Co-Produced with R. Paul Drake

It’s very unsettling to see so much red in your portfolio, day after day after day. The prices of many REITs (VNQ), including the HYL selections, have been dropping like a rock several days each week. It seems as though the suppression of the economy by restrictions related to coronavirus will drive the world into a recession, if not a depression.

Many members fear that this will drive our REITs into bankruptcy. Here we will show you why we believe, unequivocally, that this will not happen.

The example of EPR Properties

Just as it seems these days that stock prices are headed straight to zero, it’s easy to fear that income will go to zero too. All the tenants will be unable to pay rent.

Let’s suppose that were true, for a year or two. Let’s start by looking at EPR properties (EPR), owned by many HYL members.

EPR stock has dropped in price from above $80 to below $13, a decrease of more than 80%. Surely this company is close to failure!

Well, let’s look at the actual numbers. These are from the 2019 annual report to the SEC (the “10-K”).

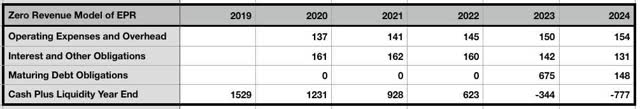

Figure 1 shows several numbers relevant to understanding EPR. One can see that their cash on hand is nearly equal to their annual revenue. Their operating expenses, overhead, and interest expenses add up to $279M, well below half of their revenue.

These expenses plus the dividends they pay out are well covered both by total revenue and by the net cash produced by operating and financing activities. What’s more, all of those interest expenses are at fixed interest rates on long-term debt.

Figure 1. Some of the financial results for EPR at the end of 2019.

A worried investor might still imagine that somehow the revenues of EPR will all vanish. After all, it seems at the moment that movie theatres and other places people go for experiences will be shut down, perhaps for years.

Let’s look at this. In addition to their cash on hand, EPR has a $1B credit line that’s unsecured and untapped. Try that on for size. You may have a home equity line of credit. Perhaps at some point you have had an unsecured personal loan. But can you imagine being given one for nearly twice your salary? The creditors find this REIT to be solid.

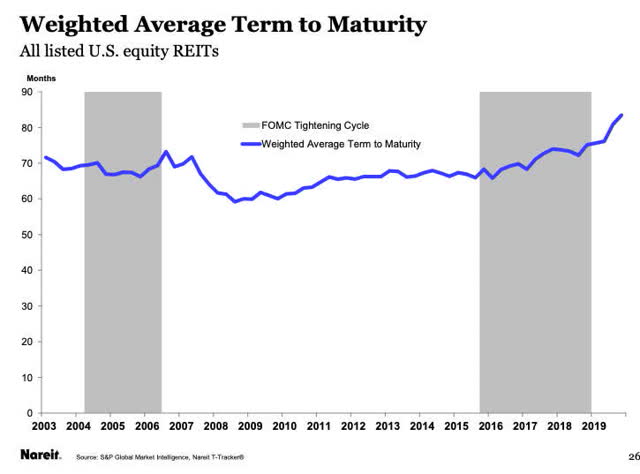

What this means is that, at the end of 2019, EPR had $1,529M in liquidity. Figure 2 shows how long this would last, if they had no revenue and cut their dividend to zero.

All of EPR’s current debt is fixed rate and long term. In fact they have no debt maturing until 2023. And with zero revenue, they would not run out of cash plus liquidity until 2023. All it would take for them to end 2024 even would be a revenue of less than 24% of what they have now.

Figure 2. A model of EPR going forward, assuming they have no revenue. Interest on the credit line is ignored.

One can see that EPR has enough liquidity to make it through years of horrible earnings. Only if you believe that the virus will permanently change the desire of humans for their experiences does it make sense to worry about bankruptcy.

Thus we see that EPR can pay their creditors, no matter what.

EPR Is a Typical REIT

We hope that you find the above reassuring. The next thing you need to know is that EPR is a typical REIT. The next few figures are from the NAREIT T-Tracker.

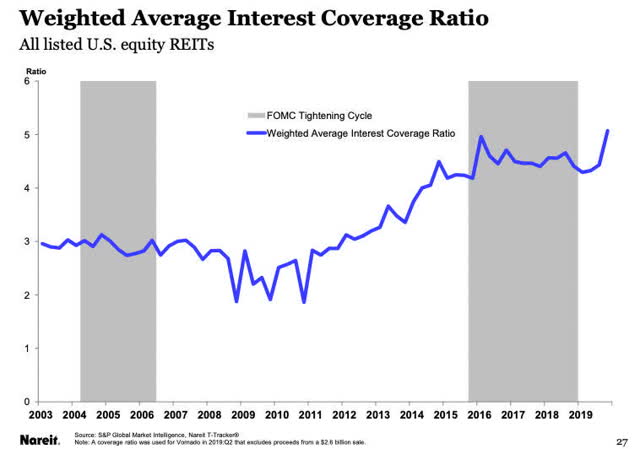

The weighted average term to maturity of the EPR debt is seven years. Figure 3 shows that this is about the same as the average across REITs.

Figure 3. The average weighted average term to maturity for all equity REITs is about the same as that of EPR, near seven years.

REITs have increased the average term to maturity since the Great Financial Crisis, which adds some security. More importantly, they have worked to minimize the debt that mature within a year or two. It was near-term debt maturities, combined with insufficient liquidity, that caused General Growth Properties to be the only equity REIT to declare bankruptcy in the modern REIT era (since 1993), and that also caused Simon Property Group (SPG) to have to cut their dividend.

The interest coverage ratio of EPR is 3.8x. This is the ratio of their net operating income (“NOI”) to their annual interest payments. NOI approximately equals Funds From Operations plus interest expenses plus overhead costs. They could still cover their interest expenses if their revenue fell by half or more.

One sees in Figure 4 that the average interest coverage ratio, across all REITs, is actually a bit larger than even this. In recent years, it has been running between 4.5x and 5x.

Figure 4. The weighted average interest coverage ratio across all equity REITs is over 4.5x.

Note also how much the interest coverage has increased since the Great Financial Crisis. This is another way in which REITs changed their practices to become less vulnerable to difficult times.

Thus we see that a typical REIT can pay their creditors, no matter what.

A Little Common Sense on Revenues

We humans all suffer from the tendency to project the immediate past into the future, whether or not doing so makes sense. This was no doubt a survival trait. Having encountered one snake in a tree, it helped to be alert for more.

Figure 5. The very deadly boomslang snake, in a tree.

Right now, amidst panic over the markets and the specter of ongoing economic shutdowns, it’s easy to feel that the whole economy is going to shut down forever.

The discussion above shows that even if a large part of the economy were to remain shut down for the two years it may take to develop and distribute a vaccine, and well-managed REIT will survive.

However, such a shut down will not and cannot happen. The worldwide restrictions on some kinds of activity going on now will reduce the rate of spread of COVID-19 and will reduce the demand on critical hospital resources.

As we ramp up the provision of hospital resources and testing technology, the western countries will return to economic activity. China, Korea, and some other countries have their economies returning toward normal already.

The politicians will come to understand that they cannot afford to pay nearly everyone to stay home. And they will come to understand how to let the virus spread slowly without overloading medical resources.

What This Means for Us

REITs in some sectors, like hotels, already are cutting their dividends. REITs in other sectors may well increase them. An example is the industrial REITs that support e-commerce and home delivery, which should benefit here.

We are indeed likely to temporarily lose some dividends, but not all of them. And they will come back quickly as the economy starts functioning more normally, no doubt boosted at first by pent-up demand.

Remember that REITs must pay out 90% of their taxable income. Even if they pay in stock, one can sell that stock if needed. And no REIT would want to pay in stock any longer than necessary.

All will be well. Much sooner than it may feel right now.

Historic Market Opportunity! Act Now!

The recent market crash has created exceptional opportunities. Many high-quality REITs are now offered at >10% sustainable dividend yields and have 100-200% upside potential in a recovery.

At High Yield Landlord, we are loading up on these discounted opportunities and share all our Top Ideas with our 1,500 members in real-time.

Start your 2-Week Free Trial today and get instant access to all our Top Picks, 3 Model Portfolios, Course to REIT investing, Tracking tools, and much more.

We have limited spots at a 20% discount. Get Started Today!

Disclosure: I am/we are long EPR. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment