Just_Super

Investment Thesis

Xos, Inc. (NASDAQ:XOS) mainly deals in the manufacturing of electric battery commercial vehicles. The company is expanding rapidly due to the enormous end-market demand and governmental efforts to phase out fossil fuel use. The company has entered into a strategic partnership with NationaLease to grow its network and geographic footprints.

About XOS

Xos, Inc is a mobility solutions company that focuses on the production of Class 5 to 8 battery-electric commercial vehicles. The company helps fleets switch from internal combustion engine cars to zero-emission vehicles with patented technology adapted to commercial use. The company also provides a wide range of services, including vehicle maintenance, charging infrastructure, financing, and service. It also manufactures the X-pack (battery system) and the X-platform, primarily for the medium and heavy-duty commercial vehicle segment. These two products are available for purchase as a part of Xos vehicles. The company also offers powertrain technology to the original equipment manufacturers (OEM) targeting the commercial, off-highway, and industrial markets.

The company’s revenue is primarily attributable to dealer relationships (stepvans) and longstanding customer relationships (powertrains). The product revenue of powertrains is 42.6% of the total revenue, while the revenue of stepvans contributes 54.2% of total revenue. The remaining 3.2% of the total revenue is classified as Ancillary revenue.

The company has seen sequential growth in unit deliveries compared to the previous quarters, and I believe this growth can remain constant due to increased consumer preference for electric vehicles (“EVs”) as a sustainable option to reduce greenhouse emissions. The company expects to broaden its customer base and expand into new markets by leveraging strategic partnerships with distributors, including Thompson Truck Centers, Yancey Bros. Co., and Murphy-Hoffman Company. It also expects to expand internationally and make the most of the opportunity by using the footprint of its existing global customers. It has diversified its supply chain, which includes suppliers from Canada, India, and South Korea, to reduce the risk of single-source supply issues. The company recently launched a proprietary fleet management platform, Xosphere, which allows fleet operators to monitor real-time performance, minimize charging costs, optimize energy usage, and manage maintenance & support.

Growth Catalyst and Revenue Trends

Governments are aggressively setting targets to phase out the use of fossil fuels and control GHG emissions. The new government initiatives can act as a tailwind for the secular growth of the industry as electric vehicles are more sustainable options than fossil fuel equivalent vehicles. That’s why companies like Xos are benefitting from these government initiatives.

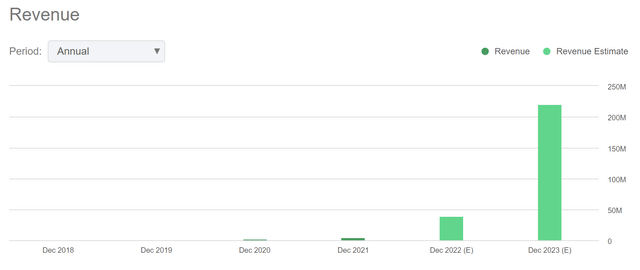

We can see in the above chart that the company is experiencing massive growth, which is driven by the dramatic increase in demand in the end market. In FY2021, the company reported revenue growth of 491.73% compared to the revenue of FY2020. The revenue has grown from $1.15 million in FY2019 to $5.05 million in FY2021, resulting in a 3-year CAGR of 154.01%. This year, the company will see huge revenue growth. In the first half of FY2022, the company has already reported revenue of $16.8 million and is expected to achieve total revenue of $39.52 million, which is an increase of 682.6%.

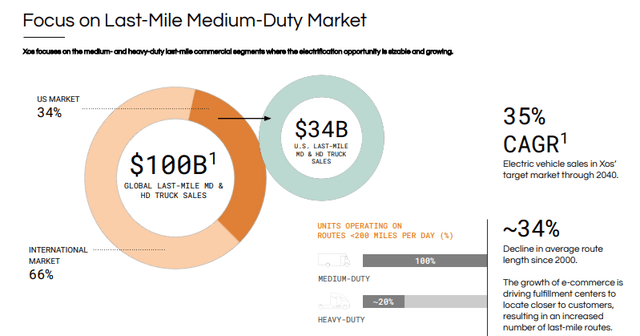

The reason behind this growth is massive demand in the end market. I think the demand might sustain in coming years, as EVs are cost-efficient compared to the fossil fuel-equivalent vehicles, and governments are aggressively setting targets to phase out the use of fossil fuels and greenhouse gas emissions. Electric vehicle sales are expected to grow massively, with a CAGR of 35% in 2022-2040. The global last-mile delivery market, the primary market of Xos, might reach a valuation of $424 billion by 2030, representing an 8-year CAGR of 10%.

Last-Mile Medium-Duty Market (Investor Relations: Slide No.7)

I think the rising demand for the products can decrease the total production cost and expand the company’s profit margins, as the rising production can help the company achieve economies of scale. After considering the increasing demand and potential margin expansion, I think next year the company can become profit making business.

Partnership with NationaLease

Recently, the company entered into a strategic partnership with NationaLease. With Xos as a Partner, NationaLease will list Xos vehicles and services among its offerings. These offerings incorporate Xos’ exclusive Xosphere fleet management platform, which gives end users access to additional features, including vehicle tracking, telematics, and battery health management. I believe this event can significantly increase the company’s earnings, as this partnership can grow its leasing and distribution network and expand its footprint across North America. The enhanced network and access to more than 900 locations can significantly increase the company’s customer base.

What is the Main Risk Faced by XOS?

Volatile Prices of Raw Materials

The company uses steel, cobalt, nickel, aluminum, copper, lithium-ion battery cells, and other raw materials. These raw materials’ costs fluctuate substantially. Any of these materials’ prices may go up if there is a scarcity or a disturbance in the supply chain. Significant price increases for the parts or materials used to make vehicles, powertrains, or battery packs, such as those demanded by suppliers of battery cells, semiconductors, or other essential parts or materials, would raise operating costs and might reduce margins if they can’t be offset by higher sales or by Fleet-as-a-Service revenue.

Valuation

The government initiatives to phase out the use of fossil fuel and the partnership with NationaLease might drive the company’s growth. I believe the partnership with NationaLease and strong demand for the products can make the FY2023 profitable.

After analyzing all the above factors, I am estimating EPS of $0.15 for FY2023, giving the forward P/E ratio of 8.54x. After comparing the forward P/E ratio of 8.54x with the sector median of 14.52x, we can say that the company is undervalued. I think with the rising product demand and prices, the company can easily mitigate the impacts of volatile raw material prices. Hence, I believe the risk-reward is favorable, and the company can trade at its sector median. I estimate the company might trade at a P/E ratio of 14.52x, giving the target price of $2.18, which is a 70.3% upside compared to the current share price of $1.28.

Conclusion

The company is experiencing robust growth due to the massive demand in the end market and the government initiatives to phase out the use of fossil fuels. I believe the strong demand might continue in the coming years as electric vehicles are more cost-effective than fossil fuel equivalent vehicles. The company has entered into a partnership with NationaLease, which can grow its leasing and distribution network and expand its footprint across North America. The company is exposed to the risk of fluctuations in prices of raw materials and disruptions in supply. After comparing the forward P/E ratio of 8.7x with the sector median of 14.52x, we can say that the company is undervalued. After considering all the above factors, I recommend a buy for Xos.

Be the first to comment