AsiaVision

Recap

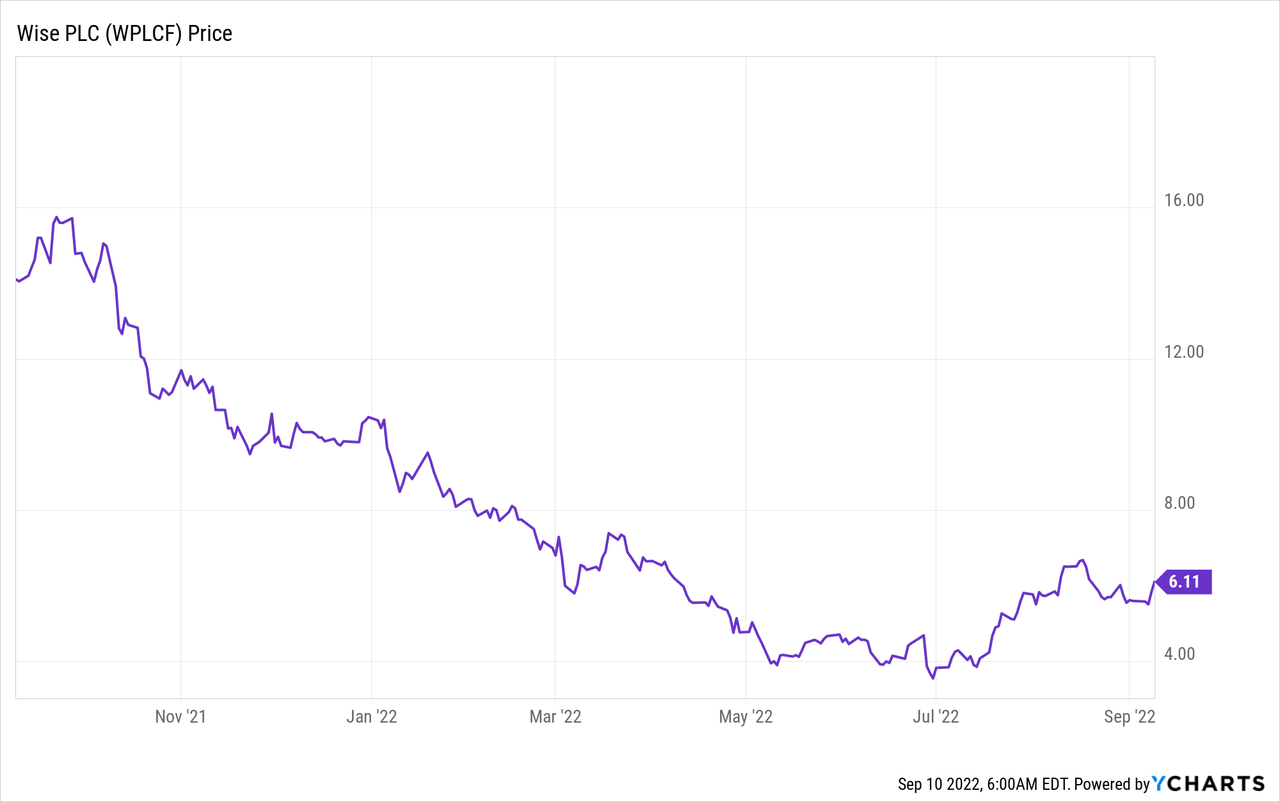

It has been six months since we published “Wise: The Growth Story Remains Compelling.” Comparing Wise (OTCPK:WPLCF) with PayPal (NASDAQ:PYPL), we found that the market was willing to pay more for PYPL after it doubled its revenue in just four years. However, despite the company’s incredible growth, Wise’s stock fell to as low as $3.5 per share before recovering to $6.1 per share. Is there any change in our thesis? Or has our view on Wise changed in the last six months?

1Q23 Trading Results Update

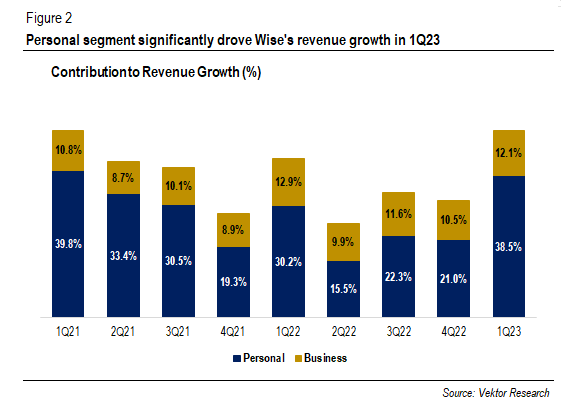

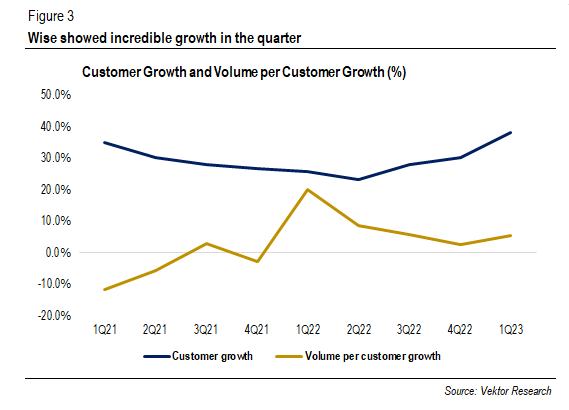

Wise reported almost 38% (Y/Y) of customer growth in 1Q23. The adoption of Wise Account accelerates, with 20% of customers being Wise Account users. Furthermore, revenue grew a staggering 51% (Y/Y), supported by solid customer growth and increasing average volume per customer (VPC). During the 1Q23 trading presentation, CFO Matt Briers said that people have started to utilize Wise for holding, receiving, and spending money instead of just sending money.

Contribution to Revenue Growth (%) (Vektor Research)

While FX volatility, which has encouraged customers to move money more and is likely to have driven customer growth, resulted in a strong quarterly result, “a much wider set of fee income” thanks to customers utilizing more functionalities drove revenue.

It also leads the management to expect Wise to book a revenue growth of 30-35% in FY2023, citing that “fundamentals” are producing healthy growth. In addition, Wise started to gain traction in “some of the biggest markets,” including the US.

Customer and VPC Growth (%) (Vektor Research)

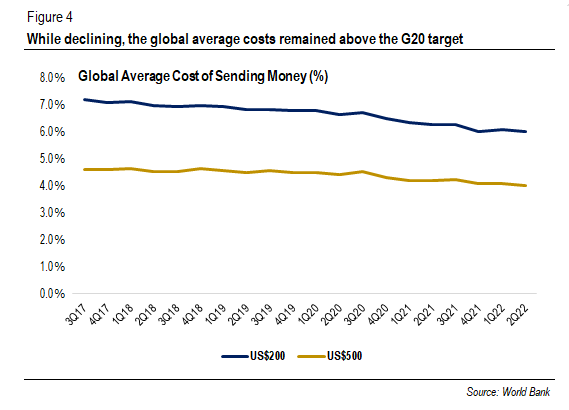

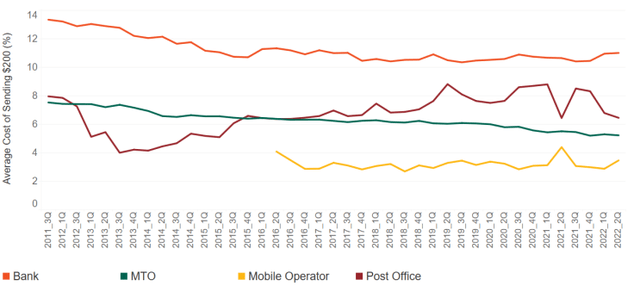

The growth story remains the same: customers migrate from banks to Wise, not from other remittance players. The latest World Bank analysis on global remittance prices suggests that while average costs have declined in the last few years, they were still well above the G20 target. Figure 5 shows that banks still charge more for sending money than other remittance service providers.

Global Average Cost of Sending Money (%) (World Bank)

Costs By Service Provider (%) (World Bank)

Furthermore, customers have started to use Wise as more than just a cross-border transaction service provider. For example, customers can invest their held money into stocks. You can see the company’s plans to improve its business through the roadmap laid out on the website.

Therefore, we believe that the growth story remains unchanged: people moving from banks to Wise drives customer growth. And customers are now using Wise for other than sending money, providing more income to the company. So, why did the share price decline? We believe that two reasons hampered the stock price increase.

The Emergence of a New Competitor

Atlantic Money, a start-up, plans to take on Wise in the money transfer service, only to be coming out of stealth in March this year. The difference is that Atlantic Money only charges a flat £3 fee up to £100,000 compared with Wise’s percentage fee. However, little information is available on how many customers Atlantic Money has acquired. Still, it secured payment institution approval in several countries, such as the National Bank of Belgium. As a result, Wise’s stock price fell from $7.3 per share in early March to below $4 per share in two months.

Will the emergence of a new competitor hamper Wise’s growth? We believe it is unlikely to be the case, at least in the foreseeable future. First, we visited Atlantic Money’s website and found that users can only send Euro and British Pound to ten different currencies. By contrast, using Wise, customers can convert 26 currencies into over 50.

Second, sending money through Atlantic Money would take days, while Wise recently announced that it completed 50% of its cross-border transaction instantly. Lastly, is the business model sustainable?

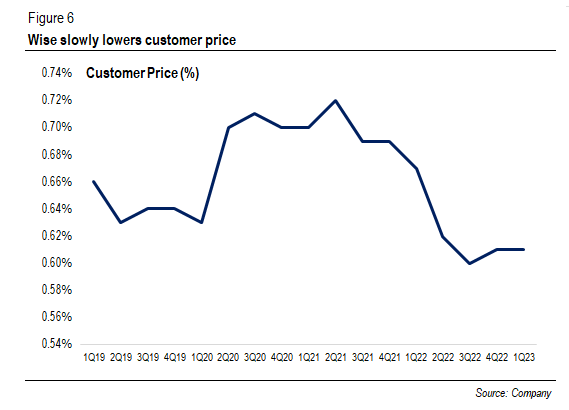

On the other hand, Wise’s management admitted that “lowering prices sustainably is hard and will take us time.” For example, Wise would have to revamp the integration with local payment systems, renegotiate more attractive terms with banking partners over time, and improve FX risk management to lower customer prices.

Wise’s Customer Prices (%) (Company)

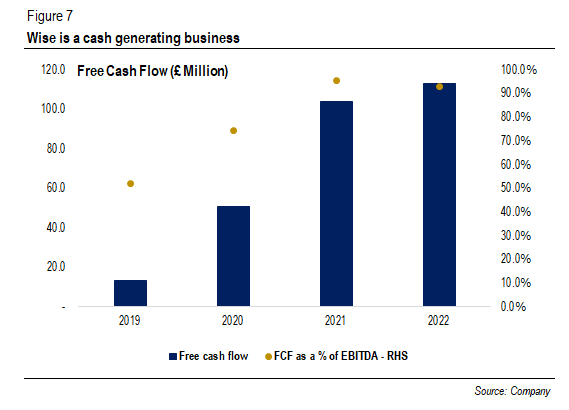

Meanwhile, with more than a decade of experience, Wise is a profitable and cash-generating enterprise (see Figure 7).

Wise’s FCF (Company)

Margins Deterioration

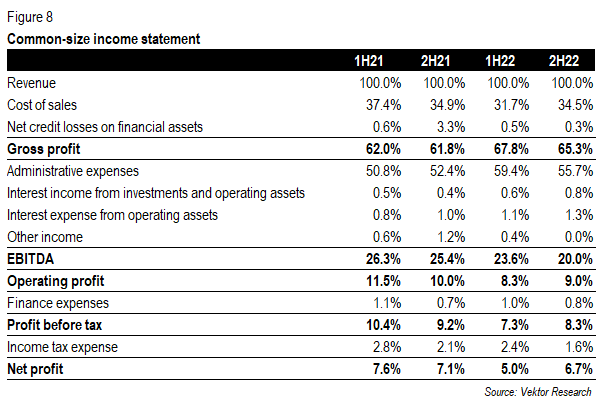

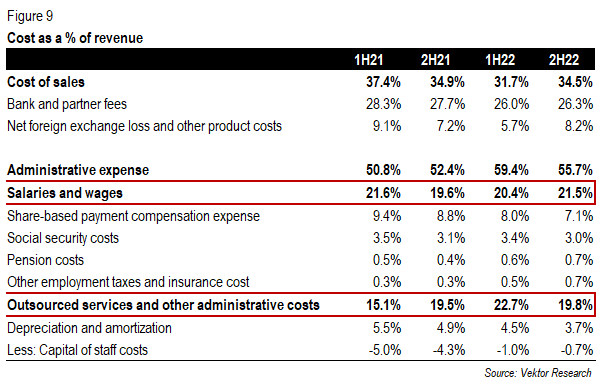

The second reason is that EBITDA margins have deteriorated in the last few semesters. Administrative expenses grew almost 48% (Y/Y) in FY2022. Moreover, salaries and marketing expenses increased 36% (Y/Y) and 30% (Y/Y), respectively, as the company is expanding its team to “support growth” and “used additional targeted ways to drive customer growth.”

Common-size Income Statement (Vektor Research)

Costs as a % of Revenue (Vektor Research)

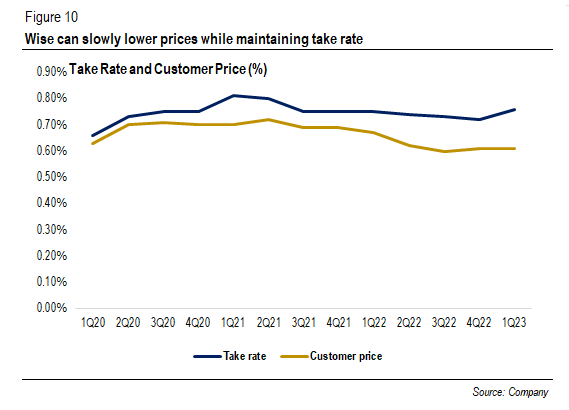

The question remains whether Wise can achieve its long-term EBITDA margin target at or above 20%, especially given that Wise still has a mission to lower fees to zero. Nevertheless, Figure 9 shows that Wise can slowly lower customer prices and maintain the take rate simultaneously. Indeed, more services generate more income. And while Matt Briers said that other fees did not exactly subsidize lower customer prices, the CFO indirectly implies that they offer more flexibility for Wise to lower prices while generating healthy margins.

Take Rate and Customer Price (%) (Company)

Still, we believe the customer prices will slightly decline while Wise drives its growth to keep margins healthy. Obviously, efforts to drive growth put pressures on margins. If new competitors emerge and offer more attractive prices, Wise’s price competitiveness will become an issue, especially if prices are the number one factor. However, in our view, Wise is trying to make its customers sticky to use more of its services that generate healthy margins. And the key to success is running a sustainable business.

Valuation

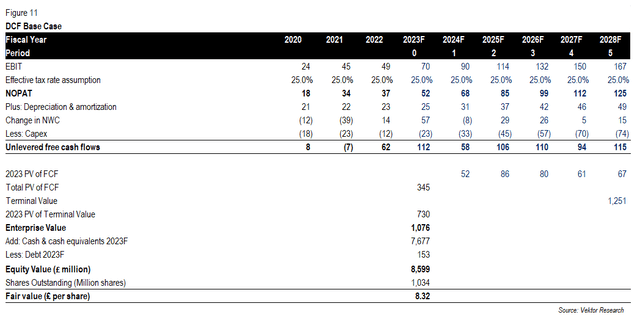

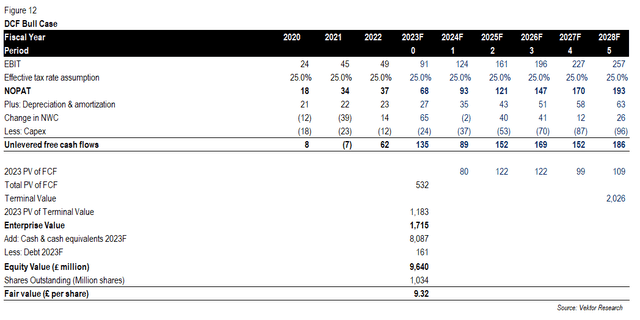

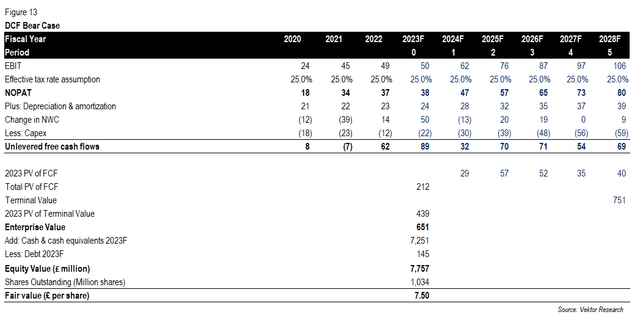

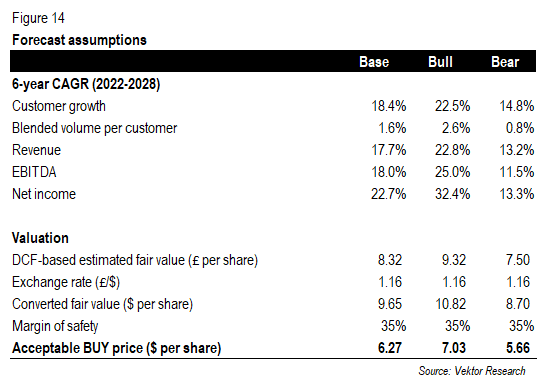

Previously, we provided our forecast and concluded that Wise’s P/S became more reasonable after incorporating future growth. Therefore, we revisited our model and created three scenarios for our DCF. According to our model, Wise’s estimated fair value stands between £7.5-£9.3 per share, with an 11.4% WACC and 2% long-term growth assumption.

DCF Base Case (Vektor Research)

DCF Bull Case (Vektor Research)

DCF Bear Case (Vektor Research)

For our base case scenario, we assume that revenue will grow 18% annually from 2022 to 2028, despite the company’s ambition to maintain its revenue growth above 20%. Moreover, we expect EBITDA margins to stay at 20% in the next two years.

Next, we converted the estimated fair values into US Dollars and applied a margin of safety of 35%. While a 35% cushion appears to be aggressive, you can’t be too careful with growth companies, so it is better to be conservative to be on the safe side, in our view. However, if our bear case is to materialize, the estimated fair value might not provide a comfortable cushion.

Forecast Assumptions (Vektor Research)

Conclusion

We believe that emerging competition from a new player and margin erosion hampered the stock price. After all, the market is expecting revenue growth and an EBITDA margin of 20%, and those reasons could hurt expectations. But we believe that Wise can still maintain its growth trajectory and margins, at least in the foreseeable future.

Moreover, our bull and base cases suggest that buying Wise still makes sense, even after we apply an aggressive margin of safety. Still, if you think our bear case is to materialize, the estimated fair value might not provide a comfortable cushion. Thus, we reiterate our bullish view on the stock. Let us know your thoughts in the comment section below.

Be the first to comment