Duncan_Andison/iStock via Getty Images

Dear Partners,

Our investment philosophy is predicated on the belief that we’re living through a prolonged period of enormous change. These upheavals—from the technological, to the industrial, to the monetary—will create remarkable opportunities (and risks) for investors.

As we’ve said before, we believe it’s a Cambrian environment.

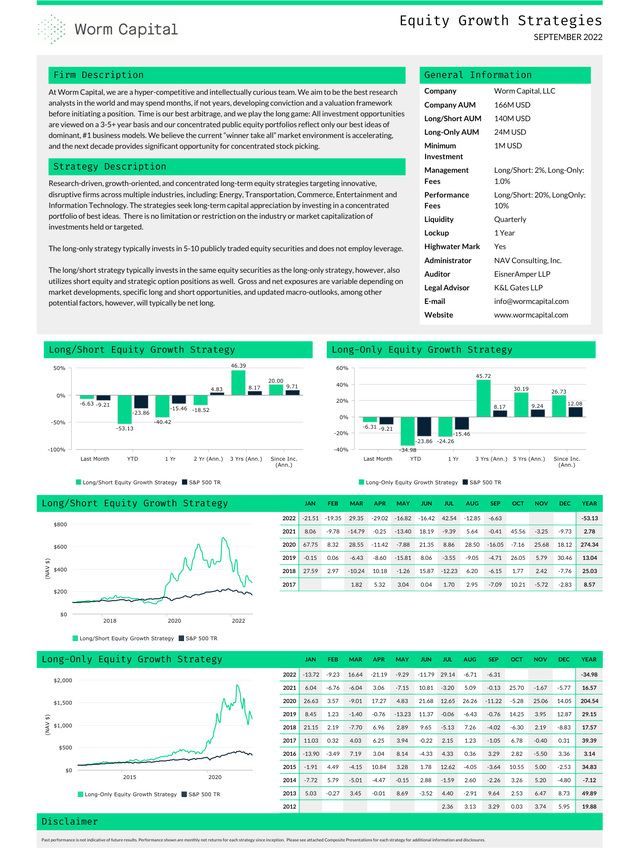

Please see below for results since inception:

Long/Short Equity Growth Strategy Net Performance

|

September |

YTD |

1 Year |

2 Year |

3 Year |

Inception* |

|

|

Strategy |

-6.63% |

-53.13% |

-40.42% |

-18.52% |

46.39% |

20.00% |

|

S&P 500 TR |

-9.21 % |

-23.86% |

-15.46% |

4.83% |

8.17% |

9.71% |

Long-Only Equity Growth Strategy Net Performance

|

September |

YTD |

1 Year |

3 Year |

5 Year |

Inception* |

|

|

Strategy |

-6.31% |

-34.98% |

-24.26% |

45.72% |

30.19% |

26.73% |

|

S&P 500 TR |

-9.21% |

-23.86% |

-15.46% |

8.17% |

9.24% |

12.08% |

|

*7/1/2012 Past performance is not indicative of future results. Performance shown are monthly net returns for each strategy since inception. Please see attached Composite Presentations for each strategy for additional information and disclosures.

|

This view of the future informs how we allocate capital (concentrated in our top ideas), how we spend time on research (future-focused qualitative analysis), and how we think about finding value across the market (hint: it’s not to be found in a P/E ratio).

We continue to believe, much as we did when we launched the long-only strategy in 2012, that rewards will accrue to those investors who remain disciplined, focused on the future, and positioned accordingly for years of compounding.

Over the next few years, we anticipate a historic redistribution of wealth in the stock market. This dynamic will create necessary periods of intense volatility, market dislocations, and capital rerouting.

All of which to say: Despite this year’s pullback in asset prices, nothing material has changed in our view. We’re on track. We continue to believe that many industrial laggards will perish, while other new entrants will achieve remarkable, near-exponential growth. We believe our portfolio is positioned on the positive side of these upheavals. In the short term, certain businesses or sectors will go in and out of favor. But we play the long game. And over the long game, there will be big winners—and big losers.

As stock pickers, this environment provides an especially fertile ground for active management. Our style of investing does not rely on favorable monetary policy to lift all asset prices. In fact, we believe a challenging monetary policy will only make our concentrated style even more advantageous in the years to come, even if we must weather the inevitable periods of volatility.

As always, we’re excited to have you as partners on this journey.

Last month, we published a Q&A with our CIO Arne Alsin that explores how he’s thinking about the market, our current positions, and the landscape ahead of us.

Rather than repeat much of what has been said a few weeks ago, we’d like to take the opportunity to address a couple of questions that we’ve periodically received from of our investors. These questions are:

- How does a position that you’ve been researching enter the portfolio?

- How do you think about exiting a position?

These are simple, but significant questions. (As a rule, simple questions are not always good questions—but good questions are almost always simple.) The answers, as you might expect, are highly nuanced. But we’d like to address them here.

Let’s start with the first one. “How does a position that’s been on your watchlist enter the portfolio?” There is a long lineage of using sports metaphors in investing, so forgive us for using an arguably trite (but nonetheless helpful) analogy here to explore the answer: Baseball.

In baseball, 30 teams compete over 162 regular season games in a quest to win the World Series. In this analogy, general managers are the CIOs who make the ultimate decisions, talent scouts are the in-house researchers, and the players around the world are the businesses available to purchase.

In this game, unlike baseball, there are no contracts—and no loyalty. Every player, from 9:30am ET to 4pm ET has a sign above his head with a dollar amount in the form of a stock price telling us what the market is willing to pay to acquire that player. On a daily or even yearly basis, the prices don’t give us much actionable information. So, to get useful information, we must go out and watch the player. The goal, of course, is to discover what they are worth—and to find significant mismatches between price and value.

This is called “investment research.”

Our watchlist of stocks is composed of anywhere from 50 to 200 businesses at time. It’s an ever-rotating cast. To continue the analogy, on the watchlist there is a wide range of players: There are high school phenoms and veteran utility players. Very often, the market gets excited about the high school phenoms and places an extremely high value on these prospects. It’s best to be wary of them. For us to purchase a company, it needs to prove to us that it can compete at the highest levels over a period of years. This requires patience.

When a GM finally acquires a player, or when we buy a stock, we do so with incomplete information. Even the best players can (and do) falter. Businesses are very similar. It’s up to the GM, then, to make sure the roster is best positioned to win throughout the season.

This is why we spend so much time on the analysis. An average baseball scout will certainly be able to tell you all about a pitcher’s fastball. But a really great scout will be able to tell you about what drives that pitcher, if that pitcher can survive a rough patch, and what that pitcher’s ultimate ambitions are.

Fundamental research is more than just getting to know a company and its financials— it’s about getting to better understand the soul and the people behind an organization to understand what type of growth it can exhibit.

In our Q&A with Arne, he says this about the current roster of “players”:

“So, yes, we’re concentrated right now. Will the portfolio look like this in the future? Almost certainly not.. But when the time is right, I think we’ll go back to owning five or seven or even 12 positions again. Or maybe even more. I’m sure we’ll talk about it more in this conversation, but we’re just in a unique situation right now. A good one, I should add. “

In baseball, of course, you could never have a three or five or even 10-player roster. In investing, however, there is no such rule. This flexibility allows us to become more concentrated when the opportunity presents itself. As Arne points out in our recent Q&A, we’ve identified a relatively small number of companies that we believe display significant mismatches between price and value, which leads us to be relatively concentrated. Over time, however, as that gap narrows—or when the market offers us discounts—it will make sense to add new positions from the watchlist.

This flexibility is integral to how we allocate capital.

On the second question, “How do you think about exiting a position?,” our answer would be very much the inverse of the first. To again use the baseball analogy, there are a couple of scenarios. First: We were wrong. Perhaps we determine we overpaid for a high school phenom who couldn’t deliver the goods once called up to the majors. Rather than wait around for him to develop and “hope” he gets better, we cut him quickly to redirect capital. A good historical example here would be our position in Zillow (Z). While it was a relatively small position, we cut it quickly when we determined they would be unlikely to accomplish a significant business model pivot.

Second, we’ll exit a position when the gap between intrinsic value and price narrows to the extent that our capital can find higher risk/reward opportunities elsewhere. An example here would be Netflix (NFLX), which we sold out of the portfolio in the summer of 2021 when we felt the valuation gap had narrowed considerably, and thus presented diminishing potential go-forward returns for our partners.

We should note that we never sell positions simply based on their price—or because they have fallen out of vogue with the investment community. Very often, our positions will go in and out of favor with the market, leading to extreme ups and downs in their stock prices. We don’t ignore the prices, but prices on their own can be relatively meaningless information if you’re trying to assess the underlying value of the business. What we care about, pretty much exclusively, is business execution.

So, to sum it up: Positions enter and exit based on a variety of factors, but the ultimate goal of the portfolio is to be best positioned for the future. In any given month or year, prices will bounce around, but what we care about most is our companies’ enduring ability to grow, improve, and become an integral part of their customer’s lives.

Over time, the market has been very adept at rewarding those who take this approach to compounding wealth. In other words, prices converge on value over the long-term.

As we’ve often said, we’re entering a period of prolonged uncertainty and industrial change. This setup will create incredible opportunities for active investors who are focused on the underlying technological trends shaping our economy. Inversely, we continue to believe there is immense risk in companies that cannot adapt in this new environment.

It is imperative, then, to be positioned accordingly.

Fundamentally, we are optimistic about the future and our strategies. We believe we’re set up for a solid runway of growth. Short-term fluctuations in the market are the price of entry, and completely natural in this environment.

Over the long-term, we expect to do well, and we’re thrilled to have you on this journey with us.

Sincerely,

Worm Capital

|

Disclosures: This has been prepared for information purposes only. This information is confidential and for the use of the intended recipients only. It may not be reproduced, redistributed, or copied in whole or in part for any purpose without the prior written consent of Worm Capital. The opinions expressed herein are those of Worm Capital and are subject to change without notice. The opinions referenced are as of the date of publication, may be modified due to changes in the market or economic conditions, and may not necessarily come to pass. Forward looking statements cannot be guaranteed. This is not an offer to sell, or a solicitation of an offer to purchase any fund managed by Worm Capital. This is not a recommendation to buy, sell, or hold any particular security. There is no assurance that any securities discussed herein will remain in an account’s portfolio at the time you receive this report or that securities sold have not been repurchased. It should not be assumed that any of the securities transactions, holdings or sectors discussed were or will be profitable, or that the investment recommendations or decisions Worm Capital makes in the future will be profitable or equal the performance of the securities discussed herein. There is no assurance that any securities, sectors or industries discussed herein will be included in or excluded from an account’s portfolio. Worm Capital reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs. Recommendations made in the last 12 months are available upon request. Worm Capital, LLC (Worm Capital) is an independent investment adviser registered under the Investment Advisers Act of 1940, as amended. Registration does not imply a certain level of skill or training. More information about Worm Capital including our investment strategies and objectives can be found in our ADV Part 2, which is available upon request. |

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment