JHVEPhoto/iStock Editorial via Getty Images

Published on the Value Lab 23/3/21

Willis Towers Watson (NASDAQ:WTW) is a pretty unique business as far as I’ve seen, but they vaguely connect to consulting type businesses, as well as broker type businesses in the corporate risk and broking segment. They’ve suffered a bit from attrition in CRB, but hiring new people should start paying off soon. Moreover, by offering advice in the sphere of compensation and hiring, advice is being needed in projects to determine how this should be done for clients. The balance sheet is safe and the multiple is low, so despite some risks on the horizon, it looks somewhat compelling. However, there is no clear catalyst or edge that we see for earnings and price to be driven so much higher.

Thoughts on the FY

The FY results can be difficult to parse because a major business in reinsurance, Willis Re, had been held as assets for sale and then eventually sold for a nice gain, affecting the reported figures.

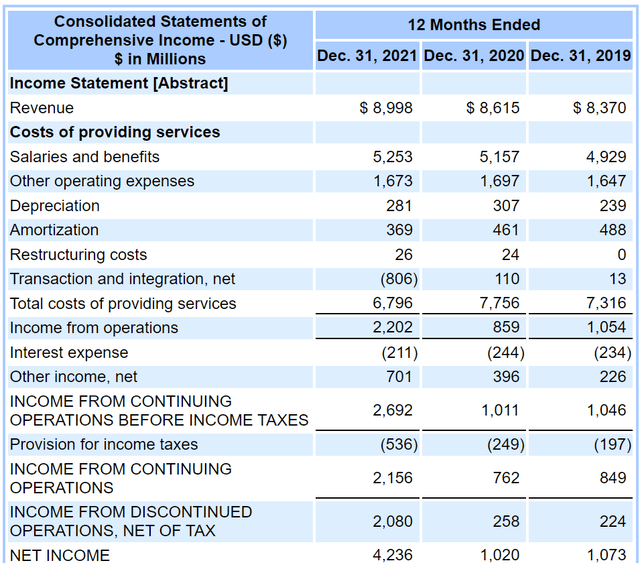

10-K Income Statement (SEC.gov)

This 4x increase in net income is of course not going to be sustained. The discontinued operations were Willis Re, and the reason the results from that segment ballooned in 2021 is because of the realised gain on its sale. The only figures that matter thereafter are going to be the earnings from the continuing businesses.

The income grew substantially for the continuing operations as well on a GAAP basis. This is simply because the costs are so much lower in 2021 due to a one-off receipt of cash related to the termination of a transaction (the $806 million income in the transaction and integration line). Adjusting for that, we see that while a major confounder, the result is still directionally the same, with some nice cost structure improvements and higher revenue growth leading to a good gain in profits, giving us the figures that WTW reports in its presentation.

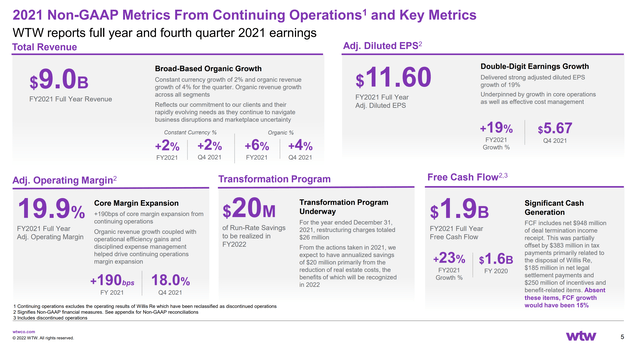

Financial Highlights (Q4 2021 WTW Pres)

The salaries and benefits line continued to grow as hiring continues in several of the segments. 2020 was a more muted year in terms of results because veteran talent was exchanged for newer talent due to attrition, meaning less productivity. This was particularly noticeable in the CRB business, but also in the human capital business, which are WTW’s two largest segments. The effects of that attrition are still being felt in 2021 according to management, with renewal of business connected to those former employees not occurring. So 2021 should be the last year we see these attrition based headwinds from the peak levels in 2020, where attrition rates have slowed down already in Q3.

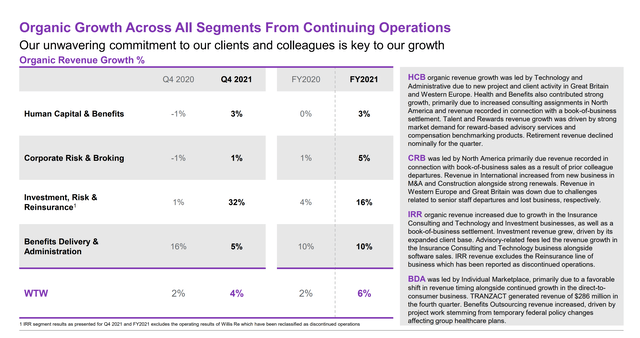

Segment Breakdown (Q4 2021 WTW Pres)

With insurance being a growing sector in the US especially, which has been affected by some natural disasters these past years, namely hurricanes. Natural disasters typically remind customers of the importance of being insured, leading to a greater volume of policies sold in the next years. HCB benefits from hiring being a central issue for clients during this great resignation period, but is more mixed as the retirement business shifts from gaining revenue on clients transferring risks to the pension finding levels to insurers, to other services related to retirement. This is because pension levels have become so well-funded.

The IRR revenue includes a gain from the settlement of some assets that didn’t transfer in connection to the separation of Willis Re. Really the gains were pretty flat in this segment on a continuing basis, and the margin expansion was less pronounced.

IRR’s operating margin was 25.3% for the fourth quarter compared to 12.5% in the prior year fourth quarter. On a full year basis, IRR’s operating margin improved to 19.5% from 14.5% in the prior year. Excluding the impact of currency and the benefit of book of business settlements, the margin declined 240 basis points for the quarter, but increased by 220 basis points for the full year.

Carl Hess, CEO of WTW

So the constant currency growth rates for the comprehensive business of 2% are more accurate for revenue, but there was still margin expansion.

Risks

While hiring related issues idiosyncratic to WTW seem to be in the rear view, with new hires in HCB and CRB gaining in productivity, all consulting and human capital intensive businesses are struggling with the fact that attrition rates have become recently high, and that there is a great resignation going on. The HCB segment is particularly exposed in this regard on the consulting side, while the CRB is exposed due to lost rolodexes in broking in the cases of attrition. Elevated human capital costs are a problem for the company, and increases the risks of stutters in productivity due to turnover for WTW. Besides that, the risks for WTW seem pretty limited. CRB should continue to be an attractive business as more insurance policies are placed on the market by them, and the balance sheet is also totally unlevered on a net debt basis, with a net cash position of basically $0.

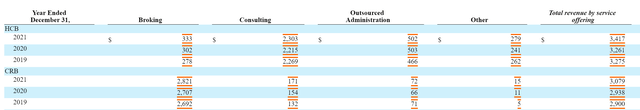

Disaggregation (SEC.gov)

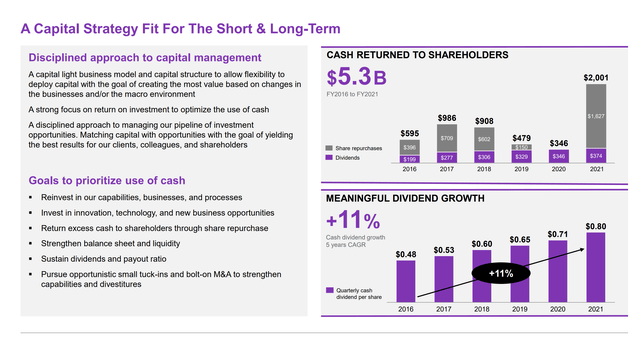

Moreover, the company has been quite generous with its payout to shareholders. While the dividend is meager, the effects of repurchases are very significant.

Capital Structure and Payout (Q4 2021 WTW Pres)

Total yield in 2021 was actually close to 15%. While it was an especially heavy year in terms of shareholder payout, yields between 4-7% have been the norm over the past couple of years. The repurchases were a good move as the company takes advantage of the lesser risk in lower prices of its own stock, and reduces the shareholder burden over time. Moreover, the dividend component is growing consistently and rapidly.

Conclusions

With no debt, the company trades at around a 7.5x multiple on the continuing earnings, with DA being very minor. That is not a high multiple at all. The WC investment rates are super low, with a decline in WC from 2020 to 2021 on a non-cash and non-interest bearing basis. Fixed capital requirements are negligible for a business of this type. The margins are high too at 19%, and the business isn’t subject to massive risks. Compensation advice is a matter that crops up every single year with the work of compensation committees in large companies leading up to those annually filed DEF14As, and insurance products remain a pretty healthy market, with insurance underwriting generally growing. WTW is also a leader in these segments, and the hiring issues have abated and we should see incremental improvement of results into 2022. The risks aren’t very high here really, and the company is a veritable stalwart. We think it’s compellingly valued and has a good profile. We’re just not sure the price action is exciting enough for us to get involved.

Be the first to comment