Solskin

X4 Pharmaceuticals Logo (X4 Website)

Headquartered in Boston, MA with research facilities in Vienna, Austria, X4 Pharmaceuticals, Inc. (NASDAQ:XFOR) is a late-stage clinical biotech company focused on the discovery and development of CXCR4 targeted small molecule therapeutics to address diseases of the immune system including chronic neutropenic disorders and certain types of cancer.

X4′ lead drug, Mavorixafor, is an orally administered, first-in-class, small molecule antagonist of the CXCR4 receptor being advanced in a number of clinical trials, with two upcoming significant near-term clinical trial readouts; from a Phase 1b trial on September 27th, and more importantly the results from its pivotal Phase 3 trial in Q4.

With approximately 86.5 million shares outstanding (including pre-funded warrants) X4 recently issued 51 million warrants as part of a $55 million financing which closed in early July, which may put a lid on X4’s share price for some time. X4 also has $33 million in secured debt which contains some onerous terms.

This is not an investment for everyone, but there are some very sophisticated biotech investors, such as Bain Capital, NEA, Orbimed, Lumira and Acorn, who all participated in the recent $55 million private placement.

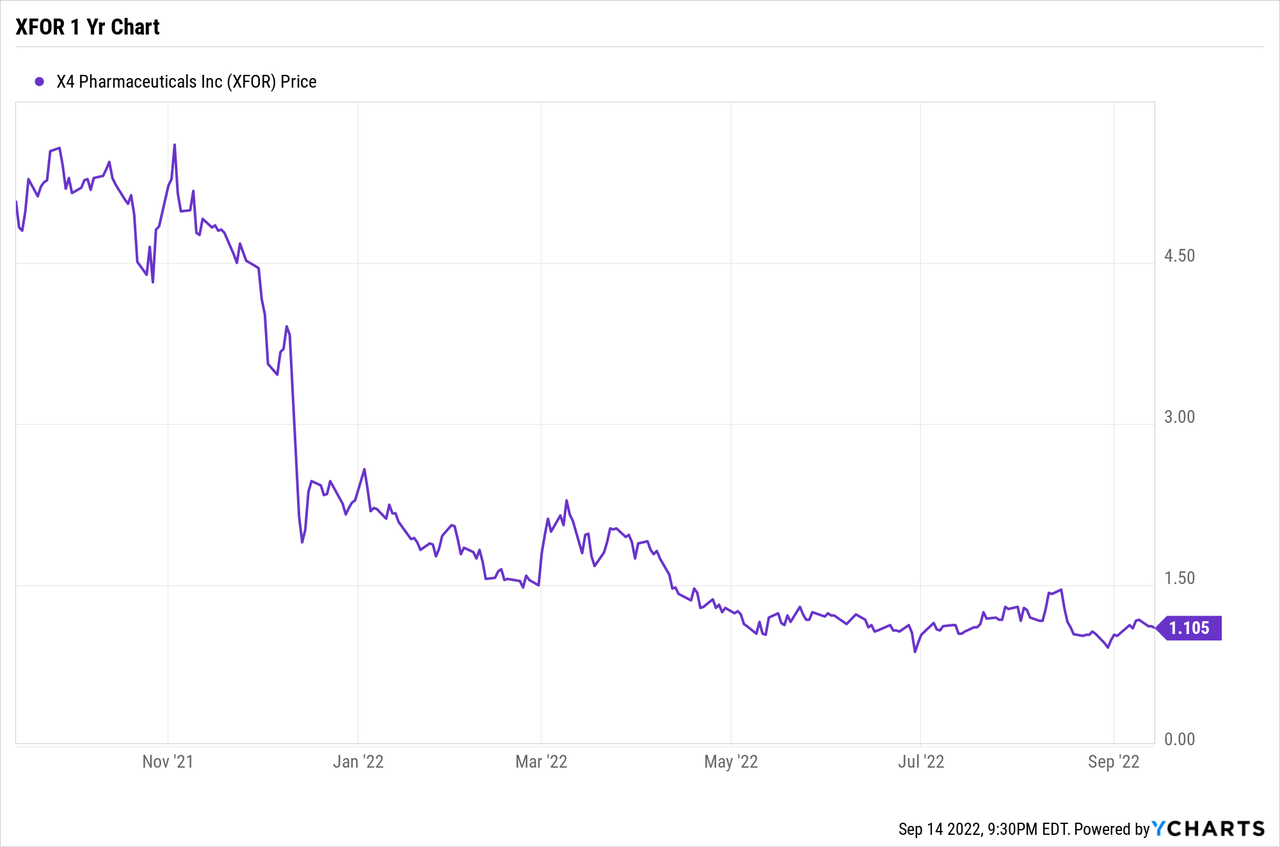

Notwithstanding some issues and the binary aspect of the investment in X4, I thought the upside was sufficient at current share price levels to buy a small X4 share position last week. X4 trades at approximately $1.10 per share which works out to X4 having a market cap of under $100M. The company has an equal amount of cash, or equivalent, and believes that it has sufficient resources to operate to Q3 2023, subject to satisfying terms set out in its secured loan agreement with Hercules Capital, discussed in more detail below.

While its upcoming Phase 1b trial results in chronic neutropenia are important, its most significant upcoming event is the read-out from its pivotal Phase 3 trial in WHIM Syndrome expected in Q4. The Company and investors are optimistic that the results will be favourable.

If the Phase 3 WHIM Syndrome clinical results meet its endpoints, there could be a significant upside for X4 investors over the next few years. An NDA for Mavorixafor could be filed in mid-2023, and FDA approval as well as a Priority Review Voucher (worth in excess of $100 Million) could be obtained in H1 2024. Commercial sales in the US could begin in 2024. The Company believes it has patent protection to 2038 and beyond.

WHIM Syndrome is a serious and debilitating rare disease with a large unmet need. Potential peak sales for Mavorixafor in WHIM Syndrome in the U.S. is in the $200 to $300 million range (my estimate), and European approval could follow 6 to 12 months later.

On the other hand, if the Phase 3 WHIM trial results fail to meet their primary endpoints etc. or are otherwise disappointing, it could spell trouble for the company.

We should know by year-end.

This article sets out my analysis.

Founders of X4

X4’s five founders are an impressive group with significant biotech credentials. The list includes its current CEO Dr. Paula Ragan, Ph.D. (M.I.T), as well as the late Henri Termeer (who passed away in 2017). Mr. Termeer was the past Chairman, President and CEO of Genzyme Corporation (bought by Sanofi), as well as a former board member of the Massachusetts Institute of Technology Corporation and the Board of Fellows of Harvard Medical School.

Senior Management Team

X4’s senior management team is led by Dr. Paula Ragan whose past experience also includes a senior role at Genzyme (where she had significant involvement in rare diseases).

X4 Management Team (X4 August 2022 Corporate Presentation)

X4’s board of directors includes a very experienced group. For more details, the Company’s website includes a short biography of each director found here.

Lead Drug Mavorixafor

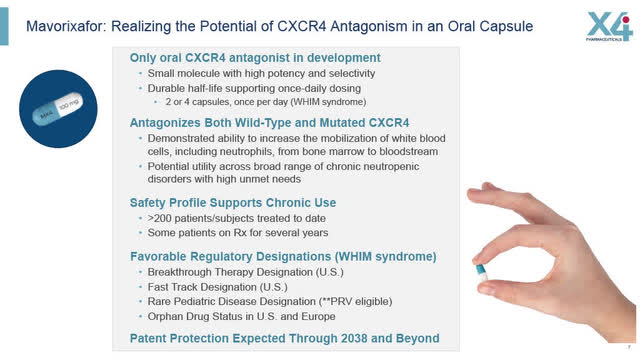

X4’s lead drug Mavorixafor is an orally administered, first-in-class, small molecule antagonist of the CXCR4 receptor, which according to X4’s August 2022 presentation, “enables the mobilization of immune cells from the bone marrow to the blood to improve immune system function.”

X4’s pipeline is set out in the slide below.

X4 Pipeline and Upcoming Milestones (X4 August 2022 corporate presentation)

Mavorixafor is being advanced in a number of clinical trials including:

1. WHIM Syndrome (Warts, Hypogammaglobulinemia, Infections and Myelokathexis), an immunodeficiency disease and sub-type of chronic neutropenia. X4 is currently in the completion stages of a global Phase 3 pivotal trial for WHIM Syndrome;

2. Chronic neutropenia disorders including subtypes Congenital, Cyclic and Idiopathic in which X4 is fully enrolled in a Phase 1b trial; and

3. Waldenstrom’s Macroglobulinemia (“WM”), a rare form of lymphoma (considered a type of non-Hodgkin’s lymphoma) in which a person’s bone marrow produces too many abnormal white blood cells; currently in Phase 1b trials. On August 4, 2022, X4 released some very promising Phase 1b trial results in WB (updated September 12). Mavorixafor was also awarded Orphan Drug designation by the FDA for WM disease regardless of CXCR4 genetic mutation.

Note, that X4 has recently announced its strategic decision to focus its resources on advancing Mavorixafor in only WHIM Syndrome and Chronic Neutropenia, and will proceed with this WM oncology and other assets only through partnering these assets going forward, although it will complete the Phase 1b WM trial (currently being finalized).

Upcoming Catalysts:

X4’s two upcoming catalysts are:

a. the presentation and discussion of the results from its open-label, multi-center Phase 1b clinical trial (ClinicalTrials.gov Identifier: NCT04154488) evaluating Mavorixafor, in 25 chronic neutropenia patients with idiopathic, cyclic, and congenital neutropenia. The presentation is scheduled for September 27, 2022 in the form of an X4 investor webinar. For more details on what type of information will be presented at the September 27 webcast, see X4’s August 31, 2022 press release here; and

b. the readout of X4’s pivotal Phase 3 4WHIM trial (ClinicalTrials.gov Identifier NCT03995108) of once-daily, oral Mavorixafor in individuals aged 12 and older with WHIM Syndrome, is expected to be released in Q4 (no specific date currently provided).

The outcome of this pivotal Phase 3 WHIM trial is the most significant upcoming catalyst for the Company as success could lead to Mavorixafor filing an NDA in Q3 2023, obtaining FDA approval and commercial sales beginning in 2024 in addition to a potential Priority Review Voucher (“PRV”) which can be sold for $100 million or more (upon FDA approval). The proceeds from the PRV could provide a form of non-dilutive funding for the Company in time for the Company’s commercial launch in WHIM Syndrome in 2024.

X4: Significant Near-Term Catalysts (X4 August 2022 corporate presentation)

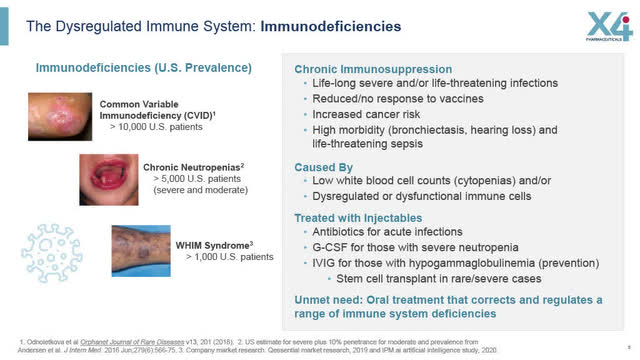

As X4 sets out in its website, chronic neutropenic diseases are caused by a dysregulated immune system, and patients who have these diseases suffer chronic immunosuppression, which in turn causes severe and/or life-threatening infections throughout their lifetime.

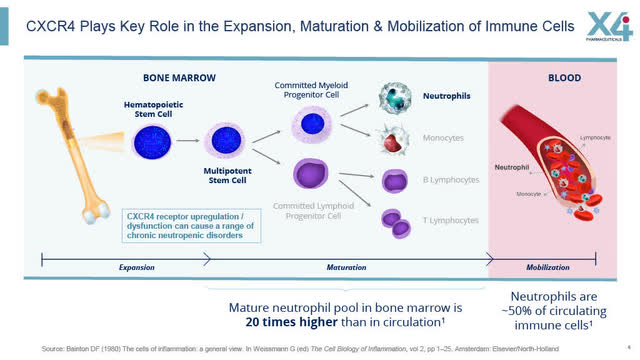

CXCR4 Plays Key Role in Immune Cells (X4 August 2022 corporate presentation)

Chronic neutropenic diseases are characterized by low white blood cell counts (cytopenia) and/or dysregulated or dysfunctional immune cells.

According to X4 and summarized in the slides below, the CXCR4 receptor plays a key role in “the expansion, maturation and mobilization of immune cells, and its dysfunction can cause a range of chronic neutropenic disorders.”

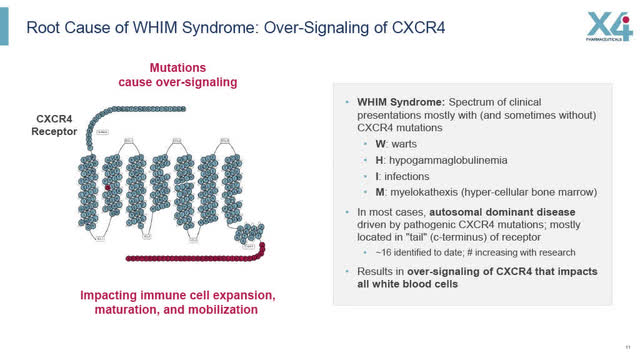

As discussed in X4’s slides below, the root cause of WHIM Syndrome is the “over-signalling of CXCR4, driven by CXCR4 genetic mutations, that impact all white blood cells”. X4 believes that Mavorixafor can “increase the mobilization of white blood cells, including neutrophils, from bone marrow to bloodstream”.

Root Cause of WHIM Syndrome: Over-signaling of CXCR4 (X4 August 2022 Corporate Presentation)

X4: Dysregulated Immune System (X4 August 2022 corporate presentation)

While there is no treatment approved specifically for WHIM Syndrome, the current protocol is to treat disease symptoms; antibiotics are prescribed for acute infection and multiple daily injections of granulocyte-colony stimulating factor (“G-CSF”) for those with severe neutropenia. Unfortunately, daily injections of G-CSF are often not tolerated well by patients or are discontinued because of the inconvenience/discomfort from taking multiple daily injections.

X4 believes that Mavorixafor will provide a safe and efficacious treatment for WHIM and other neutropenia-related diseases and if approved, has the potential of becoming the new standard of care in the treatment of all chronic neutropenia related diseases including WHIM Syndrome.

X4’s Regulatory Designations (WHIM Syndrome):

X4 has been awarded various regulatory designations for Mavorixafor in the treatment of WHIM including:

- Breakthrough Therapy Designation in the US

- Fast Track Designation

- Rare Pediatric Disease Designation (making it eligible for the Priority Review Voucher potentially worth $100 million or more)

- Orphan Drug Status in the US and Europe

Mavorixafor: Realizing potential of CXCR4 Antagonism in oral capsule (X4 August 2022 corporate presentation)

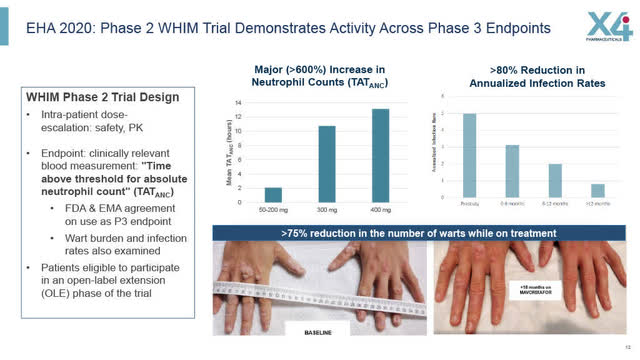

Phase 2 WHIM Trial Demonstrates Activity Across Phase 3 Endpoints

Looking at X4’s earlier Phase 2 WHIM results, X4 is cautiously optimistic that its pivotal Phase 3 WHIM trial will succeed.

Phase 2 WHIM trial results showed a 600% increase in neutrophil counts and a greater than 80% reduction in annualized infections. Furthermore, the WHIM patients who continued on in the open-label extension phase of the Phase 2 trial showed continued improvement as seen in X4’s slides below.

X4 August 2022 Corporate presentation

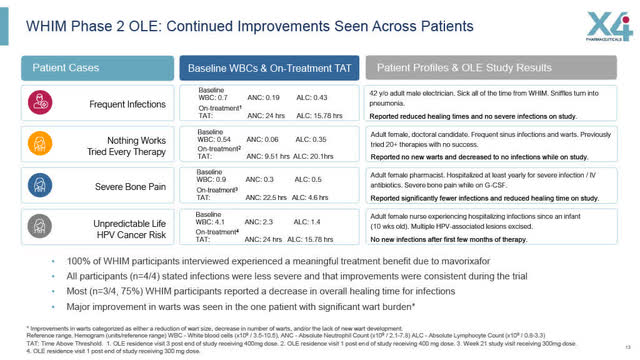

Phase 2 WHIM Open Label Extension: Continued Improvements Across Patients

In the Phase 2 WHIM Open Label extension trial, there was a continued benefit among WHIM patients as summarized by X4 in the slide below.

WHIM Phase 2 Open Label Extension: Continued Improvements Across Patients (X4 August 2022 Corporate Presentation)

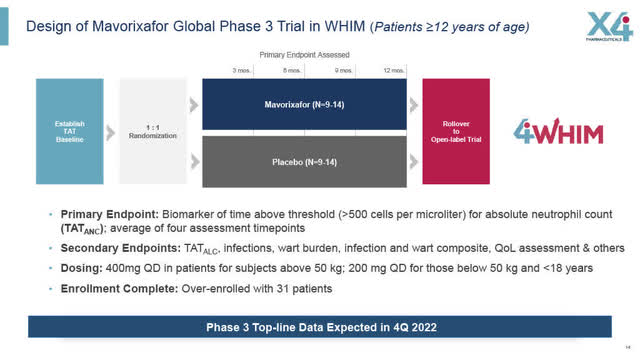

Design of WHIM Global Pivotal Phase 3 Trial

X4’s global pivotal Phase 3 WHIM trial design has two arms; 14 WHIM patients who received daily dosing of Mavorixafor, and a 14 WHIM patient placebo group. Ultimately, the trial was overenrolled and now has 31 patients.

The full details of the Phase 3 WHIM clinical trial, in 23 clinical sites in multiple countries in patients ages 12 and over, including the US, Europe and elsewhere, are set out on the clinicaltrials.gov website (ClinicalTrials.gov Identifier: NCT03995108) which was updated on September 14, 2022.

The Phase 3 WHIM trial consists of a Randomized Placebo-controlled period (52 weeks) followed by an open-label period in which any participant may continue to receive Mavorixafor (if available in the jurisdiction, until the trial terminates or the drug is approved commercially).

In order to be enrolled in this Phase 3 trial, the patient has to have, among other criteria, a “genotype-confirmed mutation of chemokine (C-X-C motif) receptor 4 (CXCR4) consistent with WHIM phenotype”.

Patients enrolled in the Phase 3 trial are treated for 52 weeks, with absolute neutrophil count measurements being the primary endpoint being measured at Weeks 13, 26, 39 and 52. There are also 52 secondary endpoints listed including infections, wart burdens, quality of life assessments and other measurements. Dosing is 400 mg per day for patients weighting over 50 kg and 200 mg once daily for those under 50 Kg and under 18 years of age. For greater details see the clinicaltrials.gov website (ClinicalTrials.gov Identifier: NCT03995108).

During our recent discussion, X4’s CEO indicated that X4 has had ongoing rigorous discussions with the FDA (because of its Breakthrough Therapy designation) during which the FDA has indicated that, assuming the clinical trial endpoints are met, the data from the Phase 3 trial will be sufficient to warrant full FDA approval for Mavorixafor in the treatment of WHIM for patients 12 years old and older.

Design of Global Phase 3 WHIM Trial (age 12 plus) (X4 August 2022 Corporate presentation)

Size of the WHIM Market

X4’s CEO estimates the WHIM patient population to be in the 1,000 to 3,500 range in the U.S. and probably at least double that number in the rest of the world.

She also indicated that based upon her own experience (when she held a senior position at Genzyme in rare diseases), she would not be surprised if the actual number of WHIM syndrome patients in the U.S. turned out to be significantly higher once an effective treatment for WHIM was approved and on the market (such that diagnosing WHIM patients would be a meaningful exercise and genetic testing for such suspected patients paid for by X4). At this point however it is simply speculation.

If and when Mavoraxifor for WHIM is approved by the FDA in the US, it will likely be approved in Europe about 6 to 12 months later.

As part of their commercial strategy to market Mavoraxifor for WHIM, X4 plans to create WHIM Centres for Excellence, provide ongoing education to medical professionals, work with WHIM patient advocacy groups and also pay for genetic testing to help diagnose WHIM Syndrome patients.

In discussing proposed pricing for Mavoraxifor in the U.S., if approved, while the pricing has not yet been finalized, it is anticipated that for a rare disease such as WHIM, pricing of Mavoraxifor, is expected in the range of $200,000 to $400,000 per annum in the US. Analysts covering X4 have used an average of about $300,000 annual pricing in modelling Mavoraxifor’s future revenues.

If X4 manages to take most of the WHIM market in the U.S. (which if approved, is likely), that could generate peak annual sales of between $200 to $300 million (assuming 1,000 WHIM patients in the U.S. at $200,000 to $300,000 per annum) less the usual discounts. Clearly identifying and expanding the number of WHIM patients, will potentially increase sales revenue projections (assuming diagnosis, prescription and insurance coverage). Sales in Europe and the rest of the world could double that figure (assuming that those markets aren’t licensed out under license/distribution agreements in which case other forms of revenues will be expected).

As well, if Mavoraxifor is approved for WHIM Syndrome in the U.S. and Europe, expansion to Japan, China and other parts of the world could also follow although more likely those ex-US jurisdictions would be the subject of licensing agreements (another source of potential non-dilutive financing and revenues for X4).

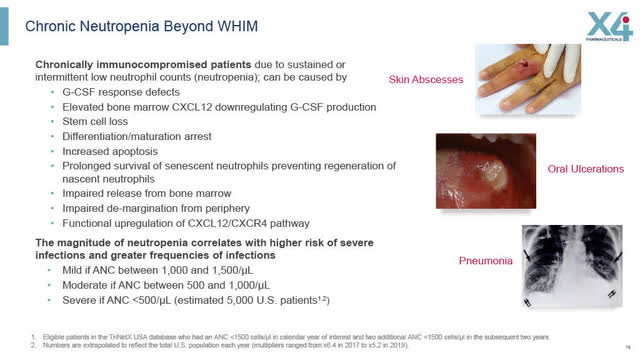

Chronic Neutropenia Beyond WHIM Syndrome – Phase 1B trial

On September 27th, X4 will be providing a corporate update and updated clinical trial data from its Phase 1b clinical trial with 25 patients being treated for Chronic Neutropenia or “CN”, including severe congenital, idiopathic or cyclic CN. Severe CN conditions can flare up a few times per year, with very severe and frequent infections, which may require hospitalization, IV administered antibiotics and potentially severe illness or even death.

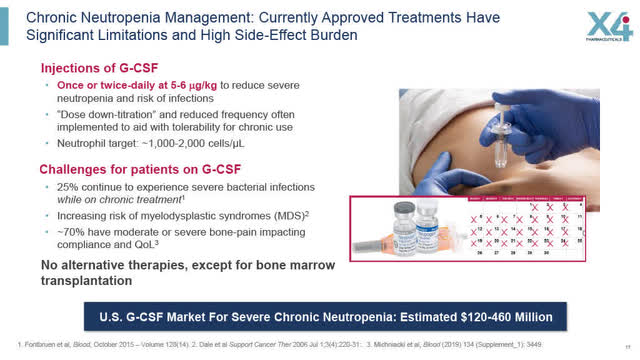

In order to manage chronic severe CN, current treatments are unsatisfactory such as once or twice daily injections of G-CSF which are not always well tolerated or tolerated at all and which can have serious side effects. The only other alternative is a bone marrow transplant which is painful, inconvenient and expensive.

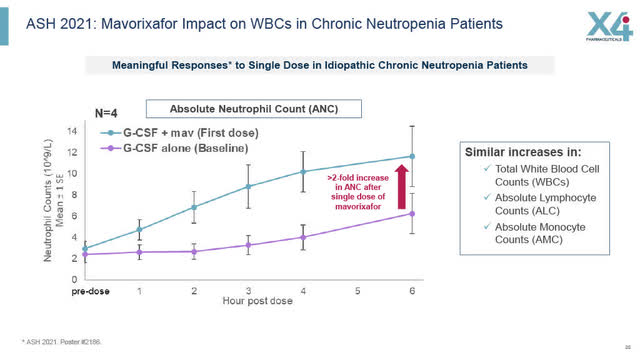

Chronic Neutropenia patients have a very low neutrophil count so potential treatments try to improve the absolute neutrophil count (“ANC”) as well as increases in white blood cells, lymphocyte and monocyte counts.

Initial Phase 1 studies involving Mavorixafor and CN showed some promising results including data presented at ASH in 2021. As can be seen in the slide below, a single combination dose of Mavorixafor in combination with G-CSF compared to a single dose of G-CSF alone, resulted in a 2 fold increase in Absolute Neutrophil Count, in addition to increases in total white blood cells, absolute lymphocyte counts and absolute monocyte counts. See X4’s slide below summarizing its ASH2021 results for more details.

ASH 2021: Mavorixafor impact on white blood cells in CN patients (X4 August 2022 corporate presentation)

Chronic Neutropenia Beyond WHIM Syndrome (X4 August 2022 Corporate Presentation)

Current Treatments for CN have Significant Limitations (X4 August 2022 Corporate presentation) 25% of CN Patients in US experience Serious Infection Events Each Yr. (X4 August 2022 Corporate presentation)

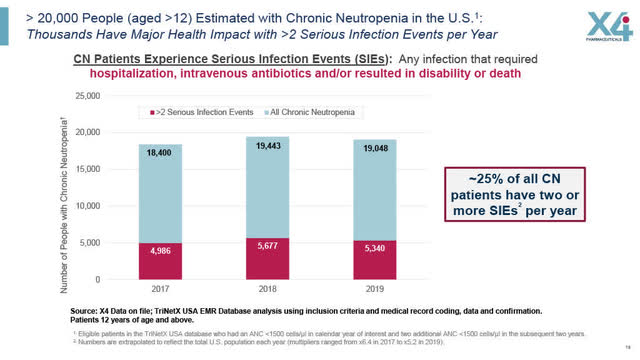

X4 estimates that its target market in the US for chronic neutropenia patients are those who suffer more than two serious infection events (“SIEs”) per year (approximately 5,000 patients i.e. 25% of all CN patients). An SIE is defined by X4 as an infection that requires hospitalization, IV antibiotics and/or results in disability or death.

Presumably, if Mavorixifor obtains FDA approval in WHIM, and if the Phase 1b trial results are encouraging in chronic neutropenia, the odds of obtaining approval for Mavorixafor in all types of chronic neutropenia increase significantly. X4 anticipates that it will have greater clarity on the path forward for Mavorixafor in the non-WHIM CN indications next year.

X4 Pharmaceuticals, Inc.: Corporate Summary

Symbol: XFOR (Nasdaq):

52-week share price high and low– $6.18 to $0.86

Share price close of September 14, 2022: $1.12

Market Cap: $91,750,000 assuming 86,516,563 common shares outstanding (including the 13,276,279 pre-funded June 30, 2022 $55 million private placement financing warrants described below, as well as an additional 4.6 million previously issued pre-funded warrants, which I am including as equivalent to common shares for the purpose of this calculation)

Common Shares outstanding as of June 20, 2022 – 30,991,198 (Source: X4 Form 10-Q, filed August 4, 2022)

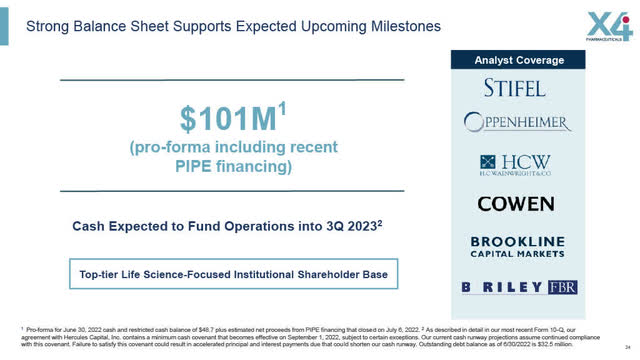

X4 Financial Snapshot (X4 August 2022 Corporate Presentation)

Cash: Pro-forma of $101 Million following June 30th, 2022 financing. See X4’s Slide above.

$55 Million Private Placement announced June 30, 2022 (closed July 6, 2022) Unit price of $1.095, under which 37,649,086 common shares were issued, 13,276,279 pre-funded warrants were issued to purchase 13,276,279 common shares at an exercise price of $0.001; and accompanying 50,925,365 warrants were issued with an exercise price of $1.095, with a 60 month expiry period. (Source: X4 Form 10-Q filed with the SEC on August 4, 2022)

Summary of Estimated Common Shares (or equivalent pre-funded Warrants)

86,516,563 common shares (including 13,276,279 pre-funded Warrants from the June 30th financing, as well as 4.6 million pre-funded Warrants from earlier financing, which I am treating as common shares for the purposes of calculating market cap and most other purposes) (Foregoing calculation confirmed by X4’s CFO by email)

50,925,365 warrants outstanding (from the June 30 private placement) with an exercise price of $1.095 (expiring on or about July 6, 2027)

Additional Warrants outstanding: 3.9 million Class A warrants have a 2024 expiry and $13.20 exercise price; 5.4 million Class B warrants have a $1.50 exercise price and an effective expiry date 30 days post Phase 3 WHIM data (which is expected to be released in Q4).(Source: X4 Form 10-Q and email confirmation from X4’s CFO)

Stock Options Outstanding as of June 30, 2022: 1,746,638 options at a weighted average exercise price of $8.59 and 7.5 years before expiry (Source: X4 Form 10-Q)

Long Term Secured Debt: Hercules Loan Agreement, as Amended:

$33,097,000 outstanding as of June 30, 2022 to Hercules Capital Inc. (“Hercules”) with an effective annual rate as of June 30 of 10.9% per annum. Subject to meeting certain milestone events, the monthly loan payments are interest only until February 1, 2023 (possibly extended to August 1, 2023 or possibly extended to February 1, 2024 as described below); subject to certain amended terms, thereafter monthly interest and principal payments are to be made; the Hercules loan matures on July 1, 2024. (Source: X4 Form 10-Q, Note 7).

On June 30, 2022, X4 entered into Amendment No. 4 to the Hercules Loan Agreement which added two milestones: the first was to extend the interest-only payments from February 1, 2023 to August 1, 2023, provided X4 raised $50 million (achieved) and achieve Performance Milestone III as defined in the Hercules Loan Agreement but not disclosed in the Form 10-Q. (Source: Note 7 of Form 10-Q).

To achieve the second milestone which would extend the interest-only monthly payment portion of the Hercules loan to February 1, 2024 the Company has to raise an additional $25,000,000 and file a New Drug Application for Mavorixafor for the treatment of WHIM syndrome. In addition, there is a requirement under the Hercules Loan Agreement that X4 maintain a minimum cash balance of $30,000,000 (in which Hercules has a first position security interest security). The $30,000,000 cash minimum can be reduced to $20,000,000 following the achievement of Performance Milestone III. If and when X4 files a New Drug Application for Mavorixafor for the treatment of WHIM syndrome, that covenant is extinguished. (Source: Note 7, Form 10-Q)

The Hercules Loan Agreement also restricts the Company’s ability to incur additional indebtedness, pay dividends, or engage in certain fundamental business transactions such as M&A, with certain exceptions. (Source: Note 7, Form 10-Q).

Outstanding Prospectus Relating to the Shareholders who participated in the June 30, 2022 $55 Million Financing

X4 filed a Prospectus dated August 5, 2022 relating to the resale of up to 101,850,730 shares of X4 by the listed shareholders who participated in the June 30, 2022 $55 million private placement financing. The 101,850,730 share figure referenced in the prospectus would cover both the common shares, pre-funded warrants, as well as unexercised warrants ($1.095 strike price, 60-month expiry date) received as part of the financing.

Those participating shareholders are sophisticated biotech investors and include Orbimed, Bain Capital Life Sciences, Growth Equity Opportunities, Lumira Ventures (related entities), Point72 Associates and even Hercules Capital. My assumption is that these investors invested in X4 (in a very weak biotech market) after significant due diligence and being satisfied with Mavorixafor’s chances of success and the upside market opportunity.

As I see it, the parties funding the $55 million private placement can minimize or even eliminate their downside risk by selling their X4 common shares and/or pre-funded warrants, and then simply keeping the 5-year warrants (eliminates the investors’ downside risk while fully maintaining upside if the company succeeds).

The problem is that the shares in X4 are not particularly liquid so in order for one of these significant shareholders to sell sufficient shares, whether simply to minimize their downside or to fund their $1.095 warrants, it may put a heavy lid on X4’s share price for some time even if the upcoming clinical trial results are positive.

Furthermore, unless X4 pays off the secured Hercules Capital Loan quickly (assuming successful Phase 3 WHIM trial results) the company may be under pressure to raise substantial funds in mid-2023 to meet certain loan milestone conditions.

If the Phase 3 WHIM trial fails or its results are insufficient to allow X4 to file a New Drug Application, X4 may be in serious financial trouble.

I am mindful of how badly things can go for biotech companies (in this bear biotech market) with secured lenders which have loan agreements with tough terms. Investors may recall the recent events with 4D pharma (LBPS) which was unable to pay off its $13.9 Million secured loan and was put into “Administration” a form of bankruptcy protection in June, 2022 by its secured lender Oxford. See 4D Pharma’s August 4, 2022 filing from the Joint Administrators of 4D Pharma. The 4D Pharma shares had been trading on both the London AIM and Nasdaq and are now either suspended or in the case of the Nasdaq listing, de-listed.

I did have some follow-up discussions with X4’s CFO Adam Mostafa on September 15 regarding its capital structure and the impact of the outstanding 51 million warrants. He gave me a more optimistic perspective which was that if the upcoming Phase 3 WHIM clinical trial results are positive the investors understood when they made the investment that it would be in their collective interest to exercise all 51 million warrants (generating another $55 million and avoiding additional dilutive financing). That additional $55 million (if the funds came in H1 2023 from the warrant exercise) would be sufficient to provide X4 the funding required to file an NDA in Q3 2023, obtain FDA approval in H1 2024 and obtain the $100MM plus Priority Review Voucher in H1 2024.

While I agree with Mr. Mostafa that it makes logical economic sense to do so (assuming successful Phase 3 WHIM trial results), there is no obligation on these warrant holders to act in the collective best interests when their warrants don’t expire until July, 2027.

Mr. Mostafa also addressed some of my concerns about the secured creditor Hercules Capital and its secured loan agreement. He indicated that Hercules have been very supportive to date, and willing to be flexible (as reflected in the various amendments to the Hercules Loan Agreement). He also pointed out that Hercules Capital was a participant in the recent $55 million private placement as an equity investor. His view was that if all goes well with the clinical trial results, Hercules would continue to remain flexible and supportive as a lender. Of course, if the Phase 3 WHIM clinical trial fails, all bets are off.

We’ll see soon enough!

Upcoming Milestones/Catalysts

X4’s upcoming milestone/catalysts include:

- Phase 1b Chronic Neutropenia trial update and discussion on September 27, 2022

- Phase 3 WHIM trial results in Q4

- subject to successful Phase 3 WHIM trial results, the filing of an NDA for Mavorixafor in WHIM Syndrome in early Q3, 2023

- the raising of additional funding in H1 2023 (assuming successful Phase 3 WHIM trial results) either by the exercise of warrants (not within X4’s control), or some other form of dilutive or non-dilutive options

- the granting of FDA approval for Mavorixafor in WHIM Syndrome in H1 2024 and commercial launch in the U.S. thereafter

- the potential granting of a Priority Review Voucher (worth in excess of $100 million) upon FDA approval of Mavorixafor in WHIM syndrome, and the sale of the voucher soon thereafter (generating in excess of $100 million in non-dilutive funding)

Analyst Ratings (from Bloomberg search September 14)

(including only those reports post the June 30, 2022 private placement financing)

Firm Recommendation Price Target Date

Oppenheimer – Outperform $5.00 08/21/2022

HC Wainwright – Buy $3.50 08/05/2022

B. Riley Securities – Buy $7.00 08/05/2022

Stifel Buy $5.00 08/04/2022

Cowen Outperform 08/04/2022

Brookline Capital Buy $6.50 08/04/2022

Summary of Investment Thesis

With an experienced management team and some promising clinical data so far, X4’s proprietary drug Mavorixafor has a reasonable chance of generating successful upcoming clinical trial results in both a Phase 1b trial in Chronic Neutropenia and more importantly in its Phase 3 pivotal trial in WHIM Syndrome.

Although there are some structural capital structure challenges including the 51 million outstanding warrants granted by X4 under the $55 million recent private financing, X4 is currently trading for about its cash position. If its Phase 3 WHIM trial generates successful results, X4 has the potential of creating an approved first in class drug small molecule antagonist of the CXCR4 receptor that can obtain FDA approval in WHIM Syndrome, a rare disease, with a potential earning of a Priority Review Voucher in H1 2024 which can be monetized for an amount in excess of $100 million.

Mavorixafor has the potential to generate $200MM to $300MM in the US alone in WHIM syndrome, and the upside for the markets in WHIM Syndrome outside of the U.S. may also be significant.

The potential market size for Mavorixafor in treating Chronic Neutropenia may be a multiple of the WHIM market but X4 is still a number of years away from potential approval in CN, with greater clarity expected on the next steps in 2023.

If all goes well, X4 could generate a multifold return for investors in the next couple of years, assuming successful Phase 3 WHIM trial results, FDA approval in H1 2022 and the Priority Review Voucher is obtained in H1 2024. In the short term, there is also the potential if the Phase 3 WHIM trial results are successful.

On the other hand if Mavorixafor’s Phase 3 WHIM trial results do not meet its primary endpoints, or are otherwise unsuccessful, X4 may be in trouble; its secured Hercules Loan could get called, warrants won’t get exercised and its share price will almost certainly plummet.

While the chances of success in the Phase 3 WHIM trial seem reasonably good, there is no assurance of success so an investment in X4 may result in a loss of some or all of your investment.

After doing my own due diligence and considering the pros and cons and the risks involved, I liked the risk-reward analysis and decided to buy a small position in X4.

Be the first to comment