Andrii Dodonov

Lately we have been exploring funds with high yields and looking at that distribution yield versus the actual total returns. Now while this may sound like an unnecessary exercise, so far our work has revealed that many high yield funds tend to not deliver anywhere close to what the distributions advertise (see here and here). Today we look at the XAI Octagon Floating Rate & Alternative Income Term Trust (NYSE:XFLT) fund which has a slightly shorter history, being around only since 2017, but goes to prove the same kind of point.

According to their website, XFLT is a closed end fund which focuses on this CLO debt and CLO equity space. The limited term trust’s assets are managed opportunistically primarily within private below investment-grade credit markets including:

- Senior secured floating-rate loans.

- Structured credit (CLO debt and CLO equity).

- Opportunistic credit (long/short credit investments and stressed credits).

The Appeal

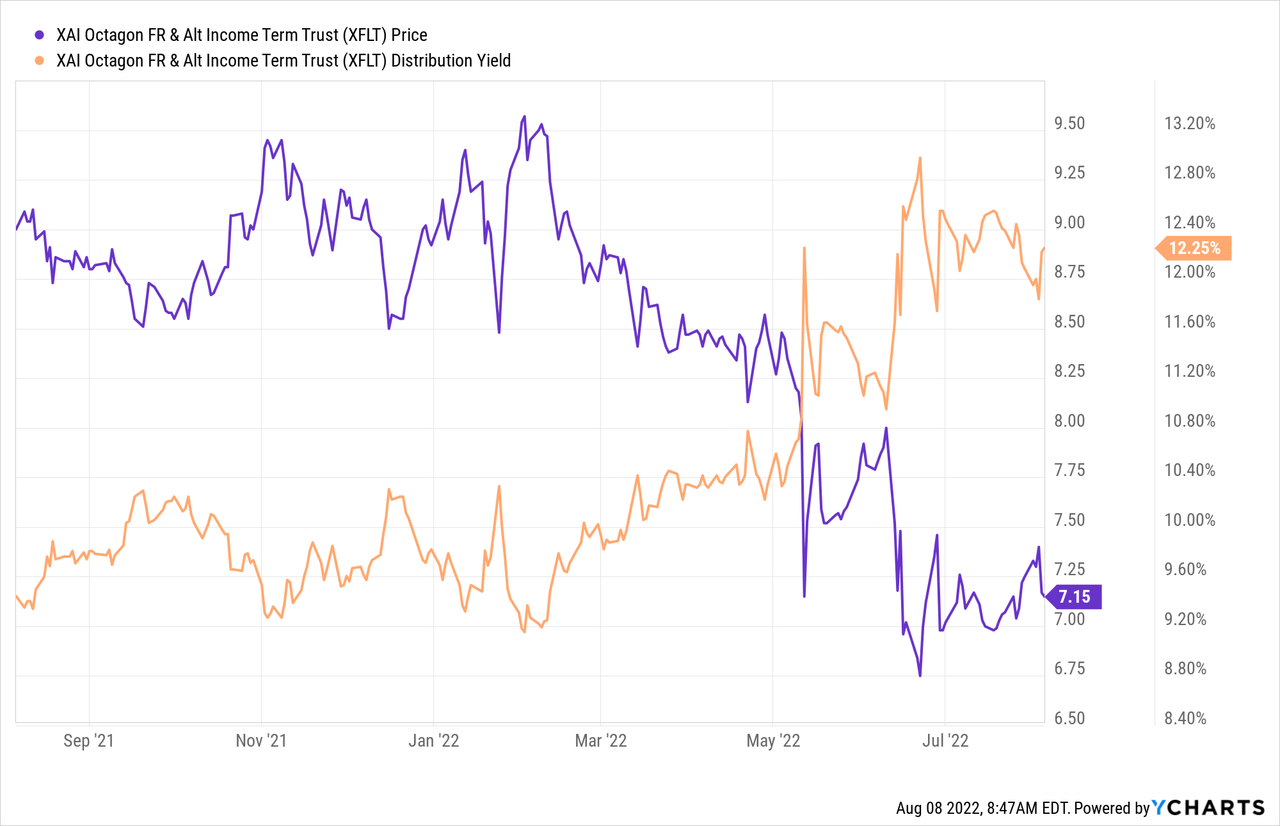

As with other investments we have discussed XFLT’s appeal comes from its large distribution yield. Currently this number is sitting really perched up and is one of the highest we can find in the CEF space.

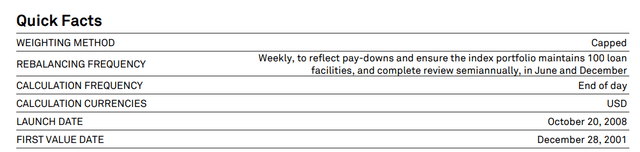

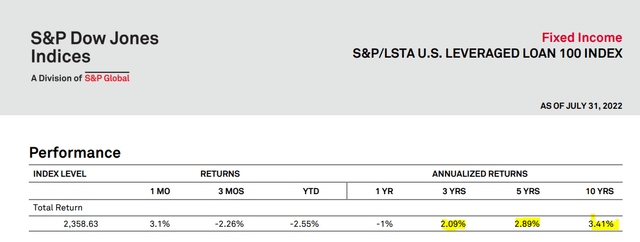

While CLOs are a resilient asset class they are not known for providing equity-like double digit returns over the long run. Yet that is precisely the concept you have to believe if you want to use up the distribution yield. Even if you decided the rest of this piece was not for you, what should strike you as you leave is that the underlying index of CLOs has not come anywhere close to generating these kind of returns over the long run. Most measures here reveal about 5% total returns when you take into account longer term considerations. One reason why there is some fuzziness here is that there are a lot of different trances in this space. Further, not all funds focus on the same areas. CLO debt and CLO equity have varied performances and the differences can be quite striking in recessions. The index we like to look at is the S&P/LSTA leveraged loan 100 index and it coincidentally is one that XFLT uses as a benchmark.

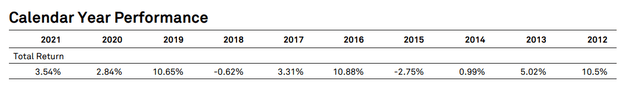

The returns showed on the factsheet, right away pour cold water on anyone expecting “double digit high yield”.

That is a 10 year performance at 3.41%. The calendar year returns are next and show how you can have bad years, without a recession.

Where Does XFLT fit in?

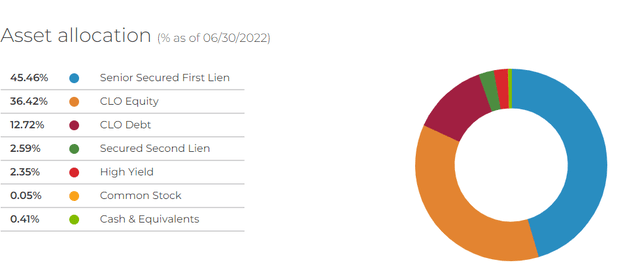

With a heavy weighting towards first lien loans and CLO debt, XFLT is designed to at least follow the leveraged loan index to a good degree.

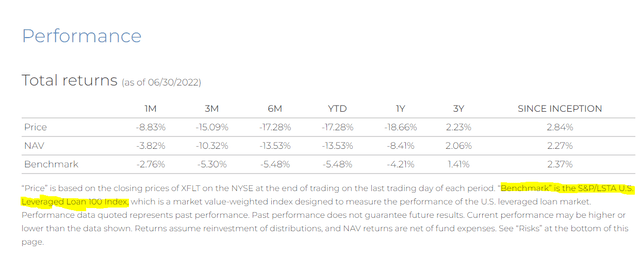

The CLO equity part is likely there at add more juice, but overall, this fund is aiming at a lower risk and lower reward than the likes of Oxford Lane capital (OXLC) and Eagle Point Credit Company Inc. (ECC). Since inception and we are talking about September 2017 here, the fund has delivered, 2.27% annually on NAV. This of course includes the distributions.

Most of the underperformance has been recent with the fund’s NAV heavily trailing the benchmark on year to date timeframe. Price performance has been worse with the fund falling 17.28% till June 30, 2022 vs a 5.48% total return drop for the index.

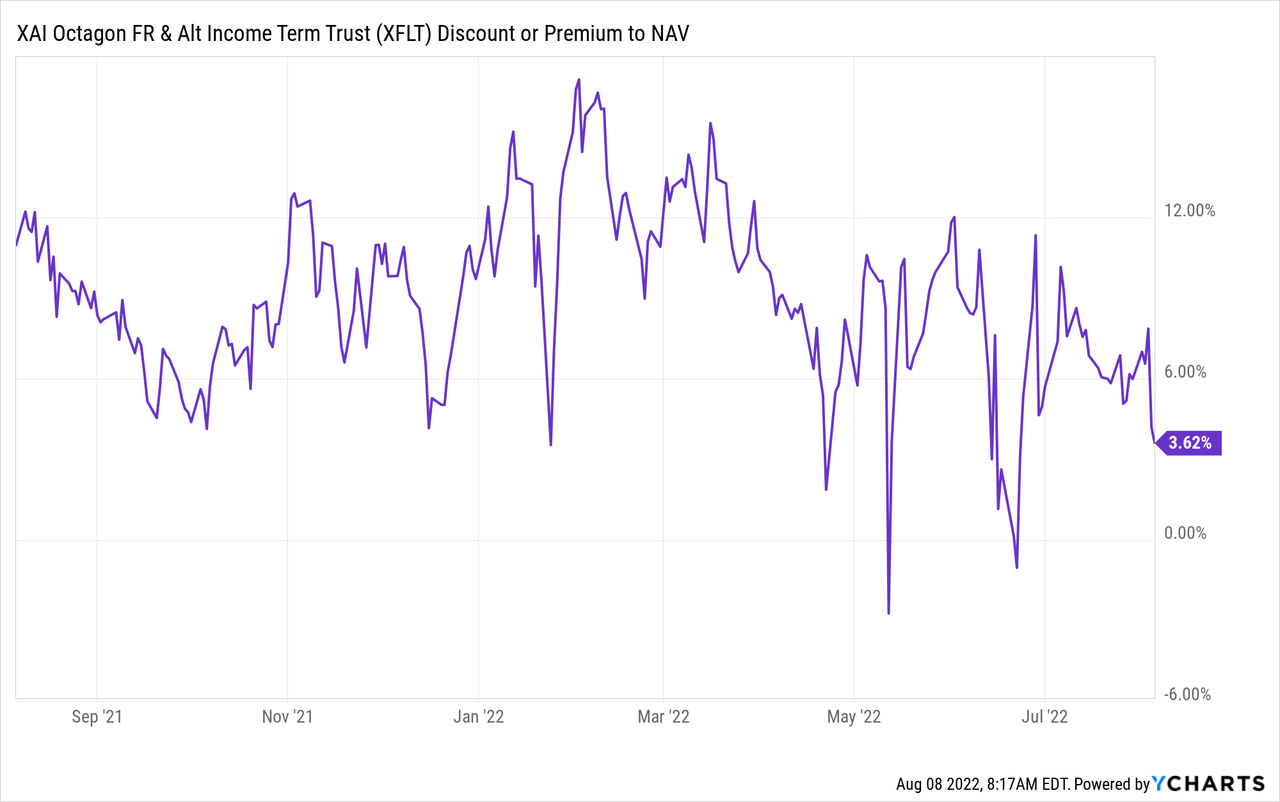

That drop of course was facilitated by investors paying rather ridiculous extra sums of money to buy into this 2% annual return fund.

This premium was 14% at one point and left us wondering whether the purchaser was aware that that premium was about 5 years worth of total returns.

Outlook

CLOs are likely in the more dangerous part of their cycle and if XFLT did not make much in the past 5 years, don’t expect fireworks at this point. The individual CLO securities are more attractively priced than in the past, but actual recession risks now compensate for that pricing advantage. Our range of total returns from this point over the next 2 years would be between negative 5% annually to positive 4% annually. We know that is wide, but the only real certainty we have here, is just like the last 5 years, the fund won’t come anywhere close to earning is distribution. That confidence comes from historical returns of the index and this lead anchor that the fund wears.

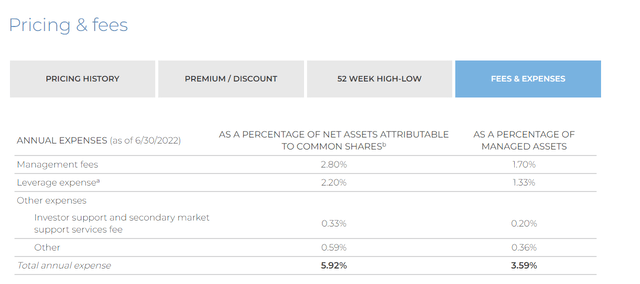

5.92% expenses on net assets for an index that will likely not make that total return, is excessive to say the least. At that level, whatever leverage adds, you can rest assured that fees subtract. We would pay 5.92% only if Howard Marks was armed with a time machine and agreed to manage our money. Outside that, no. The fund is currently at a 3.0% premium and we might get interested in it at a 20% discount to NAV.

Alternatives?

Of course we always have alternatives for those that don’t buy into the hype and are not obsessed with getting their money back via extremely poor total returns. Here, for XFLT, it is rather easy with XAI Octagon Floating Rate & Alternative Income Term Trust – 6.50% PFD (NYSE:XFLT.PA). The preferred shares remain insulated from the turmoil at the common shares and have handily beaten the common shares over the last year. Since they were just issued last year, longer term performance is not available but under any kind of normal extrapolation, these would have beaten the common shares over 5 years. They currently trade at a slight premium to par, so an early redemption risk is possible, but one we think as unlikely as XFLT is a limited term trust and issuing slightly cheaper preferred shares carries no real advantage after cost of issuance.

For XFLT, the one bright spot is that the returns here are very similar whether or not you reinvest your distributions. So it has that going for it, which is nice.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment