Alina555/iStock Unreleased via Getty Images

Introduction and Thesis

In my previous Wynn Resorts (WYNN) article, I had a fairly negative view of the company. This view came from the uncertainty the Chinese Communist Party, CCP, imposed on the region of Macau. A significant portion of Wynn’s business comes from Macau, and because the CCP was threatening the complete regulation of Macau, I believed that the risk-reward ratio of investing in Wynn Resorts was not attractive. Today, the risk of such dramatic actions still stands in some way leading to continuous risks for Wynn Resorts. Further, as Macau’s border re-opening continues to be uncertain, Wynn’s Macau operations pose significant risks and uncertainty. However, the company’s U.S. operations are showing strong recovery and future potentials leading the group’s overall recovery. Taking all of this information into consideration, I believe investments in Wynn Resorts are still a hold.

Macau’s Gaming License Update

At the beginning of the 2021H2, there have been concerns of CCP outright refusing to renew Macau’s gaming license that is set to expire in 2022, a politically imperative year for China. After internal research and a public consultation process that ended toward the end of 2021, not much has changed. Many hurdles and uncertainties are expected in the process of getting the licenses renewed. It may be unlikely that the CCP outright refuses to approve the extension of the license; however, I believe strong regulations and increased government intervention is extremely likely.

2022 is an important year for the ruling party of the Chinese government and its leader Xi Jinping. 2022 is the 100th anniversary of the CCP and the pivotal year for Xi Jinping’s other term of leadership. Therefore, Xi Jinping has been aggressively pushing many of its political goals including common prosperity, the goal of sharing wealth among everyone reducing the wealth gap. As a result, rich and powerful that takes views against the party have been prosecuted in recent months prompting many to believe that increased regulation in gambling is only a matter of time. The casino is the very symbolism of wealth and prosperity reserved for the upper-middle class and the wealthy. Thus, given CCP’s recent direction, I believe increasing regulations in Macau is likely posing a significant risk to companies operating in Macau including Wynn Resorts. Regulations may not be huge, but the simple fact that the government is regulating the gambling industry may discourage many Chinese tourists from visiting Macau.

Wynn’s Macau Operation

Despite the political risks of Macau, Wynn Resorts is showing a fairly strong recovery in its Macau operations. The occupancy rate for Wynn Palace and Wynn Macau has increased to 51.9% and 51.3% from 11.6% and 16.6%. However, I believe the full recovery back to pre-pandemic operations poses significant uncertainty.

Since the start of the pandemic, China, unlike many Western nations, has been implementing zero-covid policy imposing severe restrictions and lockdowns to maintain Covid cases near zero. As a result, the future of Macau’s full border re-opening to mainland China and Hong Kong is unknown. Omicron cases ticking up infection rate across the nation has made China’s officials reluctant to re-open travel to Macau, and the CCP’s goal of successfully hosting the Beijing winter Olympics will likely make border re-opening the least of their priorities for now. This current state is extremely damaging for Macau and Wynn Resorts’ Macau operations because, in 2018, 88.1% of travelers entering Macau came from China and Hong Kong. Further, because international border re-opening is not even considered today, the uncertainty for the future recovery of Macau creates the same uncertainty for Wynn Resorts.

I personally believe that restrictions will likely gradually decrease in months following the end of the Beijing Winter Olympics, which is expected to end on February 20th, 2022. I believe the Chinese government will have fewer incentives to maintain the current level of zero-covid policy at the cost of its economic recovery. However, I may be wrong because the main reason for the zero-covid policy implementation in China was due to its citizens’ vast support for the policy. Also, for the CCP, it may be in their interest to reduce the Western culture’s impact on its citizens through lockdowns going into the party’s 100th anniversary toward the end of 2022.

Wynn’s U.S. Operations

Unlike the uncertainties and risks, Macau operations pose to Wynn Resorts, its U.S. operation is showing an extremely strong recovery and a potentially even brighter future going into 2022.

During 2021Q3, Wynn Vegas saw an occupancy rate of 83% compared to 39.2% occupancy last year while Encore Boston Harbor saw an occupancy rate of 87.8% compared to 72.7% compared to last year. Wynn Resorts’ U.S. operation is showing a strong recovery as the public widely believes that the risks from the pandemic are likely over despite the record number of infections in the U.S.

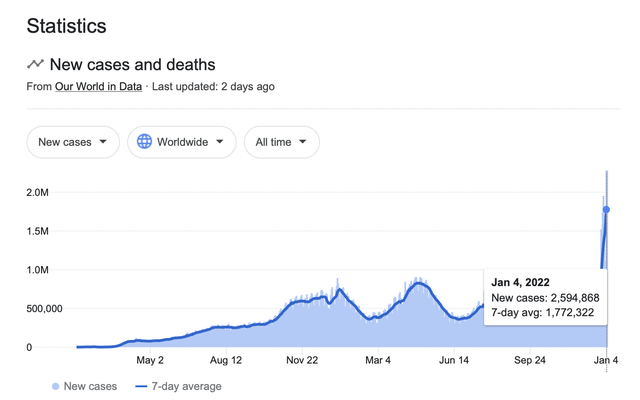

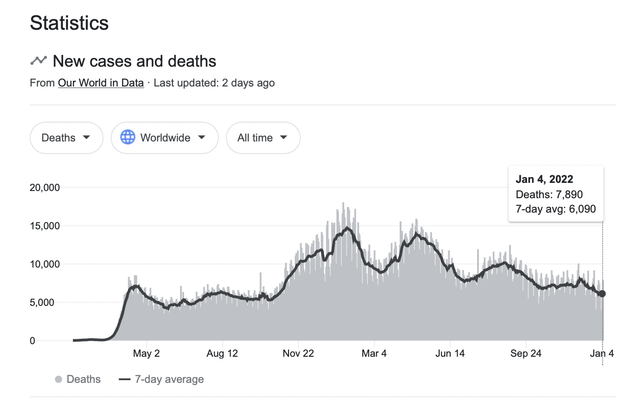

As the picture directly below shows, the U.S. is recording the highest number of Covid cases since the advent of the pandemic; however, as the second picture below shows, the fatality rate has been trending down despite an uptick in cases. This phenomenon is resulting in travelers in the U.S. going back to traveling while taking some precautions.

I believe this current recovery trend for Wynn’s U.S. operations will persist in 2022 as the vaccination rate increase continues while the Covid oral treatment pill is expected to become widely available in the coming few quarters.

Financials and Valuation

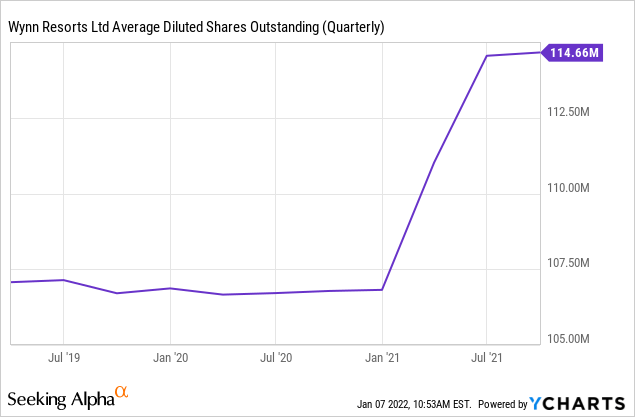

Wynn Resorts is operating near profitability today, and the company’s operations are likely to improve as U.S. operations continue to grow. According to the 2021Q3 earnings report, the company reported a revenue of $994 million along with -$83 in operating loss, which includes about $177 million depreciation and amortization costs. In total, Wynn Resorts reported a net loss of about $166 million. Further, compared to pre-pandemic times, quarterly interest payout increased from $115 million in 2019Q3 to $150 million in 2021Q3 showing about a 30% increase. As the chart below shows, the company’s outstanding shares increased about 10% showing some dilution. Wynn Resorts’ balance sheet was not any much better with about $2.5 billion in cash and about $12.6 billion in total assets. However, the total liabilities of Wynn Resorts were $13.2 billion making the stockholders’ equity negative $593. Therefore, Wynn Resorts may have a difficult time recovering its financial health back to pre-pandemic times.

[Chart created by author using YCharts in Seeking Alpha]

Wynn Resorts’ valuation, in my opinion, was fairly valued. The company has a market capitalization of about $10 billion, which is about 50% lower than pre-pandemic times. Considering that the revenue recovery was at about 60% of pre-pandemic levels and negatively affected financial operations, I believe this valuation is fair.

Summary

Wynn Resorts is attempting to recover back to the pre-pandemic prosperity it enjoyed; however, because of the significant uncertainties and risks that the company has regarding its Macau operations, I believe Wynn Resorts is a hold. The political uncertainty and the potential full recovery of Macau make me believe that investors can seek more favorable pandemic recovery stock elsewhere.

Be the first to comment