William_Potter

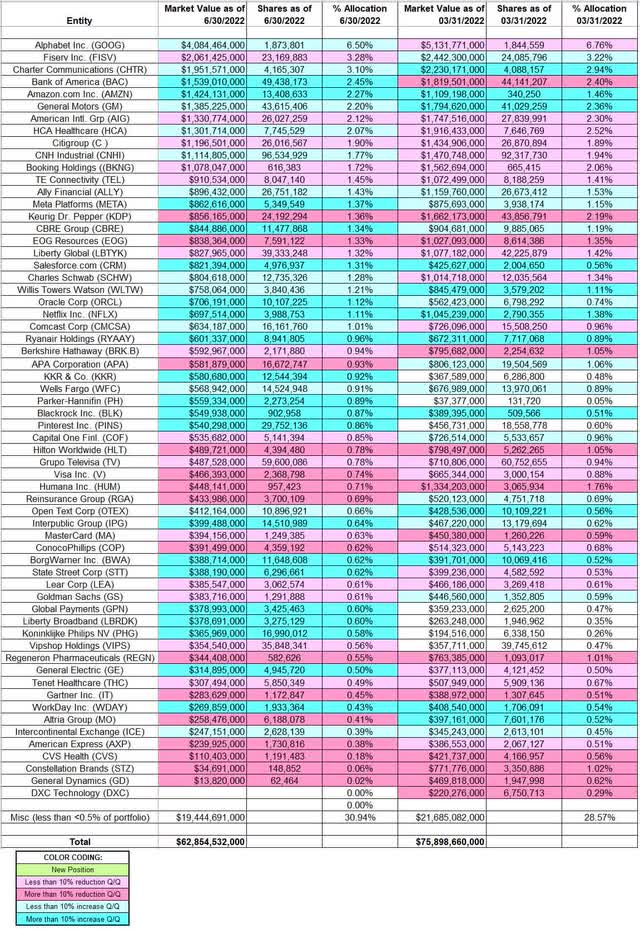

This article is part of a series that provides an ongoing analysis of the changes made to Harris Associates 13F stock portfolio on a quarterly basis. It is based on Harris Associates’ regulatory 13F Form filed on 8/15/2022. William Nygren’s 13F portfolio value decreased from $75.90B to $62.85B this quarter. The portfolio is diversified with recent 13F reports showing around 200 positions. There are 61 securities that are significantly large (more than ~0.5% of the portfolio each) and they are the focus of this article. The largest five stakes are Alphabet, Fiserv, Charter Communications, Bank of America, and Amazon.com. They add up to ~18% of the portfolio. Please visit our Tracking William Nygren’s Harris Associates Portfolio series to get an idea of their investment philosophy and our last update for the fund’s moves during Q1 2022.

Harris Associates currently has ~$120B under management. Their flagship mutual funds are the Oakmark Fund (MUTF:OAKMX) incepted in 1991 and the Oakmark International (MUTF:OAKIX) incepted in 1992. Both funds have produced substantial alpha during their lifetimes: 12.11% annualized return compared to 9.86% for the S&P 500 index for OAKMX and 8.28% annualized return for OAKIX compared to 5.49% annualized for the MSCI World ex-US Index. The other mutual funds in the group are Oakmark Select (MUTF:OAKLX), Oakmark Equity and Income (MUTF:OAKBX), Oakmark Global (MUTF:OAKGX), Oakmark Global Select (MUTF:OAKWX), and Oakmark International Small Cap (MUTF:OAKEX).

Note 1: The top holdings in the Oakmark International Fund are not in the 13F report as they are not 13F securities. The positions are Prosus (OTCPK:PROSY), Intesa Sanpaolo (OTCPK:ISNPY), Lloyds Banking Group (LYG), BNP Paribas (OTCQX:BNPQF), BMW (OTCPK:BMWYY), Allianz (OTCPK:ALIZF), Bayer (OTCPK:BAYRY), Mercedes-Benz Group (DDAIF) (OTCPK:MBGAF, OTCPK:MBGYY), and Continental Aktiengesellschaft (OTCPK:CTTAF).

Note 2: Regulatory filings since the quarter ended show them owning 266.45M shares (10.1% of the business) of Credit Suisse (CS).

Stake Disposals:

DXC Technology (DXC): The minutely small 0.29% of the portfolio stake in DXC Technology was disposed during the quarter.

Stake Increases:

Alphabet Inc. (GOOG) (GOOGL): GOOG is currently the largest 13F position by far at 6.50% of the portfolio. The bulk of the stake was purchased in 2014 at prices between ~$26 and ~$30. Next year also saw a ~20% stake increase at prices between ~$25 and ~$38. The two years through Q4 2020 had seen a ~28% selling at prices between ~$53 and ~$91. The stock currently trades at ~$102. Last six quarters have seen only minor adjustments.

Charter Communications (CHTR): CHTR is a large (top three) 3.10% of the portfolio stake. It was established in 2015 when around 2M shares were purchased at prices between ~$150 and ~$190. 2017 saw a stake doubling at prices between ~$298 and ~$395. 2018 also saw a ~55% stake increase at prices between ~$260 and ~$390. The two years through Q4 2020 had seen a ~58% selling at prices between ~$275 and ~$680. There was a ~20% stake increase in H1 2021 at prices between ~$597 and ~$722. That was followed with a ~30% increase last quarter at prices between ~$545 and ~$648. The stock currently trades at ~$329. There was a marginal increase this quarter.

Bank of America (BAC): BAC was a minutely small position in their first 13F filing in 1999. It became a significant part of the portfolio in 2011. The 2012 to 2015 timeframe saw the stake built from 9.8M shares to 138M shares at prices between ~$6 and ~$18. The next 3 years saw a ~40% reduction at prices between ~$12 and ~$33. 2019-2021 timeframe saw another ~40% selling at prices between ~$20 and ~$48. Last quarter saw a ~17% reduction while this quarter there was a similar increase. The stock is now at ~$32, and the stake is at 2.45% of the portfolio.

Amazon.com (AMZN): The 1.46% of the portfolio AMZN stake was primarily built during the last two quarters at prices between ~$102 and ~$170. The stock currently trades at ~$121.

General Motors (GM): GM is a 2.20% of the portfolio position. It is a very long-term stake. The original position was minutely small in 2007 and it was disposed the following year. In 2013, a huge ~70M share stake was established at prices between $27 and $41. The position size peaked at ~81M shares in 2015. The stake was sold down by ~25% in the 2016-2019 timeframe at prices between $28 and $46. That was followed with a ~45% reduction in the five quarters through Q2 2021 at prices between ~$18 and ~$64. There was a ~25% stake increase last quarter at prices between ~$40 and ~$66. The stock currently trades at $34.84. This quarter saw a ~6% further increase.

HCA Healthcare (HCA): HCA is now a ~2% of the portfolio stake. A large position was built over the 2016-2017 timeframe at prices between $64 and $89. Q4 2018 saw that original stake reduced by ~50% at prices between ~$120 and ~$144. Next quarter also saw a ~15% stake reduction. There was a one-third increase in Q2 2020 at prices between $82 and $118. That was followed with a ~15% stake increase next quarter at prices between ~$94 and ~$138. The four quarters through Q3 2021 had seen a ~14% selling at prices between ~$124 and ~$262. The stock currently trades at ~$203. Last three quarters have seen only minor adjustments.

CNH Industrial (CNHI): CNHI is a 1.77% of the portfolio position purchased in Q4 2020 at prices between $7.75 and $13 and the stock currently trades at $12.24. Last five quarters saw a ~55% selling at prices between ~$11 and ~$17. This quarter saw a minor ~5% stake increase.

Note: They control ~7.3% of the business.

Ally Financial (ALLY): ALLY is a 1.43% of the portfolio position first purchased in 2015 at prices between $18.50 and $24. Next year saw the position more than doubled at prices between $15.50 and $20.50. The ten quarters through Q2 2021 had seen a ~40% selling at prices between ~$12 and ~$55. The stock is now at $30.69. Last four quarters have seen minor increases.

Note: They have a ~7.5% ownership stake in Ally Financial.

Meta Platforms (META), previously Facebook: META is a 1.37% of the portfolio position. The stake saw a ~42% increase in Q1 2020 at prices between ~$146 and ~$223. That was followed with a ~35% stake increase this quarter at prices between ~$156 and ~$223. The stock currently trades at ~$139.

BlackRock, Inc. (BLK), BorgWarner (BWA), CBRE Group (CBRE), Charles Schwab (SCHW), Comcast Corp. (CMCSA), General Electric (GE), Global Payments (GPN), Intercontinental Exchange (ICE), Interpublic Group (IPG), KKR & Company (KKR), Koninklijke Philips NV (PHG), Liberty Broadband (LBRDK), Netflix Inc. (NFLX), Open Text Corp. (OTEX), Oracle Corp. (ORCL), Parker-Hannifin (PH), Pinterest (PINS), Ryanair Holdings (RYAAY), Salesforce (CRM), State Street Corp. (STT), Wells Fargo (WFC), Willis Towers Watson (WTW), and Workday Inc. (WDAY): These small (less than 1.5% of the portfolio each) positions were increased this quarter.

Stake Decreases:

Fiserv, Inc. (FISV): FISV is a large (top three) 3.28% of the portfolio position primarily built last year at prices between ~$96 and ~$111. There was a minor ~4% trimming this quarter. The stock currently trades at ~$101.

American International Group (AIG): AIG is a 2.12% of the portfolio position first purchased in 2012 at prices between ~$23 and ~$36. The stake was almost doubled over the next two years at prices between $35 and $56.50. 2016 saw a one-third selling at prices between $50 and $66. 2017-2018 timeframe saw a similar increase at prices between $37.50 and $67. The three quarters through Q3 2019 had seen a ~20% reduction at prices between $40 and $57.50. The stock is now at $51.30. Last several quarters have seen further trimming.

Citigroup Inc. (C): The 1.90% Citigroup position was built in 2014 at prices between ~$46 and ~$56. The stake was almost doubled over the next three years at prices between ~$37.50 and ~$76. Since 2018, there had been a combined ~30% selling at prices between ~$35 and ~$82. The stock currently trades at ~$44. Last few quarters have seen minor trimming.

Booking Holdings (BKNG): BKNG is now a 1.72% of the portfolio position. It was a minutely small stake first purchased in 2016 and was increased substantially next year at prices between $1465 and $2035. H1 2019 saw the stake almost doubled at prices between $1665 and $1880. H2 2019 had seen minor trimming. There was a ~25% stake increase in Q1 2020 at prices between ~$1152 and ~$2087. The four quarters through Q2 2021 had seen a ~20% trimming. The stock is currently at ~$1727. Last few quarters have also seen minor trimming.

TE Connectivity (TEL): TEL is a very long-term stake first purchased in 2011 in the high-20s price range. Recent quarters have seen minor selling. There was a 16% reduction in Q2 2020 at prices between ~$59 and ~$92. That was followed with a ~50% reduction over the last two years at prices between ~$79 and ~$165. The stock currently trades at ~$118 and the stake is at 1.45% of the portfolio.

Keurig Dr Pepper (KDP): KDP is a 1.36% of the portfolio position established in Q3 2020 at prices between ~$27 and ~$31 and doubled next quarter at around the same price range. Q1 2021 saw a ~25% further increase at prices between ~$30.50 and ~$35.50. Last two quarters have seen a ~50% selling at prices between ~$34 and ~$39. The stock currently trades at $37.44.

Constellation Brands (STZ): STZ is now a minutely small 0.06% of the portfolio stake. Recent activity follows. Q1 2020 saw a ~50% stake increase at prices between ~$106 and ~$208. The next three quarters had seen a ~23% selling at prices between ~$130 and ~$220. The position was almost sold out over the last two quarters at prices between ~$212 and ~$259. The stock currently trades at ~$236.

APA Corporation (APA), Altria Group (MO), American Express (AXP), Berkshire Hathaway (BRK.B), Capital One Financial (COF), ConocoPhillips (COP), CVS Health (CVS), EOG Resources (EOG), Gartner Inc. (IT), General Dynamics (GD), Goldman Sachs (GS), Grupo Televisa (TV), Hilton Worldwide (HLT), Humana Inc. (HUM), Lear Corp. (LEA), Liberty Global (LBTYK), Mastercard Inc. (MA), Regeneron Pharmaceuticals (REGN), Reinsurance Group of America (RGA), Tenet Healthcare (THC), Visa Inc. (V), and Vipshop Holdings (VIPS): These small (less than ~1.5% of the portfolio each) stakes were reduced during the quarter.

Note: Although the position sizes relative to the total portfolio value are very small, they have significant ownership stakes in APA Corporation, Grupo Televisa, Lear Corp, Liberty Global, Reinsurance Group of America, and Tenet Healthcare.

Below is a spreadsheet that shows the changes to William Nygren’s Harris Associates 13F portfolio holdings as of Q2 2022:

William Nygren – Oakmark – Harris Associates’ Q2 2022 13F Report Q/Q Comparison (John Vincent (author))

Be the first to comment