PeopleImages/iStock via Getty Images

Article Thesis

Equity markets have been troubled so far this year, as persistently high inflation and rising interest rates pressure the outlook for many stocks. On top of that, the market is increasingly pricing in a potential recession, which could hurt profit and revenue growth for most stocks. At the same time, the S&P 500 (NYSEARCA:SPY) has become less expensive this year and is now relatively reasonably valued. The performance for the remainder of the year depends on a range of macro factors, but the outlook isn’t too bad from here.

Will The Stock Market Keep Crashing?

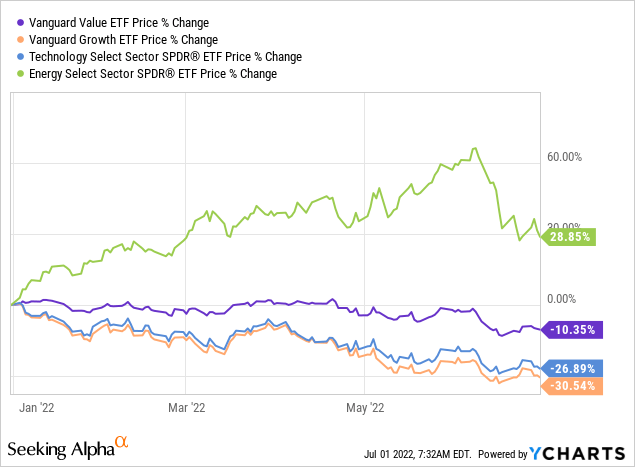

During the first half of 2022, the S&P 500 index dropped by 21%, which means that the broad market is technically in bear territory right now, following a drop of more than 20%. This market decline was based on several macro factors and did impact different sectors and industries to a different degree:

Value (VTV) did easily outperform Growth (VUG) so far this year, with a 10% drop versus a 31% drop, respectively. Across different industries, the performance has also been very different. Energy (XLE), for example, has delivered a return of around 30% this year thanks to being a beneficiary of inflation and its value characteristics. On the other hand, the growth-heavy technology industry (XLK) has experienced a pretty bad first half of the year, dropping by close to 30% over the first six months of 2022.

Inflation continues to run at an 8%+ rate and is not showing any signs of being transitory so far. This hurts consumer spending power, as less money is available for discretionary purchases when they are forced to spend more on energy, food, etc. At the same time, companies that cannot pass on inflation easily are seeing their margins come under pressure. Target (TGT) and Amazon (AMZN) are noteworthy examples, as their recent quarterly results show that cost pressure is eating into their margins.

The Fed has been forced to hike interest rates in order to contain inflation, although that hasn’t made inflation go back down towards the 2% level. More rate hikes are thus expected, which creates a range of additional problems. First, exploding mortgage rates do pressure consumers’ spending power further, and with tightening financial conditions, companies are less likely to expand their business. The risk of a recession has thus risen meaningfully, and GDP growth in 2022 could easily be underwhelming.

On top of that, rising interest rates pressure equity prices due to an additional reason. Since interest rates are factored into discounted cash flow models via the discount rate, and since a higher discount rate leads to lower fair value estimates for equities, all else equal, valuation compression is another factor to consider.

All in all, there are thus several macro issues that could continue to hurt the outlook for equities in the near term. It is possible that the S&P 500 and the market overall will continue to pull back in the next couple of weeks and months. That being said, there are also some positive signs when it comes to the longer-term outlook.

Is A Stock Market Rebound Coming?

Valuation naturally plays an important role when it comes to future equity market returns. On that front, the S&P 500 at 3,800 looks way more appealing than it did at 4,800. Following the pullback from all-time highs hit last year, the broad market is now no longer priced at a significant premium relative to the historic valuation norm.

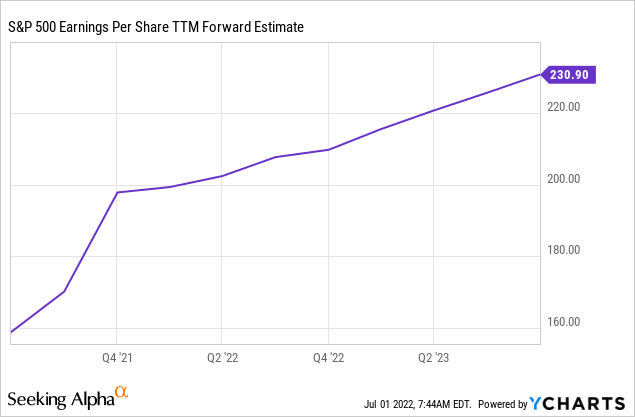

Based on current consensus estimates, the S&P 500 is forecasted to earn $210 in 2022 and around $230 in 2023. Relative to the current index level, that means that the index is valued at 18x this year’s net profit today. The earnings multiple for 2023 is 16.5, which pencils out to an earnings yield of slightly above 6%. Those are not absolute bargain valuations, but those aren’t especially high valuations, either. Contrast this with an index level of 4,800 and earnings of around $200 in 2021, which made for an earnings multiple in the high 20s. At that point, valuations surely were stretched, which is why it isn’t too surprising to see that the index has pulled back from those highs. But today, with a high-teens earnings multiple for 2022, valuations seem relatively reasonable and are not historically high any longer. Of course, it is possible that the S&P 500’s earnings will come in lower than expected, e.g. when the Fed hikes too fast and the economy takes a major hit. But since central bankers will try hard to engineer a soft landing, I do believe that there is a high likelihood that the coming recession, should we get one, will be more benign compared to what we saw during the Great Recession, for example.

At the same time, there are some signs that inflation might moderate in the coming months, as a couple of key commodities have recently started to pull back from this year’s highs. Copper and oil, for example, are both down from the highs hit earlier this year, and the same holds true for steel and even some agricultural commodities. This might ease inflation and would thereby allow for a better outlook for consumer spending. Easing inflation would also be positive for the margins of those companies that are currently facing hefty cost increases.

A reversal and a rising equity market are far from sure bets, but there are reasons to be moderately optimistic in the longer term, as valuations do not seem too stretched and since inflation could be peaking in the second half of the year.

SPY ETF Basics

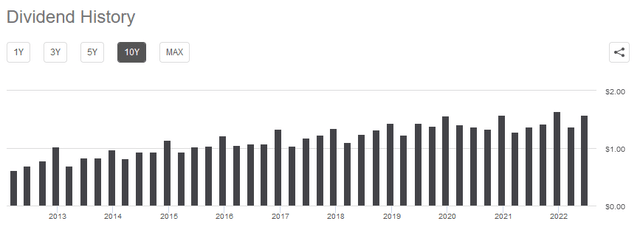

SPY, or SPDR S&P 500 Trust ETF, is one of the largest ETFs in the world. The ETF has around $350 billion of assets and is one of the best ways for investors to get broad-based exposure to the US equity market if they want that. Of course, individual stocks may offer higher yields or other characteristics investors value. But for those seeking a diversified mix of stocks, SPY is a prime choice. The ETF’s expense ratio is very low, at just 0.09%, thus even over a 10-year period, investors will lose out on just 1%, which isn’t very meaningful. The dividend yield of SPY is 1.6% at current prices. That’s considerably less than what one can get from treasuries right now, which has not always been the case. On the other hand, SPY has increased its dividend meaningfully over the years, and the same should hold true going forward:

Seeking Alpha

Distributions are somewhat uneven over time, but over the last decade, SPY’s dividend has still risen from $0.61 (Q1 2012) to more than $1.50 as of the second quarter of the current year. With dividends rising by more than 150% in that time frame, investors can expect that dividends will continue to grow at a solid pace, although not necessarily at exactly the same pace seen in the past.

The SPY ETF has delivered a 178% price return over the last decade, which results in annual returns of 11% before factoring in dividend payments. Again, past returns do not necessarily equal future returns, but the successful history of the ETF, backed by the success of the broad US equity market, could ease investor concerns. At least when one invests with a long-term horizon of at least several years, or, even better, several decades, it seems unlikely that SPY will be a bad investment.

Is SPY A Buy, Sell, Or Hold?

If someone buys today, I do believe that there is a pretty high likelihood that returns will be meaningfully positive a decade or two from now. But that does not mean that SPY will rise over the next couple of weeks or months. The market is currently facing several macro headwinds, and even though SPY is trading at a relatively reasonable valuation right now, the near-term outlook is uncertain. I thus believe that staying neutral until we have a better picture when it comes to a potential recession and the future path of inflation could be a good idea.

Be the first to comment