Richard Drury/DigitalVision via Getty Images

The SPDR FTSE International Government Inflation-Protected Bond ETF (WIP) is exactly what it says on the tin: an international government inflation-protected bond ETF. WIP’s underlying holdings perform particularly well when international inflation rises, while providing few benefits to investors when U.S. inflation increases. Although there is nothing inherently wrong with the fund, U.S. inflation funds, indexed to local inflation rates, are the better choice for U.S. investors, which include most readers and subscribers. There are few reasons to prefer WIP to comparable U.S. inflation-protection funds, so I would not be investing in WIP at the present time.

I previously covered several U.S. inflation-protection funds here. The Schwab U.S. TIPS ETF (SCHP) is most similar to WIP, but indexed to local inflation rates, and the more appropriate choice for most U.S. investors.

Inflation-Protected Bonds Overview

WIP’s investment thesis, or lack thereof, is closely related to several characteristics of U.S. treasury-inflation protected securities, or TIPs. WIP’s holdings are similar, but inferior, to TIPs, and so to understand the former we must first understand the latter.

Treasuries, including TIPs, are the safest assets in the world, backed by the full faith and credit of the U.S. government. TIPs tend to perform reasonably well during downturns and recessions, due to a flight to quality effect, and due to Federal Reserve policy. Normal treasuries perform even better, but TIPs tend to do fine.

TIPs are indexed to U.S. inflation rates, and so see strong yields, capital gains, and returns when U.S. inflation is high. TIPs can be used to hedge, even profit, from rising inflation.

TIPs offer investors safe, high-quality holdings and inflation protection, a solid combination, and perfect for conservative income investors concerned about rising cost of living.

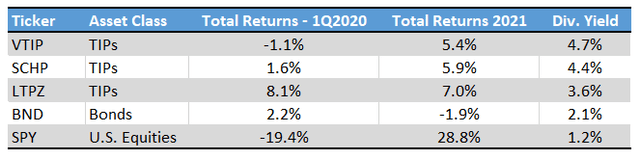

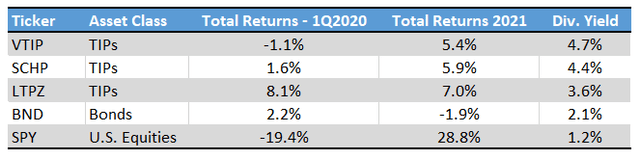

A quick table for some TIPs funds, plus select financial metrics.

SeekingAlpha – Chart by author

As can be seen above, TIPs funds performed particularly well during 1Q2020, the most recent downturn, and during 2021, a year of above-average inflation. Dividend yields are also quite strong, but very volatile, and sensitive to inflation rates. Dividends have skyrocketed these past few months, and these have yet to be (completely) reflected in trailing dividend yields. As such, investors should expect materially higher dividend yields in the near future, assuming inflation remains elevated.

WIP is similar to the funds above, but focusing on international securities. Let’s have a look at the fund.

WIP Basics

WIP Overview

WIP is an international inflation-linked bond index ETF. The fund invests in securities with similar characteristics to TIPs, but issued by foreign governments, in foreign currencies, and indexed to foreign inflation rates. It tracks the FTSE International Inflation-Linked Securities Select Index, an index of these same securities. It is a relatively simple index, investing in all relevant bonds subject to a basic set of country, credit quality, and size criteria. It is a market-cap weighted index, subject to country caps to ensure diversification.

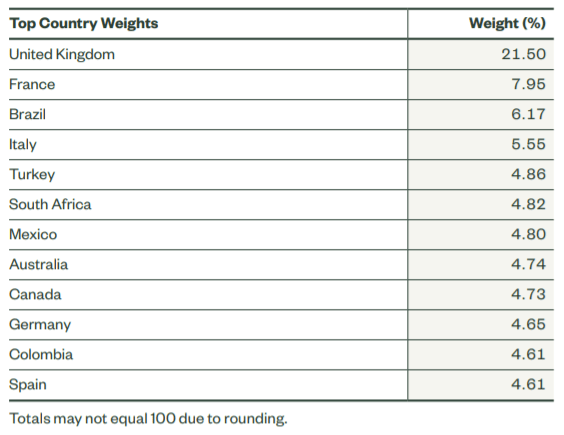

WIP is a reasonably well-diversified fund, with exposure to 211 securities from 19 different countries. The fund is somewhat overweight developed markets, but only slightly so. Country allocations are as follows.

WIP Corporate Website

Bonds are issued and indexed to local inflation rates. U.K. bonds are issued in British pounds and indexed to British inflation rates, French bonds are issued in Euros and indexed to French inflation rates, and so on.

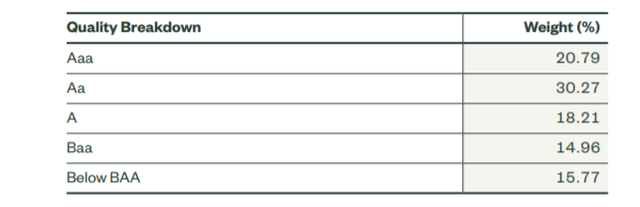

WIP’s credit quality filter results in a high-quality fund, with a median credit rating of Aa, the second-highest rating available. WIP’s holdings are quite safe, and default risk is very low.

WIP Corporate Website

WIP focuses on long-term bonds, with an average maturity of 12 years, duration of 11. Investors should expect significant losses if interest rates were to increase, a distinct possibility as monetary policy normalizes in the coming months. The Federal Reserve will most likely wait a couple more months before hiking interest rates, but foreign central banks have already started to hike.

WIP’s strategy and holdings compare unfavorably to those of most TIPs funds. Let’s have a look.

WIP versus TIPs

WIP invests in international inflation-protected securities. TIPs funds, including SCHP, invest in U.S. treasury inflation-protected securities. Although the holdings are broadly similar, there is one key difference. TIPs are issued in U.S. dollars and indexed to U.S. inflation rates, WIP’s holdings are issued in foreign currency and indexed to foreign inflation rates. This change is a significant negative for WIP and its shareholders, for four key reasons.

First and foremost, there is simply no real rationale for U.S. investors, which account for most readers and subscribers, to invest in foreign currency bonds indexed to foreign inflation rates. U.S. investors might wish to hedge their portfolios against local inflation rates, as these directly impact their cost of living. This is not the case for foreign inflation rates: U.S. investors, by and large, are not affected by the cost of living in the U.K., Germany, or Brazil. As such, U.S. investors have no real reason to hedge their portfolios against rising international inflation.

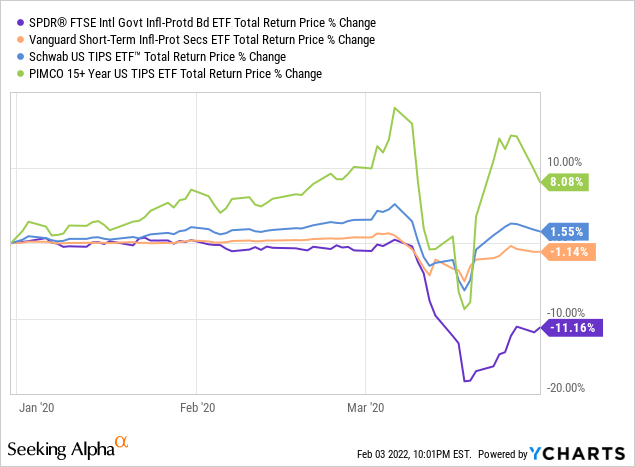

Second, foreign currency bonds are riskier than treasuries, due to foreign currency risk, and due to a lessened flight to quality effect. Dollar-denominated treasuries are the safest assets in the world, not German bunds or British gilts. As such, WIP should underperform during downturns and recessions, as was the case during 1Q2020, the onset of the coronavirus pandemic. Investors should expect the fund to underperform during future downturns as well.

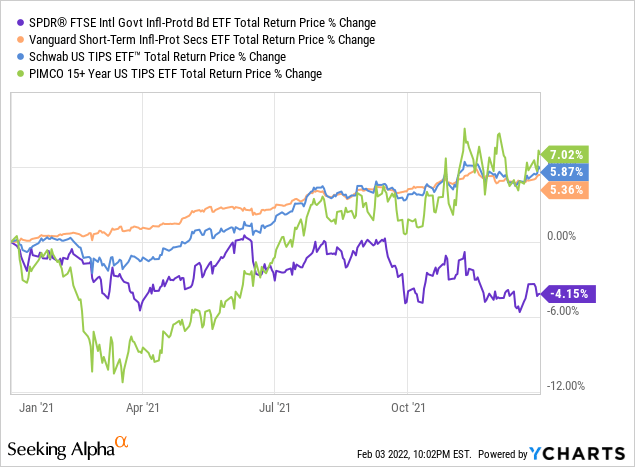

Third, as WIP’s holdings are indexed to international inflation rates, not U.S. inflation rates, the fund is an ineffective U.S. inflation hedge. As such, WIP’s investors should not expect strong yields, capital gains, or returns when U.S. inflation is high. WIP itself underperformed comparable U.S. TIPs funds during 2021, a period of heightened U.S. inflation, as expected.

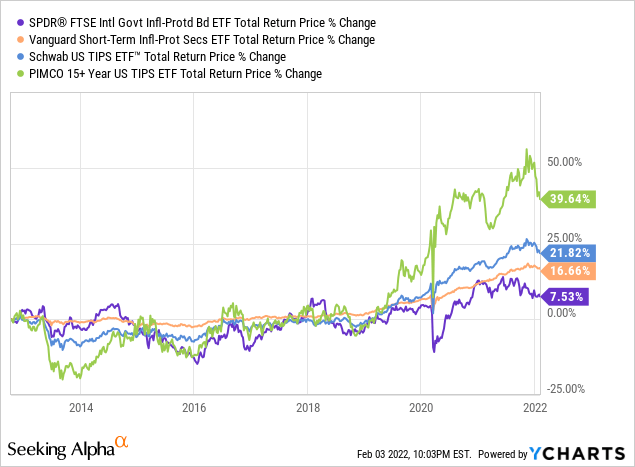

WIP’s longer-term performance is also quite weak, although most of the fund’s underperformance is quite recent.

Fourth, as U.S. inflation rates are running a bit higher than average, TIPs funds should have stronger dividend yields compared to WIP. This is surprisingly not the case, although TIPs funds are seeing comparatively strong dividend growth. Dividend growth should lead to stronger dividend yields for TIPs funds versus WIP in the coming months, assuming U.S. inflation remains elevated.

A quick table summarizing the above points.

SeekingAlpha – Chart by author

As a final point, I decided against a bearish rating for WIP as there is nothing inherently wrong with the fund, it just pales in comparison with TIPs funds. WIP should also outperform if international inflation were to skyrocket, which is a plausible scenario, but I see no reasons to believe that this will be the case.

Conclusion

WIP is an international inflation-protected bond ETF. WIP’s overall value proposition is similar to that of U.S. TIPs funds, but worse. As such, I see no reason to invest in WIP at the present time.

Be the first to comment