jamesteohart/iStock via Getty Images

Introduction

XPEL Inc (NASDAQ:XPEL) distributes automotive paint protection film (known as PPF), automotive window tint, automotive ceramic coatings, and residential and commercial window films.

I have covered the company extensively here on Seeking Alpha since the stock traded at just $5.00 per share a few years ago. Since then, the stock has taken off, reaching highs of over $100 per share last July. Recently, however, the stock has pulled back to the mid $50s in the wake of automotive supply chain issues limiting the opportunity set for XPEL to cover new cars in PPF.

Nonetheless, XPEL’s execution has remained strong, putting up record quarterly revenue in Q4 2021 and growing total 2021 revenue by 63% over 2020. Management suggested on the full-year earnings results call that another 20-30% revenue growth was possible in 2022. If automotive supply chains improve, I think they’ll come in at or even exceed the high end of that range. That said, shorter-term automotive supply chain challenges do remain.

Auto Sales – Rebounding But Still Below Historical Numbers

XPEL works with auto dealers and PPF installers. Auto dealers either pay a third-party installer to protect a high-end car with PPF and then mark this up to end consumers, or consumers pay installers to have PPF applied themselves. Some dealers will bring installation in-house. XPEL also operates and often acquires installation shops once installers are ready to retire.

This means that XPEL’s business benefits when dealers have a lot of inventory. Dealers will look to XPEL’s products to juice up margins. When inventories and new car sales are low, however, there simply aren’t as many cars for XPEL’s installer network to cover in PPF.

Although XPEL still achieved record revenue in Q4 2021 thanks to some price increases and acquisitions, net income margins were a bit lower as XPEL retained some fixed labor costs when there was relatively little work to do. While a shorter-term shareholder may focus on short-term profitability, I would argue short-term thinking is entirely the wrong way to think about XPEL. By retaining highly skilled talent (and installing film is indeed skilled-labor), XPEL not only prevents its best employees from going to a competitor but creates a tremendous amount of loyalty from employees that will ultimately result in a more efficient and motivated workforce when times are good again.

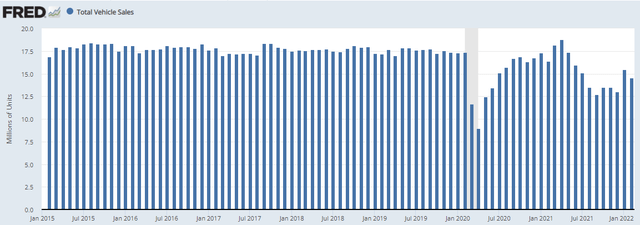

The St. Louis FED puts out plenty of economic data, including total vehicle sales numbers. Although still below historical numbers, January and February, the last two bars in the chart below, show an improvement over Q4 2021 monthly numbers. This suggests that we may have bottomed for new vehicle sales, although some challenges do remain.

Total Vehicle Sales (St. Louis FED)

Ultimately, unless you believe that auto sales are permanently impaired, it seems inevitable that vehicle sales eventually return to more normal historical averages. This is good for XPEL.

Sponsorships

XPEL has ventured into bigger and bigger sponsorships as the company grows. Over the last couple of years, XPEL has sponsored IndyCar, running the annual XPEL 375 race at Texas Motor Speedway.

This year, 2021 rookie of the year and current 2022 IndyCar championship points leader Scott McLaughlin drove the XPEL car in a race that went down to the wire.

XPEL has also sponsored the Nascar Truck Series. I expect XPEL will continue to use racing sponsorships effectively.

My DCF Model

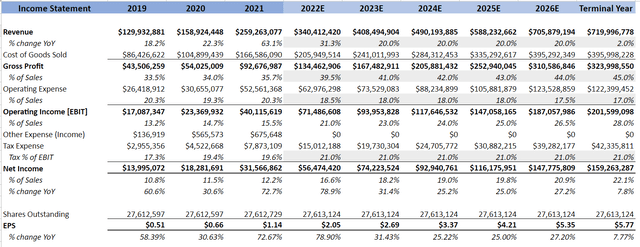

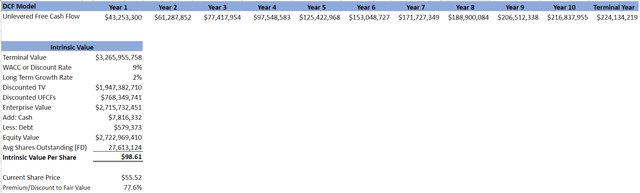

If auto supply chains improve further, I believe XPEL can grow revenue by around 31% in 2022. I recommend checking out my previous XPEL article; ‘XPEL: A Great Buy For 2022’ for the details on how I arrived at that estimate.

Over the next few years, I’ve forecasted 20% revenue growth for XPEL. Growth for XPEL comes through acquisitions, price increases, and organic growth. I have modeled slight margin improvements year over year. I’ve modeled 2% growth in the terminal year in my 5-year model.

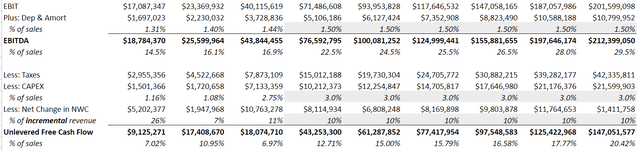

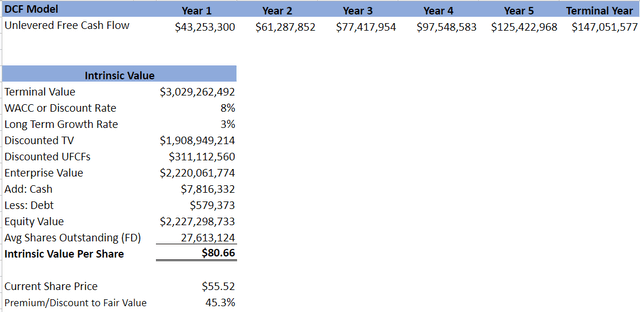

XPEL DCF Model (Author) XPEL DCF Model (Author) XPEL DCF Model (Author)

Using a discount rate of 8% and a long-term growth rate of 3%, one arrives at an enterprise value of $2.2 billion. Adjusting for cash and debt gets to an equity value of $2.227 billion, which works out to a share price of $80.66 per share, good for 45% upside.

I’ve also modeled a 10-year time frame where I bring growth down to 10% after year 5 and 5% in the final two years, with margins the same as the terminal year above. Using a 9% discount rate and a 2% long-term growth rate (being more conservative as there is more room for error on a longer time frame) results in a share price of $98.61.

Risks

All investments have risks, including XPEL. Here are the main risks today:

- Automotive supply chain issues persist for longer than expected and car sales do not rebound to normalized levels for several years.

- Another wave of COVID-19 potentially shutting down automotive manufacturing plants, especially in countries with stricter COVID rules such as China.

- Although XPEL has dominated the competition from 3M (MMM) and SunTek (owned by Eastman Chemical (EMN)), these are much larger companies with greater resources than XPEL.

Conclusion

It appears that XPEL is undervalued today in the mid-$50s given my models, which suggest fair value is somewhere between $80 and $100 per share.

Despite some challenges in the automobile industry with supply chains limiting production and sales of new cars, XPEL has still executed with growing revenue an impressive 63% in 2021. I believe auto supply chains should begin to see some normalization soon and if so, then XPEL likely has another good year in 2022.

Be the first to comment