halbergman

Prologis (NYSE:PLD) is a logistics-focused REIT specializing in warehouses near urban areas, helping it grow with the rise of ecommerce, home delivery, and, of course, Amazon.com (AMZN), one of the company’s tenants.

A quick look at Prologis’s rental revenue and AFFO show healthy trends that are largely getting better:

|

FY17 |

FY18 |

FY19 |

FY20 |

FY21 |

FY22E |

|

|

Rental Revenue |

2225.1 |

2388.8 |

2831.8 |

3791.1 |

4148 |

4697 |

|

YoY Growth |

X |

7.4% |

18.5% |

33.9% |

9.4% |

13.2% |

|

AFFO |

1597 |

1992 |

2276 |

2955 |

3924 |

4145.2 |

|

YoY Growth |

X |

24.7% |

14.3% |

29.8% |

32.8% |

5.6% |

|

AFFO as % of RR |

71.8% |

83.4% |

80.4% |

77.9% |

94.6% |

88.2% |

Note: estimated figures are calculated by a linear regression of line-item growth rates over the last twelve months and comparing them to previous years

Consistent growth in earnings and rental revenue indicate health both in ability to lower costs and maintain market demand, with FY22 set to see stronger rental revenue growth (excluding the Duke Realty acquisition, discussed below) and greater AFFO to shareholders.

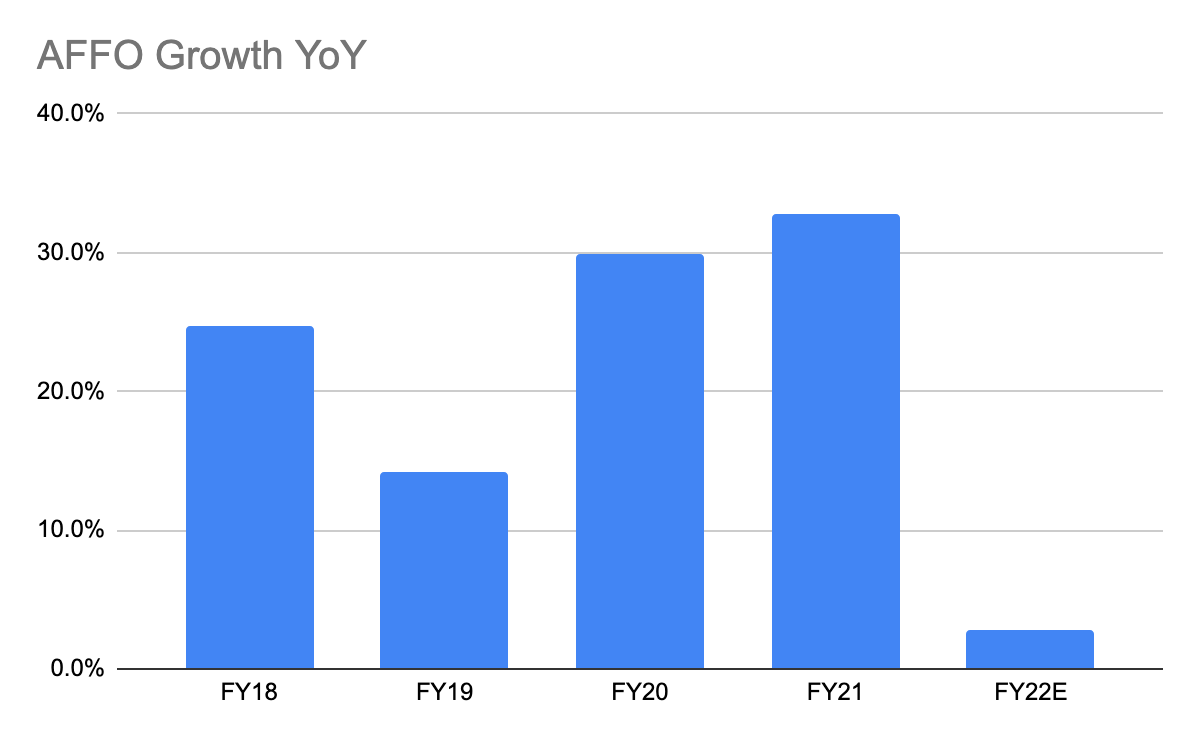

Historical AFFO Growth

On average, AFFO growth has been very robust at Prologis, which is why this year’s 5.6% gains from last year, relative to prior growth averaging in the 25% neighborhood, has been disappointing.

SEC, Author

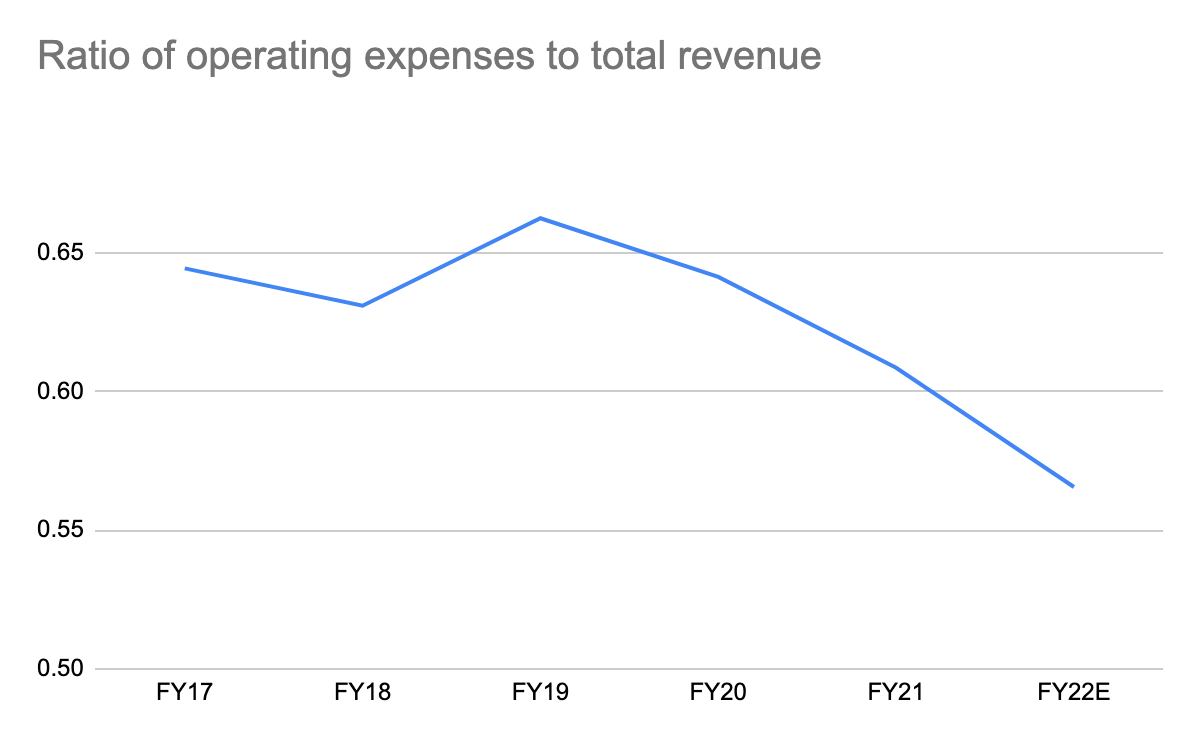

This has not been the result of lower margins or higher costs; total operating expenses are $3.3 billion over the last twelve months, or 56.5% of total revenues, down from the 64% ratio in 2019.

SEC, Author

With less of total revenue going towards operating expenses, there is a reason to pay more for PLD’s earnings on a price-to-AFFO ratio basis than in previous years thanks to this margin expansion.

Physical Expansion and Current Market View

The Duke Realty acquisition has not yet been reflected in PLD’s earnings results, and this purchase has given PLD a portfolio with 99% occupancy, which management said in their last quarter gives them room to increase rents, as Hamid Moghadam said:

“But we expect to have pricing power for the foreseeable future even in a really, really conservative absorption scenario. And I went through that before. I can’t imagine a scenario anytime soon where vacancy rates would reach 5%. So I think we’ll have pricing power, and I think we have positive leverage on an IRR basis.”

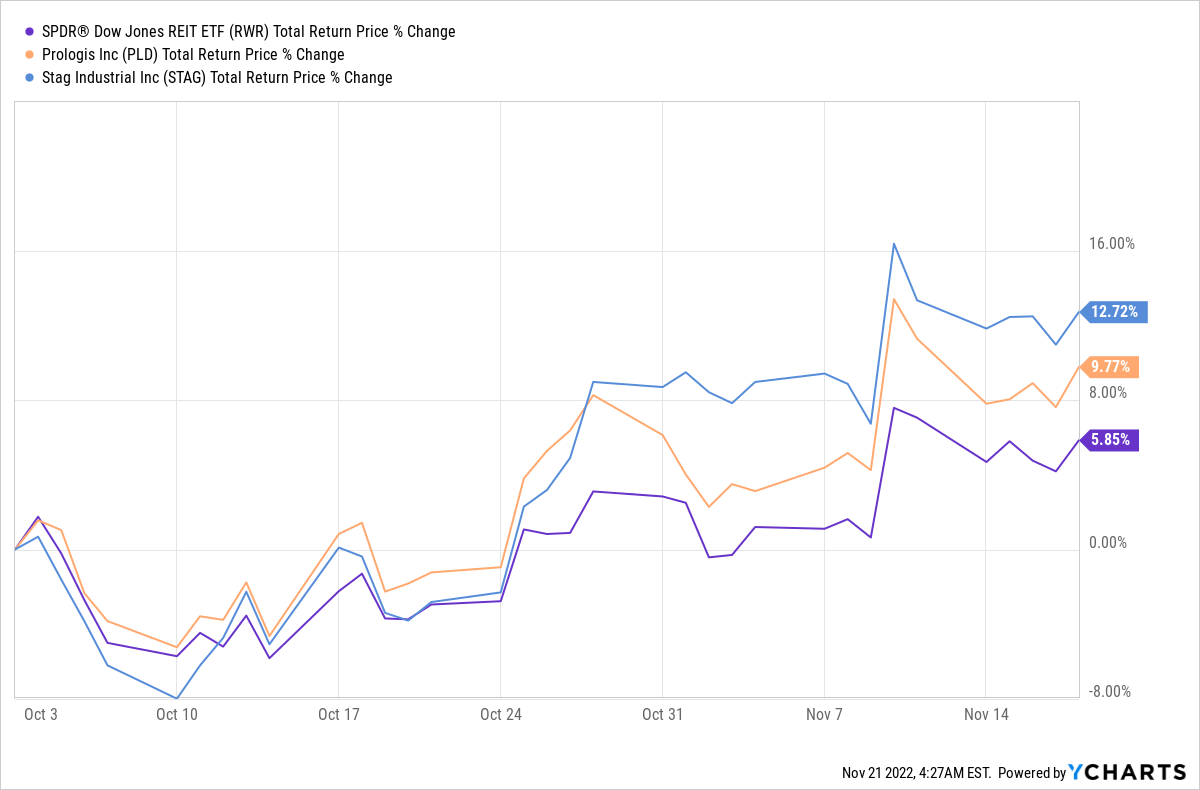

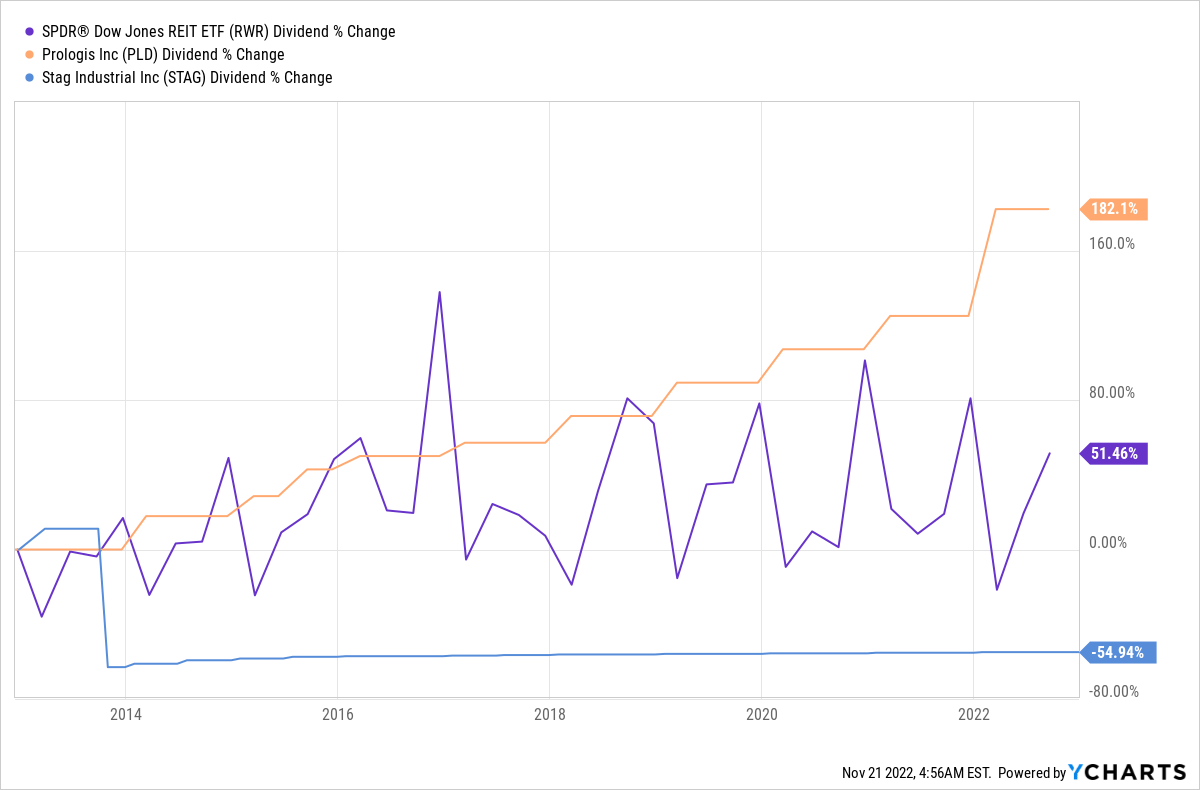

Duke Realty’s 167 million ft2 of rentable real estate for 19 logistics markets is an accretive approximately 16% of leasable space to Prologis’s pre-acquisition holdings following the October 3rd acquisition. As the stock is up around the halfway mark between the broader REIT market (RWR) and the closest competitor, the much smaller Stag Industrial (STAG), it seems the market is not taking a particularly bullish or bearish view on PLD’s acquisition.

YCharts

However, it’s also worth noting that the market isn’t taking a particularly bullish position on PLD’s own organic growth, either. Although PLD is showing lower AFFO growth excluding the Duke properties, the market has significantly written down PLD’s value with a 1-year stock decline of 30.7%, similar to STAG.

YCharts

This has resulted in a P/AFFO of 25.87, which is significantly more expensive than STAG’s 14.81 but also at a discount to the 31.86 it started 2022 with. Thus PLD’s income is cheaper to buy now than it was, but it still has a significant premium to its much smaller competitors.

That is a bit of a surprise. STAG is seeing revenue growth of around 16% over the last year and 12.96% rental revenue growth from a year ago, similar to PLD’s 13.2% rental revenue growth over the same period.

The delta is likely to vanish over time thanks to the Duke acquisition, but estimating that time frame is not easy. In its last 10-K, Duke saw rental revenue that was 18.8% of PLD’s 4.4b in TTM rental revenue on an annualized basis, but for now Duke will accrete FFO by just 1.1% according to PLD management, largely as a result of low turnover of Duke’s longer leases, which Moghadam has said is 10%-12% a year, meaning a small impact in the short term to AFFO and “the bigger impact will be what we can do once we get our hands on the rest of the portfolio rolling over through revenue management.”

Debt Load

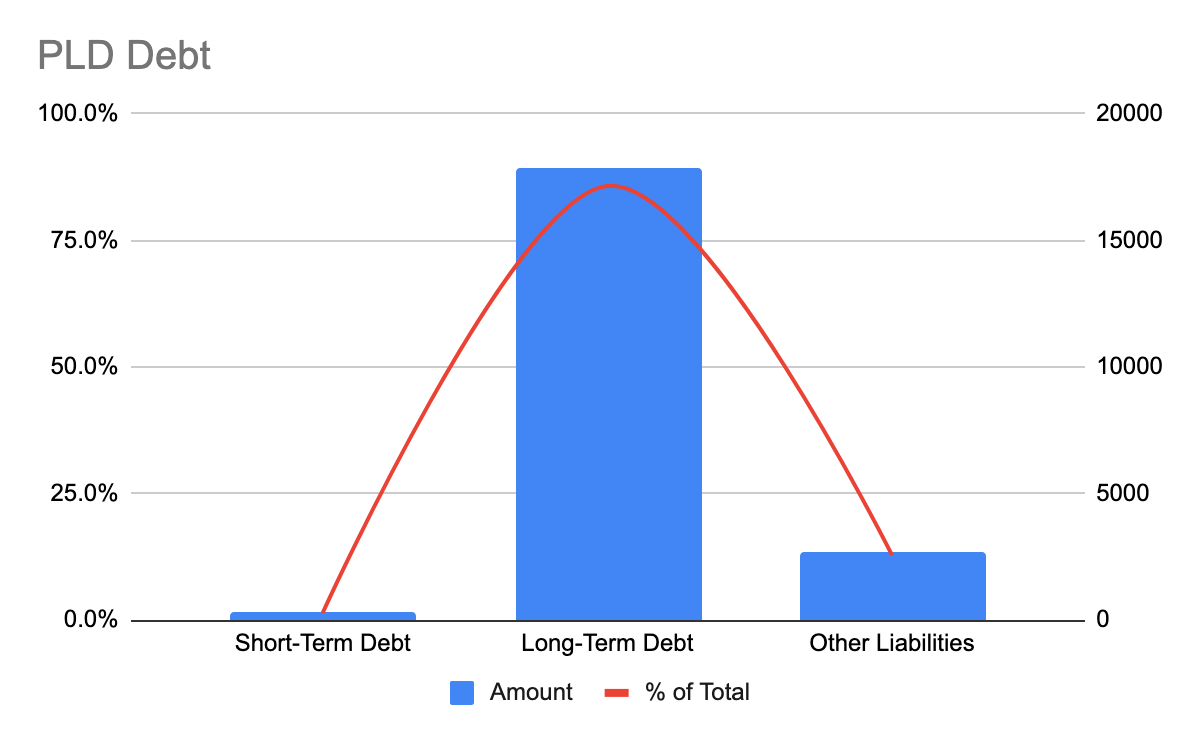

A particular concern with REITs is debt loads and debt serviceability due to rising interest rates. With 21.3 billion in debt (versus 39.6 billion in assets), this is no small issue.

SEC, Author

The vast majority of that is in more expensive long-term debt as well, which typically is more expensive to the issuer than short-term debt. In 2021, PLD paid $278.9 million in cash interest on its debt of $20.74 billion, or 1.34% in effective interest rates on its debt pile. So far, PLD has been able to maintain its cost of financing not to exceed this, as interest costs have not risen for PLD; total interest expense, at $251.1 million over the last twelve months, is 1.4% of total LT debt versus 1.5% of total LT debt in 2021.

Pricing PLD’s Future Cash Flow Relative to Peers

The accretive rental revenue to PLD over the long term provides significant upside to a REIT that is still relatively highly priced, with that higher price perhaps partly reflecting the market’s expectation of how accretive the Duke acquisition will be to AFFO over time.

However, this has most likely been less of an impact to PLD’s stock’s bad 2022 than the real market mover: rising interest rates. So far, in 2022 PLD has managed its interest expenses extremely well and kept overall net paid interest in cash on outstanding long-term debt very low despite the Fed’s rising interest rates, indicating that at the very least this discounting of PLD’s share price is unfair.

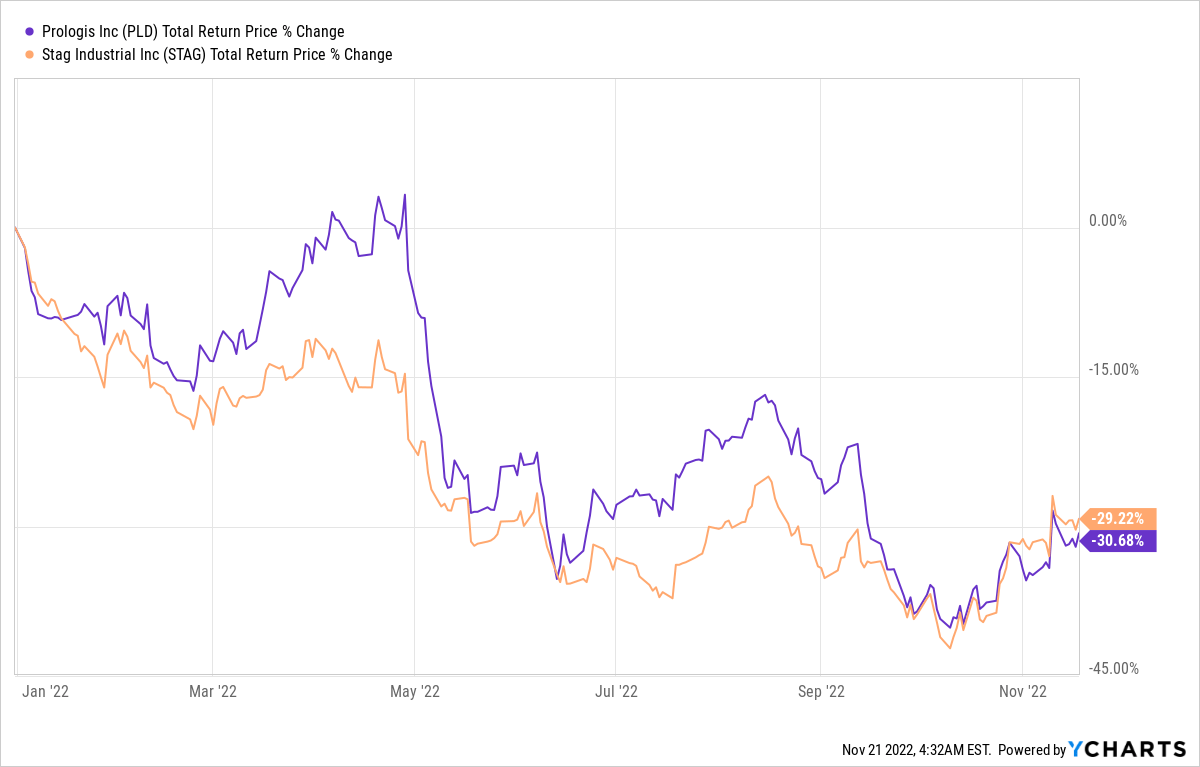

There is one more very important chart to further indicate the unfairness of this discounting.

YCharts

PLD has managed its dividend payouts much more expertly than the more cheaply priced STAG, while also outperforming the broader REIT market by triple.

At current growth rates to AFFO, and assuming valuations akin to pre-2022 rate hike fears, PLD could see AFFO rise to $13.09 billion in total by 2027, which would imply a share price of $338.64 at current P/AFFO levels and a yield on cost to current buyers of 7.8% if historical dividend growth continues at its current rate.

With significant upside to income and stock price, PLD is unquestionably a buy with a target price of $338.64 in five years.

Be the first to comment