guirong hao/iStock via Getty Images

The Geopolitical Landscape

In earlier articles, we explored why SoftBank Group Corp (OTCPK:SFTBY) CEO Mr. Son’s actions have made China revengeful following the NVIDIA-ARM deal earlier this year and why the deal was destined to fail in the first place. If the deal had gone through, then NVIDIA Corporation (NVDA), as an American company, would give an unfair global advantage to the US, leading to technological supremacy and making the world reliant on the US.

The pandemic and geopolitical tensions have sent shockwaves to the global semiconductor sphere, as a disruption in the supply chain can severely damage economies and national defenses. As a result, we have seen a movement towards deglobalization and an unprecedented need for self-sufficiency.

How China Will Respond

Beijing’s interest in RISC-V has escalated as Washington has pressured China’s semi-industry more by restricting access to state-of-the-art chip parts and equipment. The newly formed consortium of companies and research institutes set up by the Chinese government to aid in a RISC-V semiconductor architecture aims to reduce reliance on SoftBank’s ARM and enhance China’s technological position.

ARM is a British firm with a global footprint, and with its high exposure to the US, ARM architecture becomes even riskier for China following the US semiconductor restrictions. As a result, China guided tech leaders Alibaba Group Holding Limited (NYSE:BABA) and Tencent Holdings Limited (OTCPK:TCEHY) to fight the sanctions imposed by the US.

Although Alibaba and Tencent have already introduced their own ARM-based chips, the growing tensions and uncertainty about ARM’s future in China have turned the attention towards RISC-V. Long before China’s initiative to pool resources, both companies had already established teams using the RISC-V architecture to produce high-performance chips that power AI algorithms and data centers. As a result, Alibaba has successfully developed a RISC-V chip that runs on the Android operating system and its wholly-owned subsidiary, T-Head, launched its first RISC-V.

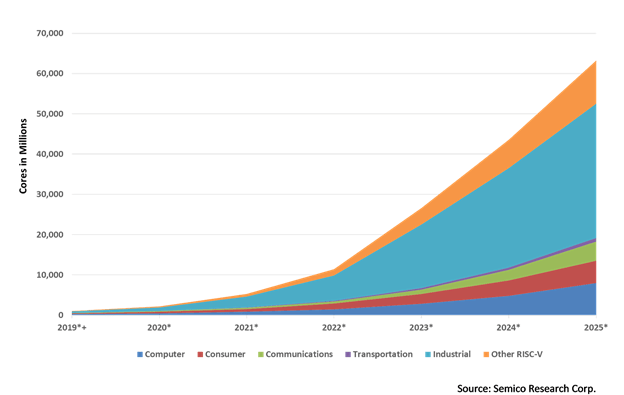

Like the US CHIPS ACT, China is putting up a $143 billion support package for its semiconductor industry as part of a substantial effort to become self-sufficient in chips and fend off American actions to slow down its technical advancements. Thus, the rise of RISC-V architecture in China is expected to push American chips out of China, which is reflected in the forecasted RISC-V CPU cores to be used in the following years.

RISC-V Growth (riscv.org)

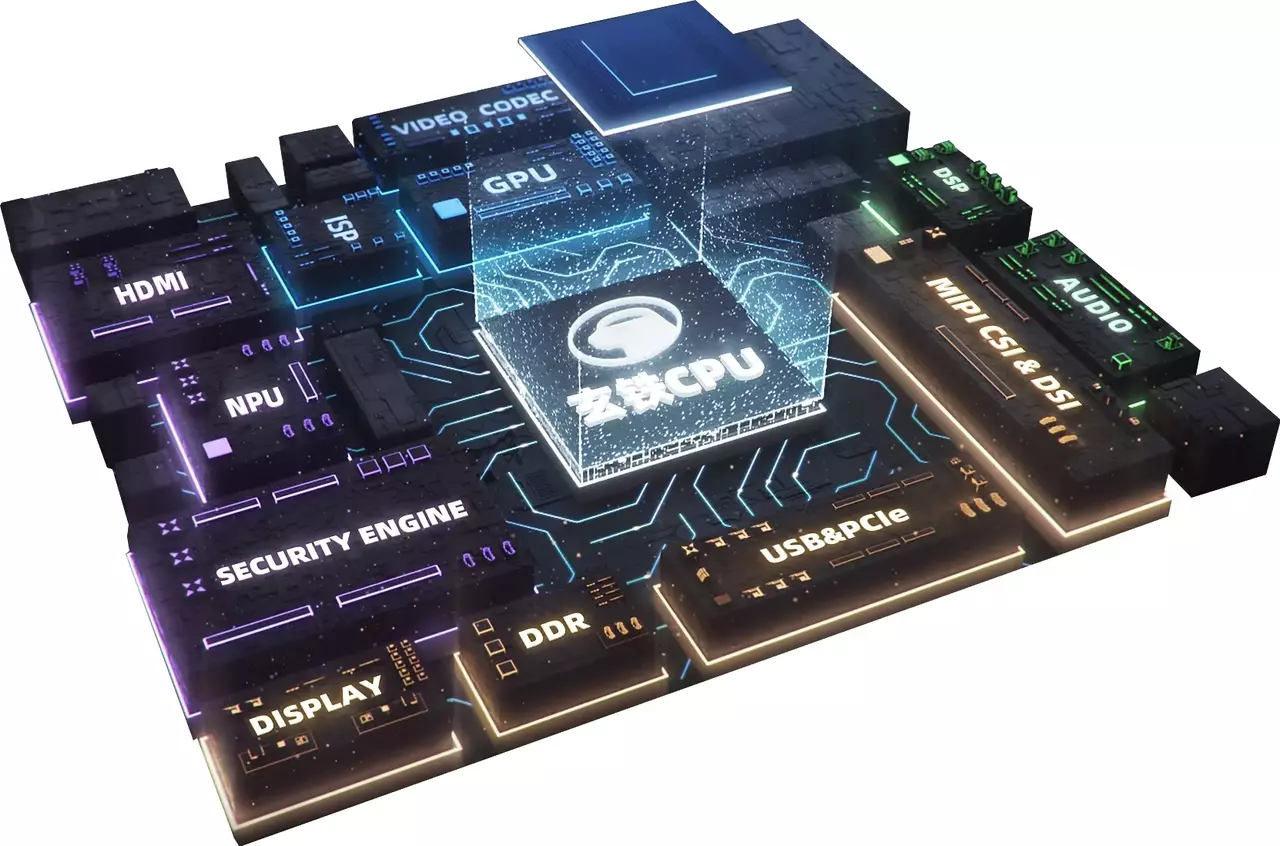

Alibaba’s/T-Head’s Chip

The Wujian 600 chip development platform, designed exclusively for creating edge Systems-on-Chip (SoC), is the foundation for the TH1520 SoC, created by T-Head. Alibaba claims its heterogeneous design and improved CPU capability enable high-performance embedded and edge devices, such as home robotics, medical imaging, and video conferencing.

www.alibabacloud.com

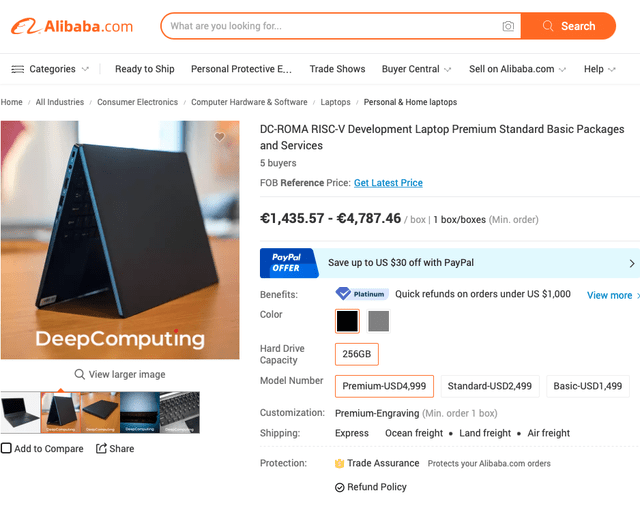

On its commercialization, Alibaba introduced its first RISC-V laptop, “ROMA,” a cost-effective, consumer-facing edge computing solution built on the Wujian 600 computing platform. Edge computing is well known for executing machine learning AI applications, such as high-volume data collecting. The TH1520 SoC from Alibaba T-Head powers ROMA, which RISC-V International claims is the first native RISC-V development laptop worldwide. The first 100 premium ROMA devices will be distributed this year, and production is anticipated to increase to 1,000 units in the first quarter of 2023.

Alibaba’s First RISC-V Laptop (www.alibaba.com)

RISC-V Gains Momentum

Apple Inc. (AAPL) seems to be based on lower-end ARM A-series or M-series IP, but the tech conglomerate is exploring shifting to the RISC-V counterparts. Apple’s A15, for instance, features more than a dozen Arm-based CPU cores dispersed over the die for various back-end tasks. SemiAnalysis confirms that these cores are aggressively converting to RISC-V in the next hardware generations.

At the same time, Intel Corporation (INTC) has announced that part of its IFS strategy is to promote foundries that could build chips based on the three principal architectures, its x86, and the ARM and RISC-V.

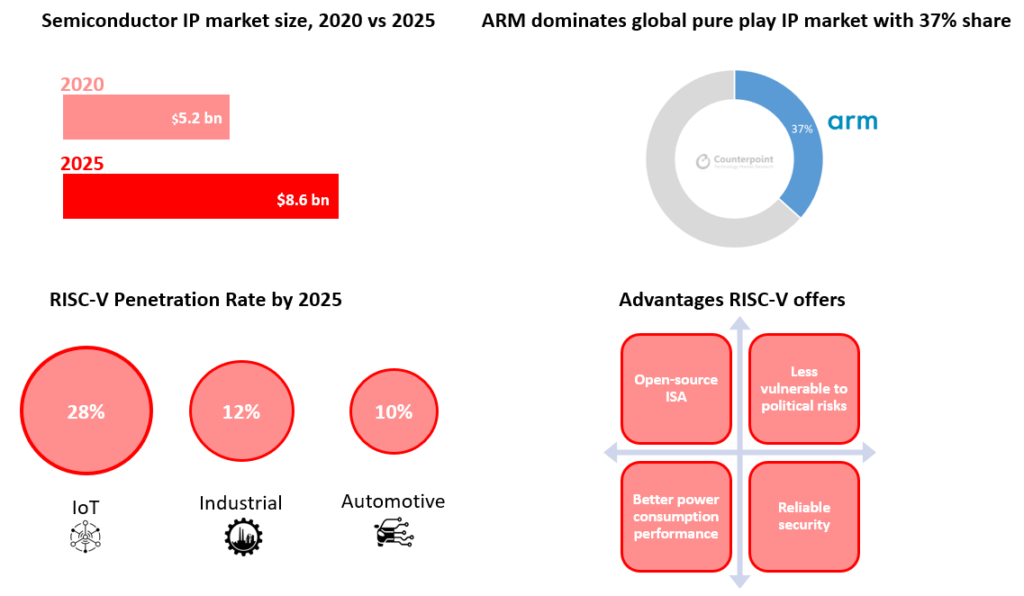

Even though RISC-V architecture is still in its early ages, much work must be done until it reaches mass adoption. Eventually, RISC-V will be everywhere as it is increasingly employed in disk drives, artificial intelligence, embedded systems, automotive systems, and machine learning applications. As a result, RISC-V is expected to reach $8.6 billion in semiconductor IP market size by 2025.

RISC-V Potential (www.counterpointresearch.com)

Concluding Thoughts

With China pouring capital and resources into the semiconductor industry to achieve self-sufficiency, the shifting geopolitical landscape and US-China Chip wars will ultimately benefit Alibaba twofold. First, primarily due to easing regulatory scrutiny, and secondly, through governmental incentives and subsidies towards Chinese semiconductors such as T-Head.

Author of Yiazou Capital Research

Unlock your investment potential through deep business analysis.

I am the founder of Yiazou Capital Research, a research platform designed to elevate your due diligence process through in-depth analysis of businesses.

I have previously worked for Deloitte and KPMG in external auditing, internal auditing, and consulting.

I am a Chartered Certified Accountant and an ACCA Global member, and I hold BSc and MSc degrees from leading UK business schools.

In addition to my research platform, I am also the founder of a private business.

Be the first to comment