Far700

Williams (NYSE:WMB) acquired MountainWest Pipelines from Southwest Gas Holdings (SWX) for $1.07 billion of cash and $0.43 billion of assumed debt, for a total cost of $1.5 billion. The assets were acquired at an 8-times EBITDA multiple, according to WMB’s acquisition press release.

This deal marks WMB’s third large acquisition this year, after its $950 million Trace Midstream acquisition and its $423 million NorTex acquisition. The total price tag for all three comes to $2.87 billion.

Asset Overview

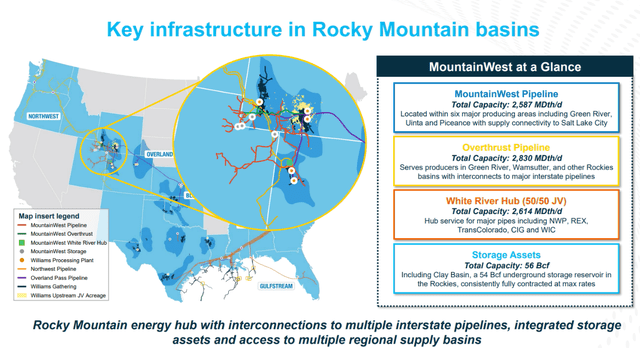

The MountainWest assets are a diverse mix of long-haul and gathering pipelines, a hub joint venture, and underground storage assets in Wyoming, Colorado, and Utah, as shown below.

Source: WMB MountainWest acquisition presentation, Dec. 15, 2022.

The deal is accretive from an EV/EBITDA perspective. WMB’s $63.4 billion enterprise value is currently 10.1-times management’s 2022 Adjusted EBITDA guidance of $6.25 billion. Relative to this multiple, the 8-times multiple paid for the MountainWest assets appears attractive.

However, when considered from a free cash flow perspective, the deal is neutral. WMB’s enterprise value is 12.0 times our estimate of its free cash flow. Assuming the MountainWest assets generate $187.5 million of EBITDA in 2023 and require $22.8 million of interest expense and $5 million of maintenance capex, the acquisition’s enterprise value to free cash flow estimate comes to 11.8-times, roughly equal to WMB’s current multiple of enterprise value to free cash flow.

Are Acquisitions the Best Use of WMB’s Capital?

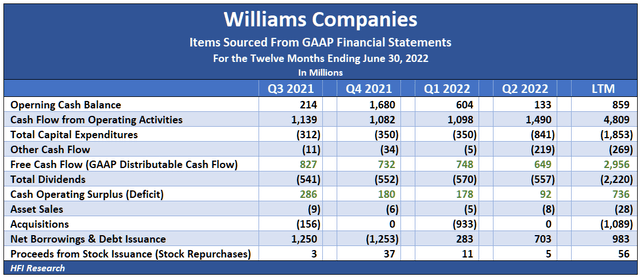

Over the past twelve months, WMB has generated a cash flow surplus of $2.96 billion. Over the past twelve months, it has spent $2.16 billion of cash and assumed $0.71 billion of debt on acquisitions.

WMB’s cash flows through the end of the third quarter, before its MountainWest acquisition, are shown below. Not that it has issued $983 million of debt to fund its acquisitions.

The question for WMB shareholders is whether the funds could be better spent or distributed to shareholders.

We view WMB stock as fairly valued in the market, so repurchases don’t make sense.

Alternatively, the funds could be spent on organic growth projects. WMB typically has an active pipeline of such projects. In the third quarter, for example, it completed the expansion of its Gulfstream pipeline, while it continued to expand its Transco pipeline.

The attractiveness of organic growth projects depends on the return on capital they generate over their lives. We’re not privy to WMB’s return projections on its organic expansion projects, but its long-term return on capital doesn’t inspire confidence about its organic growth. The company only managed to generate an average return on capital employed of 4.5% over the past five years.

Fortunately, results have improved more recently. Over the past four quarters, WMB generated a 7.7% return on capital employed. The return was driven by net income growth in nearly all WMB’s business segments.

The verdict is out as to whether the results are sustainable. Even if they are, a mid-single-digits return on capital would be roughly in line with Kinder Morgan (KMI) but still well below ONEOK (OKE) and the large MLPs such as Enterprise Products Partners (EPD) and MPLX (MPLX).

Due to WMB’s underperforming return on capital, we’d rather invest in other midstream operators if we sought growth from organic projects.

Acquisitions would make sense for WMB if they earn a higher return on capital than its legacy business. Still, the EV to free cash flow multiples of the MountainWest acquisition suggest it’s not a bargain, as it will generate a return on capital on par with WMB’s, which is nothing to get excited about.

Management intends to realize synergies from the MountainWest assets, such as from the connection between the MountainWest assets and its Wamsutter gathering joint venture. While some synergies may exist, we doubt they’re enough to turn the acquisition into a home run. More likely, returns will settle in around WMB’s historical average.

With share repurchases and organic growth not likely to benefit shareholders, and with an acquisition only making sense under the unlikely chance that management can boost the acquired assets’ return on capital, we believe the most sensible way for WMB to allocate free cash flow is to distribute it to shareholders as a dividend.

WMB’s Stock is Fully Priced with Longer-Term Upside

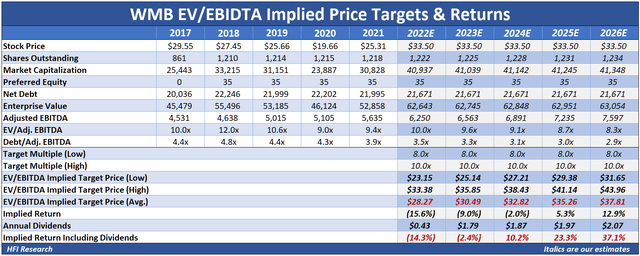

WMB shares are fully priced at the moment. But they offer a decent total return of approximately 37% through 2026.

WMB is currently valued at an 11.4-times EBITDA multiple, which is higher than the midstream average due to the stability of its natural gas assets. We use a lower multiple in our valuation to account for the company’s lower return on capital.

In our view, the best investment case for WMB stock relates to the value it stands to gain from the lack of new major natural gas pipeline projects. Since 2020, natural gas projects have been canceled due to vocal opposition. These include the PennEast Pipeline, the Atlantic Coast pipeline, and WMB’s own Constitution pipeline. Today, the Mountain Valley Pipeline has been stopped in its tracks by activist lawsuits and unsympathetic judges.

While major natural gas pipeline projects are canceled or stalled, natural gas demand is on the rise from the phaseout of coal and the growing proportion of renewables in the domestic energy mix.

In theory, the constrained supply and higher demand for natural gas pipelines should allow the owners of existing pipelines to increase their tariff rates and, in turn, bolster their value. But these days, this outcome isn’t a sure thing. For one, an increasingly activist FERC could fail to approve tariff rate increases on intra-state natural gas pipelines such as those owned by WMB.

Conclusion

We see more attractive investment opportunities than WMB elsewhere throughout the energy sector. WMB’s fully-priced stock offers little near-term appreciation potential. Meanwhile, its 5.2% yield—while well-covered and poised to increase over the coming years—is considerably lower than its midstream peers. ONEOK, for instance, is a corporation like WMB that offers a 5.6% dividend yield, more growth, and sports a higher return on capital. Of course, OKE has its own set of risks, but overall, we believe its equity is more attractively priced than WMB’s. Investors looking to allocate new capital to natural gas-weighted midstream corporations should consider OKE over WMB.

Be the first to comment