kynny/iStock via Getty Images

Overview

When it comes to finding multi-baggers, we tend to lean towards tech companies. Why?

Strong tech companies tend to have strong recurring revenue, high gross margins, high operating margins, large total addressable market (“TAM”), asset-light, and scalable business models. Combining these factors can potentially pave the road towards a multi-baggers return that non-tech companies do not possess.

So, it is not hard to understand why investors favor tech companies. If you find these companies early, chances are, you’ll make buck loads of money!

However, as we studied more companies, we find that to be further away from the truth.

There are non-tech companies like Celsius Holdings (NASDAQ:CELH) and Monster Beverage (NASDAQ:MNST) who have delivered over 10x returns for their shareholders. Now consider this, they do not possess all traits that tech companies have, so, what led to these 10x returns? We begin to get curious as we ask ourselves this question too.

Here’s what kept me really interested as I am writing this article today on XPEL (NASDAQ:XPEL), which has delivered over 20x returns for shareholders in the last 5 years. This is truly a mind-gobbling result, and that kept me even more excited to find out more.

Before we go into it, here is a brief introduction to XPEL:

XPEL first made its foray into the protective film industry as a software company providing independent installers with access to a library of pre-cut film designs. Over time, XPEL proceeds to develop its own protective films. Now, it is one of the leading providers of protective film, operating in multiple markets spanning from Canada to the U.S, Europe, Asia Pacific, Latin America, and the Middle East.

Today, XPEL is a $1.6 billion market cap company with a rapidly expanding product portfolio and is growing quickly across all of its operating markets.

Who Are Involved In The Industry?

(Source: Author’s Diagram)

Before we dive into the company, let’s take a look at the relationships between the 3 primary players in the industry:

-

XPEL – Supplier of protective films

-

Customers – These are your installers, car dealerships, and automobile OEMs that sell XPEL products.

-

End-consumers – Vehicle owners who go to customers and buy the product.

In this industry, customers are extremely crucial because they act as distribution points for XPEL. Think about it, the more customers you have, the larger the distribution footprint, and the more consumers you are able to reach. And the more consumers interact with the product, there will be more brand awareness.

This gives birth to an inherent flywheel effect in the business, which we will talk more about later on.

Now, let us look at XPEL’s products.

Extensible Model

In 2003, XPEL first stepped into the protective film industry as a software company.

Its Design Access Program (“DAP”) software is extremely valuable to installers because they have access to many different film designs and they use it to pre-cut the film. I mean, if you are an installer, would you want to manually cut these films? Heck no, because there is a high rate of human error. The likelihood of you cutting it into the wrong size is high, and the worst part is, you have to dispose of them since you can’t use them anymore. And you expose yourself to the danger of cutting yourself. That’s a big no-no.

So through this, you can see how XPEL’s DAP software is a value add to installers, by helping them to save time, labor costs, and improve installation efficiency.

However, over time, they have decided to develop their own paint protection film (“PPF”). To quote CEO Ryan Pape during a podcast:

But it took a while to realize that, that being that software company as a standalone business model was not a very good business. It took, it took different management wasn’t me, before me in around 2008 to say, hey, this concept of paint protection film has a lot of legs. It’s a really good product, but it needs more than software and patterns. It needs a brand, it needs training, it needs consumer awareness, it needs all of these other things.

Then, XPEL came up with the first “self-healing” paint protection film, and the value proposition is pretty self-explanatory – it protects your cars from damages caused by road debris, rock chips, acid rains, etc. To see how it works, you can head to their website here. If you own a car, there is a likelihood that you have experienced these issues. And you know this can be incredibly frustrating. And heart-wrenching if it’s a new car.

(Source: XPEL Investor Presentation)

But XPEL did not just stop at the PPF product.

They were able to identify customers’ needs and roll out additional products via their distribution points. They branched out to products such as window tint and ceramic coating for automotive, and window film for commercial and residential buildings.

Since there are no additional marketing expenses required to get existing customers to adopt the products, and XPEL can also negotiate lower costs with its suppliers, they can drive more revenue and higher margins.

These products were extremely well-received by their customers that during the Q3’15 earnings call, XPEL was stealing market share away from their competitors:

…when you look at sort of the history on the paint protection side, we won a lot of business historically and still do on converting customers from competitive product. And on the window tint side, that works similarly as it did on the paint protection film side historically, which is – it’s a rather drawn out sales process because we’ll talk about the product with our existing customers, then we’ll sample the product, then the customer will evaluate the product, then they may purchase some and work it into their daily operation, and then with the goal being that after that they’ve switched all of their business to us.

To give an idea of who they are competing against, they are Eastman Chemical (NYSE:EMN) and 3M (NYSE:MMM). Quick research on Google will tell you that they have been in the industry much longer than XPEL. This speaks to XPEL’s ability to innovate ahead of its competitors. As of Q4’21, the PPF and window film segment makes up 66% and 15% of its total revenue.

Here’s the thing, how did XPEL manage to overtake its competitors despite being a late entrant?

We highly suspect that during its time as a software company, XPEL could have been quietly observing its competitors, and that has contributed heavily to its success. This reminded us of how Sea Limited’s (NYSE:SE) Shopee overtook Alibaba’s (NYSE:BABA) Lazada as the leading e-commerce player in Southeast Asia despite entering the market a few years later.

While we cannot come to a definite answer, we have to say, this is truly an impressive feat.

Most recently in Q3’21, XPEL has acquired invisiFRAME to expand into the bicycle protection kit market and is also planning to expand into other categories in the future:

…we had established customer using our product into this adjacent space and we had demand from our existing customers. So, we like the idea of this as an adjacent protection market because it both opens up new customers in terms of bicycle shops. It is additional products for our current customers to sell…there are definitely other adjacent businesses that we’re interested in.

Here, you can see that the management is constantly looking at opportunities that they could enter into. This significantly expands the total addressable market for the company, which drives even more revenue.

We cannot help but notice that this is a common trait found in successful companies like Shopee and CrowdStrike (NASDAQ:CRWD) that enabled them to grow so quickly.

Here’s why we think so:

-

Shopee’s ability to expand into many different product categories, such as groceries, fashion, beauty products, etc. They also branched out to food delivery as well.

-

CrowdStrike expanded from endpoint security to log management, zero-trust security, identity protection, and many more.

This octopus-like model ensures that they have an extremely long runway to grow, delivering high and sustainable revenue growth for many years to come. Compared to companies without an extensible model, growth rates may hit the ceiling and deplete quickly.

This extensible model has helped XPEL to grow really quickly, and today, there is still plenty of market share to go after.

Global Expansion

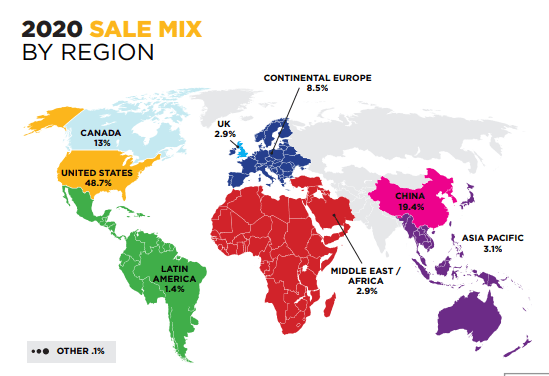

(Source: XPEL Investor Presentation)

Another key component of XPEL’s success is the ability to succeed in multiple markets. XPEL strategically acquires companies in underpenetrated regions where attach rate of PPF to new cars is extremely low.

Initially, they started out in Canada and gradually entered China, the U.S, Continental Europe, Asia Pacific, Latin America, and the Middle East.

This makes perfect sense because once you are successful in a region, you can replicate the same playbook and apply it to another market. It’s almost like a copy and paste. This also expands a whole new TAM for XPEL, driving even more revenue.

To quote what CEO Ryan Pape has said on his reason to enter into Europe:

Europe is under-penetrated and it is 6 years behind U.S. in terms of market development. So we see a huge opportunity in the market itself and then for the opportunity for that to impact the business globally, so that’s sort of driven the steps that we in a sense replicate what we’re doing in the U.S. and Europe but obviously be mindful of the differences and differences that we need to operate but that’s what driven that investment.

What we infer from here is that Europe seems like a blue ocean market and the management has spotted and pounced on the opportunity.

One of the characteristics we like to see in a management team is the growth-mindedness to pursue market expansion and XPEL’s management has impressed us.

Since it has demonstrated its ability to scale while maintaining a dominant position in Canada and the U.S showed great execution, this gives us confidence that it can succeed in regions where the penetration rate is still relatively low.

Inherent Flywheel Effect

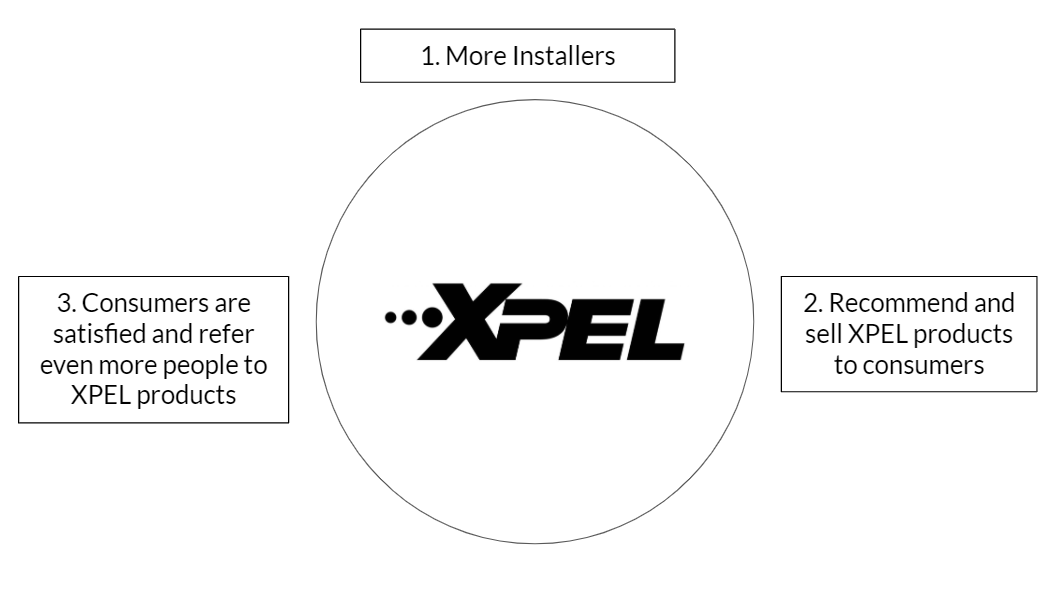

(Source: Author’s Diagram)

Earlier on, we also talked about an inherent flywheel effect within the business.

Since XPEL’s customers are the distribution points, they act as salespeople by recommending its products to the consumers. Consumers who are satisfied with the product will refer other people, and that helps to drive the acquisition of more installers and consumers to their network.

In fact, during the Q4’15 earnings call, CEO Ryan Pape talked about how customers are spreading XPEL’s brand through word-of-mouth:

We’ve seen our installer footprint in the U.K. grow significantly in terms of number of outlets and each new customer helps spread the message, generate more awareness, more excitement and sort of get the snowball moving in a market that can really use it.

We have seen how effective this worked for consumer-facing companies like Celsius Holdings, Shopee, and even Amazon (AMZN) in acquiring customers at an unprecedented pace, and XPEL has displayed that through its dominant position in countries like the Canada and U.S.

Asset-Light Model

We have talked about how non-tech companies like Celsius and Monster Beverage are able to deliver great returns.

But a key question to ask ourselves is, what is enabling them to grow so quickly?

This lies in their asset-light model, and that is, they outsource the manufacturing process to third-party suppliers, bottlers, or manufacturers. This is a similar model that XPEL is adopting.

This capital instead can be used to grow their brands, expand their distribution footprint and penetrate other regions as they are not limited by how fast they can build their manufacturing facilities.

This has enabled XPEL and other mentioned companies to scale quickly and deliver generational wealth for their shareholders.

Financials

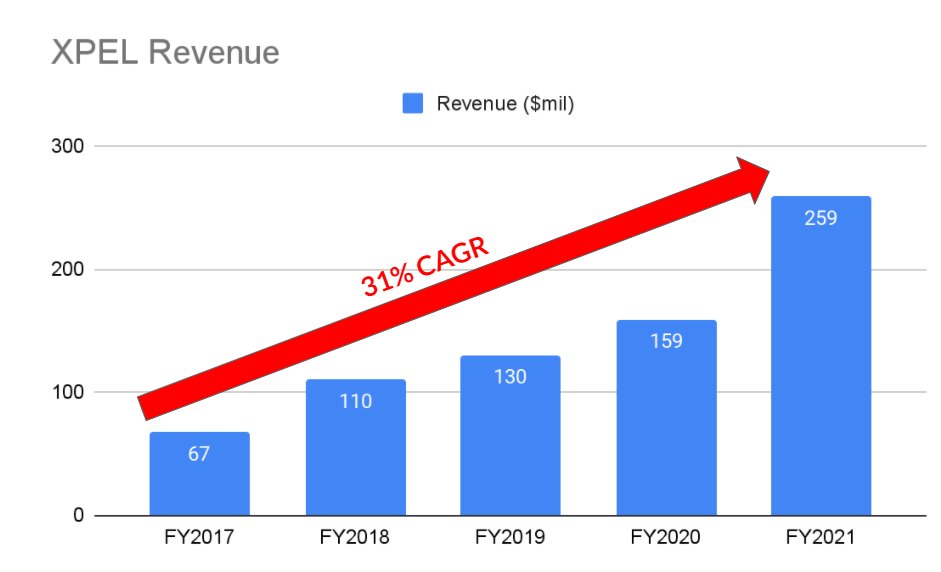

(Source: XPEL’s investor relations)

In the last 5 years, XPEL has generated a 31% revenue CAGR in the past 5 years, and that is equivalent to a 2.8x increase in revenue. You got to admit, for “just a car protective firm” company, their growth is doing pretty fine

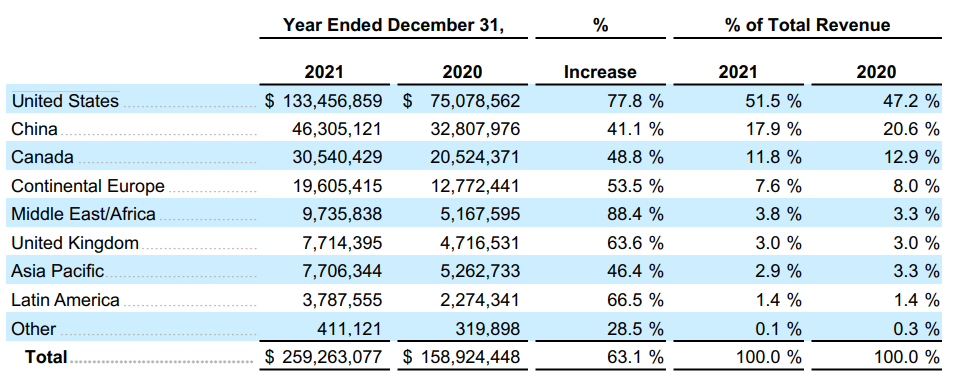

(Source: XPEL 10-K)

We can also see that XPEL performed strongly across all geographies, with most of them growing at over 50% YoY. Considering that each country has its own difficulties, XPEL has still managed to excel in all of them.

(Source: XPEL’s investor relations)

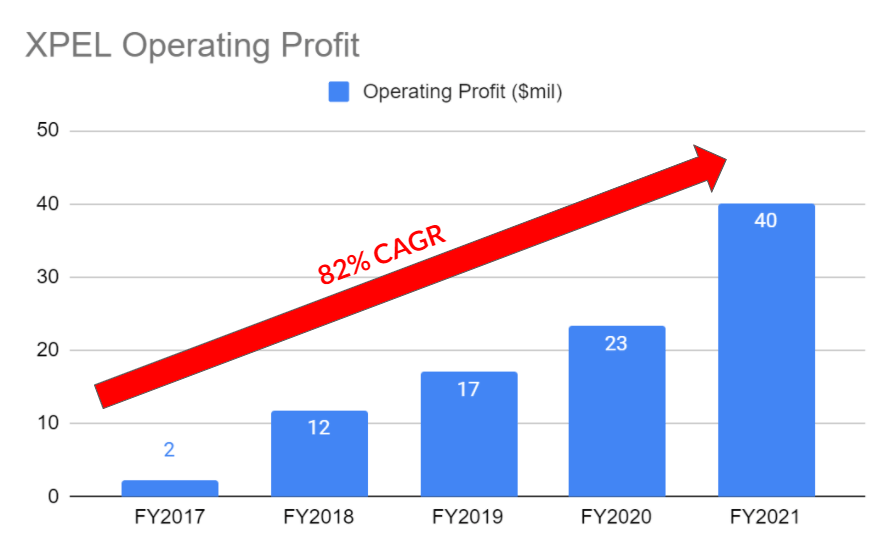

If you thought the revenue growth was great, look at their operating profit., XPEL displayed strong Operating Leverage as its Operating Profit grew at an accelerated pace of 82% CAGR. That is remarkable.

To think that in the past, XPEL was on the verge of bankruptcy and has never made a single profit, is truly an impressive result and an even incredible turnaround story.

(Source: XPEL’s Investor Relations)

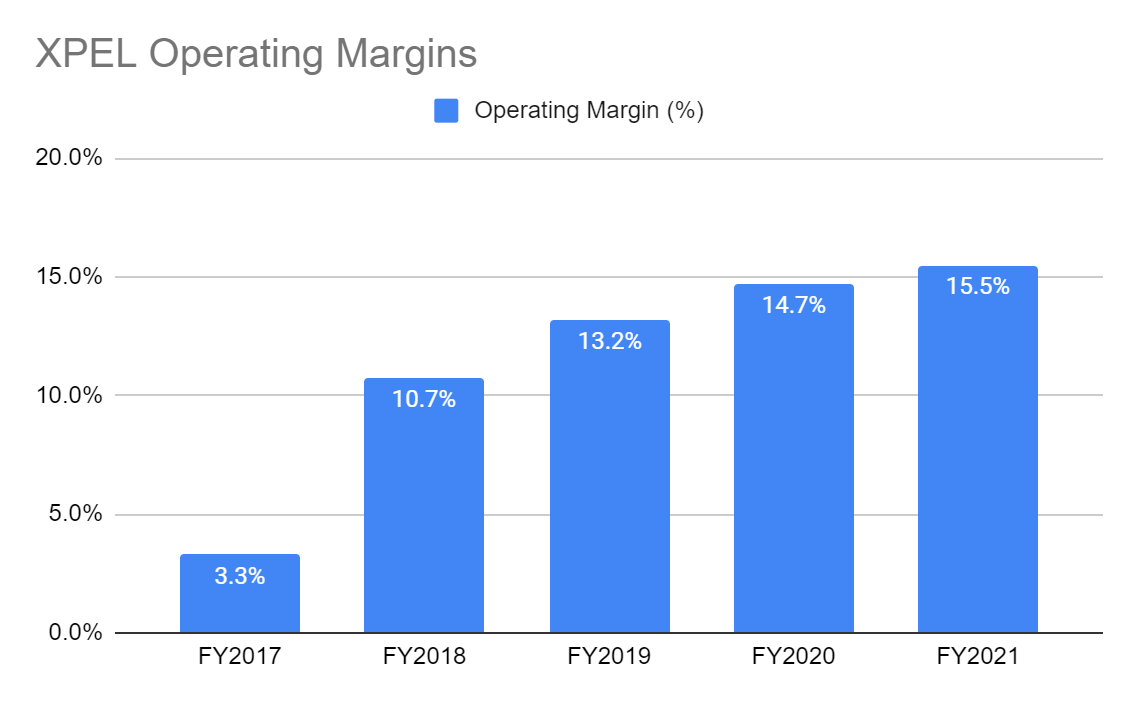

Here, you can see the impact of how strong revenue growth coupled with strong Operating Leverage has on the bottom line as the Operating Margin has increased tremendously from 3.3% in 2017 to 15.5% in 2021. That is close to a 5x increase in operating margin in just 5 years!

Given that XPEL has a rapidly expanding product portfolio and is operating in many different markets, there is still a long runway, and thus, more room for even more revenue and higher margins.

Concluding Thoughts

Earlier on, we have talked about XPEL’s excellent cadence of products ranging from paint protection film, window tint, ceramic coating, and even bicycle protection kits, as well as its ability to excel in multiple regions.

One point we like to discuss is, what are the next growth drivers for XPEL? How can they continue to grow in the next 10 years?

After doing some research, we found that there are multiple areas that XPEL can expand into, and that includes aerospace, electronics, industrial, and military equipment. But that’s not all. In categories like electronics, it can also be further broken down into mobile phones, cameras, computers, and even tablets. As long as something needs a protection film on it, that’s where XPEL can penetrate. You know what we mean here.

However, this is dependent on whether there is demand for these products, and should there be, could XPEL succeed in these new markets?

Nonetheless, you can see that the possibilities are endless, and it will be interesting to see how XPEL can capitalize on these optionalities in the long term.

Be the first to comment