Matteo Colombo

Dear Partners,

Despite the recent market selloff, the businesses that we own are compounding in value at, or beyond, our expectations. There’s been no change to our long-term investment theses on any of our core positions, and so we’ve made very few changes to the portfolio in the last three months.

We continue to feel extraordinarily bullish on our specific set of investments. Once some of the broader macroeconomic pressures abate—and we are confident they will—we believe we could snap back in relatively short order.

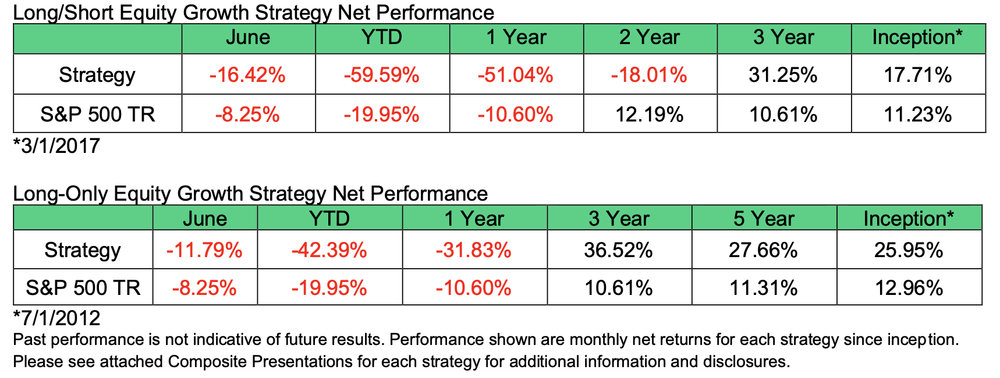

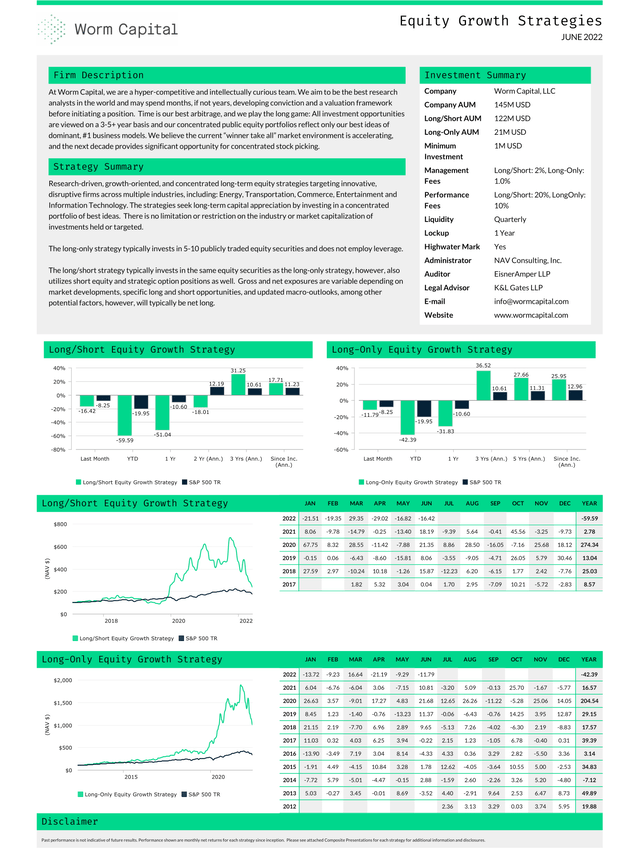

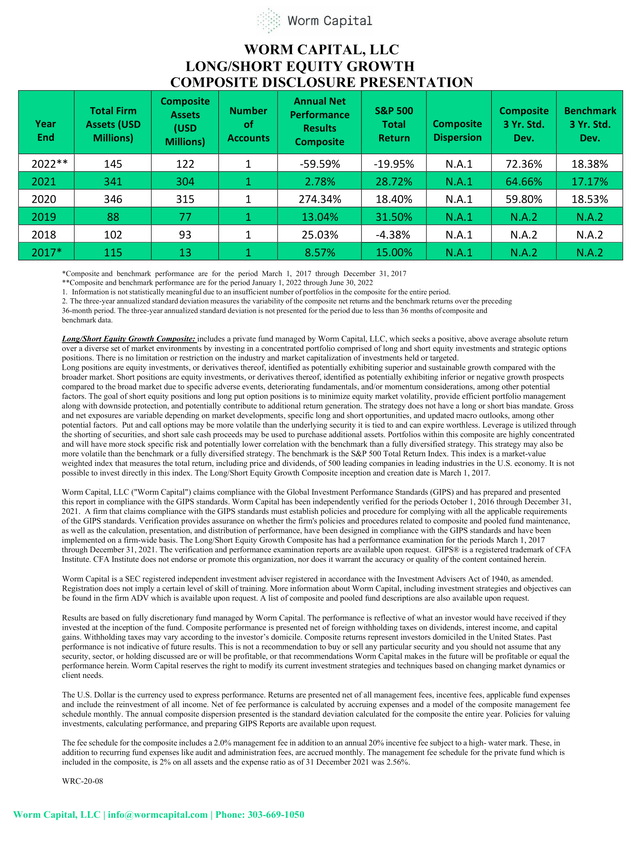

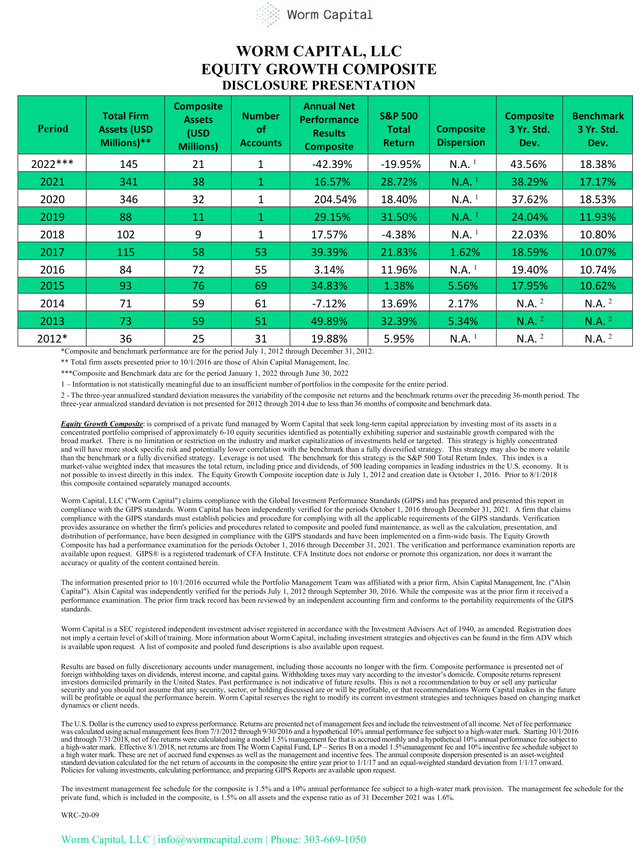

Please see below for results since inception:

Bear markets are inherently uncomfortable, but historically, they have been short-lived. They also have tended to be followed by much longer periods of market growth. As we wrote in our Q1 letter earlier this year, “major declines are relatively rare, and always followed by five to 10 years of ‘good times,’ in our experience.” Historically, markets also tend to bottom midway through economic downturns. For any long-term investor, short-term market fluctuations should be considered noise. If anything, they are typically a good time to load up on one’s highest conviction ideas.

In this letter, we’ll discuss two core positions: Tesla and Spotify.

Tesla (TSLA)

Our highest conviction idea, Tesla, continues to execute on its core objectives. Right now, we believe fair value for the business is far higher than the stock quote, but we do not believe this discrepancy can exist for much longer.

To be clear, this quarter presented significant—but temporary—challenges for Tesla. In particular, Covid-related shutdowns caused a multi-week idling of Tesla’s factory in Shanghai, which halted all vehicle production. Supply chain issues have also persisted globally, limiting Tesla’s true production capacity.

These challenges—combined with macroeconomic factors—have certainly weighed on Tesla’s stock price year-to-date. Looking forward, however, we remain increasingly bullish on both the business and its stock price. Tesla achieved record production in June 2022. Barring no future factory shutdowns, we believe Tesla is poised to accelerate production in the coming years—far beyond consensus expectations.

This quarter, we also released a 90+ page research report detailing our view on Tesla’s near- term and long-term structural advantages, its opportunities, and its likely growth trajectory. The report covers many substantive themes—from Tesla’s lead in artificial intelligence to its extreme vertical integration. At a very high level, we believe Tesla is on a path to dominate the S&P 500. And we believe this could happen sooner than many people might believe.

For this letter, we want to emphasize one theme from the report that we think many on Wall Street miss: Tesla is in a class of one when it comes to manufacturing. In fact, we believe Tesla is ushering in an advanced manufacturing renaissance that will drive production speed, capacity, and margins at an accelerated pace. We also believe Tesla will soon be generating extreme levels of cash flow, which we elaborate on below, along with an update on how we view its fair value.

Speed is cash

As you’ll note above, the theme of this quarter’s letter is “Continuous motion, experimentation, and innovation.”

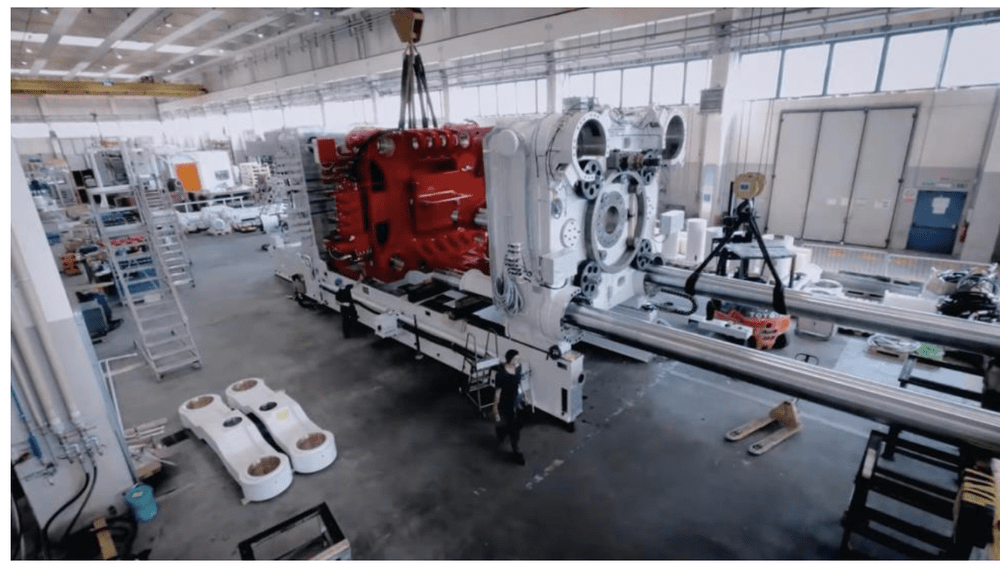

Tesla’s manufacturing process is a prime example of experimentation and a First Principles approach: Based on our on-the-ground research, they have made significant strides in the reinvention of the production of a large manufactured good by using extreme automation, unique die-casting molds, and novel stamping processes (using Tesla’s giant “Giga press”) that speed production of a Tesla vehicle by a factor of at least 10x.

At Tesla’s new facilities in Austin and Berlin, for instance, lines will stamp out car bodies every 45 seconds—an order of magnitude faster than any existing production line in the world.

One of the major themes we see very often in the media and financial press is that incumbent OEMs or startup EV manufacturers could tweak existing factories to produce electric vehicles at scale. This, the theory goes, will create significant competition for Tesla — and thus Tesla’s demand will slow. We believe this is a fundamentally incorrect view.

While OEMs and well-capitalized startups have come to market with new EV variants in recent months, no other manufacturer has come close to Tesla’s ability to generate millions of units of EVs at a 30%+ gross margin profile.

There is a good reason for this: Tesla’s factories—not its cars—are becoming the true drivers of its technical innovations.

Back in 2020, Elon Musk noted that Tesla needed to redesign its factories from scratch to allow for maximum speed and efficiency, and to meet the company’s ambitions of 50 percent annualized growth.

Speed is cash, and the results of this continuous experimentation and innovation is bearing fruit.

In Q1 2022, Tesla generated $2.2 billion in free cash flow—a 660% YoY increase. Despite challenges encountered in Q2 2022—from Covid lockdowns to supply chain issues—Q3 and Q4 are poised for explosive growth. For a product that has excessive demand, the speed at which a factory can build and deliver goods to customers enables free cash flow to grow dramatically.

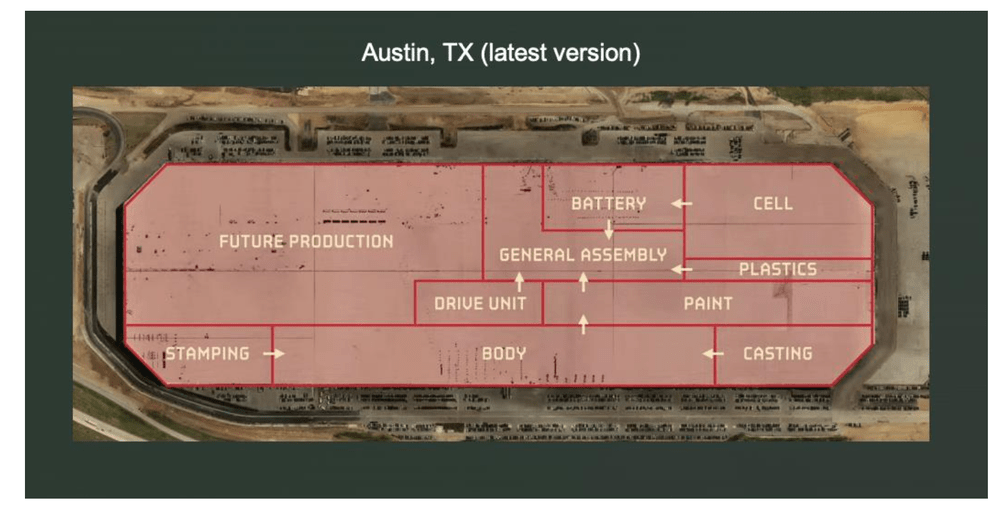

By designing its new factories with the goal of maximizing volumetric efficiency, Tesla also increases the speed and density of movement within the facility.

The goal, of course, is increasing margins, faster cash flows, and more output. “A factory that’s moving at twice the speed of another factory is equivalent to two factories,” Musk noted. “And the company that will be successful is the company that with one factory can accomplish what other companies take two or three or four factories to do.”

Later, he added: “Tesla is aiming to be the best at manufacturing of any company on Earth.”

We agree. In our report, we noted the comparison of Tesla’s factories to semiconductor chips. The similarities are striking. Tesla’s initial factories were arguably more bloated, larger, and certainly slower—just like early semiconductor chips. Tesla’s newer factories in Shanghai, Berlin and Austin are increasingly more compact, faster, and utilize more volumetric space, enabling far more efficiencies to scale. The use of the third dimension of space generates faster output with a smaller footprint.

We believe the financial implications of increasing velocity in the manufacturing process will show up in the P&L, far beyond current sell-side estimates over the next several years.

Looking out towards 2024, we believe Tesla could deliver 5 million units (if existing factories ramp as we expect them to ramp). As of this writing in mid-2022, the average sell-side estimate is 2.4 million units produced by 2024. This discrepancy in expectations of volume growth is, in our view, creating a significant discount to Tesla’s share price today—but it will not last forever.

To use some basic math: By 2024, if Tesla produces 5 million vehicles at an ASP of $50,000, that is $250 billion in revenue. On those topline figures, we believe they’d achieve roughly $50 billion in net income (assuming ~20% net income margins) in 2024. This would translate to roughly $50 in earnings per share by year-end 2024, assuming no further dilution to the stock (which we do not expect). Based on these projected earnings, our anticipated stock price for year-end 2024 would be around $3,750. This implies roughly 400% upside from where it trades today—and a market capitalization of nearly $4 trillion.

Again, this is our conservative view, and does not factor in additional earnings growth from the company’s energy operations division, FSD operations, or other future ambitions, such as the humanoid bot.

“The Spotify Machine” (SPOT)

In addition to Tesla, we continue to have high conviction in the ability of our other core holdings to outperform. Despite the stock’s underperformance year-to-date, we include Spotify in that cohort.

At its June investor event, Spotify reiterated its long-term goal of reaching 1 billion users by 2030, driving $100 billion in revenue with 20% operating margins. We believe these goals are not only achievable but could prove to be conservative in the long run. The company is building what it is calling “The Spotify Machine,” a sort of reinforcement feedback loop of growth, new users, new creators, and new high-margin monetization opportunities.

We believe Spotify’s business model will work best at truly global scale, and we believe the company is still in the early days of growth. To be clear, we don’t expect the company to generate excessive profits in the short-term as we believe the company should reinvest all available capital into growth and territory expansion. It’s also worth noting that Spotify is free cash flow positive and has a strong balance sheet—this reduces the likelihood of further share dilution and lowers near-term risk as shareholders.

As investors, we tend to look at our portfolio as one might look at a group of bananas: Some are yellow and ripe and ready to eat now, and others are green and will take some time to ripen. Spotify is a green banana.

At scale, Spotify will command significant leverage to increase revenues through re-negotiation with labels, subscription price increases, and other high-margin monetization strategies that have yet to launch, but are in the product pipeline (e.g. audiobooks, paid podcasts, live audio, events, ticketing, etc.). We believe Spotify’s market value today (~$20b) represents one of the more extreme mismatches between price and value in the market.

There are many ways to value a company, but in any risk-off market environment, valuations tend to compress for any company that does not generate near-term profits. However, in our experience, sentiment can shift rapidly on a company like Spotify. Our valuation methodology for Spotify focuses primarily on global user growth, market expansion, and platform monetization that we believe will enable a geyser of free cash flow. At 422 million active users growing roughly 20% a year, we are well on our way.

What’s often missed about Spotify’s monetization strategy is that it is not one-dimensional. For Spotify, getting more content onto the platform (especially non-music content) is helping to build a powerful reinforcement loop to attract new users—and new advertisers. As we note below, advertising will be a large driver of gross profit and net income over the long-term, and yet we believe most Wall Street analysis tends to underemphasize this growth driver. As Spotify’s Chief Content Officer said at the Investor Day, “gone are the days of ads accounting for less than 10% of Spotify’s total revenue.”

For those interested, we recommend this link to a 20-minute Investor Day highlights. Below are a few of our observations from the event:

-

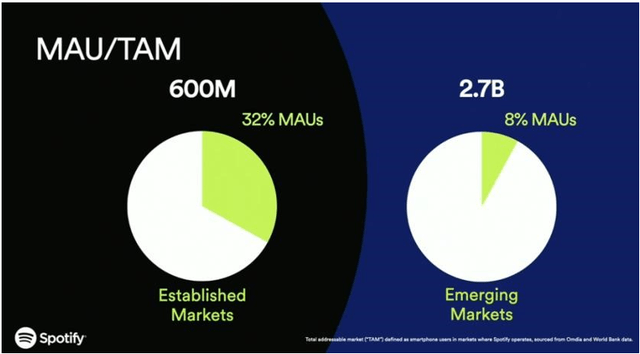

The TAM is objectively massive – We believe MAU growth still has a huge amount of runway, and Spotify reiterated its 1B MAU target by 2030 (from ~420mm today). At scale, this enables enormous leverage to increase revenues through re-negotiation with labels, price hikes, and other high-margin monetization strategies that have yet to launch (audiobooks, paid podcasts, live events, ticketing, etc.)

-

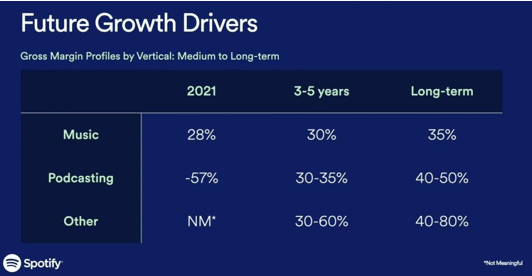

Spotify continues to invest its capital into growth of the product, which we think will lead to very attractive margins at scale.Right now, the podcast business is still a drag on consolidated gross margins, but that’s because it’s in the early stages of growth and there are significant costs to acquire content and build out podcast infrastructure. The strategy is working, which improves the LTV of users and adds incremental value back to the platform, which is why we’re excited about the reinvestment of capital.

-

At the Investor Day, Spotify shared that 7% of listening hours on its platform are podcast hours (up from ~1% in 2018), and of those podcast hours only 14% are monetized today. At scale, podcasting could reach a 50% gross margin business – a margin profile that is not reflected in today’s value.

-

-

We believe Spotify’s advertising platform growth is akin to Facebook’s mobile ad program circa 2012 or even Google AdWords in its early days. Spotify’s advertising business used to be a non-essential part of our thesis. Now, it’s clear that advertising growth is going to be a big driver of both revenue and margin over the next several years. We are in the very early innings of on-demand audio advertising, but we think it has the potential to be a massive, AWS-like driver for Spotify’s core operations. Podcasts are key to driving bigger ad-spends- “In the US, when we bundle music and podcast advertising, the average size of the spend on a campaign is 4 times that of a music-only campaign, so we’re driving bigger spends from advertisers and growing our revenue significantly.”-Dawn Ostroff

-

Spotify’s music Marketplace is a real tech business – high initial capital outlay, but revenue can increase without additional investment, giving it a high long-term profit potential. One of the major knocks on Spotify is that it pays out too much to music rightsholders, but we can see that its marketplace business is driving rapid gross profit growth. Management now expects Marketplace gross margin to increase 30%+ this year, and continue to grow at healthy double-digits. “In 2018 our Marketplace contribution to gross profit was only $20 million. In 2021 it grew to $160 million, 8x the size in just four years. We expect that number to increase another 30% or more in 2022. We see tremendous upside in Marketplace, and anticipate that its financial contribution will continue to grow at a healthy double-digit rate in the years ahead. Marketplace is the quintessential example of our approach to capital allocation. There was a significant up- front cost to build-and-launch these offerings, but we saw compelling data which gave us the confidence to double-down and invest aggressively against our goals.”- Paul Vogel, CFO

-

Revenue, margin targets, price targets. In the next decade, Spotify’s goal is to generate $100b in revenue and achieve 40% gross margins at scale, with a 20% operating margin. We think this goal is not only achievable, but perhaps even conservative, should any of the company’s new high-margin initiatives (advertising platform, audiobooks, etc.) take off faster than anticipated. Even on a shorter-term basis, we think the stock is fundamentally mispriced – at a time when the future looks very bright for the core business, shares are down some 65% from highs – which we see as a temporary dislocation of price and value. Even on a conservative basis and with a recognition of the challenging macro environment, we think the stock should be on a path to 10x over the next several years, driven purely by improving fundamentals and earnings growth. By 2024/2025, we think it’s likely that Spotify will be achieving significant positive earnings— growing at more than 50%—far beyond consensus expectations.

Business as a game of survivor

In our experience, dramatic selloffs like the one we’ve experienced this year tend to create wonderful buying opportunities. Frankly, we’re quite excited about the setup for the next few years. Asset values across the board have compressed to attractive levels; we’re of the view that dominant businesses will spring back in value—others will not. And this can happen very quickly.

On the other side, as capital has now retreated from the market, unproven business models that depend on financing could be starved. It’s like a big game of Survivor: If firms cannot effectively compete in this environment, they may simply cease to exist—voted off the island.

A deep research process is integral to our strategy, and especially in this environment. Not only does it help us identify dominant business models, but the process itself affords us the conviction to hold our businesses during the inevitable bouts of volatility we may face in the market. Like Arne said in our recent Q&A (which we have attached to the end of this letter for your reference): “I know it may not feel like it, but this is all normal. Give it a few months. These corrections don’t last forever, especially for premier growth businesses that tend to rip right back once the dust settles… When sentiment shifts, I think you’ll be surprised by how quickly we come back and reach new highs.”

The best way to mitigate true investment risk, in our view at least, is to only own companies that have extraordinarily loyal, happy customers—and who have a proven ability to generate increasing free cash flow as the business scales.

Despite the overall bearish sentiment, we’re facing today—looming economic concerns, inflationary pressures, Covid-19 lockdowns, etc.—we’re actually quite optimistic about the next several quarters. Stock quotes can and will diverge from reality for a period of time, but we believe our patience will be rewarded. As Arne also says in the latest Q&A, “it’s just a bid.” As always, we appreciate your trust. We hope you can relax, enjoy your summer, and we’re always around if you’d like to chat.

Best,

Worm Capital

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment