gesrey/iStock via Getty Images

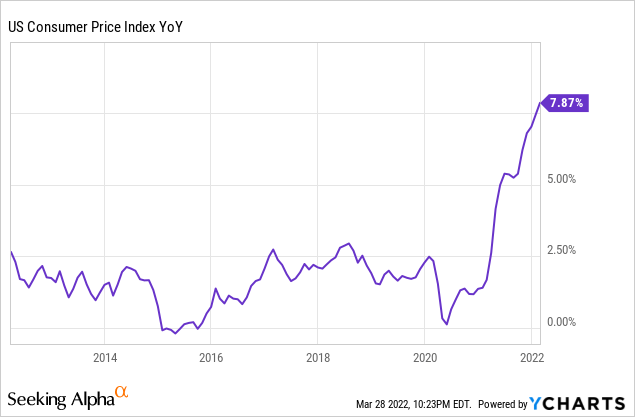

We began 2022 with inflation hitting 7.5%, which was a 40-year high. It is widely believed that this high inflation is the result of supply chain issues caused by the pandemic, as well as all the helicopter money transferred to the public during the pandemic.

Many of us were optimistic that the inflationary pressures would soon cool down as we move past the pandemic, and put an end to the ultra-accommodative monetary policy. Most developed countries have already begun to lift covid restrictions as most people have now gotten vaccinated or gained some level of immunity from previous infections. Moreover, the Fed has now begun to hike interest rates and signaled an aggressive fight to curb inflation.

Surely, inflation will soon come down?

Well, not so fast.

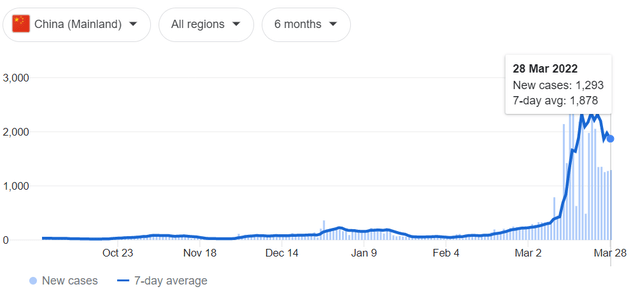

China is currently dealing with the worst Covid outbreak in a long while, and as a result, it is restricting production in Shenzhen and implementing a new lockdown in Shanghai among other things. If you thought that supply chain issues would soon be resolved, you need to think again.

Covid cases are rising in China (Google)

At the same time, Russia decided to invade Ukraine, indiscriminately bombing civilians all over the country, threatening to use nuclear weapons, and creating false flag operations, which could set the stage for the deployment of biological/chemical weapons.

Not surprisingly, this caused global outrage with 141 out of 146 countries in the UN’s national general assembly condemning Russia’s action. This is one of the very few topics where everyone is on the same page. Only a few other corrupt dictatorships stood with Russia or abstained from voting.

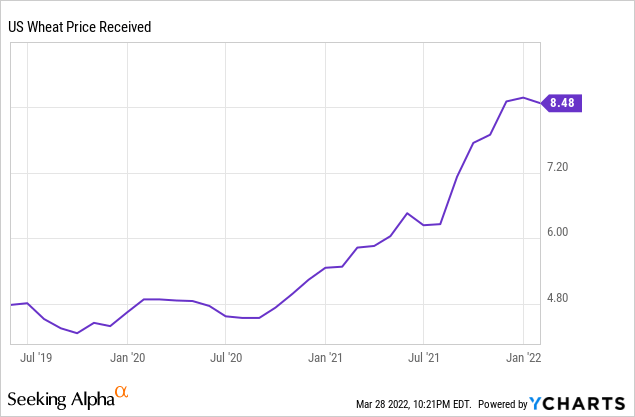

Russia is now being cut off from the rest of the world because of sanctions, and Ukraine is also being cut off because it is fighting for its survival. This is leading to a lot more supply chain issues and inflation since these are large exporters of necessities like food, energy, and other natural resources:

At the same, we are now also giving helicopter money to Ukraine to help it defend its sovereignty, and it appears that the fed is not hiking rates as aggressively as it may have planned for. Still, a few months ago, it was widely expected that we would have a 50 basis point rate hike in March, but we only got a 25 bps hike. Again, the consequence is more inflation…

But that’s not all!

There is one more risk that could spin inflation even more out of control. So far, China and India have refused to condemn Russia’s actions and some intelligence even suggests that they may be preparing to indirectly support Russia by helping it counter sanctions and/or supply important resources to it.

This would then likely result in sanctions also impacting China / India, causing more supply chain disruption, and a lot more inflation. President Biden has warned both countries of “consequences” if they aid Russia’s war crimes.

The bottom line is that the high inflation could stay for much longer than initially anticipated, and it could even get worse from here.

Even if you remain in the camp of deflation, you should recognize that the world has become so unpredictable that you need to diversify and prepare for all possible outcomes. As a result, now is also time to adjust your portfolio strategy in case you haven’t already.

As an example, if you thought that holding cash was the solution, you may need to reconsider. On the contrary, we have previously argued that shorting cash by owning leveraged real assets may serve as an effective safe haven in today’s environment.

Things like farmland, apartment communities, and hospitals generate recession- and inflation-resistant profits and continue to grow in value even as their mortgages are inflated away, and you can today invest in them today at opportunistic prices via undervalued REITs.

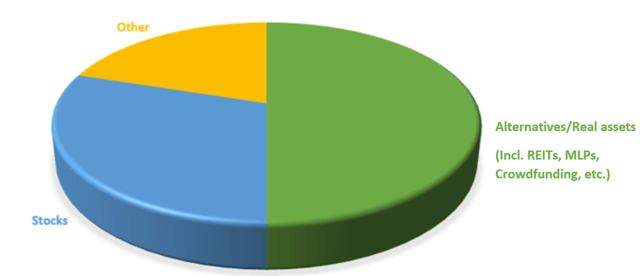

I personally have about 50% of my net worth invested in those opportunities highlighted at High Yield Landlord, and in what follows, we present 3 that we are accumulating at the moment:

High Yield Landlord Portfolio Strategy (High Yield Landlord)

Farmland Partners (FPI)

FPI is arguably the best hedge in today’s crisis. That’s because it owns 160,000 acres of US high-quality farmland that’s now surging in value, even as its fixed-rate debt is being inflated away.

Different farmland crop types (Farmland Partners)

Its farmland mainly grows row crops like wheat, corn, and soybeans. These crops are affected the most by the war in Ukraine and their prices are surging right now. As a result, rents are growing 10%+ and farmland values are already up 20% year-to-year according to the February estimates of the Fed.

In addition to that, FPI is now growing a farmland asset management and brokerage business following its recent acquisition of Murray Wise.

We think that this timely acquisition could turbo-charge FPI’s future growth as there is currently unprecedented demand for farmland investments and FPI is now becoming a one-stop-shop to serve all investor’s needs. The surging inflation should only lead to more demand for FPI’s services, boosting its profits even further.

So all in all, FPI is in an ideal position as its assets are surging in value, its debt is inflated away, and the revenue from its other services is expected to grow even faster as a result of the inflation.

Despite that, you can today buy it at an estimated 10% discount to its net asset value. Given how fast its net asset value is growing, we expect the market to reprice FPI at a substantial premium, just like its close peer, Gladstone Land (LAND), which already trades at a 70% premium.

Medical Properties Trust (MPW)

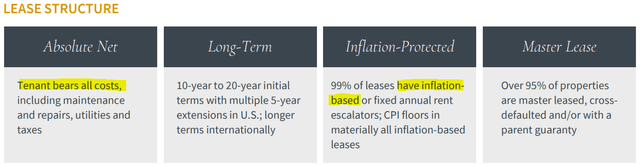

MPW is the only pureplay hospital REIT in the world. Not having much competition has allowed it to structure highly favorable lease terms that are especially important today.

Most importantly, the tenants of its hospitals are responsible for all property expenses, including even the maintenance, and they are subject to annual rent increases that are tied to the CPI.

MPW has superior leases (Medical Properties Trust )

Hospital real estate investment (Medical Properties Trust)

Most of the CPI-based rent increases are capped at ~4.5% per year, but that’s real growth considering that MPW has no property expenses, and the growth is even greater on a leveraged basis. MPW’s balance sheet is about 40% fixed-rate debt, which is slowly inflated away even as the value of its properties continues to grow.

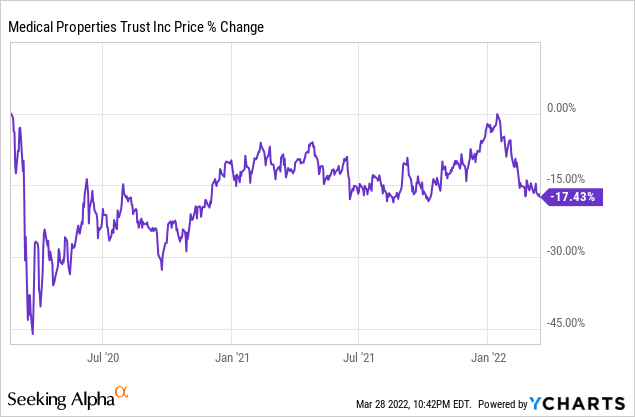

The inflation protection of MPW is then compounded by the fact that its share price is steeply discounted. Today, MPW is generating more cash flow than ever and paying higher dividends than ever, but despite that, its share price is still at a near 20% below its pre-Covid peak:

As a result, it is priced at just around 12x FFO and pays a near 6% dividend yield, which is very attractive for an inflation-protected company that’s growing at 6-8% per year.

Finally, we also invest heavily in apartment communities at High Yield Landlord. We like to own apartment communities during times of surging inflation because they can be financed with a lot of fixed-rate debt and are able to quickly adjust lease rates given that most leases are only 1-year long.

Apartment community (BSR REIT)

But not all apartment communities are equally attractive.

Today, we think that the best opportunities are in strong sunbelt markets like Austin and Dallas, Texas, which are experiencing rapid population growth. People and businesses are moving there from coastal states to lower their taxes and other costs, boost their income, and ultimately, their standards of living. This trend accelerated with the pandemic and we expect it to remain strong for years to come.

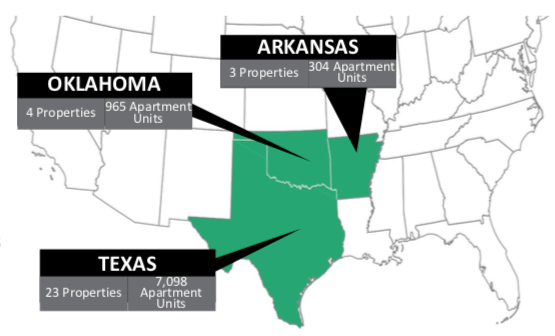

BSR REIT is ideally positioned to profit from this as almost all of its assets are in strong Texan markets.

Locations of BSR’s properties (BSR REIT)

Currently, its rents are growing at 15%+ and its net asset value is surging. In 2021, its NAV per share rose by 61%. That’s in a single year! While we don’t expect as much growth in 2022, we think that the growth will remain significant, pushing BSR’s NAV per share in the $25-30 range by year-end.

Today, you can still buy it at just $21 per share, and while you wait for the upside, you earn a near-3% monthly dividend yield.

Bottom Line

Unfortunately, it appears that the recent surge in inflation isn’t coming to an end anytime soon. Risks are on the rise and now is the time to adjust your portfolio strategy. I am investing heavily in undervalued real assets like REITs (VNQ) because I believe that they offer the best risk-to-reward in today’s environment.

Be the first to comment