PeopleImages/iStock via Getty Images

Since my first article on Xponential Fitness, Inc. (NYSE:XPOF) two months ago, although the company has missed earning expectations for another quarter, the stock price has increased by 28.31%, and the management team have optimistically reviewed their revenue expectations for end-of-year financial results. This boutique fitness company targets high-end customers that see a subscription license to their favourite studios as an investment into health rather than a discretionary expense. As an economic slowdown looms over, these wealthy health-conscious customers have little intention of ending their premium fitness memberships if we look at XPOF’s Q2 growth performance.

Furthermore, in its short history, XPOF is showing resilience to challenging times, successfully overcoming and growing the business during COVID-19 and consecutively improving top and bottom line performances over the last three quarters. Although we are still evaluating an unprofitable company with a short performance history, I am cautious of the high number of insider selling that took place over the last year. I believe there is still a lot of upside potential for this asset-light business model with predictable recurring revenue as it continues to expand globally through its franchisee network. For this reason, investors may want to take a bullish stance on this company.

How does this Boutique Fitness Company stay in Shape?

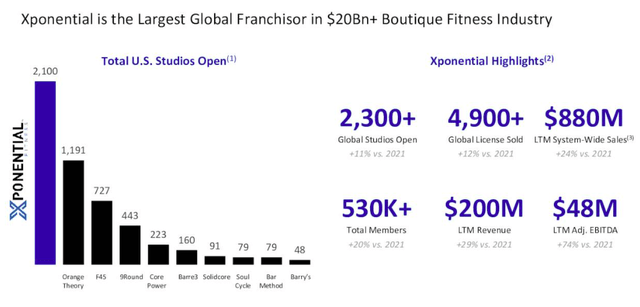

XPOF is a young company that licenses its boutique studio operations and provides its franchisees with business process knowledge and branding in exchange for royalties and service fees. In just a few years, XPOF has boosted its reputation and presence on an international scale to 14 countries. As seen below, it is the market leader in the number of studios opened in the US. The company owns ten fitness brands and is operating in 2357 studios; 128 net new studios opened in the last quarter.

Xponential Market Leader in Boutique Fitness (Xponential Fitness Investor Presentation 2022)

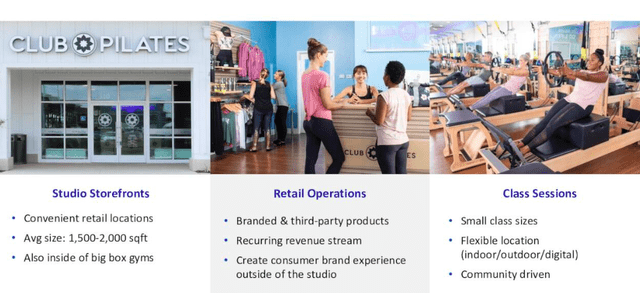

Not just anybody can run an XPOF franchisee. There is a comprehensive selection process in which 2% of leads become franchisees. Owners are generally entrepreneurial with corporate backgrounds. It also has a few significant master franchise agreements with larger organisations. The company’s presence is through studios, retail operations and class sessions. The reason to believe in this company’s future is its business model. It has highly predictable reoccurring revenue streams with limited capital requirements. Roughly 68% of the second quarter’s revenue was reoccurring, most of it through royalties.

Xponential Revenue Generation (Xponential Investor Presentation 2022)

The company’s business concept becomes integral to the consumer’s lifestyle. The typical household income is around $130,000. Thus a recurring membership package is a relatively insignificant expense. The company saw a 28% increase year-over-year in total visits. Member engagement indicates that XPOF’s offering is integral to the customer’s lifestyle.

Data-driven business intelligence is an important growth factor in the company’s success. The company has appointed a new board member with senior digital leadership experience, which will help scale the growingly complex and global business. XPASS, rolled out at the end of 2021, has been profitable on many fronts. It gives all US studio locations access from a single monthly recurring subscription. The platform has helped retain and engage with existing customers but has also helped attract new customers at zero acquisition cost for franchisees. It allows studios to book more customers into existing classes. XPLUS is a single platform that gives customers access to live and on-demand workouts. It helps to engage with the customer, increase brand awareness and provide an additional source of activity to in-person classes.

The company has four growth pillars. First, the company aims to increase the number of studios across all its brands in North America. Second, there is an enormous untapped international market in which the company wants to grow its brand presence and studios. Recently it has new master franchise agreements in the UK with Club Pilates and in Japan with CycleBar. One thousand studios are contractually obligated to open. The master franchise agreements are high-margin because of the minimal cost required to support growth. The third key driver is the scalability of the business model at a low cost, which grows the margin performance and drives free cash flow. The fourth driver is increasing same-store sales and average unit value, currently at $480,000 per studio.

Company Performance and Valuation

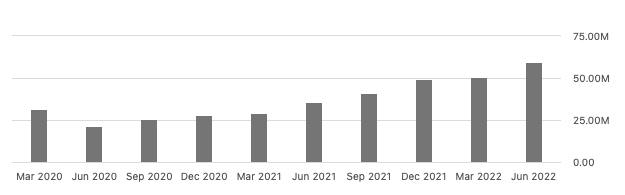

XPOF is still an unprofitable company, but what is essential to look at for this young company is its past, present and future growth potential through the number of studios contracted, the increasing number of customer subscriptions and the growth in average unit volume (AUV) per studio. These will indicate future recurring revenue growth and bring confidence to the company’s ongoing performance. Two hundred fifty-one franchise licenses have been sold globally in Q2. The licenses provide growth visibility for the coming five years. Membership growth has grown by 32% full member growth year on year in North America. On top of that, North American sales grew 45% year on year, and there has been an upward revenue trend for the last eight consecutive quarters.

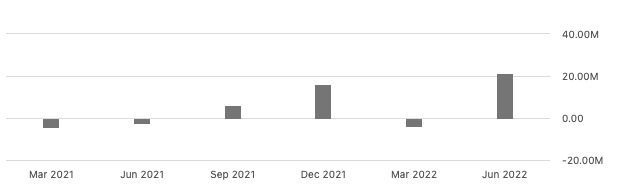

Revenue Growth Per Quarter (Seeking Alpha)

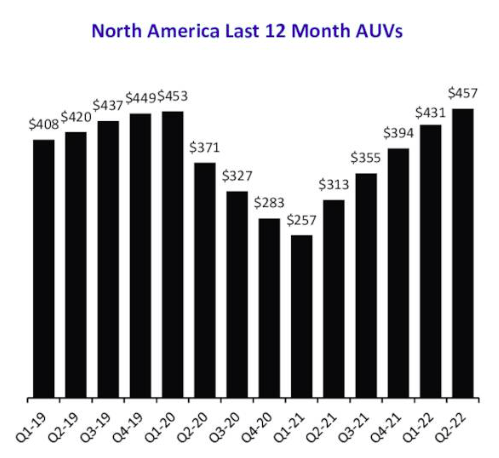

Another factor is the average unit volume per franchisee which is now higher than pre-COVID-19 numbers in the North American market, as seen in this graph below. Year on year, the North American AUVs increased by 25%, which means expanding margins for XPOF.

Average Unit Volume in 000’s (XPOF Investor Presentation 2022)

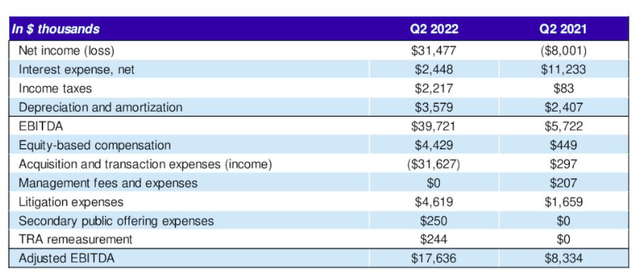

Q2 saw an adjusted EBITDA of $17.6million, which is a big jump in the right direction from a year ago, as shown in the table below. Although there is fluctuating recurring revenue. The fluctuations are because of the costs involved with equipment installations and new studios opening. Above average costs were incurred with equipment installations in preparation for the second half of the year.

Financials Q2 2022 versus Q2 2021 (Xponential Fitness Q2 Financial Report)

My previous article looked at the cash flow, which was worryingly low. The company had addressed and connected to early-year investments with high costs that would not be a recurring issue. We can see impressive growth in available positive cash flow, which is said to continue based on the business model that requires little asset investment by XPOF.

Leveraged Free Cashflow (Seeking Alpha)

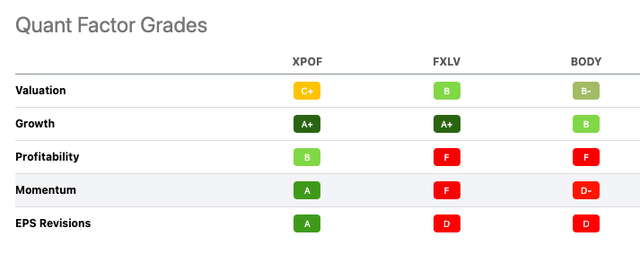

In my previous article, I also looked at competing companies F45 Training Holdings (FXLV) and Beachbody Company (BODY), which both went public, at a similar time to XPOF, at higher valued share prices, just over a year later, and we can see that XPOF has gained impressive momentum from its initial share price of $12. If we look at Seeking Alpha‘s Quant rating, there is a clear winner amongst these competing companies.

Seeking Alpha Quant Grading XPOF versus Competitors (Seeking Alpha)

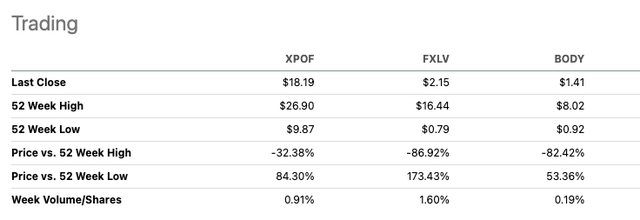

The company stock price has performed well above its peers that went public, which is a positive sign for investor confidence in the company’s performance.

Share Price XPOF versus Competitors (Seeking Alpha)

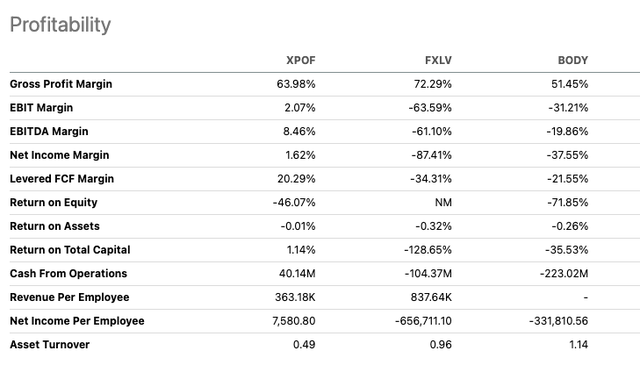

The financials are also a clear indication that the business model is working by firstly looking at the company’s historic performance and then additionally comparing it to two of its main competitors as we can see if we look at the profitability comparison below.

Profitability XPOF versus Competitors (Seeking Alpha)

Although the company costs increased because of labour and supply chain constraints, inflation, and general macro-environmental pressures, its early-year investments benefit the rest of the year. Relative to its competitors, the impact has been negligible. Most of the equipment is sourced from the US, and the company has planned equipment inventory for brands with a high volume of studio openings. There are obvious risks to investing in an unprofitable company with a high debt ratio. However, this company has a positive outlook, and we can have confidence in the management’s increasing expectations for higher revenue because of the higher-than-expected performance in franchise revenue and the exceedingly well-performing B2B agreements.

Final Thoughts

XPOF has a target price estimate of $27.89, 48% higher than its stock price today. Various analysts, including Seeking Alpha’s Quant ratings, indicate a Buy to Strong Buy recommendation for this company. It is performing much better than two competitors that took on going public just a year ago. It has kept the business running and growing through COVID-19 and this year against the backdrop of an economic downturn. It has exciting future B2B opportunities with strategic partners such as Lululemon through its home gym technology known as the MIRROR. Its offline and online business concepts ensure growth in new customers and increased engagement. Key master franchisor agreements guarantee revenue growth and a solid finish for the financial year. For these reasons, I believe investors can get excited about this company and may want to take a bullish stance on this company.

Be the first to comment