xamtiw/iStock via Getty Images

A Quick Take On YanGuFang International Group

YanGuFang International Group Co., Ltd. (YGF) has filed to raise $23 million in an IPO of its ordinary shares, according to an F-1 registration statement.

The firm produces and sells oats and related grain products in China.

YGF has grown revenue quickly and generates profits but has swung to free cash use.

I’ll provide a final opinion when we learn more about the IPO from management.

YanGuFang International Overview

Shanghai, China-based YanGuFang was founded to grow oats in Inner Mongolia and to produce finished oat-based products for consumer use in major provinces in the PRC and potentially Thailand.

Management is headed by Chairman and CEO Junguo He, who has been with the firm since inception in August 2012 and was previously founder of YanGuFang Agroeco Tech

The company’s primary offerings include:

-

Oat germ groats

-

Oat flour

-

Oatmeal

-

Oat oil

-

Oat bran

The company sells its finished products in the provinces of Beijing, Shanghai, Jiangsu, Zhejiang, Fujian, Guangdong, Anhui, Chongqing and the Inner Mongolia Autonomous Region.

YanGuFang has booked fair market value investment of $12 million as of December 31, 2021 from investors including BioNature Organic Solution Co., Upworld Fitness Approach Solutions Co., VicVans Organic Service Co., YanYat Fitness Create Co., Supreme Green Incubator Co., and HeaYan Grain Solution Co.

YanGuFang – Customer Acquisition

The company sells its products via an omni-channel approach, such as through its own mobile app, third-party ecommerce platforms, and an offline direct sales team through distributors.

Management says it had a 57.5% repurchase rate from subscription customers for the six months ended December 31, 2021.

Selling expenses as a percentage of total revenue have risen as revenues have increased, as the figures below indicate:

|

Selling |

Expenses vs. Revenue |

|

Period |

Percentage |

|

Six Mos. Ended December 31, 2021 |

26.8% |

|

FYE June 30, 2021 |

15.3% |

|

FYE June 30, 2020 |

10.2% |

(Source – SEC)

The Selling efficiency multiple, defined as how many dollars of additional new revenue are generated by each dollar of Selling spend, rose to 1.6x in the most recent reporting period, as shown in the table below:

|

Selling |

Efficiency Rate |

|

Period |

Multiple |

|

Six Mos. Ended December 31, 2021 |

1.6 |

|

FYE June 30, 2021 |

1.3 |

(Source – SEC)

YanGuFang’s Market & Competition

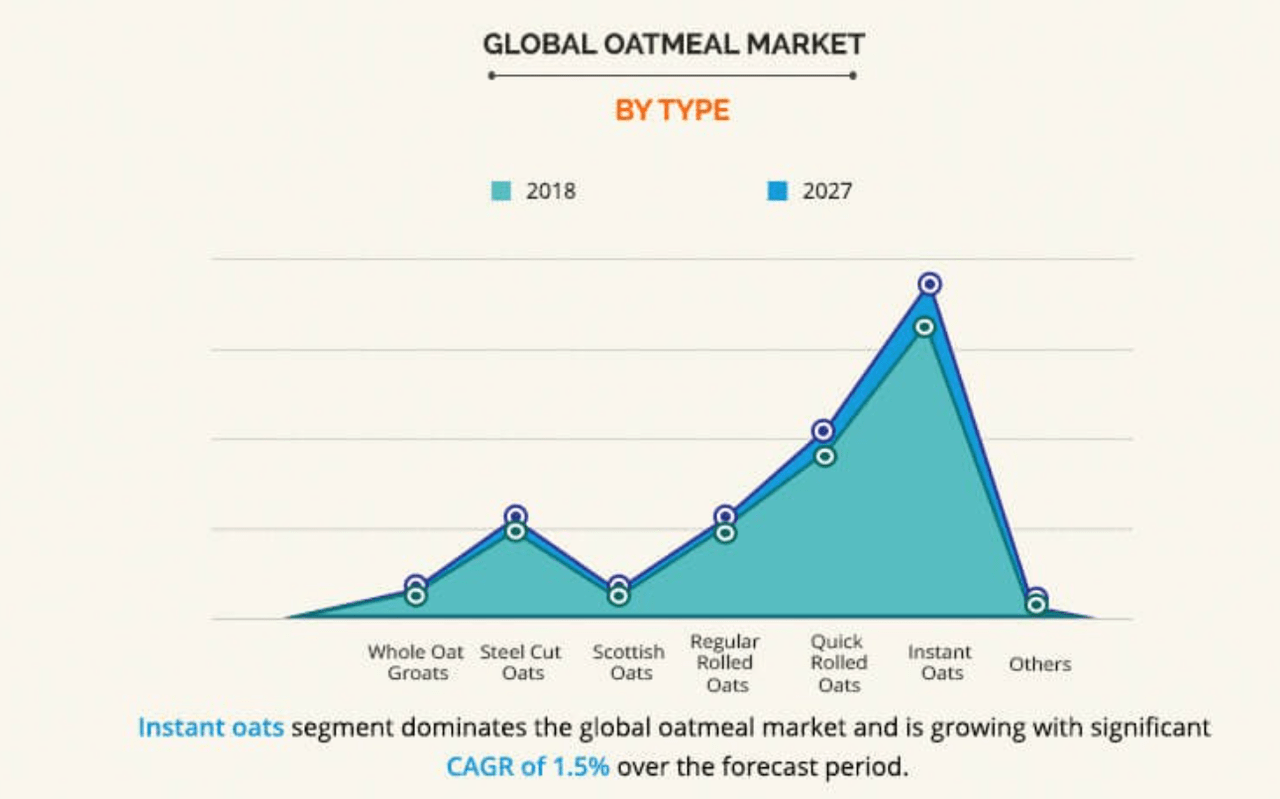

According to a 2018 market research report by Allied Market Research, the global oatmeal market was an estimated $10.5 billion in 2017 and is forecast to reach $11.9 billion by 2027.

This represents a forecast CAGR of 1.3% from 2018 to 2027.

The main drivers for this expected growth are a desire for consumers to eat healthier foods and greater availability of the product in various forms.

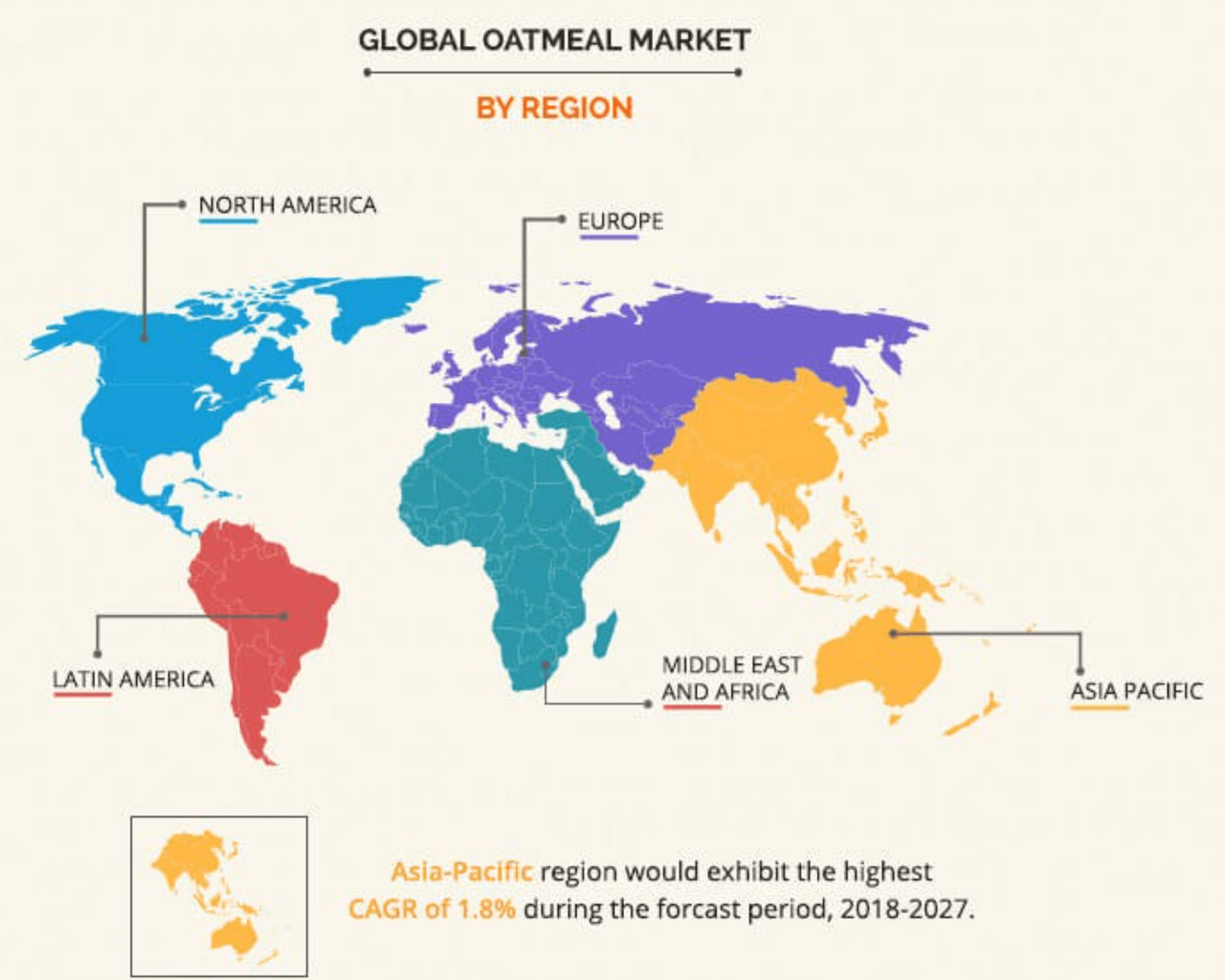

Also, the chart below shows the that the Asia-Pacific region is expected to account for growth of 1.8% through 2027, the highest of all regions:

Global Oatmeal Market by Region (Allied Market Research)

The following chart shows the global oatmeal market share breakdown by product type:

Global Oatmeal Market by Type (Allied Market Research)

YanGuFang also sells other types of oat related products, expanding its potential addressable market beyond just oatmeal.

Major competitive or other industry participants include:

-

Quaker Oats Company

-

Nature’s Path Foods

-

Nestlé S.A

-

Kellogg NA Co.

-

General Mills

-

Hamlyn’s Of Scotland

-

World Finer Foods

-

Weetabix Ltd.

-

Cargill

-

Bagrry’s India Ltd.

YanGuFang International Group Financial Performance

The company’s recent financial results can be summarized as follows:

-

Growing topline revenue

-

Increasing gross profit and gross margin

-

Higher operating profit but reduced operating margin

-

A swing to cash used in operations

Below are relevant financial results derived from the firm’s registration statement:

|

Total Revenue |

||

|

Period |

Total Revenue |

% Variance vs. Prior |

|

Six Mos. Ended December 31, 2021 |

$ 18,775,430 |

72.5% |

|

FYE June 30, 2021 |

$ 29,837,029 |

23.9% |

|

FYE June 30, 2020 |

$ 24,089,699 |

|

|

Gross Profit (Loss) |

||

|

Period |

Gross Profit (Loss) |

% Variance vs. Prior |

|

Six Mos. Ended December 31, 2021 |

$ 13,941,067 |

94.0% |

|

FYE June 30, 2021 |

$ 21,636,116 |

54.8% |

|

FYE June 30, 2020 |

$ 13,976,867 |

|

|

Gross Margin |

||

|

Period |

Gross Margin |

|

|

Six Mos. Ended December 31, 2021 |

74.25% |

|

|

FYE June 30, 2021 |

72.51% |

|

|

FYE June 30, 2020 |

58.02% |

|

|

Operating Profit (Loss) |

||

|

Period |

Operating Profit (Loss) |

Operating Margin |

|

Six Mos. Ended December 31, 2021 |

$ 5,065,057 |

27.0% |

|

FYE June 30, 2021 |

$ 12,890,592 |

43.2% |

|

FYE June 30, 2020 |

$ 8,394,983 |

34.8% |

|

Net Income (Loss) |

||

|

Period |

Net Income (Loss) |

Net Margin |

|

Six Mos. Ended December 31, 2021 |

$ 3,917,594 |

20.9% |

|

FYE June 30, 2021 |

$ 10,543,554 |

56.2% |

|

FYE June 30, 2020 |

$ 6,508,327 |

34.7% |

|

Cash Flow From Operations |

||

|

Period |

Cash Flow From Operations |

|

|

Six Mos. Ended December 31, 2021 |

$ (2,830,104) |

|

|

FYE June 30, 2021 |

$ 24,770,433 |

|

|

FYE June 30, 2020 |

$ 1,367,171 |

|

(Source – SEC)

As of December 31, 2021, YanGuFang had $6.2 million in cash and $44.1 million in total liabilities.

Free cash flow during the twelve months ended December 31, 2021, was negative ($10.9 million).

YGF IPO Details

YanGuFang intends to raise $23 million in gross proceeds from an IPO of its ordinary shares, although the final amount may differ.

No existing shareholders have indicated an interest to purchase shares .

Management says it will use the net proceeds from the IPO as follows:

approximately 30% of the net proceeds from this offering in the construction of additional production facilities, purchase of new equipment and upgrades of existing equipment;

approximately 10% of the net proceeds from this offering for the R&D of new products and technologies, upgrades of existing products and technologies, new hires of R&D staff;

approximately 12% of the net proceeds from this offering for global business expansion, primarily to North America, South East Asia and Japan; and

approximately 20% of the net proceeds from this offering for marketing and brands promotion;

approximately 28% of the net proceeds from this offering for working capital and other general corporate purposes;

(Source – SEC)

Management’s presentation of the company roadshow is not available.

Regarding outstanding legal proceedings, management says they know of ‘no material, active, pending or threatened proceeding’ against it or any subsidiaries or VIEs.

The sole listed bookrunner of the IPO is EF Hutton.

Commentary About YanGuFang’s IPO

YGF is seeking U.S. public capital market investment to increase its production capacity and for its other corporate expansion initiatives.

The firm’s financials have produced increasing topline revenue, growing gross profit and gross margin, increased operating profit but reduced operating margin and a swing to cash used in operations.

Free cash flow for the twelve months ended December 31, 2021, was negative ($10.9 million).

Selling expenses as a percentage of total revenue have grown as revenue has increased; its Selling efficiency multiple rose to 1.6x in the most recent reporting period.

The firm currently plans to pay no dividends and intends to retain future earnings to reinvest back into the company’s expansion initiatives.

YGF’s CapEx Ratio is 0.16, which indicates it is spending heavily on capital expenditures as a percentage of its operating cash flow.

The market opportunity for selling oat products is large but expected to grow at a slow to moderate rate of growth in the coming years.

Like other Chinese firms seeking to tap U.S. markets, the firm operates within a VIE structure or Variable Interest Entity. U.S. investors would only have an interest in an offshore firm with contractual rights to the firm’s operational results but would not own the underlying assets.

This is a legal gray area that brings the risk of management changing the terms of the contractual agreement or the Chinese government altering the legality of such arrangements. Prospective investors in the IPO would need to factor in this important structural uncertainty.

Additionally, the Chinese government crackdown on IPO company candidates combined with added reporting requirements from the U.S. side has put a serious damper on Chinese IPOs and their post-IPO performance.

EF Hutton is the sole underwriter and IPOs led by the firm over the last 12-month period have generated an average return of negative (64.7%) since their IPO. This is a bottom-tier performance for all major underwriters during the period.

A significant risk to the company’s outlook is the uncertain future status of Chinese company stocks in relation to the U.S. HFCA act, which requires delisting if the firm’s auditors do not make their working papers available for audit for three years by the PCAOB.

Also, the firm faces the uncertainty of additional COVID-19 variants spreading within China, likely resulting in lockdown responses by authorities as part of their zero-COVID policies.

When we learn more details about the IPO, including the company’s capitalization figures and proposed pricing and valuation, I’ll provide an update.

Expected IPO Pricing Date: To be announced.

Be the first to comment