turk_stock_photographer

I like high yielding investments as much as anyone else, but I also acknowledge the fact that total returns also matter. For those who currently have enough income or simply want to diversify their income stream between value and growth, there are plenty of the latter that remain rather inexpensive, especially considering their forward growth prospects.

This brings me to Williams-Sonoma (NYSE:WSM), which remains attractive and sits well below its 52-week high of $223. In this article, I highlight why WSM remains a good option for dividend growth investors in this crazy market, so let’s get started.

Why WSM?

Williams-Sonoma is a leader in the U.S. domestic home segment, with a strong retail platform that gives it direct access to consumers. Its brands and stores include its namesake Williams-Sonoma, which offers high-end cooking products, Pottery Barn / Pottery Barn Kids, and West Elm, which is an emerging concept for young professional. WSM also caters to developers of commercial and residential projects.

WSM’s stores are generally located in high end shopping malls and retail centers such as those owned by the leading shopping center REIT Federal Realty Investment Trust (FRT). It’s built a defensible position in the home furnishings industry, giving it brand equity that resonates with consumers.

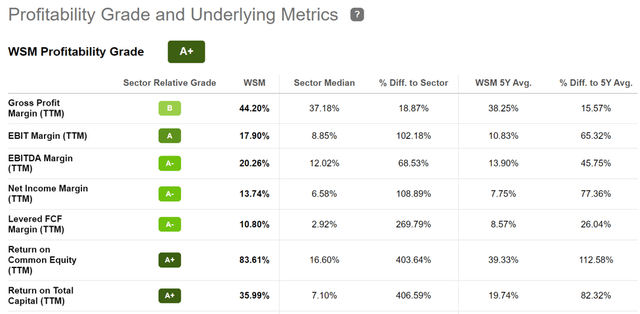

This has enabled WSM to price its products at a premium and this is reflected by is strong margins. As shown below, WSM scores an A+ profitability rating with sector leading EBTIDA and Net Income margins of 20% and 14%, respectively.

WSM Profitability (Seeking Alpha)

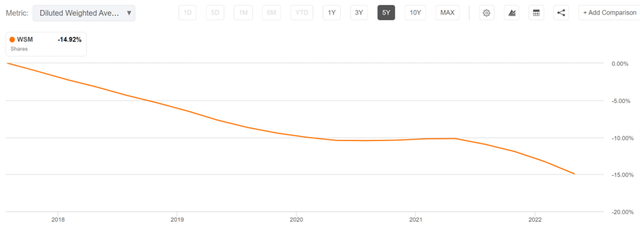

Moreover, WSM generates a very high 83% return on equity, due primarily to its active share repurchases. As shown below, WSM retired an impressive 15% of its outstanding share count over the past 5 years alone.

WSM Shares Outstanding (Seeking Alpha)

Meanwhile, WSM continues to demonstrate strong growth, with revenue rising by 9.5% YoY in the first fiscal quarter (ended in May). This is on top of very strong growth last year, when many consumers were flush with cash and investing in stay at home living. This is reflected by the 50% revenue growth that WSM has seen on a 2-year stacked basis.

Moreover, unlike lower end retailers that have had to absorb cost inflation, WSM expanded its margins, with operating margins growing by 140 bps YoY to 17.1%. Plus, WSM continued robust capital returns to shareholders, with $500 million in share repurchases during the fiscal first quarter alone.

Looking forward, management reiterated its commitment to becoming a $10 billion dollar run-rate company by the end of next year. This includes promising growth on WSM’s B2B side, which saw 53% YoY growth in the recent quarter, and recent installs at Marriott’s (MAR) new headquarter hotel.

While risks to the thesis include new entrants into the space such as the online retailer, Wayfair (W), WSM maintains the first mover advantage in many ways, including customer analytics, as noted by Morningstar in its recent analyst report:

Williams-Sonoma is in a strong position to outperform its competitors and grow market share–a key tenet of our thesis is the company’s continued access to some of the best analytics in retail. First, Williams-Sonoma has a nearly 20-year lead on most retailers, collecting insights on end users for more than 25 years, at a granular level (collecting more than 100 data points on each transaction, initially via the catalog channel).

Williams-Sonoma has collected e-commerce data from more than 880 million shopping sessions annually, more than 700 different engagement metrics between the home page and checkout, and more than 200 billion aggregate data points from site engagement, which are all parsed by more than 100 in-house marketing and data science employees.

This deep knowledge, in our opinion, is ultimately what results in the business operating more efficiently and turning inventory faster than most of its peers. The robust capture of customer purchasing patterns allows the firm to market tactically, since vast amounts of transactions can become predictive in nature. Williams-Sonoma can begin to work out what the consumer’s next likely purchase might be and produce information to facilitate that next sale more quickly, leading to lower repeat customer acquisition costs.

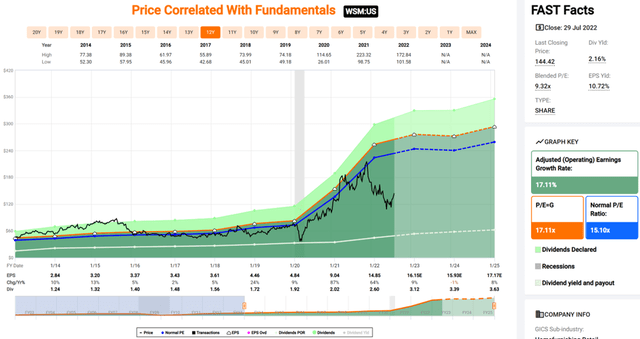

I see value in the stock at the current price of $142.42, with a forward PE of just 9.1, which includes the 6.7% EPS growth that analysts expect this year. This valuation sits well below the normal PE of 15.1 over the past decade.

While the 2.2% dividend yield isn’t high, it comes with a low 18% payout ratio, a 14.4% 5-year CAGR, and 16 years of consecutive growth. This, combined with meaningful share buybacks, and a reversion to its mean valuation can contribute to strong shareholder returns going forward.

Investor Takeaway

Williams-Sonoma is a premium retailer that is well-positioned to continue growing despite the challenges in the retail sector. The company has a history of outperformance, and its recent results show that it is still firing on all cylinders.

While inflation continues to be a headwind for consumer spending, I believe WSM can weather through these challenges relatively intact. I believe WSM has a solid combination of growth, dividend growth, and a compelling valuation for potentially strong long-term returns.

Be the first to comment