Jonathan Kitchen

Xeris Biopharma (NASDAQ:XERS) recently reported their Q3 earnings with a beat on EPS and revenue. The earnings revealed strong growth with record net product revenue rising 17% from the previous quarter and 31% over Q3 of 2021. Xeris appears to be on track to hit their goal of cash-flow breakeven by year-end of 2023. Despite the progress and potential upside, XERS is still trading around $1.50 per share and is down roughly 25% over the past twelve months. I believe XERS offers a great speculative opportunity at these prices. As a result, I am looking to make XERS a “Top Idea” in my Compounding Healthcare Marketplace Service.

I intend to review the company’s Q3 earnings and provide my views on the quarter. In addition, I discuss why I am promoting XERS as a “Top Idea” in Compounding Healthcare. Finally, I update my strategy to take advantage of these current prices.

Q3 Performance

The company’s third-quarter total net product revenue was a record $29.6M, up 31% compared to Q3 of last year. Xeris reported they saw growth from all three of the company’s products with Gvoke pulling in $13.7M for the quarter, up 24% over Q3 of last year. Gvoke’s net revenue for the first three quarters was $37.6M, up 35% over the same period last year. The company attributes this increase to growth in prescriptions, which hit 38K in Q3.

Keveyis pulled $13.4M in net revenue for the quarter, up 17% over Q3 of last year on a pro forma basis. Year-to-date Keveyis has pulled in $35.5M, up 19% over the same period last year. Xeris reported that they are seeing an increase in the number of patients on Keveyis, plus, the company had a net pricing increase, which led to a spike in revenue growth.

Recorlev pulled in $2.5M in net revenue, which was more than double what they pulled in the second quarter of 2022. Xeris is seeing “weekly growth of new patient referrals and new patients coming on the therapy.”

In the end, the company still reported a net loss of $21.8M, or $0.16 per share for Q3. For the first three quarters of the year, the company has accumulated a net loss of $81.7M, or $0.60 per share.

In terms of cash, Xeris finished Q3 with $93.4M in total cash, cash equivalents, and short-term investments, down from the $111.6M they had at the end of Q2. In addition, the company plans to draw the supplementary $50M from the Hayfin debt facility by the end of this year. As a result, the company updated their year-end 2022 cash guidance to a new range of $110M-$120M. Xeris believes that their balance sheet and revenue growth will help them hit cash-flow-breakeven by the end of next year.

My Thoughts on Q3

Overall, I am incredibly happy with the company’s progress thus far in 2022. Xeris saw significant year-over-year growth across the board and increases in market share. What is more, Xeris still believes they are on track for cash-flow-breakeven by the end of next year. Assuming the company does leave 2022 with $110M-$120M in cash, I believe Xeris could make it to profitability without the need for additional dilutive funding.

A New “Top Idea”

I have a “Top Idea” list in my Compounding Healthcare Seeking Alpha Marketplace Service that comprises about sixteen tickers coming from my three portfolios (Bio Boom, Bioreactor, and Healthy Dividends). These tickers offer a strong value proposition and have an actionable trading/investment opportunity.

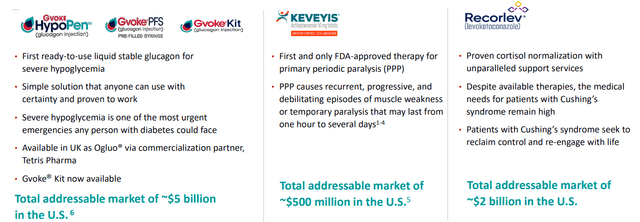

Xeris is a “Bio Boom” ticker that I am deciding to make XERS a Top Idea for a number of reasons. First, Xeris has a diversified revenue base due to their three commercial products in outsized addressable markets.

Xeris Biopharma Products and Markets (Xeris Biopharma)

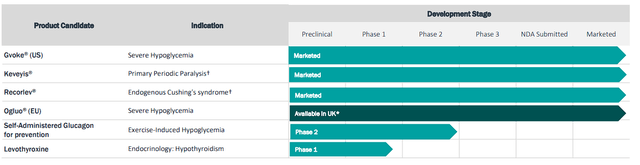

Second, the company has a unique platform technology that can develop advanced shelf-stable formulations. Third, Xeris has a robust pipeline with a number of development programs that have the potential to extend the company’s current products into new indications, as well as new product candidates.

Xeris Biopharma Pipeline (Xeris Biopharma)

Fourth, Xeris is currently in a strong financial position that will allow the company to continue to push their three commercial products while keeping the pipeline moving forward. Finally, the company’s management team has proven they are capable of making deals and constructing a company to generate long-term value.

Indeed, the characteristics listed above are not unique to Xeris, but you would be hard-pressed to find a small-cap biotech with these traits, valuation, and this close to hitting cash-flow-breakeven.

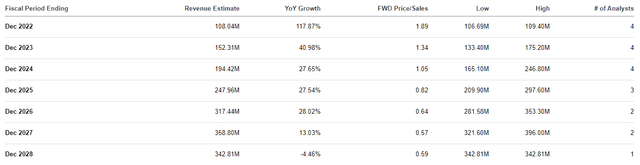

Xeris is projected to pull in over $100M in revenue for this year and is expected to report strong double-digit growth for the next several years. Considering the company’s Q3 total revenue and growth trends, I believe Xeris will able to hit the Street’s 2020 revenue estimates of ~$108M, which would be a 1.89x forward price-to-sales.

Xeris Annual Revenue Estimates (Seeking Alpha)

Considering the industry’s average price-to-sales is around 4x-5x, we can say XERS is undervalued for its 2022 estimates, and it is heavily discounted for its future projections. In fact, the Street estimates Xeris will pull in around $250M in 2025, which would be less than 1x forward price-to-sales… meaning the company’s current market cap (~$200M) is less than the revenue estimate for 2025. Indeed, these are just estimates, but they do illustrate how discounted XERS is at the moment for its current and future revenue estimates. If the market was to price XERS in line with its peers, XERS would be trading around $4 per share right now, and over $9 in the coming years. XERS is currently trading around $1.50 per share, so we can say there is significant upside potential in the ticker.

One might find it hard to believe the company is going to more than double its revenue over the next few years, but keep in mind the company’s three commercial products are just hitting the market. So, the Street’s estimated growth for Xeris is not unwarranted. I believe this potential has gone unnoticed by the market and provided me with an opportunity to invest in a promising company with a potential multi-bagger upshot.

Some Risks

Although I am looking to elevate XERS to a “Top Idea”, it is still a “Bio Boom” ticker, so it still is a speculative ticker with risks. First, Xeris is still burning through cash, so investors need to accept that the market will continue to punish XERS until cash-flow-breakeven is almost guaranteed.

Another risk to consider is that XERS is an underfollowed ticker with little-to-no hype around it. Xeris is not a gene therapy or cell therapy company targeting rare genetic diseases or oncology. Therefore, investors should not expect XERS to demand a high premium compared to other cutting-edge technology companies that have a lot of hype. It is possible XERS is a slow grind for several years and is driven by fundamentals rather than its prospects.

Indeed, these risks are extremely concerning, but nonetheless, they can weigh down the share price until they are addressed. Therefore, I am giving XERS a conviction level of 3 out of 5.

My Plan

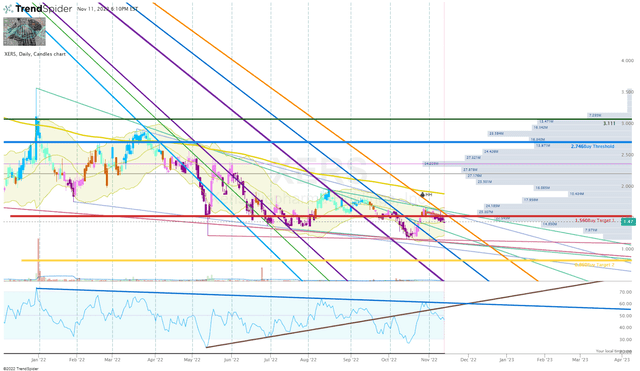

In my previous XERS article, I discussed that was waiting for XERS to drop below my Buy Threshold of $2.74 and was looking to accumulate around $1.50 per share through a series of buy orders. Since then, my XERS has been dormant as I waited for the overall market to start responding appropriately to positive news.

XERS Daily Chart (Trendspider)

Well, the market did have a positive response to the latest CPI data, so I am looking to dust off my XERS position and restart my accumulation. I plan on making a small addition in the near term. After that, I will wait for the share price to break through the nearest downtrend ray before clicking the buy button as long as the share price is under my Buy Threshold of $2.74. I intend to make several more small additions before the end of 2023 in anticipation the company will hit their goal of cash-flow-breakeven.

I am still planning on booking profits and have set sell orders around $5 per share and $7 per share in order to move my XERS position back into a “house money” status.

Long-term, I have decided to make XERS a larger position in the Bio Boom portfolio for at least 5 more years in anticipation that XERS will hit breakeven at the end of 2023 and will ultimately graduate into my “Bioreactor” growth portfolio.

Be the first to comment