jaanalisette/iStock Editorial via Getty Images

Investment thesis

We are down 50% from our initial buy rating for Wise (OTCPK:WPLCF) in September 2021. Our update view is to maintain this rating, due to our belief that 1) Wise has high earnings visibility with multiyear growth prospects with its cost-efficient money transfer service, and 2) the overhang on CEO Käärmann’s tax disputes will conclude in the next year or so.

Quick primer

Wise plc (rebranded from TransferWise in 2021) was established in 2011. It is a cross-border payments network offering low-cost commission with full transparency (an average all-in price charged in Q2 FY3/2023 was 0.64%) and faster turnaround time (over half of transfers arrive immediately, 90% within 24 hours) compared to the traditional international money transfer industry. It serves over 10 million customers globally and processed GBP76 billion/$92 billion in international payments volume in FY3/2022. Based in the UK, its Estonian founders Kristo Käärmann and Taavet Hinrikus developed the business after an expensive and unsatisfactory experience sending money home using a UK bank. The company was listed in July 2021. Peers include high street banks, Western Union (WU), MoneyGram (MGI), PayPal (PYPL) (including Xoom), World Remit, Ebury, and Flywire (FLYW). There are also new entrants in the form of fintech companies such as UK’s Revolut, US Remitly, and Germany’s N26.

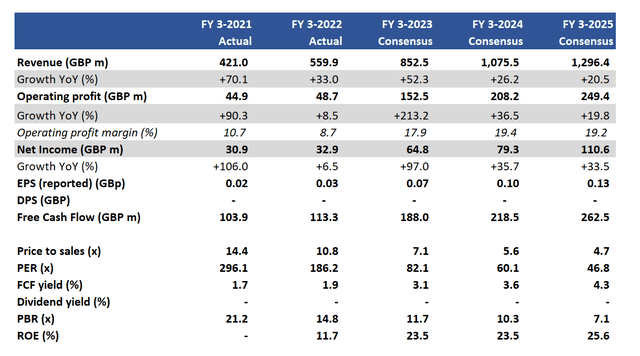

Key financials with consensus forecasts

Key financials with consensus forecasts (Company, Refinitiv)

Our objectives

We revisit our initial piece from September 2021 where we recommended a buy. Since then the shares have fallen 50%, driven by what we believe are the following factors: 1) in September 2021 the UK Financial Conduct Authority (the FCA) launched an investigation into Wise’s CEO Kristo Käärmann was listed as an individual who had defaulted on tax by the British tax authority HMRC. The significant risk here is that the FCA could remove the approval of Käärmann as a senior manager, making it difficult for him to continue leading the business, and 2) FY3/2022 results saw 33% revenue growth YoY which was a marked deceleration YoY, and the company experiencing falling operating margins at it continued to invest in the business.

In hindsight, we overpaid with our initial buy rating, and reputational as well as an operational risk over Käärmann’s unresolved status at the company would place a discount on the shares. We were attracted by Wise’s cost leadership and high performance in a large and growing addressable market.

In this piece, we want to assess recent trading and current valuations.

What a difference a year makes

The trading statement for Q2 FY3/2023 highlight an acceleration in the business, with customer cross-border transfer volumes increasing 50% YoY (Q2 FY3/2022 grew 36% YoY), 5.5 million customers transacting (+40% YoY), and a growing total income take rate of 0.85%, with the company generating net interest income on customer balances with rising interest rates.

The extreme macroeconomic conditions being experienced have led to some price hikes for certain currencies, but this does deter the fact that transfer volumes have regained momentum. The reason appears to be with high volatility in the FX market, customers may be bringing forward money transfers to lock in rates. There could also be a greater need for some customers to send money home, given that economic conditions are becoming more acute in the developing world. Overall, we believe this growth acceleration is not a sustainable trend, but the company raised its FY expectations for revenue to grow by 55%-60% YoY (previously 30%-35% YoY). One key positive is that improvements have resulted in decreasing paused transactions and customer support waiting times have dropped by 50%, improving the customer experience.

There has been no recent mention of costs, although there is continuous mention of investing ‘heavily’ in products and infrastructure and the Support team has grown. However, consensus forecasts (see Key financials table above) is estimating a significant ramp in operating profit margin. We believe the key assumption being made is that operating cost growth YoY will be significantly lower than topline growth, despite Wise continuing to increase headcount. This view looks too bullish to us, but we believe indicates the right direction of travel.

We believe it is fair to assume sales growth will slow to the 20%-25% YoY range for the medium term. However, we still have the conviction that this will be a sustainable trend with the money transfer market’s persistent lack of transparency and high fees. We do not believe the major players will change, allowing Wise to continue gaining market share.

Valuation

In our previous piece, we said to buy with the shares trading on PER 176x. We clearly overpaid, and we did not anticipate the major negative turnaround in sentiment for growth stocks and Käärmann’s tax issues. On consensus forecasts, the shares are trading on PER FY3/2024 60.1x, which remains an elevated multiple. However, taking into account that Wise is a profitable and free cash flow generative business, with a decent track record and what appears to be a sustainable growth profile, the multiple does not look too outrageous for what is becoming a high-quality franchise.

Risks

Upside risk comes from the continued acceleration of customer transfer growth, driven by high volatility in the FX market as well as other macro uncertainties. Wise could also increase its market share as more users become aware and switch over to its cost-effective service.

Downside risk comes from a recession, resulting in rising unemployment or falling working hours which could reduce cross-border transfer volumes. A negative outcome for CEO Käärmann in the UK tax dispute may mean he has to step down from a management role.

Conclusion

We overpaid for the shares in September 2021, and we need the shares to double from here to be square. We have decided that it is right to add and have a buy rating, based on the two following factors: 1) Wise’s business model still has a long sustainable growth runway which is profitable and cash generative, and 2) Käärmann’s tax dispute could be resolved in the next year or so, meaning whatever the outcome this overhang will disappear, and the company will already have a plan B in place if he has to step down. This rating is not for the short term and is more of a multiyear investment outlook.

Be the first to comment