Nyaaka Photo/iStock via Getty Images

This work was strictly voluntary, but any animal who absented himself from it would have his rations reduced by half. ― George Orwell, Animal Farm

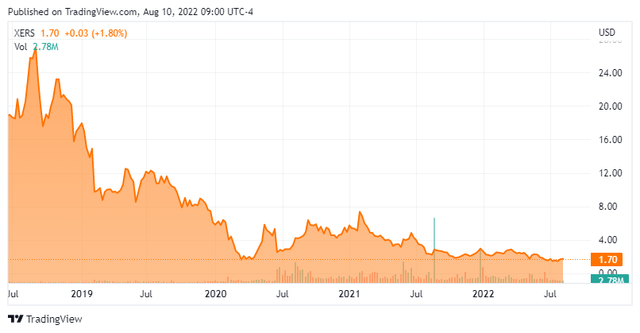

Today, we put Xeris Biopharma Holdings (NASDAQ:XERS) in the spotlight. The company is seeing significant revenue growth but that hasn’t translated into profitability or shareholder appreciation yet. Can the shares rebound? An analysis follows below.

Company Overview:

Xeris Biopharma Holdings is a small biopharma firm based in Chicago. The company is the result of the combination of Xeris and Strongbridge Biopharma which happened last year. Original Xeris holders wound up with approximately 60% of the shares of the combined entity. The company has several products on the market (see below) and others in the developmental pipeline. The stock currently trades around $1.75 a share and sports an approximate $230 million market capitalization.

February Company Presentation

Product Portfolio:

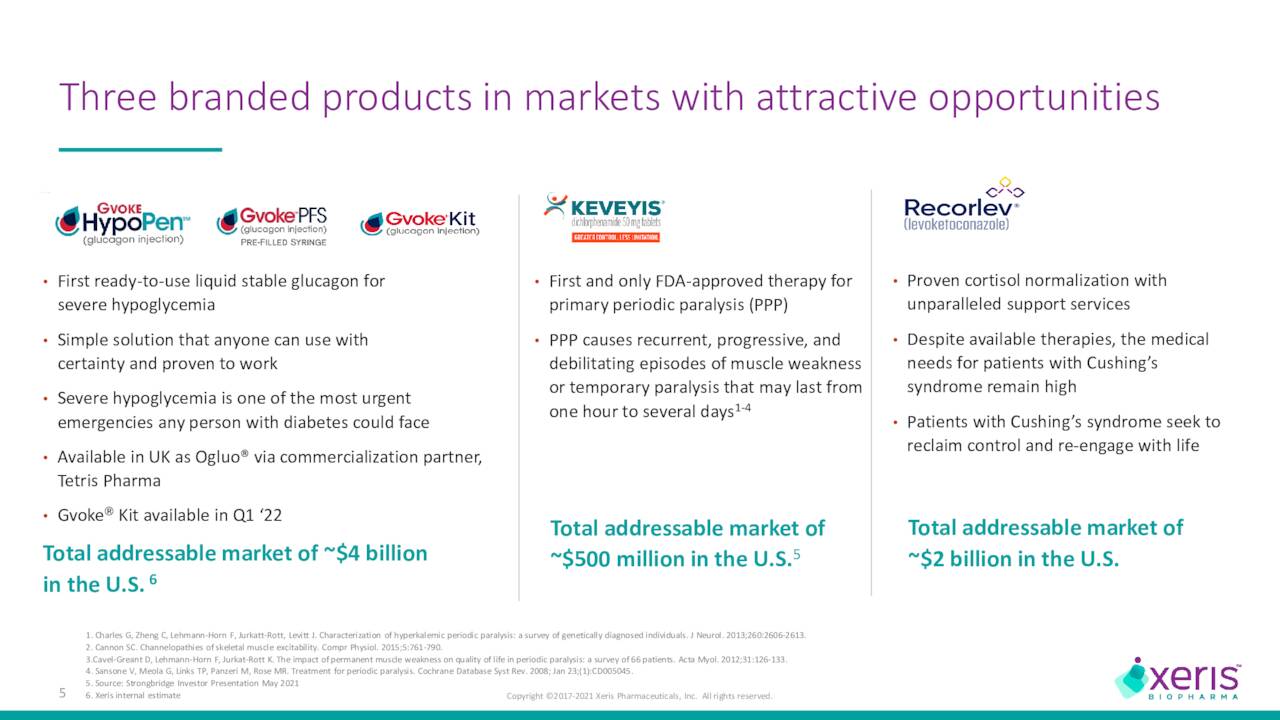

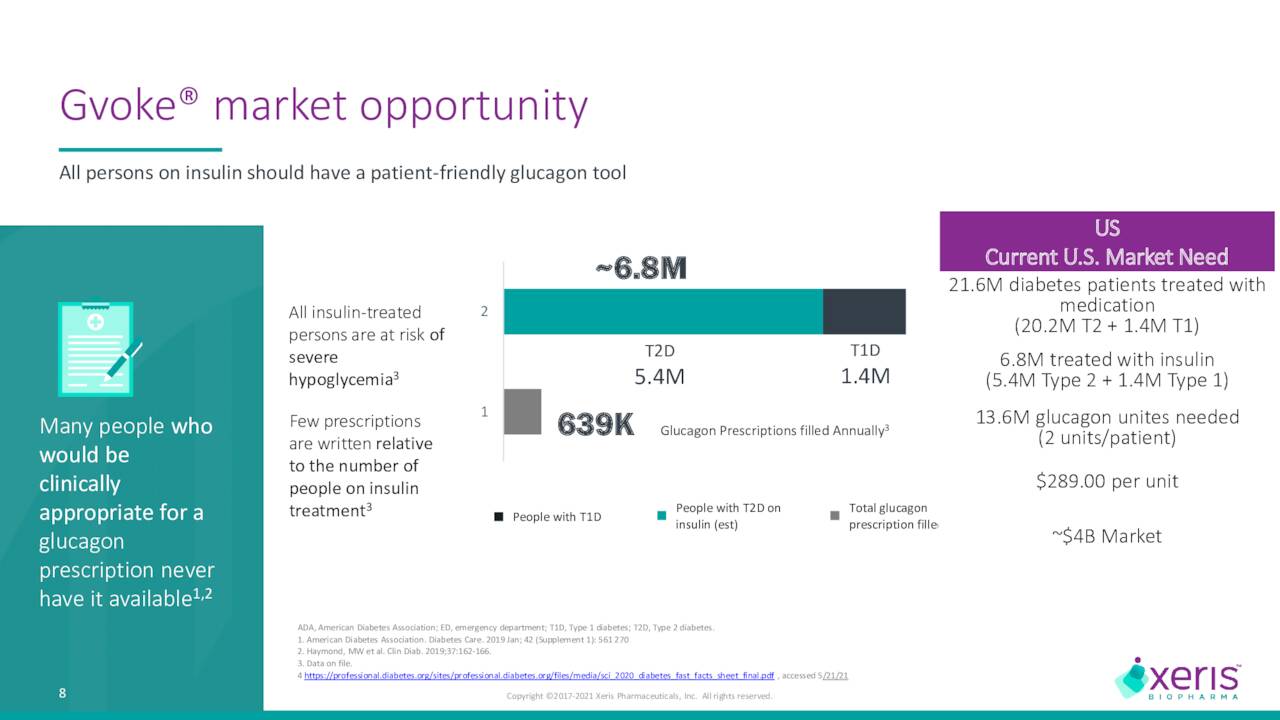

Gvoke

A ready-to-use liquid glucagon for the treatment of severe hypoglycemia

Keveyis

A therapy for the treatment of hyperkalemic, hypokalemic, and related variants of primary periodic paralysis. Was acquired in the Strongbridge merger.

Recorlev

A cortisol synthesis inhibitor proved for the treatment of endogenous hypercortisolemia in adult patients with Cushing’s syndrome. The product was acquired within the Strongbridge merger and was approved by the FDA late last year. It was launched in the U.S. in January of this year.

A year ago, Xeris made a deal with Tetris (Now Arecor) to commercialize Ogluo in the European Economic Area, U.K., and Switzerland for severe hypoglycemia in patients with diabetes mellitus. This agreement entitles Xeris to mid-single-digit royalties on net sales. It also can garner one-off commercial milestone payments if net revenues for a particular year exceed pre-defined thresholds. Commercialization of Ogluo are in their very early stages and are not germane to this analysis.

February Company Presentation

First Quarter Results:

The company posted first quarter numbers on May 11th. Xeris had a GAAP loss of 25 cents a share, in line with expectations. Revenues rose over 170% to just shy of $22 million, slightly below the consensus.

Prescriptions for Gvoke grew 88% on a year-over-year basis. This product now has 22% of the glucagon market and continues to take market share. The number of patients on Keveyis rose 12% above the levels of 1Q2021. Recorlev just launched in the quarter and will not show meaningful sales until the second quarter.

February Company Presentation

Second Quarter Results:

Today, the company posted second quarter numbers. The GAAP loss narrowed to 19 cents a share in the quarter, four cents a share above the consensus. Revenues rose nearly 185% to just over $25 million, roughly inline with expectations.

Gvoke net revenues for the first six months of the year rose 42%, despite an average price decrease, to $23.9 million. Prescription grew 73% from the same period a year ago.

Keveyis net revenues rose 20% in the first half of this year to $22.1 million. This was the result of both a price increase and an 11% increase in sales volume. Recorlev has now booked $1.1 million in revenues since it was launched earlier this year.

|

Six Months Ended June 30, |

Change |

|||||||||||

|

2022 |

2021 |

$ |

% |

|||||||||

|

Product revenue (in thousands): |

||||||||||||

|

Gvoke |

$ |

23,932 |

$ |

16,886 |

$ |

7,046 |

42% |

|||||

|

Keveyis |

22,136 |

– |

22,136 |

nm |

||||||||

|

Recorlev |

1,102 |

– |

1,102 |

nm |

||||||||

|

Product revenue, net |

47,170 |

16,886 |

30,284 |

nm |

||||||||

|

Royalty, contract and other revenue |

209 |

215 |

(6 |

) |

-3% |

|||||||

|

Total revenue |

$ |

47,379 |

$ |

17,101 |

$ |

30,278 |

nm |

|||||

Analyst Commentary & Balance Sheet:

Since late April, four analyst firms including Mizuho Securities and H.C. Wainwright have reissued Buy ratings on XERS. Price targets proffered are in a tight $6.00 to $6.50 a share range. Just over eight percent of the outstanding float is currently held short. The company’s Chief Scientific Officer sold just over $27,000 worth of shares in February. The CEO bought 100,000 shares in May. That is the only insider activity in this equity so far in 2022.

The company had cash and marketable securities of just over $110 million at the end of the second quarter. Xeris has a like amount of long term debt. At the first quarter conference call, leadership guided to a year-end 2022 cash balance of between $90 million to $110 million. It also projects Xeris can achieve cash flow breakeven levels by year-end 2023

Verdict

The current analyst consensus has revenues rising more than 120% in FY2022 to some $110 million. The analyst community projects nearly $160 million in revenues in FY2023 as well.

Given its growth, XERS is not expensive based on price to forward sales basis. This is especially true if the company continues to march to cash flow break even status. I view the stock as only a small ‘watch item‘ holding at this point and one I hold through covered call positions within my portfolio.

Withholding information is the essence of tyranny. Control of the flow of information is the tool of the dictatorship. ― Bruce Coville

Be the first to comment