Overview

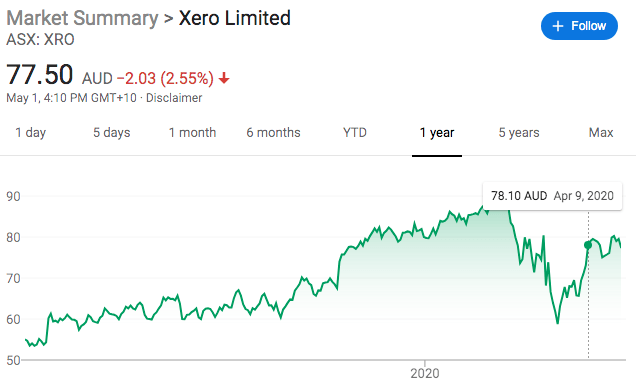

Xero [ASX: XRO] / (OTCPK:XROLF) is a New Zealand-based company building a cloud accounting software for SMEs. Given its easy-to-use product, global presence, and strong company culture, we have always liked the business. As of today, the fundamentals have been strong and the stock still presents a solid investment opportunity. Over the years, the share price has steadily appreciated. However, the COVID-19 outbreak that has been impacting many SMEs globally will likely create pressure on the stock in the near-term. We are yet to find out the overall impact on Xero’s business as we look forward to the second-half earnings release (H2 2020) on May 14. Therefore, there is a possible near-term entry point opportunity in and around the earnings date to pick up the stock at a bargain.

Catalyst

Key metrics have always been strong. Based on the most recent half-year earnings report ending September 2019 (H1 2020), top-line and ARR (Annual Recurring Revenue) run rate growth exceeded ~30% while FCF (free cash flow) reached $4.8 million. Much of the increase in FCF was due to the 33% increase in receipts from customers and the slowing growth rate in expenditure.

(source: company’s H1 2020 report)

The steady improvement in FCF growth has also been in line with the solid ~20%-50% subscriber growth across all its markets. The company’s strong focus on the product seems to be paying off here, as the enhancements it made around the products drove the strong conversion in H1 2020. In North America where the revenue grew about ~34% YoY, the company partnered with a digital bank serving mostly SMEs, Novo Bank, to provide seamless integration between their users and Xero. The company also launched alternative lending products in South Africa while doing a similar integration with an SME bank, Hang Seng, in Hong Kong. Both regions fall under the Rest of The World segments, which grew the fastest in H1 by ~52% YoY. ARR run rate also already exceeded ~$700 million, and given such scale, the business operates very efficiently as profitability significantly improves. While the company still posted a net loss in the previous fiscal year, Xero made $1.3 million in net profit in H1 2020.

Near-Term Risk Creates an Opportunity

As we have discussed, given Xero’s global presence, COVID-19 should affect the business to some extent as we have seen slowdowns and a wave of furloughs happening across SMEs globally. As the company expects to release its H2 2020 earnings report in about two weeks, we similarly expect Xero to absorb the potential impact most probably in the form of cancellations or delayed renewals of subscriptions, given its SME-dominated user base.

Valuation

Xero is a uniquely attractive growth story. The business is profitable while all the key metrics are improving and going in the right direction as the company consistently posts 20%-50% top-line growth across all of its markets. Its ~85% gross margin is best-in-class, which reflects the efficiency in its go-to-market. The gross margin figure has also expanded by ~700 bps since 2017 and is superior to many US-based cloud software companies targeting similar SME segments. Dropbox (DBX), for instance, typically posts a lower +80% gross margin figure, though it has an efficient go-to-market as well.

(source: google)

The stock trades at ~18x P/S at the moment and share price has appreciated by almost ~40% in the last twelve months. Another company that shares similar characteristics with Xero is Atlassian (TEAM). Atlassian is an Australian cloud software company that consistently posts +30% top-line growth while generating positive FCF and having equally strong go-to-market efficiency. Given that Atlassian trades at ~26x P/S, the consensus is that these well-performing cloud stocks do not come cheap. As such, we remain bullish on Xero at any price considering the amazing long-term upside. The stock currently trades at ~$77 per share and it fell to ~$58 per share during the broad COVID-19 selloff in March. Upon another possible near-term impact we discussed, there is another opportunity to pick up the stock at a bargain upon the release of its H2 2020 earnings report.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment