ozgurdonmaz/iStock Unreleased via Getty Images

Q2 earnings results have turned to a tale of two cities for digital advertising companies; a group that highlighted the challenge facing their respective companies, and another group that is more focused on the opportunity ahead.

For example, despite popping on its Q2 earnings results, YouTube’s markedly slower revenue growth was very noticeable.

Alphabet Inc. (GOOG) (GOOGL) attributed the slowdown to strong results in Q2 of 2021. They also highlighted that pulling ad spend by advertisers was the biggest reason for the QoQ decline, while ATT (Apple’s App Tracking and Transparency) impact remained constant. My view is the last two factors could be related. CFO Ruth Porat said the following during the earnings call:

I did note that we have seen pullbacks in spend by some advertisers that, in fact, was the biggest factor in the quarter-on-quarter change, the sequential decline in the growth rate. And we’re — that we do view that as rather idiosyncratic as I said, some of its supply chain, some of its inventory. And so, just working through that… The war was a modest headwind to year-on-year and sequential growth. AT&T impact, in fact, remained relatively constant, we’ve said that for the last couple of quarters. So that does remain headwind. So, we’re working through those.

Looking at Meta Platforms Inc. (META), their advertising business actually declined YoY for the first time ever. The company noted that competition with TikTok was the main challenge, followed by Apple’s ATT changes. Here is Mark Zuckerberg during the Q2 earnings call:

The second challenge that we face here is the signal loss from Apple’s iOS changes. And as I’ve discussed before, our approach here is to grow first-party understanding of people’s interests by making it easier for people to engage with businesses in our own apps, whether that’s through business messaging, shops or new ad products.

Snap (SNAP) offered a similar story, they lamented stronger competition (resulting from advertisers pulling ad spend).

On how to counter Apple’s ATT, Snap CFO Derek Andersen said that the company must continue to…

…invest in our direct response business and improving that consistently over time. Number one, we’re improving our first- and third-party measurement solutions; and two, through better ranking and optimization that delivers better optimization for our advertising partners and therefore return on ad spend over time; and then three is really about continuing to cultivate new sources of revenue across our business, and there’s lots of opportunity for that.

On the other side of the aisle, Microsoft Corporation (MSFT) saw double-digit growth in their advertising business driven primarily by LinkedIn. The company highlighted its acquisition of Xandr and deal with Netflix (NFLX) as evidence of the potential this segment of their business has.

We are a leader in B2B digital advertising, and we continue to see customers choose us for higher reach and ROI. More broadly, despite the current headwinds in the ad market, we are expanding our opportunity in advertising as we look towards the long term.

Microsoft CEO Satya Nadella remarked in the Q2 earnings call.

Spotify (SPOT) was more of the same; advertising revenue was stronger than subscription, growing north of 30% (similar to LinkedIn). And while they noted there was softness in the business in the last two weeks, they still expected the business to grow meaningfully in Q3.

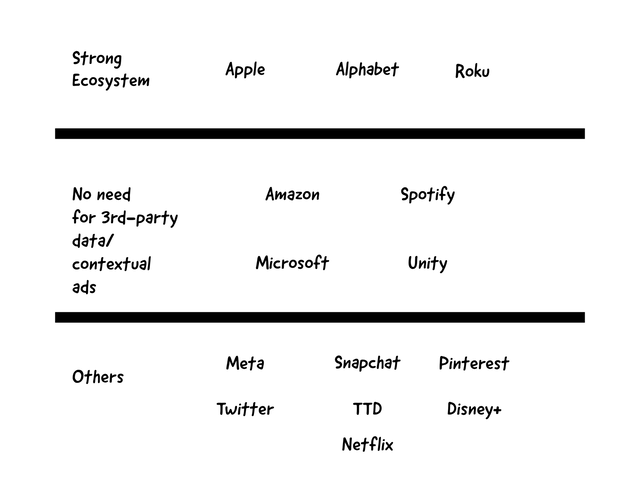

That divide is rather curious. While it can be explained by competition (companies that compete with TikTok are doing poorly; those that don’t are doing well), I believe the nature of the data being monetized is just as important. Digital advertising companies that will do well have either: 1) control the ecosystem of their 1st-party data, 2) no need for 3rd-party data 3) are relying on contextual ads. Other digital companies that don’t have any of these characteristics could underperform.

My view is that the order of those characteristics also matters; companies that have their own ecosystem will do better than those who don’t need 3rd-party data to monetize ads, who will in turn do better than companies relying on contextual ads, and so on.

This basically puts companies like Apple, Alphabet (particularly the Android and Search businesses), Amazon.com Inc. (AMZN), Microsoft, Roku Inc. (ROKU), Spotify, Unity Software Inc. (U) in the outperforming bucket.

While other companies like Meta, Snap, Pinterest (PINS), Twitter Inc. (TWTR), The Trade Desk (TTD), the streaming services of companies like The Walt Disney Company (DIS), and Netflix Inc. in the underperforming bucket.

This isn’t necessarily a death sentence for the second bucket, but it is a framework for investors to follow how those companies navigate their challenges to join the first bucket.

The bottom third will be the long-term underperformers (Created by author)

Because companies like Apple, Alphabet, and Roku control their ecosystem, they have perfect view of their customer data whether on their own apps or on the competing apps residing in their ecosystem. So they have a breadth of data of which they have full control.

Comparing that to the bottom group, they have their own data, but thanks to ATT they don’t have full visibility into their users, which affected their monetization capability.

The middle group meanwhile suffers from the same tracking difficulty as the bottom group, but they have all the data they need. For example, Unity only needs to know that a user plays to mobile game x in order to advertise mobile game y to him/her. It doesn’t matter to Unity what said user is doing on other apps.

This should result in the upper group gaining more share from the lower ones, which should translate to higher stock returns.

The Roku mystery

Roku’s stock absolutely plummeted following Q2 results. While advertising revenue grew a comparatively high 26 percent compared to the rest of the companies mentioned in the article (supporting my thesis that different types of data will have inherent monetization advantages), management warned of slowing advertising revenue for the rest of the year. This really shouldn’t happen based on the idea that Roku’s first-party data should be very valuable to advertisers.

One explanation could be that, in the short-term, the position of a company’s advertising product in the funnel will determine its performance. Digital advertisers that are closer to the bottom of the funnel will prove to be stickier. In other words, the closer the distance between the ad and the user buying the product, the better a company’s advertising revenue will be at this point of the cycle. This would explain Roku’s partnership with Walmart (WMT). This would also mean that advertising budgets allocated to Amazon.com and Google search are likely to prove more resilient than those allocated to YouTube for example, given the buying intent for users in the former two is much higher than that of the user watching YouTube. It is also consistent with how the three products performed in Q3. Given Roku is more of a top-of-the-funnel product, that could explain why advertising budgets allocated to it are getting cut.

This also indicates that companies that have advertising products across the funnel will do better than others who don’t. Amazon for example can combine data from Twitch for instance (top of the funnel) with Amazon.com (bottom of the funnel). Alphabet can do the same with YouTube and search.

Implications for Netflix

Netflix recently announced they are partnering with Microsoft on ads.

I’ve previously voiced my disapproval of Netflix adding an advertising tier:

you want a tier that entices high-churn/non-subscribers to subscribe while simultaneously avoiding the cannibalization of the $20 a month subscription business. That seems hard to do.

It is a bit more reassuring to Netflix that both Hulu and Discovery+ make more on their ad-supported tier than their premium one.

The other issue that Q2 brought Netflix is that their advertising offering will have many of the challenges facing the “others” companies. The data they have on their users (mostly viewership data) is unlikely to be enticing on its own to advertisers in the current environment. Netflix is also the type of product more suited to top-of-the-funnel advertising, which is unlikely to do well in the short-term. This applies to Disney+ and Warner Bros. Discovery (WBD) as well.

Longer-term the company can address that by going into commerce, but for now its advertising product looks like it will be born in the eye of the storm.

Conclusion

Q2 earnings carried some interesting insights into the future winners and losers in digital media. Companies that have no need for third-party data will probably do better than the ones that do long-term. In the short-term, companies that have advertising products at the bottom of the funnel (or that covers the entire funnel like Alphabet and Amazon) are likely to do better. Investors should focus on buying those I labelled as outperformers, but also keep an eye on how the underperformers try to improve their offering, as they could become investable under that scenario.

Be the first to comment