koto_feja

By Jeff Spiegel

Key Takeaways

- Neurological diseases and disorders are among the world’s most prevalent health conditions. The need to address them is mounting amid an aging global population and as the world grapples with the mental health challenges that were exacerbated by the pandemic.

- Innovations in biotechnology, particularly in genomics and immunology, are uncovering potential causes of many neurological disorders and offering new options to treat and potentially cure them.

- A combination of critical public and private investments in neuroscience, government grants, and charitable donations are helping accelerate a wave of advancements and opportunities in this fast-growing theme.

Neuroscience Companies Are Leading the Fight Against Neurological Disorders

Mind over matter

Our brain is at the center of everything we do, feel, and think. It is arguably our most important organ, yet, limited historical understanding of its function and anatomy inhibited progress in treating neurological diseases and disorders. Fortunately, several catalysts are turning the tides.

Recognition that aging populations will give rise to new healthcare needs and heightened awareness of mental health issues are bringing renewed focus to neurological health.

On top of this, recent advances in genomics and immunology, new diagnostics and surgeries, and reductions in stigma associated with mental health are unlocking radical progress in neuroscience this decade akin to the genomics revolution of the past two decades.

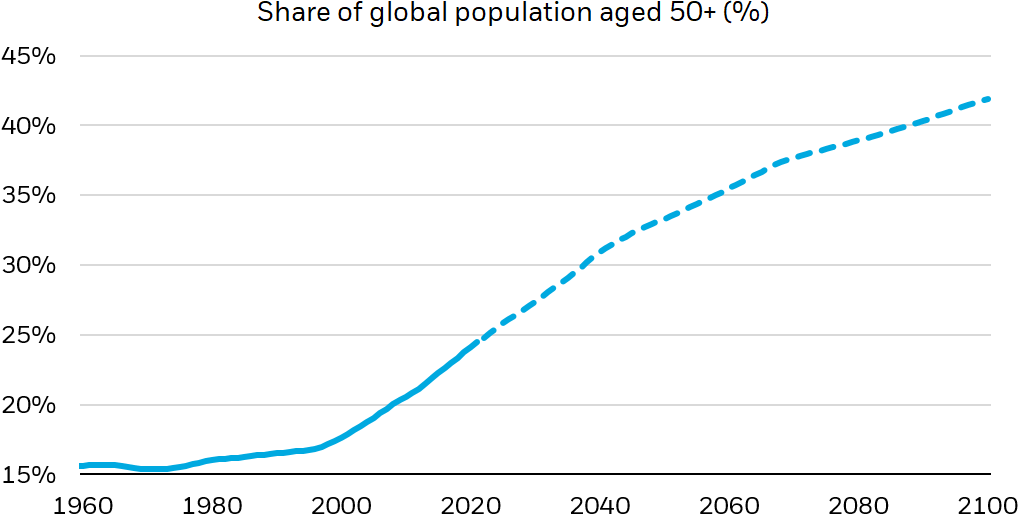

Neurological treatments are essential to meeting the health needs of a rapidly aging global population

Note: Dotted line reflects projections according the 2021 UN World Population Prospects.Source: UN Department of Economic & Social Affairs, 2021; Analysis by BlackRock, August 2022.

Chart Description: Line chart showing annual share of global population age 50 and above from 1960 to 2100, projecting years 2022-2100. This chart shows how a rapidly growing global population could drive demand for neurological treatments.

Neurological conditions manifest in a variety of ways, from those that onset suddenly, or are intermittent, to those that are chronic and degenerative. One in three people suffers from a neurological condition, globally, and the number of annual deaths from them increased 61% from 1990 to 2019.1

But a new wave of innovative treatments, spanning modern therapeutics and medical devices, are close to unlocking our ability to treat, and possibly cure, many of the world’s most harrowing afflictions.

Global sales of central nervous system therapeutics totaled over $116 billion in 2020 and are on pace to reach $205.7 billion by 2028.2 Similarly, sales of neurology-related instruments and devices, including those used in brain and spine surgery, are projected to reach $11 billion by 2027, growing 30% from 2020.3

A combination of critical public and private investments, government grants, and charitable donations are helping accelerate a wave of advancements and opportunities in this fast-growing medical field, potentially benefitting neuroscience investments.

New Treatments Offer Promise To Treat Chronic And Degenerative Neurological Diseases

Progress in fighting the progression

Degenerative and chronic neurological diseases can be devastating. They can affect individuals throughout their lives, often worsening over time, the result of genetics, innate biological factors, as well as certain environmental factors. While this might make cures seem impossible, several recent advances are flipping the script.

Dementia is the most common degenerative neurological condition in the United States, with most cases coming from Alzheimer’s disease.4 Those with Alzheimer’s suffer from memory loss and cognitive and behavioral issues. While much is still unknown about the disease, genome sequencing technology has thus far attributed approximately 70% of cases to genetic factors.

These findings are proving essential in developing drugs that slow Alzheimer’s and reduce its impact, as well as diagnostics that identify at-risk populations. While effective cures have been elusive, neuro biopharmaceutical companies are developing promising treatments that are advancing through clinical trials.

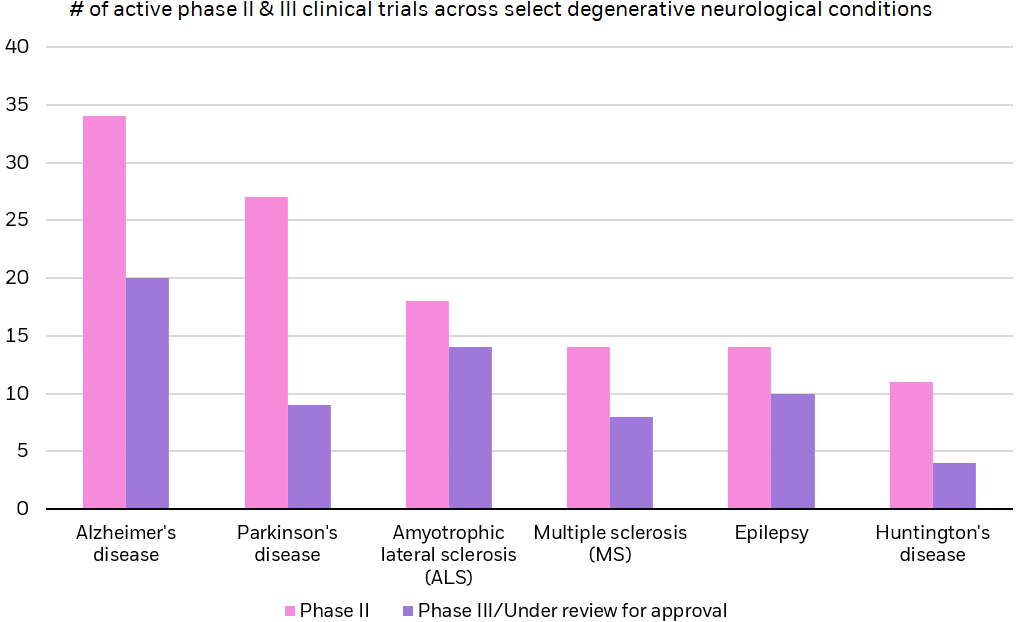

Robust later stage drug pipelines could potentially address some of the most prevalent and devastating degenerative neurological conditions

Note: Chart reflects 165 drugs across 183 clinical trials; drugs may be in trials for multiple conditions and 6 drugs completed phase III and were under review for approval. Initial universe (284 drugs) sourced using FactSet’s drug database for each condition; clinical trial stage determined individually using Springer’s Adis Insight drug database. 119 drugs were excluded due to clinical trials being discontinued or not entering the next phase for 4+ years after the completed phase.

Source: FactSet, Springer Adis Insight, 2022; BlackRock analysis.

Chart Description: Clustered column chart showing the number of active phase 2 & 3 clinical trials across select degenerative neurological conditions. This chart shows how there are robust drug pipelines to treat some of the world’s most devastating neurological diseases.

Drugs that harness or act similarly to our immune systems are showing promise. In the case of Alzheimer’s, these drugs seek to reduce the negative impacts of a variety of biological processes related to the disease, many of which are dictated by disease-associated genes.5 Gene therapies and other genetic medicines, while in earlier stages, are also promising.

Rather than combatting symptoms, these drugs seek to alter or interfere with the genetics of predisposed individuals — many such drugs are currently in clinical trials to treat Alzheimer’s and other forms of dementia.6 With over 50 million people suffering from dementia worldwide, the appetite for novel therapeutics is immense. Recent estimates project the market for Alzheimer’s drugs to reach $7 billion by 2026, representing an 8.1% compound annual growth rate (CAGR) from $4.8 billion in 2021.7

Next-generation therapeutics designed to treat several other progressive neurological conditions are also underway. Numerous antisense therapies, for instance, treating amyotrophic lateral sclerosis (ALS), Huntington’s disease, and Duchenne muscular dystrophy are currently in late-stage clinical trials.8

These therapies use synthetic genetic material (antisense oligonucleotides) to interfere with disease-related genetic processes and have already seen success in treating other illnesses. At the end of 2021, there were eight approved antisense therapies, including nusinersen for spinal muscular atrophy, a rare neurological disease.9 Other promising therapeutics for such diseases include antibody drug conjugates and tyrosine kinase inhibitors, among others.

Expanded Ability To Treat Neurotraumatic Conditions

The road to real recovery

Not all neurological conditions are progressive or chronic. Unfortunately, various disorders occur due to tragic or unexpected circumstances outside of one’s control – and everyone is susceptible.

Physical accidents or conditions from other organ systems, like blood clots, can cause strokes, traumatic brain injury (TBI), spinal cord injuries (SCI), and chronic traumatic encephalopathy (CTE).

Such diseases are characterized by significantly diminished cognitive and motor abilities, behavioral problems, paralysis, and a range of secondary conditions like dementia and depression. In the past, neurotraumatic diseases had either few minimally effective treatments, inadequate care options, or were overlooked entirely.

Decades of innovation are bringing forth new options. Powerful diagnostic tools like modern CT scanners and MRI machines can identify neurotraumatic diseases more accurately and faster than ever, providing critical insights in the crucial hours after injury.10

In the operating room, minimally invasive cranial and spinal access tools, robotic neurosurgery devices, neurosurgery computers, and monitoring devices are augmenting surgeons’ operating ability.11 As patients cope with their conditions, new and upcoming medical interventions are offering the ability to protect and/or restore neurological function, treat symptoms, and offer patients a sense of normalcy.

These include implantable devices that give paraplegics the ability to digitally stimulate paralyzed limbs and medications that protect the brain following injury.12,13 Excitingly, in the future, cell therapies and small molecule drugs could offer regenerative therapeutic benefits. Recent early-stage studies show the promise of these drugs in repairing damaged nerves for sufferers of traumatic brain and spinal cord injuries.14,15

Neurotraumatic diseases are among the leading causes of death globally, and the primary one for young people in industrialized countries.16,17 Fighting them is a key priority for governments and health care organizations around the world. The global market for traumatic brain injuries alone is expected to reach $201 billion by 2029, growing at a 5% CAGR from this year.18

Mental health: Wider acceptance and more diverse treatments

Less stigma, more hope

Addressing mental health and neuropsychiatric conditions has fast become a primary global healthcare priority and a wide range of interventions, both new and old, are primed to play a large role in the success of these efforts. The global population endured significant hardship over the past two years, grappling with social isolation, the loss of loved ones, and unprecedented financial and geopolitical instability.

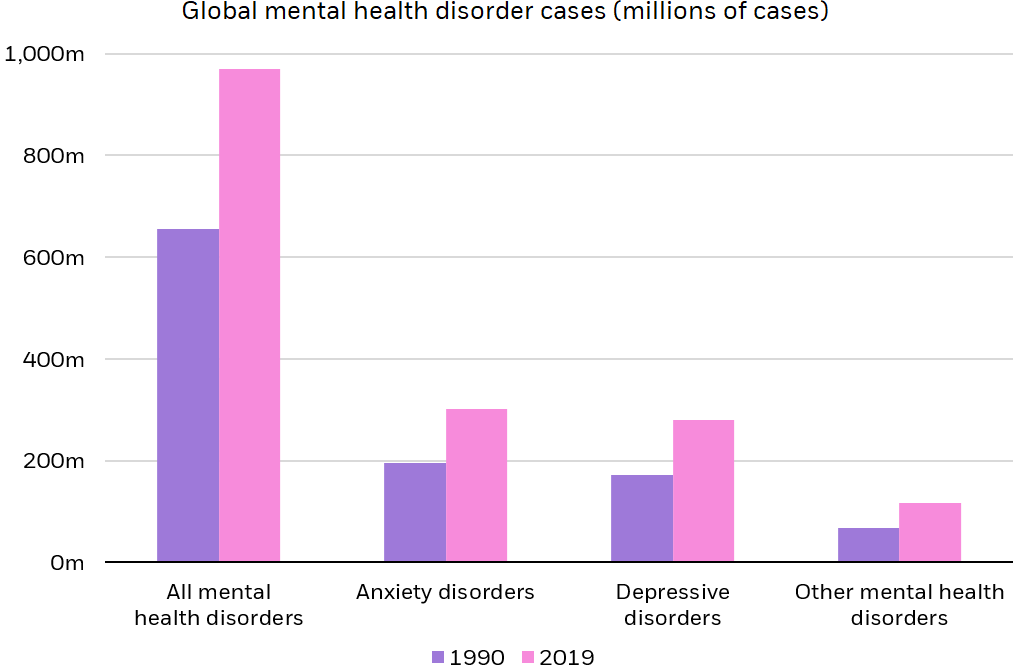

The toll on mental health has been immense and continues to mount. Nearly one billion people currently live with a mental health disorder, and, at the end of 2020, after one year of COVID-19, global cases of anxiety and major depression increased 26% and 28% respectively.19,20

Cases of mental health disorders are continuing to rise, illustrating the need for more and more effective treatments

Note: Other mental health disorders don’t include all disorders not already represented in the chart

Source: The Lancet, 2022.

Chart Description: Clustered column chart showing the global cases of mental health disorders in 2019 versus 1990. This chart shows how cases of mental health disorders are growing significantly, illustrating the importance of addressing them through treatments.

While concerning, this surge is pulling back the long-held global stigma toward mental health disorders and catalyzing a widespread push to address them head-on. More people are seeking treatment than ever, with 43% of mental health professionals noting an increase in patients compared to before the pandemic.21

And, within the public and private sectors, greater recognition of the societal and economic impacts of mental health disorders is sparking large scale efforts to address psychiatric conditions. This past May, the Biden Administration outlined a national strategy to “to transform how [the US] understands, accesses, and treats mental health,” and a recent survey of health benefit providers found that 90% of employers are increasing their investment in employees’ mental health.22,23

We believe a greater emphasis on treating mental health and neuropsychiatric conditions could uncover a large market for treatments produced by neuroscience companies. Existing psychiatric medications, like antidepressants and antianxiety drugs, will likely play a large part of this in the near term and experience increased prescription volumes from heightened psychiatric consultations.

Decreased stigma and the rise of telemedicine options could serve as a tailwind in this regard. We also expect new strategies that use existing medications to further increase demand. Augmentation strategy, for example, treats depression by improving the efficacy of established antidepressants with other pharmaceutical agents like antipsychotics.24

Looking forward, neuroscience companies are developing new therapeutics that could go even further in treating neuropsychiatric diseases, including non-mental health conditions like epilepsy and dyskinesia. Phase 3 clinical trials for a novel antidepressant, zuranolone, show that the compound relieves symptoms of major depression in just three days, compared to 4-6 weeks for traditional options.25

Other treatment options like transcranial magnetic stimulation (TMS) could also experience newfound demand, particularly from patients seeking non-pharmaceutical interventions. Since its FDA approval to treat major depression in 2008, TMS has become a particular area of interest for neurology researchers and is showing promise for treating a wide range of other conditions like schizophrenia and aphasia.26,27

As these conditions receive more attention, the market for treating them could experience significant growth, potentially benefitting investments with exposure to mental health solutions.

Getting Exposure To Neuroscience Stocks With ETFs

Investors looking for exposure to advancements in neuroscience via public equities may want to consider ETFs targeting companies that generate the majority of their revenue from neuro biopharmaceuticals and neurology devices:

- Neurology biopharmaceuticals: Therapeutics that treat psychiatric disorders and disorders of the central nervous system, including the brain, spinal cord, and nerves

- Neurology devices: Medical devices that diagnose, monitor, and treat neurological disorders

Conclusion

Neurological diseases are among the most prevalent and destructive health conditions in the world. Innovations in neuroscience could soon make many of today’s under-addressed conditions things of the past, potentially benefitting neuroscience investments.

In our view, investors looking to invest in neuroscience may want to consider ETFs that provide exposure to pure-play neuroscience stocks across the theme’s value chain.

© 2022 BlackRock, Inc. All rights reserved.

1 Feigin, Valery L. “The Evolution of Neuroepidemiology: Marking the 40-Year Anniversary of Publishing Studies on Epidemiology of Neurological Disorders.” Neuroepidemiology 56.1 (2022): 2-3.

2 Grand View Research, “Central Nervous System Therapeutic Market Size, Share & Trends Analysis Report By Disease (Neurovascular Diseases, CNS Trauma, Mental Health, Neurodegenerative Diseases, Infectious Diseases), By Region, And Segment Forecasts, 2021 – 2028,” 2021.

3 Market Research Guru, “Global Neurology Devices Market Outlook 2022,” December 2021.

4 Feigin, Valery L., et al. “Burden of neurological disorders across the US from 1990-2017: a global burden of disease study.” JAMA neurology 78.2 (2021): 165-176.

5 Mayo Clinic, “Alzheimer’s treatments: What’s on the horizon?”, June 2021.

6 US National Library of Medicine, “ClinicalTrials.gov,” accessed July 2022.

7 The Business Research Company, “Alzheimer’s Disease Treatment Global Market Report 2022,” March 2022.

8 Moumné, Lara, Anne-Céline Marie, and Nicolas Crouvezier. “Oligonucleotide therapeutics: from discovery and development to patentability.” Pharmaceutics 14.2 (2022): 260.

9 Ibid.

10 Neurologica, “Recent Advances in CT Scan Technology,” 2021.

11 Spine Universe, “Advancements in Spine Surgery,” January 2019.

12 Mayo Clinical, “Traumatic brain injury,” accessed July 2022.

13 Fierce Biotech, “Sci-fi no more: Synchron implants mind-reading device in first US patient in paralysis trial,” July 2022.

14 Álvarez, Z., et al. “Bioactive scaffolds with enhanced supramolecular motion promote recovery from spinal cord injury.” Science 374.6569 (2021): 848-856.

15 Argonne National Laboratory, “Fixing spinal cord injuries with ‘dancing molecules’,” March 2022.

16 Bonilla, Celia, and Mercedes Zurita. “Cell-based therapies for traumatic brain injury: Therapeutic treatments and clinical trials.” Biomedicines 9.6 (2021): 669.

17 Dewan, Michael C., et al. “Estimating the global incidence of traumatic brain injury.” Journal of neurosurgery 130.4 (2018): 1080-1097.

18 Data Bridge Market Research, “Global Traumatic Brain Injuries Treatment Market – Industry Trends and Forecast to 2029,” February 2022.

19 Kuehn, Bridget M. “WHO: Pandemic Sparked a Push for Global Mental Health Transformation.” JAMA 328.1 (2022): 5-7.

20 World Health Organization, “Mental Health and COVID-19: Early evidence of the pandemic’s impact: Scientific brief,” March 2022.

21 American Psychological Association, “Worsening mental health crisis pressures psychologist workforce,” October 2021.

22 The White House, “Reducing the Economic Burden of Unmet Mental Health Needs,” May 2022.

23 Wellable Labs, “Mental Health, Digital Solutions Top List of Employee Wellness Trends for 2022, According to Wellable Labs Report,” January 2022.

24 Taylor, Rachael W., et al. “Pharmacological augmentation in unipolar depression: a guide to the guidelines.” International Journal of Neuropsychopharmacology 23.9 (2020): 587-625.

25 Biogen, “age Therapeutics and Biogen Announce that the Phase 3 SKYLARK Study of Zuranolone in Postpartum Depression Met its Primary and All Key Secondary Endpoints,” June 2022.

26 Penn Medicine News, “The Promise of Transcranial Magnetic Stimulation,” April 2022.

27 Lorentzen, Rasmus, et al. “The efficacy of transcranial magnetic stimulation (TMS) for negative symptoms in schizophrenia: a systematic review and meta-analysis.” Schizophrenia 8.1 (2022): 1-12.

Carefully consider the Funds’ investment objectives, risk factors, and charges and expenses before investing. This and other information can be found in the Funds’ prospectuses or, if available, the summary prospectuses, which may be obtained by visiting the iShares Fund and BlackRock Fund prospectus pages. Read the prospectus carefully before investing.

Investing involves risk, including possible loss of principal.

International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation and the possibility of substantial volatility due to adverse political, economic or other developments. These risks often are heightened for investments in emerging/ developing markets or in concentrations of single countries.

Funds that concentrate investments in specific industries, sectors, markets or asset classes may underperform or be more volatile than other industries, sectors, markets or asset classes and than the general securities market.

Technology companies may be subject to severe competition and product obsolescence.

This material represents an assessment of the market environment as of the date indicated; is subject to change; and is not intended to be a forecast of future events or a guarantee of future results. This information should not be relied upon by the reader as research or investment advice regarding the funds or any issuer or security in particular.

The strategies discussed are strictly for illustrative and educational purposes and are not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. There is no guarantee that any strategies discussed will be effective.

The information presented does not take into consideration commissions, tax implications, or other transactions costs, which may significantly affect the economic consequences of a given strategy or investment decision.

This material contains general information only and does not take into account an individual’s financial circumstances. This information should not be relied upon as a primary basis for an investment decision. Rather, an assessment should be made as to whether the information is appropriate in individual circumstances and consideration should be given to talking to a financial professional before making an investment decision.

The information provided is not intended to be tax advice. Investors should be urged to consult their tax professionals or financial professionals for more information regarding their specific tax situations.

The Funds are distributed by BlackRock Investments, LLC (together with its affiliates, “BlackRock”).

The iShares Funds are not sponsored, endorsed, issued, sold or promoted by Bloomberg, BlackRock Index Services, LLC, Cohen & Steers, European Public Real Estate Association (“EPRA®”), FTSE International Limited (“FTSE”), ICE Data Indices, LLC, NSE Indices Ltd, JPMorgan, JPX Group, London Stock Exchange Group (“LSEG”), MSCI Inc., Markit Indices Limited, Morningstar, Inc., Nasdaq, Inc., National Association of Real Estate Investment Trusts (“NAREIT”), Nikkei, Inc., Russell or S&P Dow Jones Indices LLC or STOXX Ltd. None of these companies make any representation regarding the advisability of investing in the Funds. With the exception of BlackRock Index Services, LLC, which is an affiliate, BlackRock Investments, LLC is not affiliated with the companies listed above.

Neither FTSE, LSEG, nor NAREIT makes any warranty regarding the FTSE Nareit Equity REITS Index, FTSE Nareit All Residential Capped Index or FTSE Nareit All Mortgage Capped Index. Neither FTSE, EPRA, LSEG, nor NAREIT makes any warranty regarding the FTSE EPRA Nareit Developed ex-U.S. Index or FTSE EPRA Nareit Global REITs Index. “FTSE®” is a trademark of London Stock Exchange Group companies and is used by FTSE under license.

© 2022 BlackRock, Inc. All rights reserved. BLACKROCK, BLACKROCK SOLUTIONS, BUILD ON BLACKROCK, ALADDIN, iSHARES, iBONDS, FACTORSELECT, iTHINKING, iSHARES CONNECT, FUND FRENZY, LIFEPATH, SO WHAT DO I DO WITH MY MONEY, INVESTING FOR A NEW WORLD, BUILT FOR THESE TIMES, the iShares Core Graphic, CoRI and the CoRI logo are trademarks of BlackRock, Inc., or its subsidiaries in the United States and elsewhere. All other marks are the property of their respective owners.

iCRMH0822U/S-2398990

This post originally appeared on the iShares Market Insights.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment