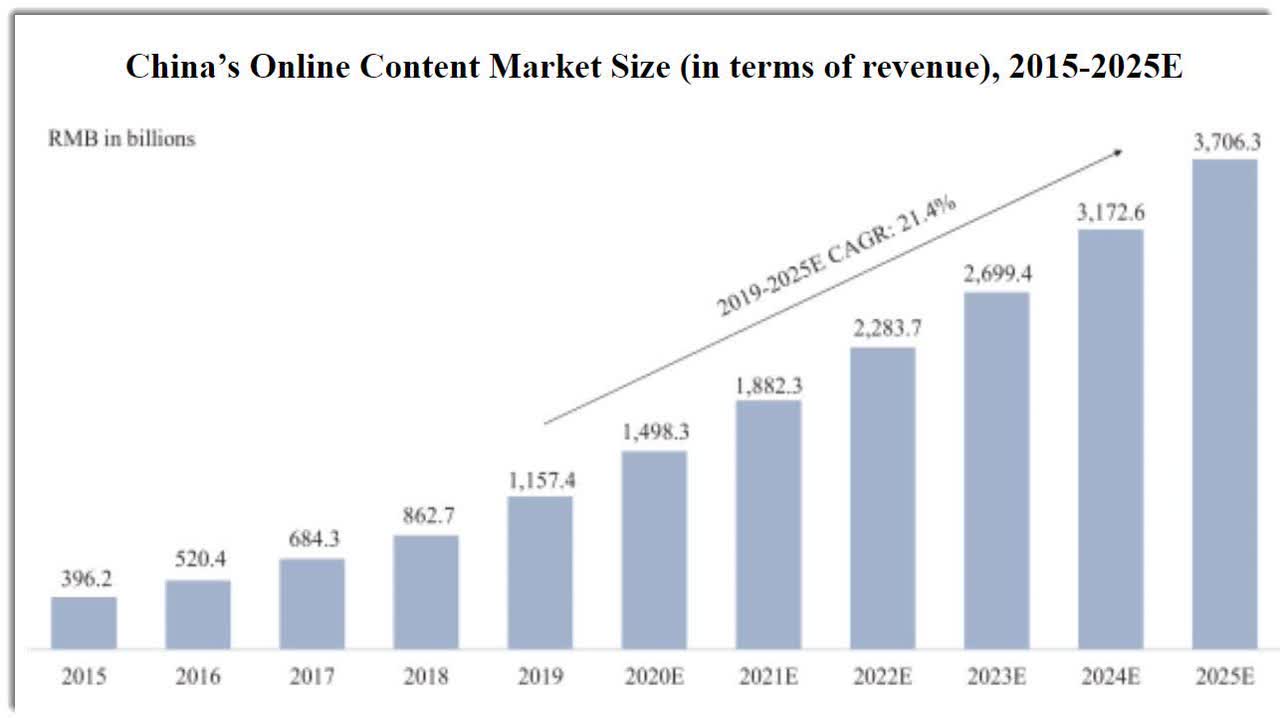

According to a 2020 market research report by CIC (commissioned by the company), the Chinese market for online content is expected to reach RMB3.7 trillion ($528 billion) by 2025, as the chart shows below:

China Online Content Market (CIC)

This represents an extremely high forecast CAGR of 21.4% from 2019 to 2025.

The main drivers for this expected growth are improving capabilities to encourage users to generate content [UGC], which is lower cost than professionally generated content and results in greater user engagement across the site.

Also, management believes that China’s online content community opportunity is still in the early stages of monetization ‘with significant growth potential’ ahead of it, including a more diversified monetization profile than the U.S., which has been primarily advertising based.

As management said in the company’s IPO F-1 filing:

Compared with the U.S. market, where monetization is primarily through advertising, China’s online content community market features more diversified monetization channels, including online advertising, paid membership, content-commerce solutions, content e-commerce, virtual gifting in live streaming, online games, IP-based monetization, and online education.

The firm competes with other online communities and online content producers within China, in a variety of horizontal and vertical industries.

Zhihu’s Recent Financial Performance

-

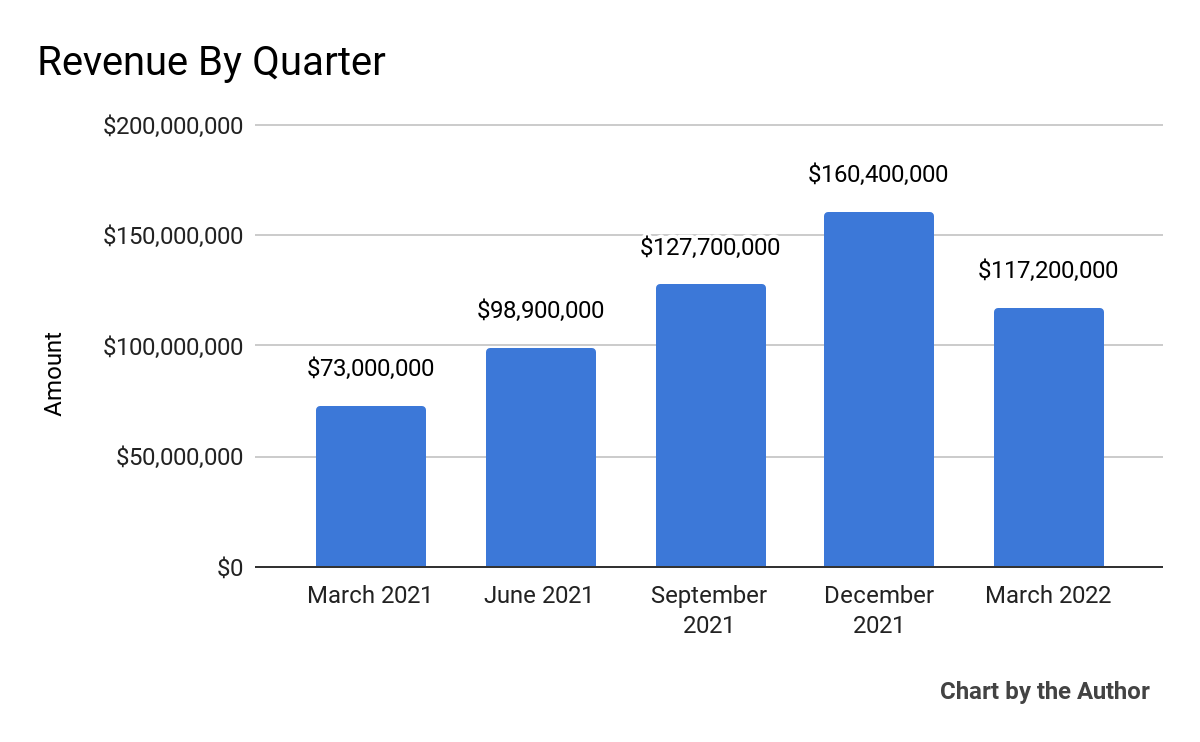

Total revenue by quarter has grown over the past 5 quarters:

5 Quarter Total Revenue (Seeking Alpha)

-

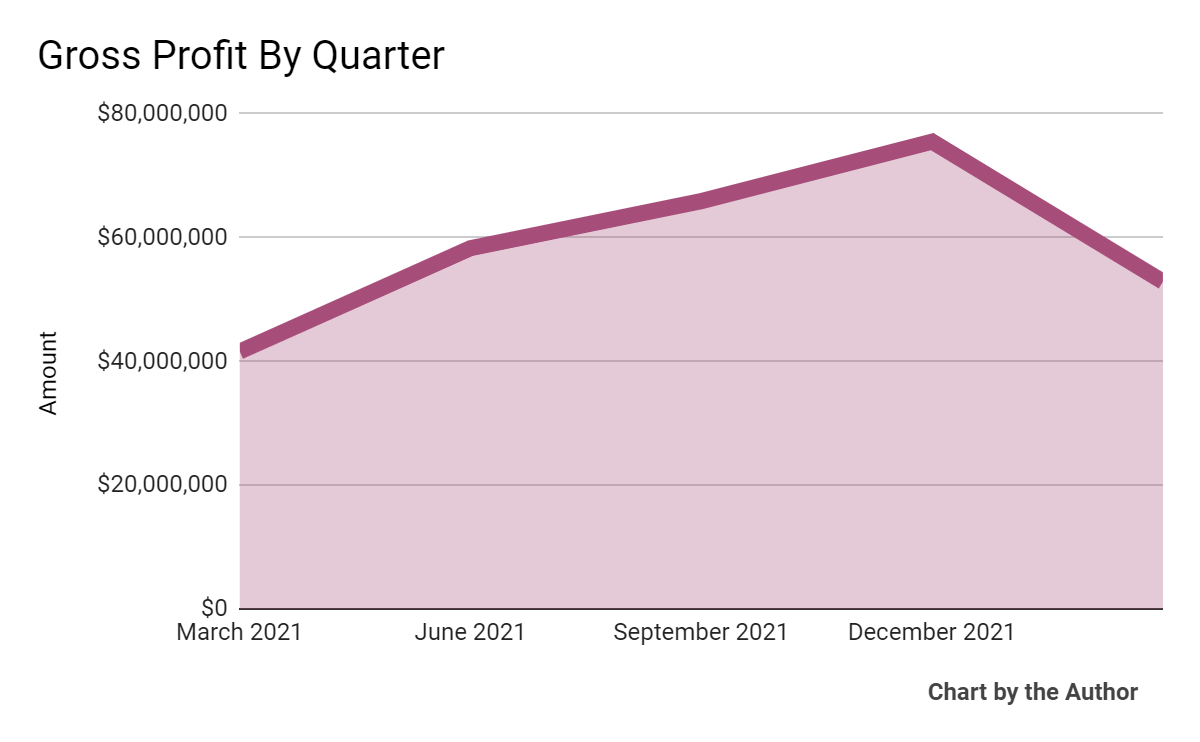

Gross profit by quarter has followed a similar trajectory to that of total revenue:

5 Quarter Gross Profit (Seeking Alpha)

-

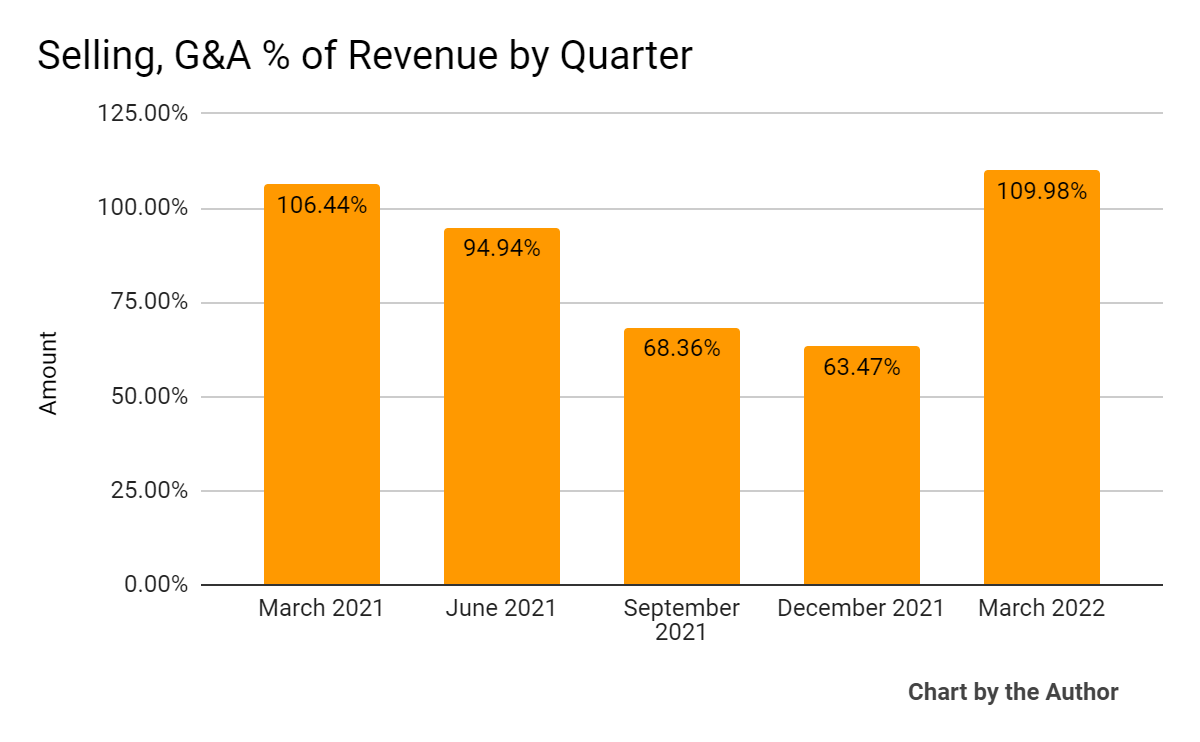

Selling, G&A expenses as a percentage of total revenue by quarter have risen sharply in the most recent quarter:

5 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

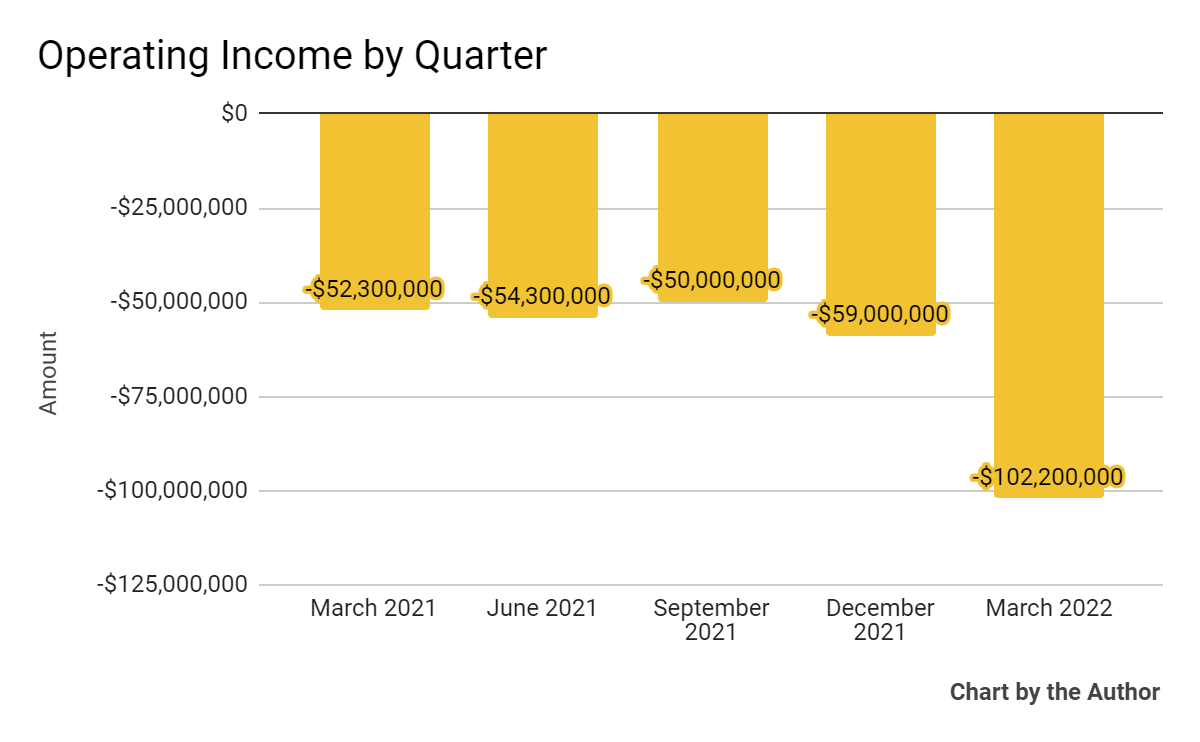

Operating income by quarter has remained negative and worsened significantly in Q1 2022:

5 Quarter Operating Income (Seeking Alpha)

-

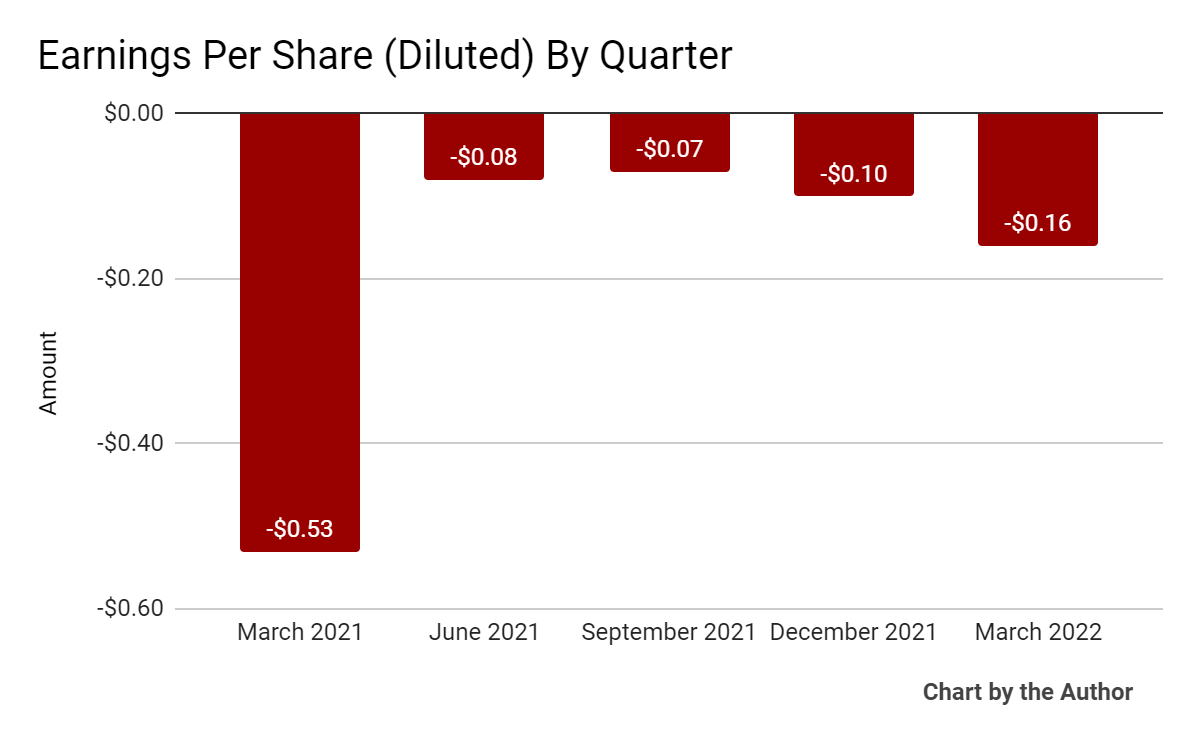

Earnings per share (Diluted) have also remained negative and have deteriorated further in recent quarters:

5 Quarter Earnings Per Share (Seeking Alpha)

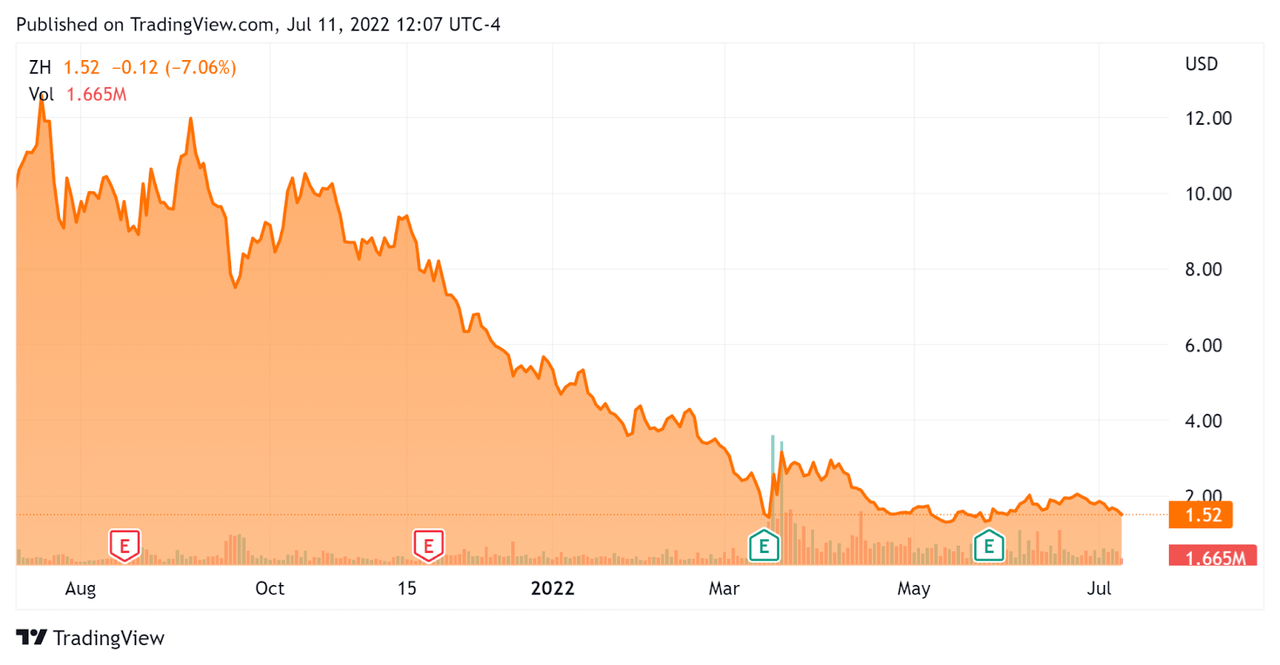

In the past 12 months, ZH’s stock price has dropped 84.9 percent vs. the U.S. S&P 500 index’ fall of around 11.9 percent, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation Metrics For Zhihu

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure |

Amount |

|

Enterprise Value |

-$21,680,000 |

|

Market Capitalization |

$1,030,000,000 |

|

Price / Sales [TTM] |

1.91 |

|

Revenue Growth Rate [TTM] |

96.32% |

|

Operating Cash Flow [TTM] |

-$69,270,000 |

|

Earnings Per Share (Fully Diluted) |

-$0.41 |

(Source – Seeking Alpha)

Commentary On Zhihu

In its last earnings call (Source – Seeking Alpha), covering Q1 2022’s results, management highlighted its average MAU (Monthly Active Users) growth of 19.4% year-over-year, with more than 96% mobile MAUs.

However, the company saw reduced new user growth but higher existing user engagement and retention which it credits to enhanced recommendations via its machine learning system improvements.

Content grew markedly year-over-year, with questions and answers growing by 36% and 30%, respectively.

Notably, the Board of Directors has ‘proposed to obtain shareholders’ approval for a share repurchase program of up to $100 million available for the coming 12 months’, indicating management believes the company’s shares are undervalued.

As to its financial results, total revenue grew by 55.4% year-over-year, with content commerce solutions representing the highest percentage of total revenue at 30.5%, followed by paid membership and advertising revenues at 29.8% and 29.2%, respectively.

So, the firm has truly diversified revenue stream sources.

However, operating losses worsened sharply for the quarter, due in part to its dual listing in Hong Kong.

For the balance sheet, the firm concluded the quarter with just over $1 billion in cash, equivalents, term deposits, restricted cash and short-term investments.

Looking ahead, management removed providing guidance per Hong Kong market regulations.

Regarding valuation, the stock market has severely punished Zhihu over the past year, likely in part due to its high operating losses as well as its China-centric focus.

An interesting aspect of the challenge the company faces according to the CEO is to ‘help people to discuss a topic on a more positive note,’ as China undergoes significant social change and tensions.

One wonders if the current uncertain social environment is weighing negatively on the firm’s growth prospects as online negativity may result in turning users off from the platform.

In any event, until management makes progress toward operating breakeven while continuing to grow total revenue, it is likely the stock will continue to have little upside potential.

I’m on Hold for ZH in the near term.

Be the first to comment