Godji10/iStock via Getty Images

MACRO trends: Fed interest rate hike and overvalued tech sector and crypto-collectibles falling back to earth

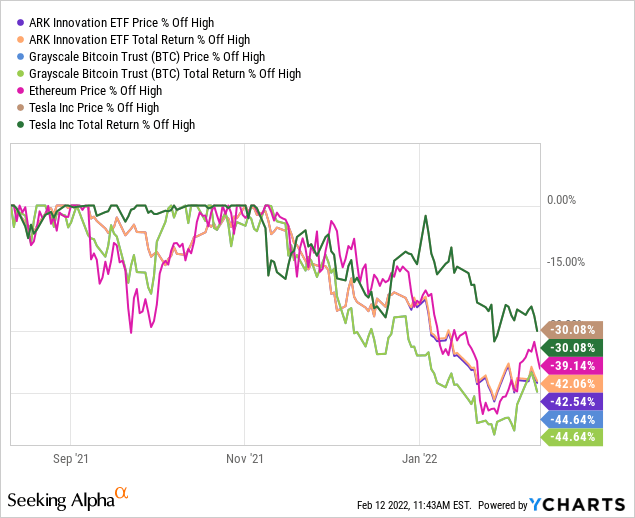

With the macroeconomic backdrop of Fed increasing interest rates, high-growth technology stocks are rapidly deflating. For example, ARK Innovation ETF (NYSEARCA:ARKK), the poster child of pie-in-the-sky growth stocks, has lost close to 54% of its value, and the NASDAQ 100 is about to enter bear market territory. Furthermore, as I warned readers in my previous bearish article on cryptocurrencies, Bitcoin (BTC-USD), Ethereum (ETH-USD) bubble has almost lost 50%+ of their value within the last several months, and the technicals look horrendous. As shown in the graph below, it is not a surprise the point where these speculative bubble stocks and digital collectibles started collapsing was when Fed started to shift rapidly into a hawkish posture (in November 2021) right after Jerome Powell got reappointed as Fed chairman. We view continuous sector rotation into value stocks, international stocks, and healthcare stocks moving forward during the next decade.

Seeking Alpha

Tech is undoubtedly overvalued, and healthcare is historically undervalued

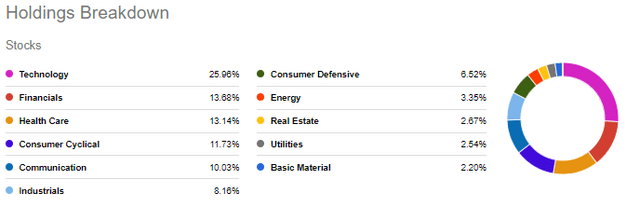

In our view, Tech is more overvalued than ever, and healthcare is undervalued than ever. As shown below, currently, technology sector accounts for 25% of the S&P500, and healthcare accounts for around 13%. A good way to think about is to compare a sector’s percentage of GDP to % of the market share of S&P500. According to Statista, the Technology sector accounts for around 9-10% of the total GDP, and the growth has plateaued since 2017. In our view, technology has now become a zero-sum game where productivity gain has slowed down, and competition and regulatory pressure are increasing, slowing down their growth prospect. Adding insult to injury, the valuation for the tech sector is historically high (compared to other sectors) and we do not think it is realistic that investing in the technology sector will generate an attractive return on capital even if the fundamental business continues to grow at a decent rate. In comparison, healthcare as a percent of GDP across the world is consistently compounding, and its percentage share of GDP almost doubles that of the technology sector, 17.8%-18%. In our view, this indicates that actual money spent in healthcare is significantly larger than tech and maybe growing as fast, but the valuations have not caught up with it.

We project the healthcare sector to continuously compound as 1) healthcare’s non-cyclical nature (payers are price inelastic), 2) skyrocketing demand for healthcare from an aging population, 3) increase in demand from emerging markets (China, India). As of today, the US, EU, and Japan account for 80-90% of the pharmaceutical market, however, during the next few decades, we view the emerging market juggernaut economies to drive global healthcare growth as the purchasing power improves and the population rapidly ages (i.e., China, India, etc..).

Seeking Alpha S&P500 sector weighting as of 2022-Feb

Why we expect the technology sector to underperform during the last decade

Many growth investors will argue that Tech will grow faster (than healthcare and biotech) and justify the current valuation. We disagree with the point of view because of three reasons.

First, we are seeing a very high inflation rate (~7.5%), and global central banks are slowly and steadily increasing interest rates. This will further put pressure on high P/E growth-sector companies (which are concentrated in the technology sector). As a result, investors will look more and more for value or defensive growth sectors that are reasonably priced; healthcare and biopharma is the best option. Unlike healthcare, the technology sector is more cyclical in nature – for example, during the recession, people will still spend money on drugs if they get sick, but many of them stop subscribing to Netflix (NASDAQ:NFLX) and buy fewer products through Amazon (NASDAQ:AMZN).

Second, bipartisan-backed antitrust push from major governments is capping the inorganic growth (M&A) of giant technology companies that drove S&P500 and NASDAQ during the last decade. There is increasingly more and more pushback on big tech acquiring smaller players. As such, many unprofitable technology companies with high valuations (Uber (NYSE:UBER), DoorDash (NYSE:DASH), Airbnb (NASDAQ:ABNB)) will continue to see the decline in their valuation and lower prospects of M&A, making it less attractive of an investment.

Thirdly, the headwind from the stagnating economy will likely be a tough environment for the technology sector to grow at the same speed to maintain its valuation. As the growth-rate declines and the discount rate increases (with the interest rate going up), the company’s valuation is bound to come down to earth. Especially, many tech juggernauts, so-called FANGS, are facing more and more competition with each other (becoming a zero-sum game), and growth has been slowing down, as we have seen with Amazon and Facebook’s (NASDAQ:FB) painful collapse in share price after the disappointing earnings. B:C Companies like Facebook or Meta, which is a technically glorified marketing company, will have a hard time accessing and monetizing customers’ data during the next decade, even though Metaverse becomes the next big thing. B:B companies (i.e., SAAS) may see decline in their pricing power as users cut down cost as the economy enters stagflation. In contrast, healthcare is, in a way, non-correlated to the general economy as people still need drugs and access to healthcare services even during the recession. For example, healthcare expenditure as a percentage of GDP has actually increased from 16.3% to 17.2% during the global financial crisis (GFC).

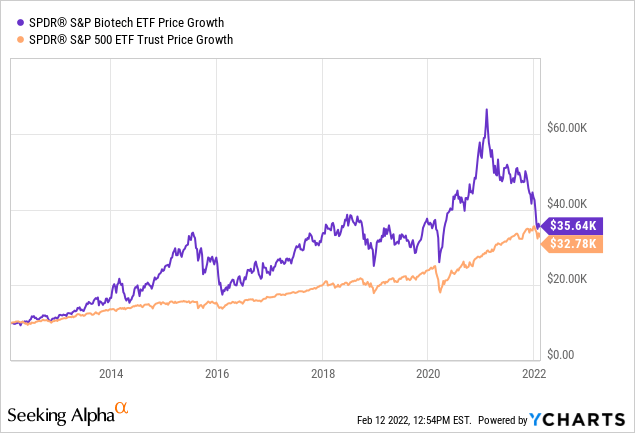

Why I like Biotech at this point

Cheap valuation – back to the 2018 level when the companies have better fundamentals

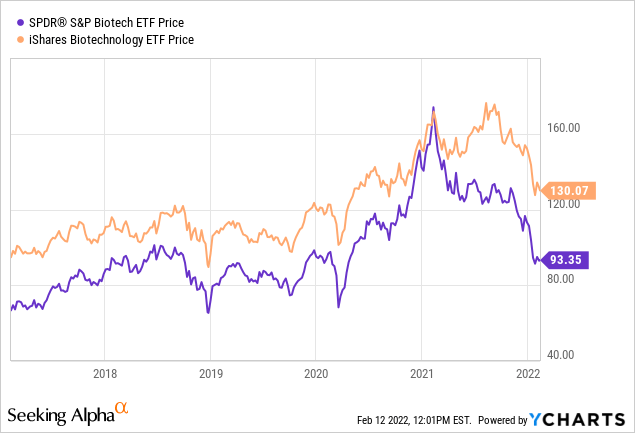

Many Biotechs have been over-punished during the last 1 year, and many biotechs’ enterprise values are reaching close to or even under their cash value; a good example would be Galapagos (NASDAQ:GLPG) before the new CEO stepped in. In our view, during 2020-2021, Biotech had a remarkable rally as many “generalists-tourists” piled into this space after the COVID19 pandemic. In our view, Moderna’s (MRNA) Tesla (TSLA) like gain was driven by generalist investors. Around mid-2021, these generalists slowly exited the biotech sector, and iShares Nasdaq Biotechnology ETF (NASDAQ:IBB) has consistently drifted down to the current level, now hovering around 2018 levels. In addition, I expect a high degree of M&A activity from Big pharma to lift the valuation as we enter 2022-23.

Seeking Alpha

Non-cyclical growth nature of biotech

First time in history, healthcare became cyclical due to COVID19. As COVID19 abates, it will become the only undervalued, non-cyclical growth sector. One may argue that biotech will suffer the same macro pressure that the tech sector will face. However, we fundamentally disagree with this view for the following reasons.

First, unlike the technology sector, where many tech companies are unprofitable because their business model is flawed (for example, I do not think Uber Eats, DoorDash will ever reach profitability if they weren’t profitable during the pandemic), Biotechs have a well-defined market with price inelastic buyers (patients and insurers). We know how many patients are out there and how much payers are willing to pay for a new drug. The only reason why clinical-stage companies are not profitable is that they did not receive the FDA’s stamp of approval. Once the drug is approved, they can immediately generate cash flow with very high margins (average gross profit margin for pharma is around 76%) and are protected by patents allowing biopharma companies a guaranteed cash flow.

Secondly, the small-mid cap Biotech sector’s valuation is driven by drug approval (regulatory) and big-pharma M&A. Unlike the technology sector, where new acquisitions are frowned upon by the regulatory and the relatively shallow moat around their technology (i.e., Google can easily copy other small-cap tech’s business model), the Biotech sector is more of an intellectual property-driven sector where it is tough for big pharma to copy small biotech’s drug. As such, this leaves M&A or license-in deals as the only way to acquire new technology or pipeline candidates. As the big pharmaceutical company’s internal R&D productivity has consistently declined (described as the “Eroom’s law“) during the last 50 years, and big pharmas’ appetite for fueling innovation through small/mid-cap biotech will only accelerate.

Why we are expecting a high degree of M&A activity in the Biotech sector that will lift the biopharma valuation in 2022

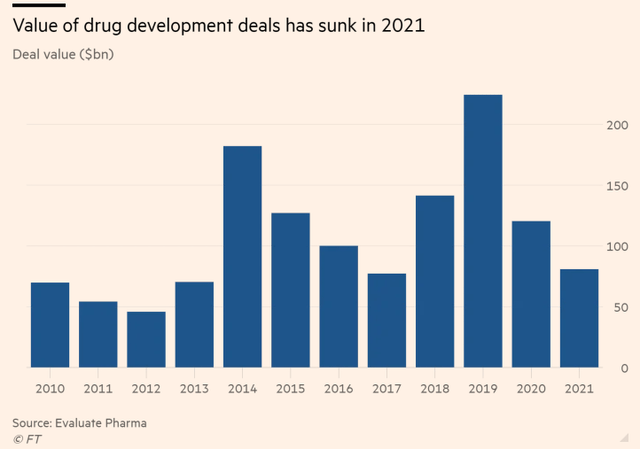

The decline in deal momentum during the last few years

Since 2019, the deal value for drug R&D has declined considerably. In our view, this is likely because of the lack of in-person conferences and the inability of people to travel freely. However, as COVID19 abates, we view the M&A activity to bounce back rapidly and deal momentum from big pharma BD to accelerate. As we highlight in the chart below, we have seen similar lows back in 2010-2013 and 2017, where the subsequent years show a rapid bounce in deal activity, and the biotech sector outperformed the S&P500 (SPY).

Source: Financial times articles

Seeking Alpha YCharts

Big pharma’s war chest is full of dry powder

Big pharma is swimming in dry powder and waiting patiently to deploy it; according to an analyst from SVB Leerink, 18 large-cap and European pharmaceutical companies will have close to USD 500Bn of cash at hand by the end of 2022. Assuming small-mid cap biotech costs USD1B each, there is enough dry powder for 500 M&As. Furthermore, as big pharmaceutical companies’ shares are appreciating due to sector rotation into value stocks, they will be able to raise more capital through the public market if they need to.

Big pharma is under dire need to replenish their pipeline

Worldwide total brand name prescription medications at risk from patent expiry are constantly increasing from USD16bn to close to USD28bn in 2026, according to Evaluate Pharma (page 22). This means that big pharmaceutical companies will see a high degree of revenue erosion as more copycat drugs enter the market after the patent expires. As such, there will be more pressure for those companies to aggressively acquire new clinical candidates that can plug the gap and replenish their declining pipeline.

Risks

- Tepid M&A activity may continue. The fact that biotech valuations are undervalued doesn’t mean big pharmaceutical companies will buy more biotechs than what they need (buying three biotech companies instead of one because they are on a 50% discount).

- Fed interest rate hike may pull down the market further and pull Biotechs with it.

- Geopolitical risks such as Russia invading Ukraine and China invading Taiwan may impact investor sentiment.

In conclusion, my plan

Biotech is ridiculously undervalued at this price level, reaching close to 2018 prices, and many companies are trading around their cash value. In our view, the Biotech sector’s fundamentals are better than ever, well-financed, and exponentially growing scientific innovation. We highlight that biotech is an undervalued, non-cyclical growth sector that investors should have adequate exposure to, as we expect a sharp rebound across the sector during 2022-2023 due to increase in M&A activity. We project the technology sector to suffer and may generate no or negative return even at this price level due to the factors that are mentioned in this article. As we believe we have the capacity to pick the winners, we have been going on a bargain hunting for undervalued mid/small-cap biotechs where they have phase 2 assets with a novel mechanism of action that addresses a large market size with high unmet needs. However, in biotech, the rising tide doesn’t lift all boats because small/mid-cap clinical-stage biotechs possess an inherent risk of the drug failing and the company going to zero. As such, our view is for investors who don’t have the expertise to pick individual stocks to buy a diversified broad biotech index like iShares Nasdaq Biotechnology ETF, SPDR S&P Biotech ETF (XBI), First Trust NYSE Arca Biotechnology Index Fund (FBT), and VanEck Vectors Biotech ETF (BBH). We highlight that XBI includes more mid-cap (perhaps speculative companies such as (BHVN), (NASDAQ:CYTK), (TPTX), and IBB includes safer big pharma/healthcare services (i.e., (AMGN), (GILD), (BIIB), (NASDAQ:REGN), (IQV), (VRTX), (ILMN)) with multiple approved candidates and solid cash flows. As such, if the market bounces, we view XBI may show a larger return, but down is also greater. We also like companies like Lonza (OTCPK:LZAGY) (OTCPK:LZAGF) (LONN), Samsung Biologics, WuXi Biologics (OTCPK:WXXWY) that are the key backbone to biotech/pharma R&D without any clinical risk (binary risk of stock going to zero if the trial fails). Other low-risk options would be going for drug royalties, Royalty Pharma (NASDAQ:RPRX) and DRI Healthcare Trust (DHT.UN) may offer low-risk and non-correlated dividends for investors who want to avoid volatility. Tekla Healthcare has few actively managed funds available for investors interested in active stock picking.

Be the first to comment