Alexandr Milodan/iStock via Getty Images

Wingstop (NASDAQ:WING) has been a high-growth, fast casual restaurant chain since its founding in 1997, producing same store sales growth (SSG) for the last 18 years while continuing to expand its footprint both domestically and internationally. The market has rewarded the company with some very rich valuations, with current and forward price/earnings of 93x and 66x respectively, and a price to sales of over 13x. Despite a very competent management team and a very resilient balance sheet, the growth story is beginning to turn, most notably on the earnings side as the effects of inflation are starting to be felt, but are likely to get worse as Wingstop is also seeing some short-term tailwinds as well. With the valuations quite rich, especially as we are seeing many high-flyers in other industries get pummeled in the current bear market, I think a short or put position in Wingstop may be a good hedge to the continued market risks a long portfolio will have in this current market.

The Good

There is a lot to like about Wingstop. Management has delivered stellar returns through all markets, including both the COVID drop in 2020 as well as the GFC in 2008. The company is profitable and cashflow generative with most of its earnings falling onto its balance sheet. Wingstop is also largely focused on a low price point which could see benefits if diners start to trade down when they dine out.

With the focus of this article being the near-term risks to its share price, I would encourage readers to review the following article which outlines management’s business plan. Wingstop’s investor presentation also outlines its plans going forward and historical execution success.

Management has taken out debt as well to help fund its growth, but has done so at fixed interest rates (although it has an untapped variable line as well) which means the current rate hiking environment should not impact it and in fact may help as Wingstop has a large cash balance ($165m+) on hand currently. Its debt is not due for several years with its most recent $250m raise not due until 2029.

Margin Compression

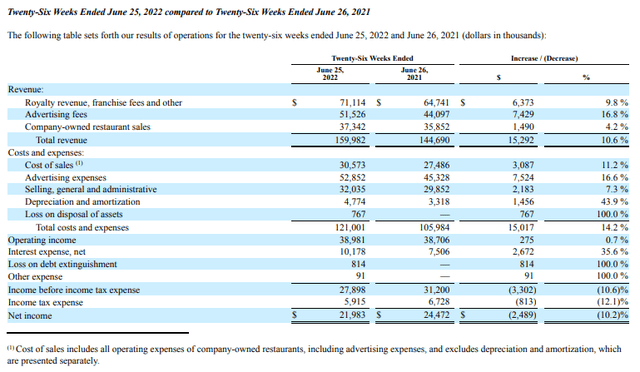

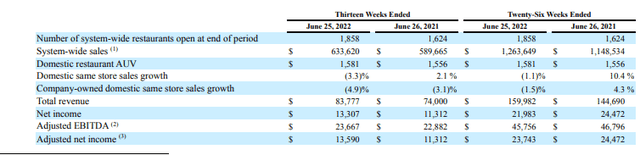

The risk with high growth companies is that they require continued proof that the growth narrative is in place. With Wingstop continuing to expand its store footprint with franchisors both domestically and internationally, they should be able to continue to see a growth narrative in revenues. However, if we look at the cost pressures as well as the same store sales performance in its last 10-Q report, it is much less encouraging:

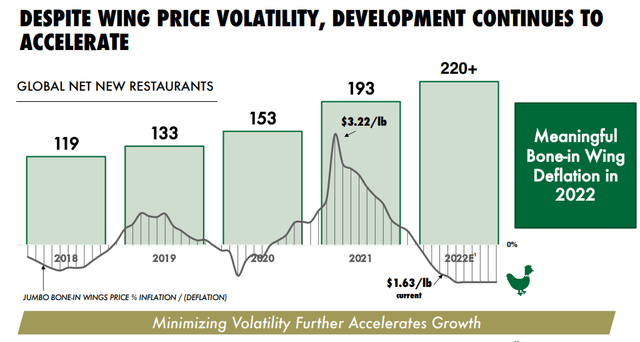

In the above we can see that despite the sales jump in H1 2022 from 2021 of 10.6%, costs increased at 14.2% with a very small increase falling to operating income line. When you look at the additional costs due to the recent financing (which will be on-going for the near future), the company’s profitability is actually eroding. This is more concerning when we look at the recent pricing for chicken wings:

With the cost of its major product at near cyclical lows, this becomes more concerning for margins going forward if we see a cyclical uptick during the football season when demand traditionally increases.

We are also seeing a drop in Same Store Sales Growth as well; the last quarter is likely cyclically lower to begin with, but the comparison to the prior year is concerning for a company with a price earnings over 90x.

It is not a surprise that Wingstop is seeing cost pressure from all sides. With CPI running at over 8% and wage inflation running also over 8%, it is unlikely that their cost structure is going to improve. The additional headwind is that eating out in general will drop as customers home balance sheets get stressed by inflation as well. I believe these will certainly impact the growth narrative on the earnings front, if not the revenue front as well which is likely to see investors punish its high-flying multiples, despite the strong execution management has shown.

Technicals

Wingstop shares have already sold off some as the broad market has entered into a bear market. I believe there is likely much further for Wingstop shares to fall as the likelihood of negative earnings due to the above factors is quite high in the near term and we have seen very negative responses to bad earnings even for blue chip companies.

The current trading looks like a bear flag and there is a lot of room down to the base last summer at around $70. Combined with the erosion in fundamentals that I believe inflation is driving, it is hard to see positives in the short term for Wingstop.

The Takeaway

I believe a short position in Wingstop will serve as a good hedge to a generally long portfolio as it should pay off if inflation continues to remain elevated, combined with a heightened interest rate environment that will squeeze its customers and its cost base. There is not a tremendous amount of volume on Put options, though they are readily available so there could be risk on liquidity if you use this as a mechanism to short Wingstop shares. I prefer Puts due to the cap on risk capital required as it suits my investment style.

Be the first to comment