Gold, XAU, Russia, Ukraine, Oil, Breakeven rates, Rate Hike Bets – Talking Points

- Gold prices continue to advance as traders await Russia’s next move on Ukraine

- Short-term inflation expectations surge as WTI crude surpasses $95 per barrel

- Bullion traders eye Russia’s next move, US retail sales and the FOMC minutes

Gold prices moved higher overnight, underpinned by fears over a Russian attack on Ukraine, adding onto last week’s impressive gain of just under 3% – the yellow metal’s best performance since May 2021. US officials warned that Putin’s forces could launch an invasion as soon as Wednesday, citing mostly unspecified intelligence. US satellite images are reported to show military units moving from assembly areas into “attack positions.” Meanwhile, diplomatic efforts to avoid a conflict remain underway.

German Chancellor Olaf Scholz is set to speak with Russian President Vladimir Putin after visiting Ukraine on Monday. Germany has been criticized for taking too soft of a stance in recent weeks, with some speculating that the soft stance is because of the country’s heavy reliance on Russian natural gas. Energy prices have shifted higher due to geopolitical strife.

Those higher energy prices have sent near-term inflation expectations soaring despite traders increasing their bets on Federal Reserve rate hikes. Crude oil prices rose above $95 per barrel earlier this week as fears over western sanctions removing Russia’s nearly 10 million barrels per day of oil out of the global market increases. The 1-year breakeven rate has quickly advanced higher over the last week, along with the 5-year breakeven rate to a lesser extent, helping bolster bullion’s inflation-hedging appeal.

The conflict in Ukraine is also stoking a surge in volatility across equity markets, bolstering gold’s case as a store of value. The S&P 500 VIX “fear gauge” rose 3.58% in New York on Monday. Stock indexes across the Asia-Pacific region are mostly lower in Tuesday trading, with South Korea’s KOSPI down around 1% through mid-day trading. Gold typically performs well as a volatility hedge, and given that a conflict in Eastern Europe would do little to derail Fed rate hikes, Treasuries offer little attraction. That said, the fundamental backdrop for Gold looks rosy at the current calculus. A major de-escalation in rhetoric would likely threaten the yellow metal.

Gold Technical Forecast

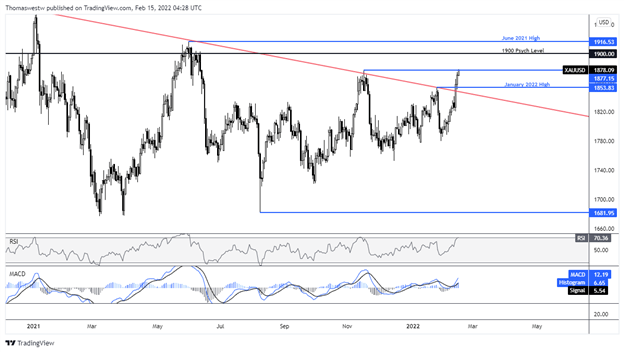

XAU/USD is attempting to clear the November high of 1877.15 as bulls pile on the buy button. The move follows a break above trendline resistance stemming from the September 2020 swing high. The Relative Strength Index (RSI) entered ‘overbought’ conditions on the move, rising above the 70 level. The MACD oscillator is also pulling higher from the center line, reflecting the bullish momentum in prices.

A clean break above 1877.15 would bring the 1900 psychological level into focus. Next up, if bulls succeed, is the June 2021 high at 1916.53. Alternatively, failing to hold prices above the November high may see prices pull back, perhaps to the January high at 1853.83. A deeper retracement would put former trendline resistance on the cards.

XAU/USD Daily Chart

Chart created with TradingView

— Written by Thomas Westwater, Analyst for DailyFX.com

To contact Thomas, use the comments section below or @FxWestwater on Twitter

Be the first to comment