stockcam

Snap Q2 earnings results

That the quarterly report was not positive could be guessed as early as May, when Snap Inc. (NYSE:SNAP) reported that it had revised its guidance for Q2. The company had initially stated that it expected revenue growth estimated between 20% and 25% over the previous year, with adjusted EBITDA estimated between break-even and $50 million. The reported results, however, fell far short of these estimates.

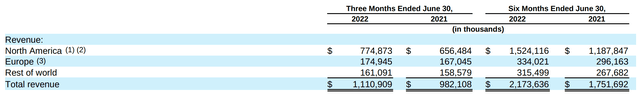

Second quarter revenues grew 13% to $1.11 billion, below analysts’ estimates of $1.14 billion. In addition, the company reported adjusted EBITDA of $7 million (compared to $117 million in Q2 of 2021) and a net loss of $422 million, compared to a net loss of $152 million in Q2 of 2021.

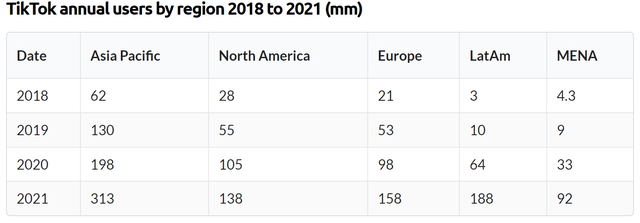

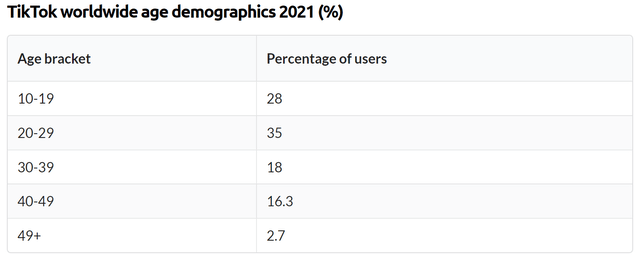

However, some positive results were also related to user growth. Daily active users (DAUs) grew by 18% over the previous year, with a growth of 4% in America, 10% in Europe, and 35% in the rest of the world. In addition, the company reported that it had reached 90% of 13-24 year-olds and 75% of 13-34 year-olds in more than 20 countries, although penetration in Europe is still low. Competition with TikTok is one of the most critical issues facing the company. Chinese social is taking space away from Snap and Instagram, especially in Europe and Asia, where it has more users and more downloads.

Moreover, especially for Snap, which is used by younger average users than Instagram or Facebook, the challenge with TikTok is even more pronounced. More than 80% of TikTok’s users are 10-39 years old, precisely the age group that uses Snap the most.

Snap acquisitions and debt

Snap has made several acquisitions in the past two years, enabling it to increase its technological offerings to users. The main acquisitions were:

- Wave Optics Limited (“Wave Optics”) is a display technology company that provides light engines and diffractive waveguides for augmented reality. The company paid a total of $541.8 million, of which $510.4 million represented the purchase consideration and consisted mainly of 4.7 million shares of Class A common stock with a fair value of $252.0 million, $13.7 million in cash, and $238.4 million to be paid by May 2023 in cash or company stock. The remaining $31.4 million and $31.4 million of the total consideration transferred represented compensation for future work services.

- Fit Analytics GmbH (“Fit Analytics”) is a sizing technology company that provides solutions to retailers and brands to grow their e-commerce and shopping offerings. The consideration for the purchase of Fit Analytics was $124.4 million, represented mainly by current and future cash payments.

Both of these acquisitions were financed through cash and share issuance. As a result, Snap currently has $2.3 billion in cash and $2.5 billion in short-term investments, covering long-term debt of $3.7 billion and capital leases of $400 million.

The company’s debt is thus fully covered by the company’s cash and short-term investments; however, much of Snap’s debt will need to be rolled over between 2025 and 2026 at higher rates than at present. Specifically, $1.15 billion maturing in 2026 at a rate of 0.75% per annum and $888 million maturing in 2025 at a rate of 0.25% per annum.

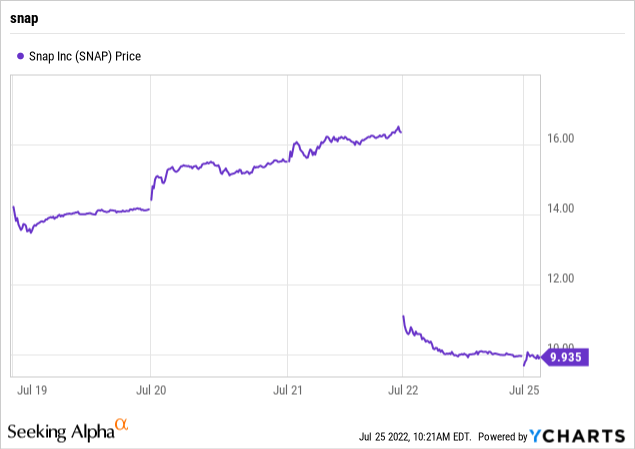

Snap stock performance

Snap’s quarterly results were not favorable. The stock plummeted nearly 40% after the results came out, hitting a 52-week low at $9.91. This major sell-off is a consequence of the poor quarterly results and the fear that many investors have that Snap’s growth has slowed well below the 50% annual growth it had been making in recent years. The reasons for Snap’s slowing growth lie in Apple’s change in privacy controls, limiting the tracking capabilities of digital advertisers and allowing iPhone users to opt-out of data sharing, and the slowing economy.

The companies do not yet seem to have found a definitive solution for the first problem. Snap announced in its letter to shareholders that it intends to implement three strategies to improve the advertiser experience:

“Improving our privacy-preserving first-party (1P) measurement tools including Advanced Conversions (AC) and Estimated Conversions (EC); ensuring our advertising performance is represented well in advertisers’ preferred third-party (3P) measurement solutions; and, finally, continuing our investment in ranking and personalization.”

These solutions, especially personalization, could push companies to pay more for advertising, but they will still take some time to implement.

Regarding the macroeconomic situation, the likely recession that will hit much of Europe and the possible recession that will hit the U.S. will hurt the marketing spending capabilities of companies, which are already now cutting these costs to preserve margins. In this case, companies will prefer to invest in those platforms that allow them to reach their target audience most accurately. Snap, if it does not live up to Facebook (META) in precision, could see a decrease in the money companies spend, and it already states: “In some cases, advertisers have lowered their bids per action to reflect their current willingness to pay”.

Conclusions

Snap is a financially sound company with positive free cash flow, although it is not yet profitable on the EBIT side. The company’s debt situation is also under control, although the debt will have to be refinanced at higher rates in a few years. Thus, the perplexities about this investment relate to future growth prospects and valuation.

Growth prospects are not comparable to those of the past four years. The adverse macroeconomic environment will not disappear in a few quarters, just as it will not be easy for the company to compensate for the damage caused by Apple (AAPL) with the change in privacy policies. This is precisely why watching the company’s current valuation is essential.

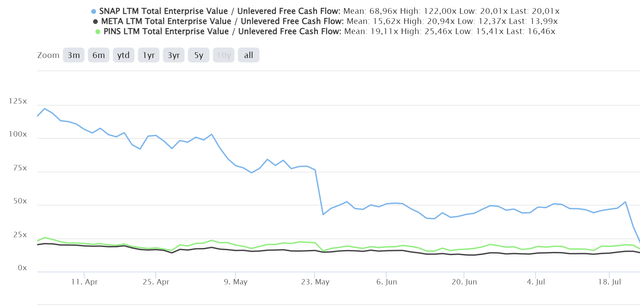

After the significant sell-off of the last few days, the company’s multiples have come down considerably, approaching those of competitors such as Facebook and Pinterest (PINS). However, the company remains the most expensive in both EV/Free Cash Flow and PB, which is justified by higher expected future growth than the other two competitors.

Therefore, the company does not appear to be undervalued compared to other companies in its sector; at best, it is correctly valued, but if growth slows further, there is still room for the stock to fall.

Be the first to comment