skynesher/E+ via Getty Images

Merger arbitrage

In a weak and weakening equity and credit market environment, I particularly like merger arb opportunities in deals that were announced recently. These have buyers with the most open eyes and the least likelihood of breaking their deal.

Who?

Zendesk (NYSE:ZEN) is a customer support SaaS company.

What?

Zendesk signed a definitive agreement to sell to a private equity consortium of Permira and Hellman & Friedman for $77.50 per share in cash.

When?

The deal will probably close in the fourth quarter of 2022.

Where?

Zendesk is headquartered in San Francisco and has customers in the US, Europe, the Middle East, Africa, and Asia.

Why?

Amazingly, this management turned down a proposal to buy the company for $127-132 per share in cash in February – just four months ago. The current deal appears to be perfectly timed by the buyers. It will probably close. Shareholders will probably get $77.50 by year end and capture an 11% IRR.

|

Target |

Ticker |

Parity |

Spread |

IRR |

|

Zendesk |

(ZEN) |

$77.50 |

$3.32 |

11% |

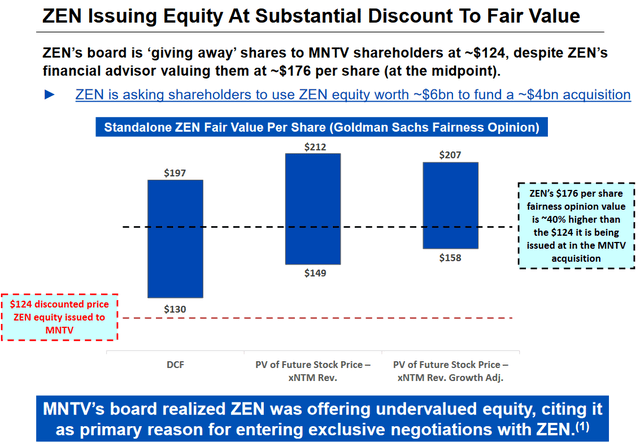

However, this is a situation with a lot of optionality. If something surprising happens to disrupt this perfectly adequate but unexciting base case, it will probably be something good. The current buyers appear to be getting a sensible price, but it leaves open the possibility of a strategic bidder showing up. If other private equity bidders were willing to pay 64-70% more a quarter ago, long-term oriented strategic buyers should be willing to lob in at least half that premium today. During Zendesk’s terminated deal to buy Momentive (MNTV), Goldman (GS) wrote a fairness opinion that valued Zendesk at $176 per share, $98.50 above the price that the company is getting in their sale. In this slide, shareholder activist Jana highlights how low Zendesk management valued their shares in issuing them in the failed MNTV deal at around $124, $46.50 above the current deal price:

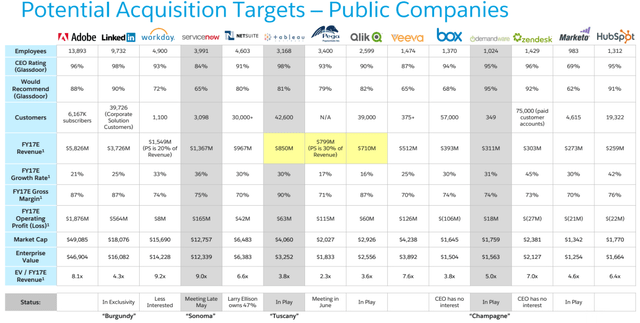

In considering strategic deal targets, Zendesk is one of fourteen that Salesforce (CRM) once considered. They were one of two where the “CEO has no interest”, hurting their status as a strategic target.

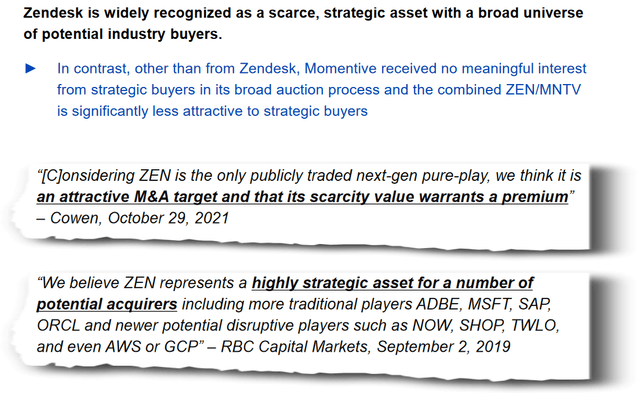

But since then, Zendesk management tried an ill-considered deal with MNTV largely based on the CEOs’ friendship, then bungled a sales process that seems to have bottom ticked the market. At some point, a strategic bidder will stop caring about the CEO’s interest level and start thinking about lobbing in a $90 per share bid. Jana highlighted ZEN’s strategic value and potential bidders including ADBE, MSFT, SAP, ORCL, NOW, SHOP, TWLO, AMZN, and GCP.

Caveat

This board and management managed to get themselves into this situation. Last year their shares traded at $158 per share, they turned their noses up at $127-132 in a deal, then desperately flung themselves at $77.50. They are some combination of unlucky and stupid. They have screwed up everything so far so could even screw this up. And while I think that this $77.50 is the reasonably likely downside due to the deal’s low risk and optionality, shares were trading around $56 based on its standalone prospects before the deal announcement.

Conclusion

This is a low risk deal requiring only US antitrust and shareholder approval. Jana Partners withdrew their board nominees, making shareholder approval quite likely. You’ll probably get a sleepy 11% yield; but you’ll get a freeroll that something better happens, especially if markets stabilize over the next few months.

TL; DR

Buy ZEN.

Be the first to comment