AdrianHancu/iStock Editorial via Getty Images

Wise plc (OTCPK:WPLCF) is a payment processing company that enables international money transfers. The company has a high 5-year average revenue growth of 56.44%. Thus, we analyzed the driving factor of revenue growth based on the Business and Personal segments and then compared Wise with conventional banks and its peers to determine its competitive advantage and whether Wise could continue to generate high revenue growth.

Personal Customers Segment Driving Revenue Growth

|

Wise |

2019 |

2020 |

2021 |

|

Personal Customer (‘mln’) |

4.5 |

5.7 |

7.0 |

|

Growth % |

26.67% |

22.81% |

|

|

Personal Volume Per Customer (‘VPC’) ($) |

9,744.4 |

9,752.3 |

10,660.6 |

|

Growth % |

0.08% |

9.31% |

|

|

Total Personal Volume ($ mln) (‘a’) |

43,849.75 |

55,587.97 |

74,624.17 |

|

Growth % |

26.77% |

34.25% |

|

|

Business Customer (‘mln’) |

0.2 |

0.3 |

0.4 |

|

Growth % |

50.00% |

33.33% |

|

|

Business Volume Per Customer (‘VPC’) ($) |

56,189.6 |

53,071.6 |

62,742.4 |

|

Growth % |

-5.55% |

18.22% |

|

|

Total Business Volume ($ mln) |

11,237.92 |

15,921.49 |

25,096.96 |

|

Growth % |

41.68% |

57.63% |

|

|

Total Volume |

55,087.67 |

71,509.46 |

99,721.12 |

|

Personal Take Rate (‘b’) |

0.75% |

0.81% |

0.76% |

|

Growth % |

6.96% |

-5.45% |

|

|

Business Take Rate |

0.60% |

0.66% |

0.66% |

|

Growth % |

10.52% |

0.85% |

|

|

Personal Revenue ($ mln) (‘c’) |

330.9 |

448.64 |

569.44 |

|

Growth % |

35.60% |

26.93% |

|

|

Business Revenue ($ mln) |

66.9 |

104.77 |

166.55 |

|

Growth % |

56.58% |

58.97% |

|

|

Total Revenue ($ mln) |

397.77 |

553.40 |

735.99 |

|

Growth % |

39.13% |

32.99% |

*b = c/a

** Converted from GBP to USD exchange rate of 1.3145

Source: Wise, Khaveen Investments

We compared Wise’s Personal and Business accounts based on a few metrics (number of customers, volume per customer and take rate) to determine the main factor for its high revenue growth. Based on the table above, the 2-year average growth of the company’s Business account customers was higher (41.67%) than Personal accounts at 24.74%. Although there was a decline in Business VPC in 2020, the 2-year average growth of 6.34% is still higher than Personal VPC (4.70%).

We then calculated the yearly volume by multiplying VPC and the number of customers. The growth in total Business volume was higher (2-year average of 49.65%) as compared to total Personal volume (2-year average of 30.51%). Additionally, we calculated each segment’s take rate by dividing the revenue by the total volume for each segment. Although the Business segment has a lower take rate at 0.66% as compared to the Personal segment with 0.76% in 2021, it had a higher growth with a 2-year average growth of 5.69% whereas the Personal take rate decreased by 5.45% in 2021 resulting in a lower 2-year average growth of 0.76%.

Overall, we believe that the factor which had contributed the most to Wise’s revenue growth the most was the growth in the Personal segment revenue. Although the company’s Personal segment had lower revenue growth compared to its Business segment, the Personal segment revenue represented a larger percentage of Wise’s total revenue (77.37%) and its changes would contribute a larger impact on the company’s total revenue. Plus, we believe that the lower revenue growth of the company in 2021 (32.99%) as compared to 2020 (39.13%) was due to the decrease in the Personal segment’s take rate. However, we also believe that the Business segment could be the main driver of revenue growth in the future as it had higher growth in 2021 in all aspects (volume, take rate, revenue, VPC) as compared to the Personal segment.

Edge Over Banks Through Rates, Speed and Ease

Wise’s users mainly use Wise for international money transfers. With a Personal account, users can transfer income and earnings to their home country, send money home, shop through overseas online stores, and buy and manage property abroad. Whereas for Wise Business, the difference is that it allows businesses to connect with accounting software and manage expenses and cash flow. Through Wise, businesses can pay overseas staff, receive payments from overseas customers, buy inventory overseas and pay vendor invoices. We compared Wise with conventional banks based on qualitative factors to determine whether Wise has an advantage over the conventional bank.

Based on the applications of Wise, we believe the factors that contribute to the increasing adoption of online payment facilitators like Wise include:

Due to the wide usage of Wise for international transfer, we believe that having a low fee and exchange rate is an important factor. Wise stands out where it has a lower fee and charged a mid-market exchange rate as compared to the average bank fees who usually offer a poor exchange rate with a markup of up to 5% and also up to $25 transfers fees. Hence, users using Wise would benefit by paying less to transfer the same amount.

Foreign workers also remit money back to their home country through international transfer which is why coverage is an important factor as then more foreign workers from more countries are able to conduct the international transfer back home. With Wise, users can send money to 80 countries. However, banks have greater international coverage such as JPMorgan (JPM) which supports cross-currency transfers to more than 160 countries. Overall, Wise is at a disadvantage relative to traditional banks in terms of coverage.

We believe businesses making international transactions would prefer a faster transfer speed to maintain the cash flow. With this, 50% of wise payments are instant while 88% arrive within 24 hours. In contrast, a bank wire transfer takes 2-5 business days. We believe that this would benefit users, especially those who require the transaction to be done instantly. It is also more convenient to transfer internationally from Wise as it can all be done from the Wise app or online. However, some banks require international bank transfers to be done physically at bank branches due to the paperwork needed.

Besides that, according to Wise, foreign students studying abroad also use international transfers to receive allowances or for the payment of school fees. We believe Wise is more accessible for overseas students as they do not only target the working class. It is easier to open an account on Wise as only proof of ID and Personal details are needed. In contrast, banks normally require ID and proof of income whereas students require proof of enrolment.

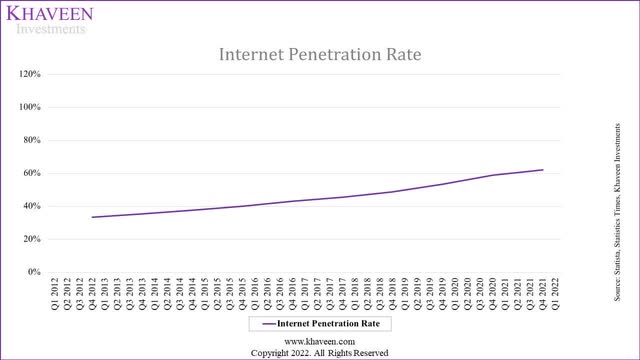

As discussed, we believe users are shifting away from traditional banks to online payment processing providers because of the benefits provided such as low cost, exchange rate and convenience. We believe that the benefits online payment processors such as Wise provide and the rise in internet penetration rate would provide more accessibility to online services hence increasing adoption opportunities for Wise.

Statista, Statistics Times, Khaveen Investments

Overall Stands Out Among Its Peers

We compared Wise with its peers in terms of product positioning, financial metrics and reviews to determine Wise overall competitiveness.

Product Positioning:

|

Product Positioning Comparison |

Fees |

Exchange Rate |

Coverage |

Speed |

Payment Method |

Average Ranking |

|

Wise |

1 |

1 |

5 |

2 |

2 |

2 |

|

MoneyGram (MGI) |

3 |

2 |

1 |

3 |

2 |

2 |

|

Western Union (WU) |

3 |

4 |

2 |

1 |

1 |

2 |

|

Payoneer (PAYO) |

5 |

4 |

2 |

4 |

6 |

4 |

|

Revolut |

6 |

6 |

4 |

4 |

4 |

5 |

|

Remitly (RELY) |

2 |

2 |

6 |

4 |

4 |

4 |

Source: Money Transfers, FXcompared, iCompareFX, Revolut, Khaveen Investments

We compared Wise product positioning based on a few criteria, fees, exchange rate, coverage, speed, and payment method. We constructed a ranking system by compiling 10-11 head-to-head comparisons respectively for each criterion totaling up to 55 pairs from sources such as Money Transfers, FXcompared and iCompareFX, then ranked them.

Based on the table above, Wise is at the top in terms of fees and exchange rate. For other aspects, Wise is also competitive as we ranked it second behind Western Union for transfer speed and payment method. However, Wise is ranked 5th for coverage as it provides fewer currency options as compared to its peers. Based on the average ranking, Wise, Money Gram, and Western Union are on par with each other but still more competitive than Payoneer, Revolut, and Remitly.

Financial Metrics:

|

Financial Metrics Comparison |

2021 Customers (‘mln’) |

2021 Revenue ($ bln) |

Revenue/ Customer ($) |

|

Wise |

7.40 |

0.56 |

75.66 |

|

MoneyGram |

47.00 |

1.28 |

27.32 |

|

Western Union |

150.00 |

5.10 |

34.00 |

|

Payoneer |

5.00 |

0.14 |

27.40 |

|

Revolut |

15.00 |

0.50 |

33.33 |

|

Remitly |

2.80 |

0.14 |

48.32 |

Source: Company Data, Khaveen Investments

In 2021, Western Union had the highest number of customers (150 mln) and revenue ($5.10 bln). Wise had the third lowest number of customers (7.4 mln) followed by Payoneer with the second lowest number of customers (5 mln). Among all companies, Remitly had the lowest number of customers at 2.8 mln as well as the lowest revenue of $0.14 bln. Whereas Wise had the third lowest revenue $0.56 bln after Revolut. Although Wise had the lowest number of customers and revenue, however, it had the highest revenue per customer ($121.71), followed by Remitly at $48.32 per customer. We believe that this is mainly due to the low fee and exchange rate Wise provides. Overall, despite its lower revenue and customers in comparison to its competitors, we believe Wise stands out due to its revenue per customer which is the highest among competitors.

Competitive Positioning:

|

Reviews Comparison |

NPS |

Trust Pilot Reviews |

|

Wise |

17 |

4.5 |

|

MoneyGram |

-2 |

4.3 |

|

Western Union |

-7 |

3.9 |

|

Payoneer |

9 |

4.3 |

|

Revolut |

22 |

4.4 |

|

Remitly |

13 |

4.2 |

Source: Comparably, Trust Pilot, Khaveen Investments

As seen above, Wise has the second highest NPS score at 17 while Revolut has the highest NPS score of 22. This shows that Wise has high customer satisfaction and loyalty. Moreover, based on Trust Pilot reviews, Wise has the highest average reviews (4.5) followed by Revolut (4.4) whereas MoneyGram has the lowest average review of 4.3. Hence, we believe that Wise overall has the same positioning as Revolut in terms of competitive positioning. We believe that Wise’s strong competitive positioning justifies why Wise has high revenue per customer.

Risk: Exchange Rate Fluctuation

We believe that the exchange rate fluctuation would pose a risk to Wise. This is because Wise has the lowest fees and exchanges rate and doesn’t charge a spread as discussed in the points above. Hence, we believe the fluctuation in the exchange rate could affect Wise’s profit.

Verdict

To conclude, we believe that the company’s Personal customer segment revenue growth is the main contributor to its total revenue growth and is further supported by Wise having an edge over banks and its competitors. Wise is relatively competitive in terms of product positioning, being on par with Money Gram, and Western Union. It has the highest revenue per client and is also on par with Revolut in terms of reviews. Therefore, we believe overall Wise stands out as compared to its competitors.

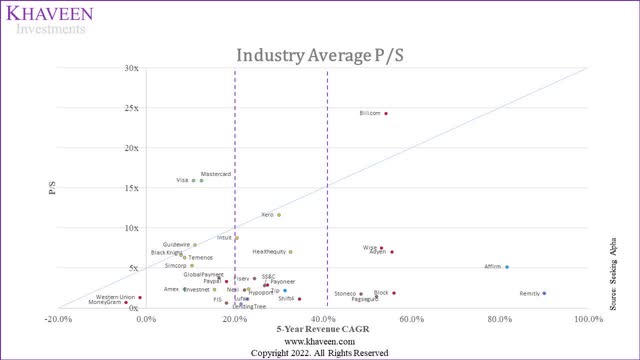

Seeking Alpha, Khaveen Investments

|

Average P/S |

3-year |

5-year |

|

<20% |

3.57x |

3.96x |

|

20%-40% |

4.08x |

3.89x |

|

>40% |

6.18x |

6.39x |

Source: Seeking Alpha, Khaveen Investments

To determine the value of the company, we added Wise, MoneyGram, Western Union, Payoneer, Revolut, and Remitly to our previous P/S comparison based on the 3-year and 5-year revenue CAGR then updated the average P/S for each revenue growth segment. As Wise has a past 5-year revenue CAGR of 53.21%, we valued Wise based on the 5-year high growth (>40%) average P/S of 6.39x on a forecasted FY2023 revenue of $992.2 mln (based on analyst revenue consensus) then divided by its shares outstanding of 1.02 bln. Thus, we obtained a price target of $6.18 which is a downside of 0.8% for its shares and rate the company as a Hold.

Be the first to comment