Davizro/iStock via Getty Images

In these harsh market conditions, it is hard to find a relatively stable stock, let alone one with the potential to double or grow even higher. Yatra Online, Inc. (NASDAQ:YTRA) is one such rare stock.

Yatra is a very well-known and trusted brand in India. However, the brand is not at all known in the U.S. where Yatra’s stock is listed. Yatra’s revenue was seriously affected during the pandemic since its primary focus is travel. In addition, just before the pandemic, Yatra agreed to be acquired by Ebix, a U.S.-based insurance software company. However, the deal fell through in 2020 in the middle of the pandemic.

Yatra’s stock price went down dramatically with the revenue decline and the failed merger with Ebix. With very few analysts following the stock, it is still languishing at a very low $100m valuation. In contrast, some of its peers listed in India with similar revenues are valued almost ten times as much. To unlock the value and attract more analysts’ following, Yatra decided to list the stock of its Indian subsidiary in the Indian stock market.

The fast travel recovery in India and the imminent IPO of the Indian subsidiary at a potentially high valuation portends a multi-fold return for the currently low-priced Yatra stock.

Brand Yatra

Yatra brand is a well-recognized and trusted brand in India.

- Yatra is the largest B2B travel operator in India.

- It is the second-largest OTA operator in India.

- Yatra was Voted as the most trusted OTA Brand in India twice

- It has won the best domestic and inbound tour operator award four times.

- Among the OTA players, Yatra has the largest hotel inventory in India.

- Yatra has an excellent customer loyalty program.

Yatra’s management team, in particular the CEO Dhruv Shringi, is very quiet and focused, and they have seen Yatra through turbulent times, making multiple pivots over the years. Around 2014, when the competition increased with every OTA offering steep unprofitable discounts for consumers, Yatra pivoted to focus more on corporations and the B2B sector by making some acquisitions. The move paid off as the B2B part of the revenue steadily increased; currently, almost 60% of the revenue comes from B2B. Due to tight integrations, corporate customers also tend to be sticky. Yatra claims 98% customer retention for B2B clients.

Yatra has found a way to leverage its corporate connection to attract corporate employees and families for their personal travel needs. Yatra has a unique and attractive customer loyalty program that the consumers find appealing. Providers who do not have their own loyalty programs use that as a proxy which attracts more providers and keeps them in Yatra’s fold.

Pandemic Turbulence

Because of their focus on travel, Yatra’s revenue declined dramatically when the pandemic hit. In 2019 before the pandemic, Yatra agreed to be acquired by Ebix, an insurance software provider who also set up Indan financial operations through their subsidiary, Ebixcash. However, Ebix delayed the deal probably due to the pandemic, which resulted in Yatra terminating the deal and suing Ebix. Yatra lost the case, which added to their owes along with the revenue decline due to the pandemic. The stock price fell dramatically during this period and has not yet fully recovered.

Yatra managed the downturn during Covid-19 well by focusing on automation, reducing headcount expenses, and raising additional funds through a secondary offering. Now that the travel in India is recovering, Yatra is well-positioned to take advantage of that. However, the stock price does not reflect the optimism of the travel forecast for India, primarily because Yatra is not well known in the US, and not many analysts cover the stock.

In one of the analyst presentations, Yatra’s CEO lamented the fact that Yatra is clubbed with microcaps in the US with a minimal following, while in India, it is regarded as a significant OTA player.

Travel Recovery

As covid-19 has receded in India with impressive vaccination rates and overall immunity, travel has returned strong. For the Jan-March 2022 quarter, Yatra reported $12.9m adjusted revenue and an adjusted EBITA profit of $0.7m. For the financial year ending in March ’22, Yatra reported revenues of $26.2m, a 50% increase YoY, and an adjusted EBITA profit of $2.1m vs. a loss of $5m for FY21.

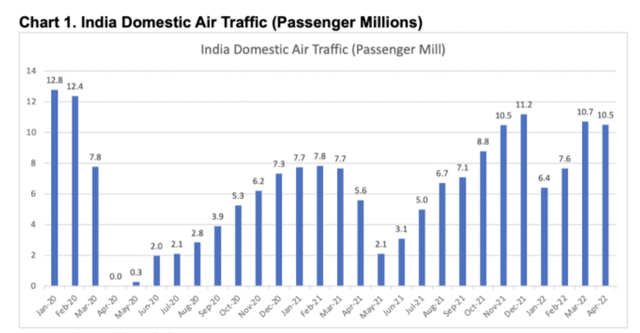

On the earnings call for Q4 FY22, Yatra management indicated that the Omicron scare impacted the early part of Q4’22, as seen in the India air travel graph shown above. However, they were very optimistic about the Apr-June quarter, where they see corporate traffic coming back to almost 90% of the pre-covid levels and the international travel also picking back up strongly.

Yatra management expects the domestic and international travel to be back to pre-covid-19 levels by the end of 2022. Beyond that travel sector in India is expected to grow at a staggering 17.3% CAGR till 2029. In addition, there is the continuing shift to online travel booking, which got accelerated during the pandemic. These trends will help Yatra’s revenues and profits grow in the coming quarters and years.

Yatra IPO In India

In 2021 the Indian stock market, particularly the IPO market, did exceptionally well. One of the peers of Yatra, Easy Trip Planners, went IPO in 2021. The Easy trip Planners has revenue levels similar to Yatra’s but generates higher profits. As corporate travel returns, Yatra is likely to accelerate and exceed the revenues of Easy Trip Planners and improve profitability due to lower competition and the stickiness of its corporate customer base. Recently the Easy Trip Planners valuation touched $1.1B in India, about ten times that of the US-listed valuation of Yatra.

The languishing stock price of Yatra, along with the high valuation of its peers listed on Indian stock exchanges, have prompted Yatra management to initiate the process of listing Yatra stock in India. Please refer to this article which talks about Yatra’s planned IPO and the rationale behind it in detail.

In the India IPO, Yatra is planning to raise $100 million from the fresh sale of shares of the Indian subsidiary along with a sale of additional 9 million shares as an Offer For Sale (OFS). As a result, Yatra subsidiary’s expected valuation in India ranges from $500m to $800m depending on the percentage of shares offered to raise the $100m. Once Yatra subsidiary shares are listed, the valuation can rise closer to $1B because of its name recognition, in line with its peers in India. Given that the current valuation of Nasdaq listed shares is only around $100m, a valuation above $500m for the subsidiary could be massive. Moreover, given that Nasdaq-listed Yatra Online wholly owns the Yatra subsidiary in India, that valuation will likely reflect back on the U.S.-listed Yatra stock.

Yatra took the critical step of filing DRHP for the India subsidiary on March 25 with the Securities and Exchange Board of India (SEBI), the equivalent of SEC in the US.

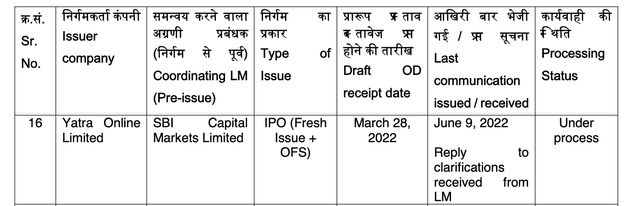

As the DRHP document undergoes SEBI review, a few rounds of queries and responses have been exchanged between SEBI and the Lead Manager for Yatra IPO, SBI Capital. According to the status published by SEBI on June 10, the LM responded to a query from SEBI on June 9. The response is under review by SEBI.

Securities and Exchange Board Of India

This exchange could go on for a few more rounds until SEBI is satisfied when it will issue its observation which is the approval to move forward with the IPO. Based on the current approval trends, SEBI approval for Yatra DRHP is expected sometime by the first half of July. Typically it takes about a month after the SEBI approval to list the stock on the stock exchange.

Potential Acquisition Target?

Despite Yatra moving forward with the IPO process in India, it could still be an acquisition target due to its narrow focus and strong brand recognition. In India, establishing a brand like Yatra takes a long time. However, the combination of brand name recognition, the sticky corporate customer base, and a large hotel room provider base makes Yatra very attractive for anyone to establish a new presence or add to their company to become a leader in the online travel space.

Many potential candidates might be interested in Yatra, including fintech companies and other International OTA companies. Among these, two potential candidates stand out – Flipkart (FPKT) and Ebixcash (EBIX).

Flipkart acquired Cleartrip in 2021 at a bargain price when Cleartrip was distressed due to the pandemic. Flipkart is planning to go public in 2023 at a high valuation expected to be in the range of $60B to $70B. Before the IPO, Flipkart is rumored to be bulking up its travel and health portfolios. With the Cleartrip acquisition, Flipkart has a small travel segment footprint. Acquisition of Yatra will clearly place them as a leader in the B2B segment and also position them to challenge the leader MMYT in the B2C segment.

Ebixcash is a subsidiary of Ebix and is about to IPO in India. As mentioned earlier, Ebix and Yatra have a history where Ebix made an offer to buy Yatra in 2019, and the deal fell through. In the IPO, Ebixcash is expected to fetch a valuation in the range of $4B to $5B. Ebixcash leads in smaller segments such as foreign exchange and remittance, but it does not have a leadership position in more significant segments such as travel. Ebix CEO Robin Raina has been open about his desire to make acquisitions in travel to become a leader in that segment. Despite the failed acquisition attempt earlier, it is possible that Ebixcash may attempt another run at Yatra after the Ebixcash IPO.

Since Yatra is already on the path to an IPO, any offer to buy Yatra will have to be at a significant premium to the current valuation online. However, since the likely target valuation of Yatra through the IPO is in the range of $500m to $800m, Yatra may be open to considering a buyout offer in that range.

Huge Upside Potential

As discussed earlier, Yatra Online stock has not recovered from the ground lost during the pandemic and the failed Ebix merger deal. However, based on the travel recovery, some analysts have projected a doubling of the stock based on the revenue and profit growth with travel recovery in India.

The upcoming IPO adds to this projection. If the IPO indeed goes through at the projected valuation, the valuation of the wholly-owned Indian subsidiary will be many multiples of the parent. This subsidiary valuation will be reflected back on the parent Yatra’s stock price online listed on Nasdaq.

Risks

One of the most significant risks Yatra faces is the return of the pandemic. Any possibility of the return of the pandemic in any form could pose a threat to the recovering travel industry in India and could directly affect the top and bottom lines of Yatra.

The other risk is the competition. The Indian OTA space is very competitive, particularly in the consumer space, where many players offer deep discounts and giveaways to attract customers. However, the risk is relatively low since Yatra derives more than 60% of its revenue from the less competitive and more sticky corporate segment.

As mentioned earlier, Yatra’s India subsidiary’s IPO is going through a SEBI review. There is an excellent chance that SEBI will approve it. However, any possibility of a rejection of the listing could hurt the valuation of Yatra. However, the positive impact of travel recovery in India should put a floor on such an impact.

Conclusion

In India, consumer and corporate travel are expected to grow back to pre-pandemic levels in 2022. Over the next few years, travel in India is projected to grow at a high double-digit rate. Also, the shift towards online booking keeps increasing. Yatra is a direct beneficiary of both these trends and may grow above the projected growth in travel with its well-recognized and trusted brand. Since Yatra shares have still not recovered fully from the pandemic lows, the travel recovery, while providing an upside, also limits the downside.

The imminent IPO of Yatra’s Indian subsidiary at a multiple of the parent’s valuation adds to the potential, making languishing Yatra stock a rare gem of an investment opportunity.

Be the first to comment