tumsasedgars/iStock via Getty Images

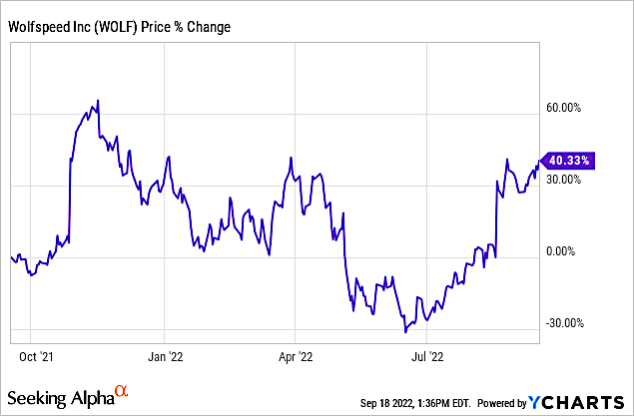

Wolfspeed (NYSE:WOLF) has sucked the oxygen out of the room with its mixed media promotions touting its Silicon Carbide (“SiC”) endeavors. Investors must have been reading, and listening, and watching because shares have risen 40% in the past 1-year period, as shown in Chart 1.

YCharts

Chart 1

At its latest earning’s call, WOLF reported an adjusted loss of 2 cents per share on $228.5M in revenue, up 56.7% year-over-year. Analysts were expecting a loss of 10 cents per share on $207.58M. For F1Q guidance, Wolfspeed said it expects revenue to be between $232.5M and $247.5M, with analysts expecting $224.45M in sales.

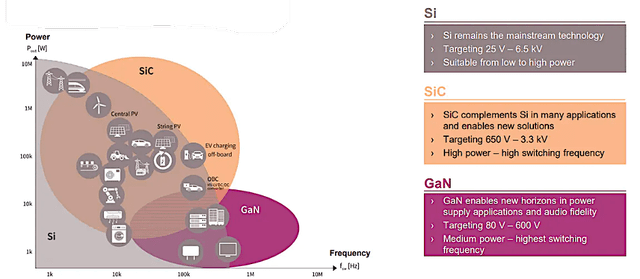

Comparing Silicon vs Silicon Carbide Automotive Chips

To begin this analysis, we need to see what SiC chips can do, what are the benefits compared to silicon (“Si”) chips, and where they are used. Chart 2 shows the benefits of SiC vs Si, but as I point out in this article, it is not a fixed, cut and dry analysis because Si technology is not sitting idly by watching the SiC parade pass.

Chart 2

Demand for automotive power semiconductors is rapidly growing, as EVs become more widely available, according to The Information Network’s report entitled “Power Semiconductors: Markets, Materials and Technologies.“

Today’s EVs have internal architectures that can handle 400 V per battery pack. Historically, most current EVs, including those from Tesla, use 400-volt systems in part because homes typically use a 380-volt three-phase current, so an appropriate charging infrastructure has already existed. The first EVs also used components from plug-in hybrids that were 400-volt-based.

400 volts to 800 volts the Catalyst for SiC

To increase EV ranges and reduce charging times, EV manufacturers have plans to upgrade to 800-V batteries.

Typically, 800-V systems also move from Si-based IGBTs to SiC MOSFETs. SiC devices provide much higher switching speeds and thus lower switching losses. By doubling the voltage, charging times are decreased by about 50% for the same battery size. This allows manufacturers to reduce the size of battery packs and make them smaller, linked to ultra-efficient motors and aerodynamics to maximize mileage. Smaller battery packs are lighter which can, in turn, mean a lighter chassis, brakes, and other components to support them.

Currently, the Porsche Taycan uses an 800-volt system, as does other models built on the same platform such as the Audi e-tron GT. Separately, only the Lucid Air, Hyundai Ioniq 5, and the Kia EV6 use the 800-volt architecture.

The Porsche Taycan can charge its battery (to 80%) in 22.5 minutes on a 800-volt level 3 charger, versus 90 minutes on a 400-volt level 3 charger. Obviously one of the barriers to a larger adoption rate for the 800-volt systems is the charging stations themselves. Only a minority of them offer 800-volt charging, most of them on Tritium, Ionity, and Electrify America networks.

Silicon Chips Make Up the Vast Majority of EV Components

Currently, the vast majority of EVs with 400-volt systems use silicon chips. While the SiC chip is the top contender to take on silicon, not everyone is moving to the new technology yet.

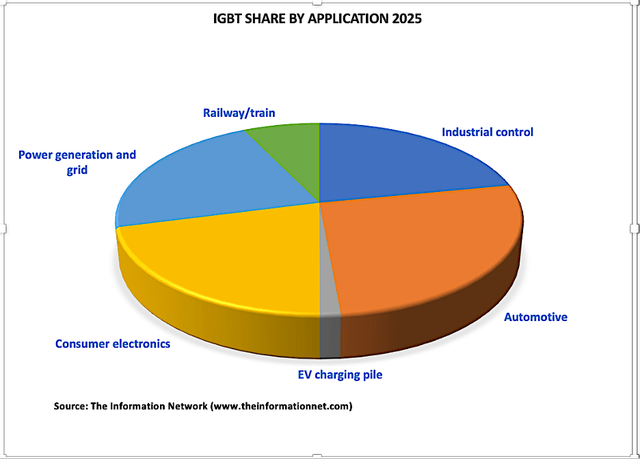

According to The Information Network’s report, the IGBT market was $5.8 billion in 2021 growing at CAGR of 10%. Market segmentation for 2025 by application is shown in Chart 3. The Automotive segment will be the greatest at 23%, up from 14% in 2020.

Chart 3

Demand is so great that there is a shortage of IGBTs for EVs. Traditional IGBT companies Infineon, Fuji Electric, and Mitsubishi Electric are now competing to meet demand from Chinese manufacturers. These companies are signing up customers from Chinese EV manufacturers. For example, BYD (OTCPK:BYDDF) signed IGBT supply orders with Silan Micro, Star Semiconductor, Times Electric, and China Resources Micro in late 2021.

Moreover, the average IGBT generally costs less than its SiC counterpart. The cost savings come primarily from wafer cost. A 200mm SiC wafer costs $1,500 while a 300m wafer costs less than $100 (less than $30 for a 200mm wafer). The larger 300mm wafer produces 2.25x more chips than a 200mm wafer while equipment cost is only 1.7X that of the 200mm wafer fab.

SiC Chips

SiC chips are not new. Infineon introduced its first chips made from silicon carbide more than 20 years ago. Infineon sells SiC MOSFETs and other power devices to more than 3,000 customers today. As I noted in an August 23, 2022 Seeking Alpha article entitled “Analysis Of II-VI’s SiC Wafer Agreement With Infineon Technologies,” II-VI (now Coherent (COHR)) reinforced its role as an SiC wafers leader by inking a deal to supply IC leader Infineon Technologies.

Silicon Chips Continue to Advance and Compete

As the industry moves to 800-volt EV systems, Renesas Electronics (OTCPK:RNECY) rolled out a new generation of compact high-voltage IGBTs with withstand voltages of up to 1,200 V and current ratings of up to 300 A, in a bid to boost the power electronics at the heart of EVs.

Its 400-800V silicon-based AE5 process for IGBTs achieves a 10% reduction in power losses compared to the current-generation AE4 products, a power savings that will help EV developers save battery power and increase driving range. In addition, the new products are approximately 10% smaller.

According to Renesas, the AE5-generation IGBTs will be mass produced starting in the first half of 2023 on Renesas’ 200- and 300-mm wafer lines at the company’s factory in Naka, Japan. Additionally, Renesas will ramp up production starting in the first half of 2024 at its new power semiconductor 300-mm wafer fab in Kofu, Japan to meet the growing demand for power semiconductor products.

These devices will compete with SiC MOSFETs from WOLF, and will be in production around the same time WOLF’s new fab opens.

Investor Takeaway

As for WOLF’s automotive customers, Lucid Motors will use WOLF’s silicon carbide XM3 power modules in Lucid‘s pure-BEV car, the Lucid Air. WOLF will supply SiC for Lucid’s rear inverter in the Lucid Air.

How big is Lucid? In my August 5, 2022 Seeking Alpha article entitled “Tesla: No Competitor Yet From EV Startups,” I noted:

“Lucid delivered 360 EVs, helping to account for $57.7 million in revenue in Q1 2022, but revised its 2022 production volume outlook to a range of 6K to 7K vehicles following the release of its Q2 results. Guidance earlier in the year was for production volume of 12K to 14K vehicles.”

Keep in mind that EVs are the strongest driver for SiC devices, yet WOLF notes in its recent F4Q earnings call:

“In the last three years, we’ve generated more than 2,300 power device design-ins across a diverse non-automotive set of end equipments, including design-ins for medical imaging device, an air taxi and an electric static filtering device.

Additionally, we have more than 6,100 non-automotive power device projects in our opportunity pipeline, and we’re only scratching the surface in the diverse range of these applications and our team continues to find ways in which silicon carbide can help the world conserve more energy.”

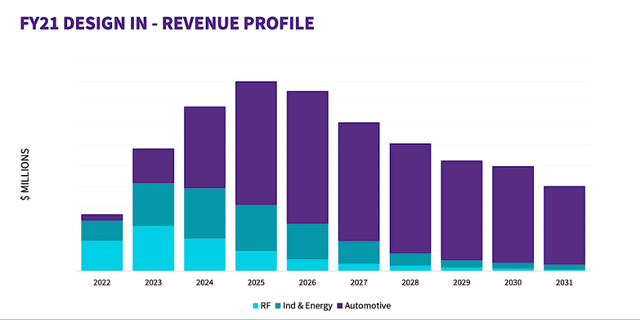

WOLF is vague about revenue breakouts, and we need to wait until November 2022 to get an update of its Investor Day presentation. However, Chart 4 shows a chart from WOLF’s 2021 Investor Day presentation of “design-ins” based on revenue.

Chart 4

What is of interest is that design-ins in 2021 for Automotive represented just 10.0% of total design-ins growing to 27.6% in 2022 according to 2021 analysis. In contrast, RF represented 54.0% of 2021 design-ins dropping to 36.8% and Industrial represented 36.0% constant at 35.6%.

Of particular interest that BofA’s Arya did get right is that he noted:

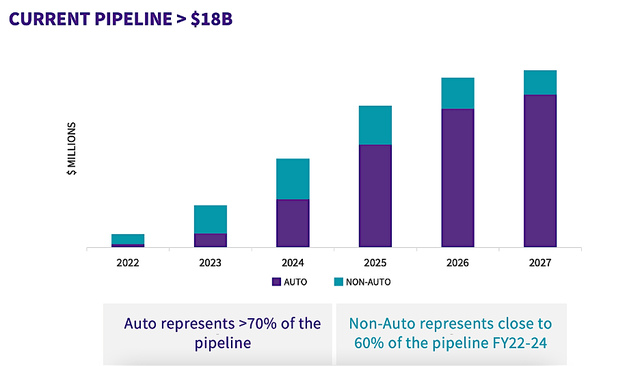

“Autos represents 70%-75% of WOLF design-in activity, but we note growth vectors in infra/industrial (solar inverters, high-end medical equipment, EV charging stations) that can diversify WOLF’s revenue stream (2300+ non-auto design-ins in last three years).”

In other words, Autos represent 70% of WOLF’s $18 billion pipeline, as shown in Chart 5, I too question how WOLF can move from 10% in 2021 to 70% in light of other SiC companies in the market and the movement of Si-based IGBT to work at 800-volts as detailed by Renesas. Also important is the growth of Solar and EV Charging Stations, which is expected to be strong in “green” technology, as well as the huge 2300+ non-auto design-ins.

Chart 5 also shows that WOLF’s pipeline for Automotive was projected at 18% in 2022 growing to 31% in 2023 and not surprisingly comparable to its design-in forecast.

Chart 5

Keep in mind that WOLF’s current automotive company is Lucid. As I said above, Lucid shipped just 360 EVs in the past quarter and has already dropped its forecast for 2022.

In contrast, Tesla (TSLA) has shipped 10,000 of its Model Y all-wheel drive EV at its Texas Gigafactory. The Model Y has a front and rear inverter, which converts DC energy from the battery to AC to run the vehicle. The front inverter uses Si IGBT switches made by Infineon (OTCQX:IFNNY) and the rear inverter uses SiC MOSFET power modules made by ST Microelectronics (STM).

The SiC inverter in the Model Y is a second-generation device manufactured by ST Microelectronics, which has been used in the Tesla Model 3 and Model S Plaid. Tesla sold 508,000 Model 3s in 2021 and is now on its next-generation SiC MOSFET power inverter.

And let’s not forget II-VI’s (now Coherent) agreement to supply Infineon with SiC wafers, which I discussed in the previously mentioned article, “Analysis Of II-VI’s SiC Wafer Agreement With Infineon Technologies.”

According to my sources, WOLF’s Mohawk Valley plant opened in April 2022 with production scheduled for July, but that has been postponed to the end of 2022 or early 2023. If true, it will set back WOLF’s schedule by almost one year at a time when Infineon and ST Microelectronics are shipping products to EV customers.

Indeed, WOLF is and will be facing significant headwinds in competition with STM and IFNNY in the SiC space, as well as Renesas in the high-voltage Si IGBT camp.

On financial metrics, WOLF reported revenues for FY 2022 of $726 million, but reported a loss of $201 million. As I pointed out above, reported adjusted loss of 2 cents per share on $228.5M in revenue, up 56.7% year-over-year. Analysts were expecting a loss of 10 cents per share on $207.58M. But a loss is a loss.

According to Simply Wall Street, WOLF has a Fair Value of $41.53 and is 189.6% overvalued.

I rate this company a Sell. Take profits now that have been based on hype, before these headwinds manifest themselves in significant top and bottom line erosion.

Be the first to comment