Today’s markets are unlike any we have seen in the past as some think we are on the verge of a depression. The COVID-19 virus has brought an insurmountable level of uncertainty.

If there is one thing I do know it is the fact that financial markets are not fans of uncertainty, and that is exactly what we are living through right now, which has caused steep declines. We are all unsure of the full impact that it will have on the economy as a whole, but looking back at the solid footing we were on in terms of economic strength, I believe we will look back at these times, from an investor point of view, and see it as a great opportunity to build, grow, or reposition your portfolio.

Investors have gone into panic selling mode as questions continue to pile up. Investors are trying to determine whether to sell their securities completely with the likes of Goldman Sachs expecting the US economy to contract by 34% in the second quarter with unemployment rising to 15%. We will see how the economic news is in the coming weeks to determine if we will see lower lows in the market.

Those that decide to jump ship from the market will have to decide when the right time is to get back in, and timing the market is a very dangerous game that many lose out on. Since 1948, the US has experienced 10 bear markets, not including the current situation. From peak to recovery, it has taken on average 3.9 years for markets to climb back to previous highs, with the median at 2.7 years. On five of those occasions, the market recovered in two years or less.

There is no way of knowing how quickly we will recover this time, but I am siding on this one being quicker than normal. The primary reason is due to the fact the slowdown was not economic based, but merely based on a global virus. Unemployment will reach record highs and it will take time to get everyone back to work, but I believe it will be a quick recovery once businesses are able to return to normal.

With all that being said, here is a REIT I would like for you to keep an eye on as we continue to experience volatile moves in the market in the coming weeks.

A Focus On Middle Market

STORE Capital Corporation (STOR) is a triple-net lease REIT that went public in late 2014. STORE Capital is run similar to that of fan favorite Realty Income (O), in that they acquire buildings and enter into sale-leaseback transactions directly with tenants. This business model is beneficial to STOR due to the fact they get to review potential tenant’s financial security prior to purchasing a property to ensure they would be safe to partner with going forward.

Source: STOR Q4 Investor Presentation

The management team lead by CEO Christopher Volk has surrounded himself with a management team vast with real estate experience. The strength of the team will be tested during times like this, as this will be the first true slowdown the team has seen since going public.

A few of the areas that STOR has been able to differentiate themselves has been on their focus on middle-market America, which has limited sources to raise capital at favorable terms. As noted in the company’s Q4 investor presentation, the median tenant revenue is just $55 million, with 74% of STOR tenants having revenues exceeding $50 million. Do not be misled by the middle-market strategy, as it does result in some higher risk; however, it is important to know that 75% of the company’s leased contracts are investment grade quality, with some tenants being graded by STORE management, which could skew things.

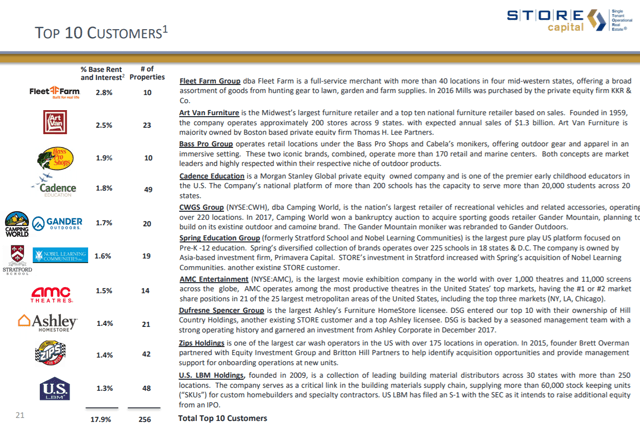

Here is a look at the company’s top 10 tenants.

Source: STOR Q4 Investor Presentation

Here is a look at the breakdown of tenants within the different industry groups:

- Service: 66%

- Retail: 18%

- Manufacturing: 16%

Another area STORE Capital stands out from other net-lease REITs is around their long-term lease agreements, providing predictable income streams for investors. STORE Capital sports the longest average lease term in the space, and new quarterly investments during Q4 were even longer at a weighted average of 17 years.

STORE Capital has built a defensive portfolio built to last in any economic backdrop. Management has done a fine job diversifying the portfolio, with no single tenant accounting for more than 2.8% of base rent revenues, but one of their larger tenants comes with an asterisk. The company’s second largest tenant, Art Van Furniture recently filed for bankruptcy, of which, the tenant accounts for 2.5% of STOR’s annual rent with 23 locations leased by STOR.

The Potential For A Quick Turnaround

After the latest sell-off, STORE Capital has fallen 60% year-to-date, which seems excessive. Yes, landlords will lose out on rents with tenants going BK, and giving relief to others to help them survive. There are plenty of concerns with the company dealing primarily with middle market tenants in secondary and tertiary markets.

At the same time though I see this as a possible positive. Given the current pandemic, I believe these secondary and tertiary markets may be the first markets to return to some sort of normalcy.

I do still expect volatility in the market moving forward as the virus numbers continue to rise in the states, but I believe a lot is already priced into the STOR price making any further drops much less than what we have seen.

The stock currently yields a dividend of 9.6%, which is very high for them. The CEO released a CEO letter a few weeks ago discussing his commitment to the dividend. In addition to a high dividend yield, the company trades at a P/FFO of 7.59x compared to their 5-year average of 16.33x.

Investor Takeaway

As I discussed above, STORE Capital is a triple-net lease REIT that focuses on middle market tenants in secondary and tertiary markets. However, I am of the opinion that these markets will be the first to return to normalcy. The company has its risks being a landlord during this economic slowdown and with its second largest tenant filing BK a little while back.

However, the stock is trading down 60+% YTD and the current valuation is very reasonable given the fact I believe this recovery will be swift and secondary and tertiary markets may be the first to return to normal. The company will undoubtedly see more volatility with the worst of the virus expected in the coming weeks, as such, I will be looking to add to my position.

Note: I hope you all enjoyed the article and found it informative. As always, I look forward to reading and responding to your comments below and feel free to leave any feedback. Happy investing and stay safe!

Historic Market Opportunity! Act Now!

The recent market crash has created exceptional opportunities. Many high-quality REITs are now offered at >10% sustainable dividend yields and have 100-200% upside potential in a recovery.

At High Yield Landlord, we are loading up on these discounted opportunities and share all our Top Ideas with our 1,500 members in real-time.

Start your 2-Week Free Trial today and get instant access to all our Top Picks, 3 Model Portfolios, Course to REIT investing, Tracking tools, and much more.

We have limited spots at a 20% discount. Get Started Today!

Disclosure: I am/we are long STOR. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment